It is a tough environment for a lot of enterprises right now, and has been since the advent of the coronavirus pandemic more than two years ago. And now the war in Ukraine is going to add another layer of uncertainty over commerce. And yet, data is being collected and needs to be processed for competitive advantage – this has not changed, and it will not change.

Those IT suppliers who are flexible with their offerings – particularly those that conserve capital as well as move expenditures from CapEx to OpEx, offloading the capital expenses to a certain degree on the IT vendors or those who lease and finance gear – are going to do better in such an environment. And that, in a nutshell, is precisely why Hewlett Packard Enterprise has been turning in good numbers in the trailing twelve months under relatively new chief executive officer Antonio Neri.

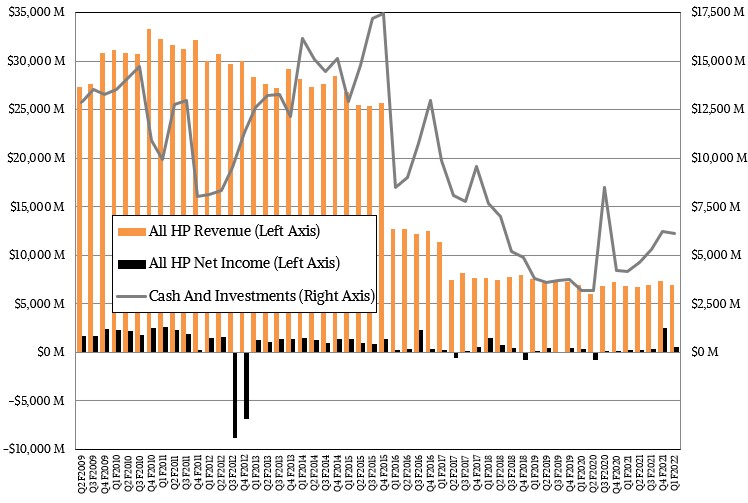

Over the past six years, HPE has intentionally spun off software, outsourcing, PCs, and printers to focus itself down on the core enterprise business that is an amalgam of the server businesses of the old Hewlett Packard, Compaq, Digital Equipment, SGI, and now Cray, plus a bunch of edge networking stuff and an amalgamated services business, called PointNext. The much smaller HPE is not particularly profitable, but then again the volume enterprise server business and the HPC systems business have never been terribly profitable, so this is no surprise to us. We have often said that system buyers should send HPE – as well as Dell, Lenovo, Inspur, and IBM – Thank You notes because, based on their financials, they often are building systems as much as for love as for money.

But, HPE is making more money and keeping more of it in recent quarters, and is also making the transition to sell everything in the catalog under its GreenLake cloud utility pricing model, and this seems to be resonating with customers at this uncertain time. While HPE is not booking most of this GreenLake “as a service” revenue now, since it is allocated proportionally over the length of contracts that run from 36 months to 60 months – the deferred revenue is starting to build.

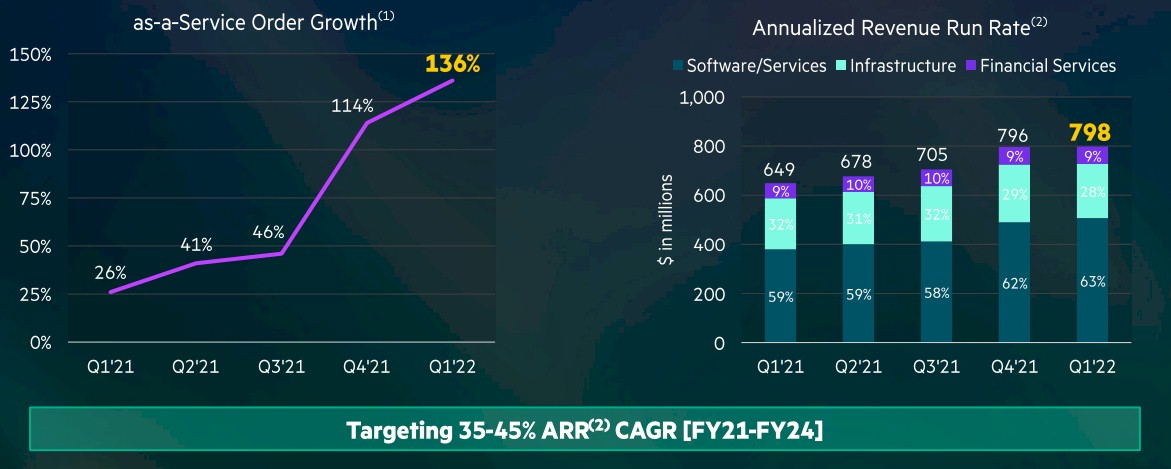

In the first quarter of fiscal 2022 ended in January, HPE added another 100 GreenLake customers, bringing the total up to 1,350. While GreenLake is an important annuity-like revenue stream for HPE, I tis not the only one it has, and if you add up all of the “as a service” revenues that were recognized and then show the annualized revenue rate (ARR) for these sales, you get charts that look like this:

Orders for “as-a-service” priced products grew at 136 percent year-on-year in Q1 of fiscal 2022, and the annualized run rate came in at $798 million. Nearly two third of that is for systems and networking software, and the rest is for infrastructure and regular financing – think of it as “money as a service,” we suppose. The order backlog for these AAS offerings at HPE grew by 100 customers and $500 million – which is another way of saying, we believe, that the new customers were all GreenLake customers – and the total contract value from all AAS products sold to customers stood at $6.5 billion. (It is unclear if this is a figure that is net of revenue already recognized, but it should be if AAR is to be a meaningful figure.) The plan is for the AAR for the AAS portion of the HPE business to have a compound annual growth rate of 35 percent to 40 percent between fiscal 2021 and fiscal 2024, which puts it at around a $2.2 billion run rate as HPE exits its fiscal 2024 in October 2024. And if the backlog for AAS products scales like the run rate does, it should be somewhere around $18 billion at that time.

“That’s why I said that when I think about the future of this company, the product is HPE GreenLake,” Neri said on the call with Wall Street analysts going over the financial results. “Everything gets delivered through HPE GreenLake, whether it is a connectivity through a subscription model, whether it is compute and storage that you can consume elastically with data services running on top of it, whether it is the services to operate in a HPE GreenLake. HPE GreenLake is becoming a platform of choice for many customers because it offers that flexibility and in an architecture that’s edge-to-cloud. And that’s inclusive, by the way, of the public cloud. And that’s why when you see the innovation we’re going to bring in the next two weeks, it includes the public cloud in the way we manage that.”

It will be interesting to see what HPE does here, but the implication is that either GreenLake systems will be one someone’s cloud, or HPE will buy capacity on someone’s cloud and make the management of all of it consistent under a single GreenLake management framework. (The latter one is an interesting concept. Are you allowed to resell AWS capacity? Think of the volume discounting HPE could command if it bought up giant blocks of Amazon Web Services, Microsoft Azure, and Google Cloud.)

In the quarter ended in January, HPE posted overall sales of $6.96 billion, up 1.9 percent, and net income more than doubled to $513 million. Some of that income is due to price increases it is passing along to customers, and some of it is due to intense cost controls and effective supply chain management. The company burned a little cash to help boost its parts inventory, which HPE is building up because customers are giving it more visibility into their infrastructure plans because of the shortages endemic in the IT sector right now. With parts lead times ranging from 52 weeks to 70 weeks for a lot of components, end user customers have little choice but to make a plan and tell their IT vendors as far in advance as they can.

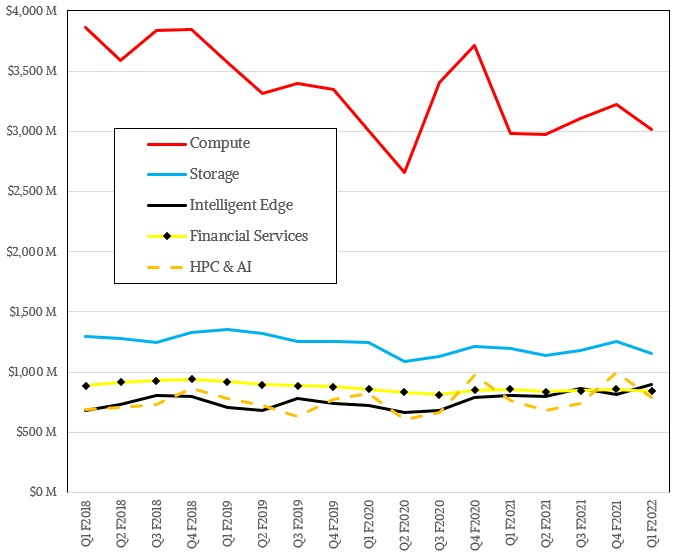

The Compute division, which is comprised of mostly ProLiant servers based on Intel Xeon SP and AMD Epyc processors, had 1 percent growth to $3.02 billion in the quarter, but operating income rose by 21.6 percent to $416 million. Orders of X86 servers rose by more than 20 percent in the quarter, so you can see the gap between supply (revenues up 1 percent) and demand (orders up by more than 20 percent). Some orders always spill over into the next quarter, but this is probably a higher than usual rate. The Storage division had more than 15 percent order growth, so not as strong as servers, but this was the fourth quarter with such high growth. (Well, by HPE historical standards, this is high growth.) Storage revenues fell by 3.1 percent in the quarter, to $1.16 billion, and operating income fell by 28.5 percent to $168 million. In the quarter, close to 10 percent of combined compute and storage orders were for products sold AAS as opposed to being acquired straight up by customers, according to Neri.

HPE breaks out its HPC and AI business as a separate division, and this is mostly Cray supercomputer business with some smattering of SGI big memory NUMA machines aimed at those markets along with the Apollo dense server and storage designs – plus their respective software stacks. Two big HPC deals were pushed out from Q1 to Q2 for revenue recognition – one of them almost certainly is some of the “Frontier” Cray EX supercomputer at Oak Ridge National Laboratory – and that hurt sales, which fell 21 percent sequentially to $790 million, but up 3.7 percent year on year. The HPC system business is always choppy, and the AI systems business is no different (and in fact HPE customers sometimes buy the same type of machinery to run these workloads separately, or buy one machine to run them concurrently). That the HPC & AI division saw operating income swing to a 7 million loss from a $43 million gain in the year ago quarter and from a $143 gain in Q4 of fiscal 2021 ended in October. The good news is that HPE order growth for its HPC and AI systems rose by more than 20 percent in the first quarter of fiscal 2022, which boosted the order book for these systems to $2.7 billion – a record for HPE and Cray alike.

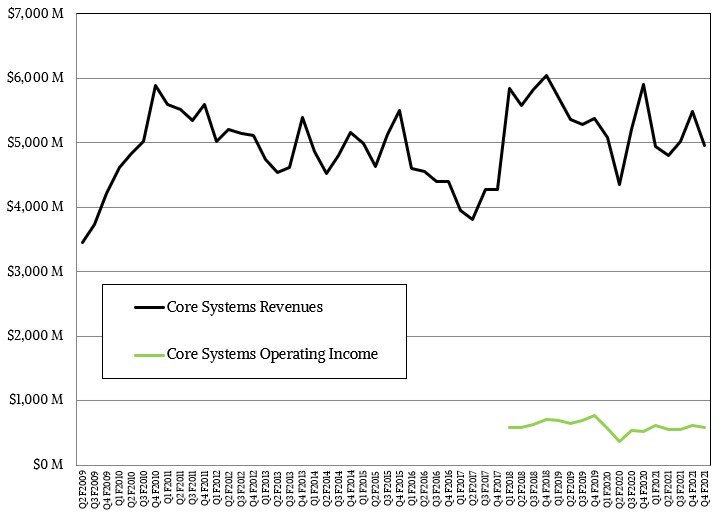

What we have been looking at through all of the years of changes at Hewlett-Packard and then Hewlett Packard Enterprise is the core systems business, and as you can see below, the company has done a pretty good job of building it and maintaining it since the Great Recession:

For the January quarter, this core systems business – in this case, Compute, plus HPC & AI plus Storage – had $4.96 billion in sales, up four-tenths of a point year on year, with operating income of $577 million, down 6.9 percent. This data includes servers, storage, and networking all the way back, but we did not have an easy way to extract tech support for systems out of the old Technology Services group, so it does not include that in the old data. It is as apples to applesauce as we can make the comparison to show you the general trend over the past decade and change.

The point is, HPE has always been able to keep rebuilding a systems business on about the same scope. Which is a feat in and of itself.

Be the first to comment