After many years of investment, Mellanox Technologies is reaping from the research and development that it has sown in the InfiniBand and Ethernet markets, pushing up bandwidth to 56 Gb/sec and now to 100 Gb/sec just as Intel’s “Haswell” Xeon E5 v3 processors – the dominant CPUs behind the machines cloud, hyperscale, and HPC datacenters – are ramping.

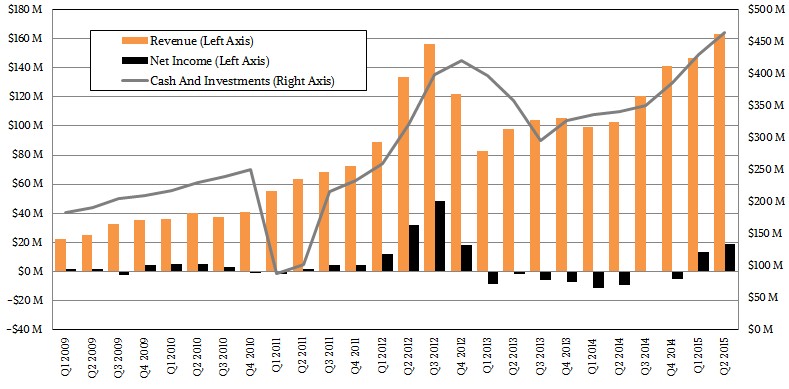

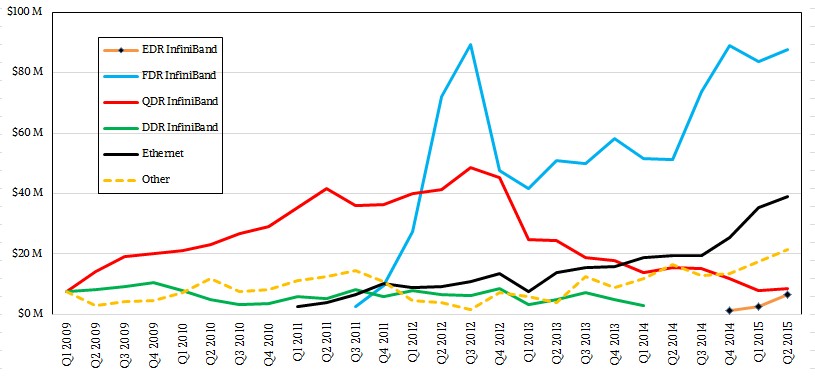

In its second quarter, which ended in June, Mellanox posted record revenues, surpassing a peak it hit back in 2012 when one of its key partners – most of us suspect it was Hewlett-Packard, but no one ever confirmed this – bought a lot more switches and adapters from Mellanox than it should have based on the transition phase between 40 Gb/sec QDR InfiniBand and 56 Gb/sec FDR InfiniBand at the time. It took whoever it was some time to burn off that capacity, but Mellanox has not only bounced back. It has steadily grown its sales and now its profits.

Mellanox booked $163.1 million in revenues in the June quarter, up 59.1 percent from the year-ago period when the market had hit a lull ahead of Intel’s Haswell Xeon launch in early September. Like other vendors in the cloud, hyperscale, and HPC markets, Mellanox tends to ride on the peaks and valleys of Intel’s Xeon rollouts, and with supercomputer and hyperscale customers generally getting in front of the line for the latest processors and networking, they do big deals that can drive revenues up fast. Then, over a couple of quarters, the rest of the market catches up to Intel, Mellanox, and other component suppliers to ride up the wave.

The 100 Gb/sec EDR wave is just getting started, and as we previously reported, there are three systems on the Top 500 ranking of supercomputers that have deployed this cutting-edge InfiniBand. Eyal Waldman, president and CEO at Mellanox pointed out on a conference call with Wall Street analysts, it took four quarters before both QDR and FDR InfiniBand comprised more than half of the InfiniBand business. “We don’t know what the trajectory is going to be,” Waldman explained, “but we think it is going to grow in line with the past history of two transitions to QDR and to FDR.”

How fast that transition occurs, Mellanox is not going to attempt to predict because there are too many variables when it comes to cluster installations and budgets and application needs. During the second quarter, EDR InfiniBand products – including adapters, switches, and cables – accounted for about 4 percent of the company’s revenues, or about $6.5 million. Another $96.1 million in Mellanox products were shipped supporting lower-speed InfiniBand protocols, and we estimate that the lion’s share was for FDR InfiniBand, although Mellanox did not provide that detail.

Mellanox brought $19.2 million to the bottom line in the second quarter, shifting from a loss of $9 million in the year-ago period. The company exited the quarter with $464 million in cash and equivalents in the bank, which could be useful for acquisitions and for expanding the company’s reach in the Ethernet switching market.

As The Next Platform previously reported, Mellanox has just launched its Spectrum Ethernet switch ASIC, which aligns with the 25 Gb/sec and 50 Gb/sec adapters and 50 Gb/sec and 100 Gb/sec switch ports that Google and Microsoft created along with the help of Mellanox and rival switch chip maker Broadcom and switch maker Arista Networks, which relies on Intel and Broadcom ASICs for its switches. These two big hyperscalers wanted to gear down the technologies used for 100 Gb/sec switching to make lower-powered and more affordable and compact switching than was available using 10 Gb/sec and 40 Gb/sec technologies.

In Q2, Ethernet products drove $39.2 million in sales, nearly double from the year-ago period and rising steadily for the past several quarters. While the HPC market tends to drive InfiniBand sales – there is a certain amount of InfiniBand used for clustered storage arrays and for database clusters too, and HPC drives under 50 percent of Mellanox revenues these days – cloud providers and hyperscalers generally favor Ethernet over InfiniBand expecting in specific cases. So if Mellanox wants to grow, it has to push Ethernet as hard as it has pushed InfiniBand and let its bandwidth-hungry customers pick the option they think is best for them. This is why Mellanox got out in front with Broadcom to endorse the 25G effort started by Google and Microsoft last summer.

It is going to take a while for sales of adapters that use the 25G specification to ramp, and Waldman warned Wall Street about this. “We expect that in Q3 it will be slow, mainly tire kicking experiments with 25G, 50G and 100G,” Waldman explained. “We expect to see slightly more significant growth in Q4 and then in early 2016.”

Broadcom just launched its 25G adapter chips and adapter cards this week, and is ramping its “Tomahawk” ASICs, which support 50 Gb/sec and 100 Gb/sec switching, for delivery later this year and early next. Mellanox will make and sell its own Spectrum switches, which will start shipping in volume this quarter according to Waldman, and related ConnectX-4 adapters have been shipping for months. Mellanox is also looking to have third parties pick up its Spectrum Ethernet chips to make their own gear, but no such deals have been announced as yet. Broadcom makes its own adapters and sells its adapter and switch chips to third parties; it does not and will not make its own Tomahawk switches, as far as we know.

Mellanox does not do revenue forecasting, but Waldman said that the HPC portion of the InfiniBand business would continue to grow, as would InfiniBand uses for database and storage clusters. In general, he said that InfiniBand would be used mostly by HPC shops and Ethernet by cloud builders and hyperscalers. It is not clear which way enterprises will go, but certainly the financial sector is familiar with Mellanox, particularly for latency-sensitive workloads. As we have said before, we think enterprises will take a very hard look at 25G Ethernet for a lot of their workloads, particularly if cloud builders and hyperscalers are driving performance up and price/performance down as we think they are. The question then becomes, can an enterprise or an HPC shop get the Google and Microsoft price for 25G products? If they can, the switch and adapter markets could see a big shake up.

This is just history repeating itself again. HPC users want the best processor. At a certain point, they make a decision to go with the current version or wait. Several start waiting for next best Intel CPU. New Intel CPU comes out and they build the new projects. Mellanox gets a bubble of revenue due to the CPU upgrade cycle.

The most laughable aspect of this is the Spectrum switch. Nobody buys Mellanox Ethernet switches today, what makes you think they will suddenly start?

The most important aspect of the Ethernet switching is the software. Broadcom gives the software for free basically. Quanta is shipping minimum 10K boxes per month with the Broadcom OS. It is robust and full featured. Mellanox just does not have the software.

Also, it’s a major effort to port software to a new chip and debug it. And with Mellanox there are massive bugs.

Anyway, no Ethernet swtich vendor is excited to compete against their asic supplier. Mellanox will be the only user of Spectrum and it will be as big of a joke as the SwitchX-2.

Have you checked the latest Omni-Path webinars? Intel wants this market.

https://www-ssl.intel.com/content/www/us/en/events/online.html#7,all