There is a new sheriff in town at Hewlett Packard Enterprise – that would be chief executive officer Antonio Neri – and that means a new way of looking at the books and therefore steering the business. No, we didn’t mean that the other way around.

In opening up its books for the first quarter of its fiscal 2018 year, which ended in January, we can see some important things about HPE’s business, and at the same time, we have lost some visibility about core parts of its business.

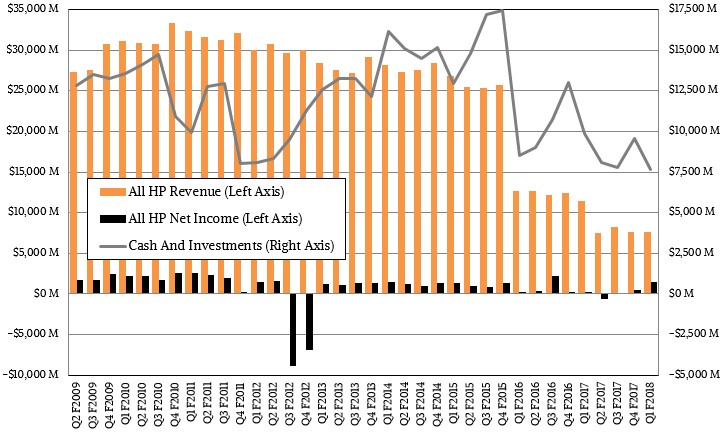

First of all, the books have been reclassified significantly in the wake of selling off the bulk of its enterprise services and software businesses, for which it has been able to boost its cash pile in the fiscal 2017 year and with which it paid off the taxes on its overseas cash hoard thanks to the Tax Cuts and Jobs Act pushed by the Trump Administration and enacted by the US Congress as the calendar 2017 came to an end. Specifically, in the first quarter of fiscal 2018, HPE booked $919 million in charges for paying taxes on overseas cash, but even still it was able to book a tax benefit of $2.14 billion related to the spinoff of those enterprise services and software units. The net-net is that net income went up by a factor of 5.6X, but this is tax accounting and bookkeeping, so don’t take it too far. HPE’s earnings from continuing operations – perhaps a better measure of its financial health – fell by 42.4 percent to $261 million, against revenues of $7.67 billion, up 11.2 percent. The company is in a pinchers, as it often is – and despite having spun off its PC and printer businesses, which didn’t help bolster profits when all was said and done.

The larger problem, as we have pointed out before, is that it is very difficult to make a buck in the server, storage, and networking business with so many big buyers pushing down prices, enterprises shifting some compute from their own datacenters to public clouds (and therefore some of their budgets from capex to opex), and so many companies competing to sell wares to datacenters.

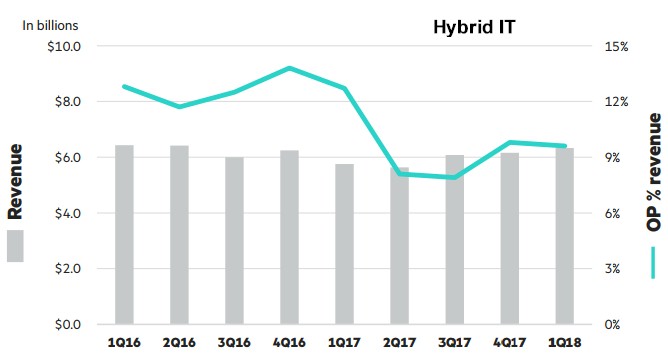

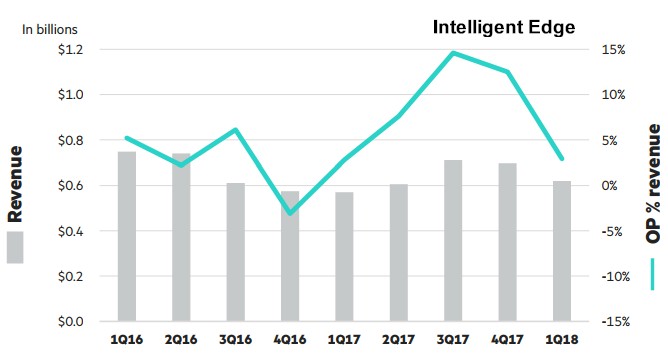

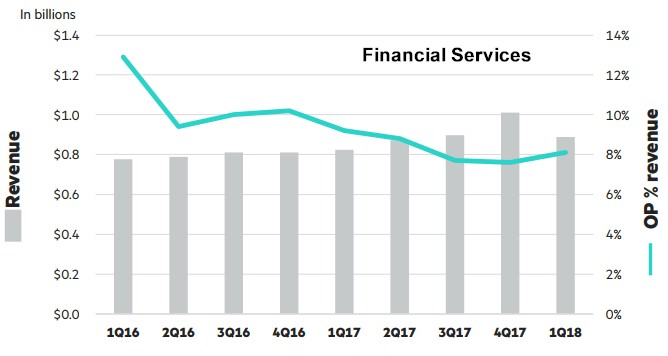

Under Neri, HPE is carving itself into three core businesses. The first is called Hybrid IT, and it takes the compute, storage, and datacenter networking businesses that are the core of the new HPE and adds to each of these areas the technology services – mostly break fix support and systems software update services – related to each general line. HPE has not furnished a set of books that are backwards compatible, restating its old results for, say, the past two years, but we will be building this data as it becomes available. The second main unit, which coincides with our expansion into edge computing, is called Intelligent Edge, and at the moment this is mostly the Aruba Networks networking gear plus related services. Financial Services is the third leg of the HPE stool, and it is unchanged from the characterization in prior financial reports.

Let’s take a look at the Hybrid IT group, which had sales of $6.33 billion, up 10 percent year on year, and which posted an operating profit of $608 million, down 17.1 percent. So, even adding in very profitable services to the core server sales could not help grow the overall profitability of this line of business. This shows the intense competitive pressure that Dell and the ODMs are putting on HPE, which has been the volume leader in systems since it bought Compaq back in 2001. Within Hybrid IT, compute – meaning servers plus their services – posted sales of $3.49 billion, up 11.1 percent. HPE has been backing away from hyperscale server sales in recent quarters, and it could be that it is trying to buy back some market share by being very aggressive with pricing, thus accounting for the drop in operating profits. The high prices of DRAM and flash memory are not helping here, either, but the year-on-year compares for memory prices already had the spike in them this time last year.

In a conference call with Wall Street analysts going over the figures, Neri said that the core ProLiant business as well as traditional HPC (mainly SGI iron, but also some Apollo gear), hyperconverged storage (mainly based on its own SimpliVity line as well as VMware vSAN and maybe a smattering of Nutanix), and next-generation Synergy composable systems all saw growth. He called out the supercomputer wins at oil and gas giant Eni and the US Department of Defense, which we have already told you about this month. HPE’s sales to Tier 1 cloud builders, hyperscalers, and service providers have been shrinking dramatically in the past two quarters, and seem to have settled down to a new normal that we guess is about a quarter of overall server revenues not including support. Tim Stonesifer, HPE’s chief financial officer, said on the call that excluding Tier 1 customers, server revenues (here including companion support revenues) rose by 14 percent, and if you take out the support the core server business (presumably the number it would have reported under the old way of doing the books) was up by 16 percent year-on year. If you do the math on that, then actual physical server hardware that Stonesifer implied that HPE brought in was $3.6 billion, but this is more than the $3.49 billion HPE reported with support added in. So maybe this means only core ProLiant servers sold to enterprises. It is hard to say. In any event, Stonesifer said that HPC sales were up in the low double digits in fiscal Q1, Synergy sales rose more than 40 percent sequentially and SimpliVity hyperconverged storage tripled year-on-year. (It looks like HPE is putting SimpliVity into the compute bucket, not the storage bucket.)

Neri did a little prognosticating about the server market for Wall Street, and said that revenue growth has been driven by the sale of denser, more expensive systems. Sales of volume, bare-bones systems will decline along with the general downward trend in enterprise server spending (it is hard to say which is causing what, we think) and that this would be offset by sales of heftier machines, packed with memory, flash and maybe accelerators like GPUs. “We see the growth in value normalized with the decline in enterprise, so it is hard to give you a number, but it is going to come down to the mix,” explained Neri. “We believe the value units will continue to grow and the volume side of house will be in decline. And that ultimately is going to be a mass exercise. But, again, let me emphasize where our focus is, and our focus is profitable share growth.”

On the storage front, HPE saw 24.1 percent growth, to $948 million, driven by 3PAR arrays returning to growth after a pause and the acquisition of all-flash array maker Nimble. On an organic basis, not including the Nimble addition, storage sales rose by 11 percent. (Again, these numbers include the hardware, software, and support relating to storage arrays.) Obviously, storage revenues are bolstered significantly by the huge increase in flash memory costs, which have doubled in the past year or so. This cuts both ways, because as flash becomes a more important component of storage, it also reduces the bottom line as a percent of sales. Stonesifer said that HPE’s all-flash arrays save 16 percent growth, and that HPE expected to take back some market share in external disk arrays.

That brings us to datacenter networking. While this business grew by 26.5 percent in the first quarter of fiscal 2018, it only accounted for $62 million. And that is with support contract added in. If HPE’s networking business was proportional to its share of the overall server market and its server revenues, it would be at least a $1.5 billion business. The former Hewlett Packard shelled out $2.7 billion in November 2009 to buy rival switch maker 3Com, and we now know after having the Aruba Networks edge products pulled out of the networking numbers just how little revenue HPE is getting from datacenter networking. 3Com was a big player in China when it was acquired, and had an annual run rate of around $1.3 billion in revenues with about half of that coming from China. The Middle Kingdom has been a disappointment for both server and switch sales in recent years, to say the least, and because of aggressive moves by indigenous companies to protect their home turf.

If you add up the Hybrid IT products – compute, storage, and networking in the datacenter – then revenues rose by 13.8 percent to $4.5 billion. There is another layer to this Hybrid IT group, however. Last year, HPE carved out its digital transformation services business into a unit called Pointnext, which aims to implement hybrid IT in the datacenter and smarts out on the edge on behalf of customers. This Pointnext business has 25,000 employees, more than three dozen ecosystem partners, and does 11,000 projects on behalf of customers per year, including professional services for transforming IT setups and operational services to run on-premises and cloud capacity on their behalf. In the first quarter, this Pointnext business had 1.7 percent revenue growth, to $1.83 billion.

Compute is about 55 percent of the Hybrid IT business, with storage being about 15 percent, datacenter networking being 1 percent, and Pointnext being 29 percent.

The Intelligent Edge business is comprised entirely of Aruba products and support, which accounted for $549 million in product sales, up 9.2 percent, and $71 million in services, up 6 percent. Add it up and Intelligent Edge had $620 million in revenues, up 8.8 percent. The Intelligent Edge business had an operating profit of $18 million, up 12.5 percent year on year.

That leaves Financial Services, the arm of HPE that provides financing for all of its various wares and sometimes that made by partners and even sometimes competitors. In the quarter, Financial Services, which doesn’t really have a product and is only a service, had sales of $888 million, up 7.9 percent. Operating profits for the banking part of HPE fell by 5.3 percent to $72 million.

As for making investments with the overseas cash hoard, HPE is doing exactly what we expect that many – if not most – corporations will do. And that is handing a lot of that cash back as dividends and share repurchases that will eventually be distributed to the company’s top brass. Stonesifer said that in fiscal 2018 and 2019, HPE plans to distribute $1.5 billion in dividends (a 50 percent increase) and do $5.5 billion in share repurchases. The company is undergoing a massive cost-cutting exercise, called HPE Next, which is trying to squeeze out an incremental $1 billion in free cash flow from the company on an annualized basis eventually (about $250 million expected this year), and it also has profits it generates each quarter, so it will not completely deplete its cash hoard by being generous to shareholders and executives through dividends and buybacks.

Be the first to comment