John Chambers has led networking giant and now systems player Cisco Systems for two decades and is stepping down as CEO to let a new generation of executives run the company that he utterly transformed from a router maker to a broad and very profitable IT supplier.

Cisco just closed out its third quarter of fiscal 2013, and in going over the financials, Chambers came out swinging about the company’s difficulties in growing its switching and routing business in the face of staunch competition from traditional suppliers like Juniper Networks, Hewlett-Packard, Arista Networks, and Mellanox Technologies as well as from a new breed of upstarts who are supplying open switches or, worse yet, building such gear themselves as Google has been doing for the past decade and Facebook is starting to do.

If you look at Cisco’s numbers, it is hard to discern the effect, and that is because companies like Google and Facebook buy far fewer switches than they do servers and storage arrays. And until a lot of midrange and large enterprises get into open switching, Cisco can probably expect moderate growth.

We think that Cisco had a much more dramatic effect on the server business when it launched its Unified Computing System back in March 2009, into the gaping maw of the Great Recession, than the open switch movement has had on Cisco. But then again, if Cisco had not gone into servers, perhaps it would have had stronger partnerships with server makers; moreover, in the absence of open switches – some homegrown, others made by ODMs on command and relabeled by peddlers – Cisco might have been even more of a force in switching and routing.

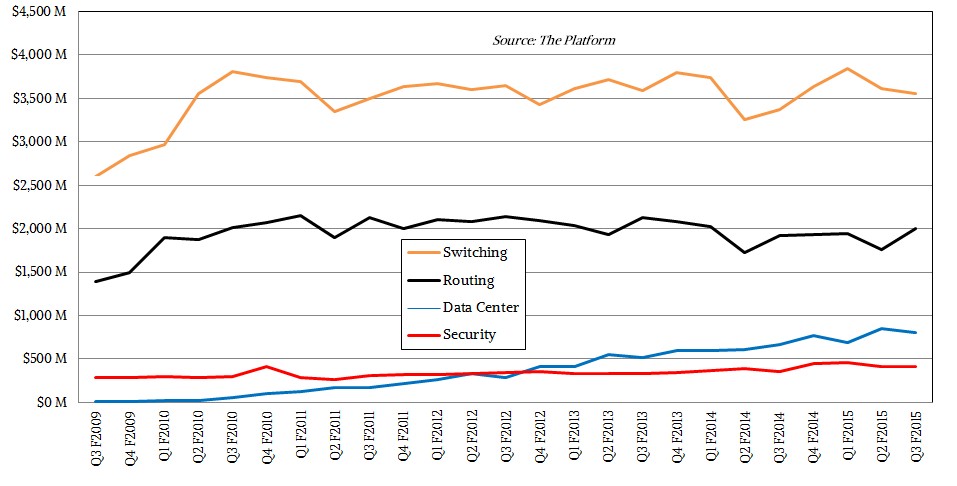

In the quarter ended in March, Cisco’s switching revenues were up 6 percent to $3.56 billion, and rose 11 percent in the prior quarter as well, and when asked why Cisco was not able to grow more, Chambers got a little feistier than usual in his response. “Our margins on switching actually were at the higher end of our range,” Chambers said. “They have been remarkably consistent for the last eight quarters. So all this garbage about new players coming in and software coming in and white label killing our approach was entirely wrong.”

In fact, Chambers explained, Cisco was selling customers on a complete stack of IT wares that help them with the digitization of their enterprise and that these customers, as he put it, don’t even think of Cisco as a routing and switching company anymore. “And the best of all, architectures beat white label and free software,” he added as a punctuation mark.

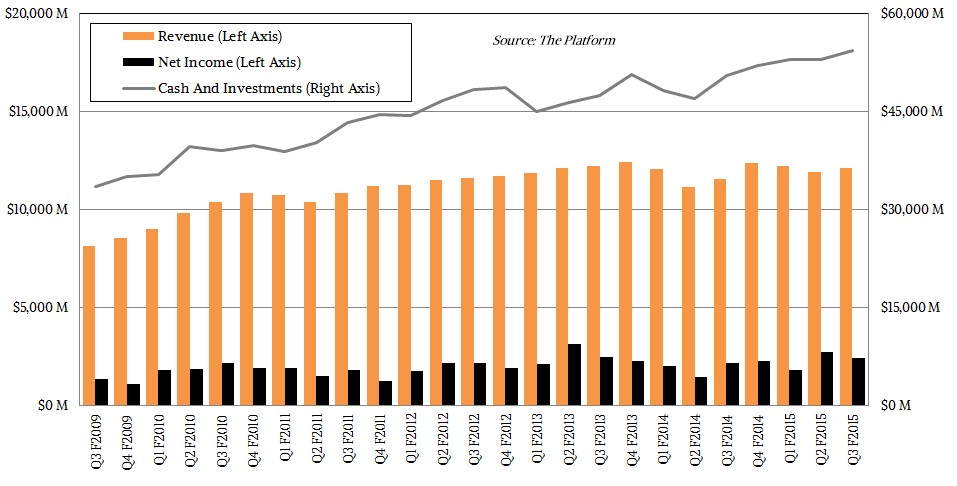

Cisco has certainly had its issues, particularly as Chambers wandered off into Flip digital cameras as a means of loading up the network, but it has done well in systems and with a fairly large number of other acquisitions that have kept the company on a more or less steady revenue and profit growth curve and its cash hoard rising along with it. The numbers are staggering, particularly that cash pile:

There are two ways of looking at that chart. Some potential competitors no doubt look at it like a nearly unassailable wall, while others look at it as a wall that can – and should – be knocked down. Very few companies come to dominate their IT niches as much as Cisco has done for the two decades that Chambers has been running it. Maybe IBM during the mainframe era, maybe Microsoft in desktop software when that mattered more before the Internet came in and gave Apple a second life with real personal computers, and maybe Google in search engines and online advertising, and maybe Amazon in both online retail and cloud computing.

“Our margins on switching actually were at the higher end of our range. They have been remarkably consistent for the last eight quarters. So all this garbage about new players coming in and software coming in and white label killing our approach was entirely wrong.”

To be sure, Cisco has had its ups and downs and its switching business did take a few lumps in the year-ago period that make its compares look better and, as the above chart shows, it has a way to go to get back to overall revenue levels it was setting in its fiscal 2013. But even with the wiggles in sales and net income and some pretty hefty acquisitions every now and then, that Cisco cash pile just keeps growing. At the beginning of the period we examined for the above chart, Cisco had $10.3 billion in long term debt but had $33.6 billion in cash and investments for a net cash position of $23.3 billion. At the time, that was a little more than two quarters of revenue for Cisco. Fast forward to the March quarter, and Cisco’s long-term debt has gradually risen over those six years, but it has $54.4 billion in cash and investments, and net of debts, it has $33.4 billion in the coffers, which is nearly three quarters of revenue at its current run rate.

In the trailing four quarters, Cisco has brought 19 percent of its $48.68 billion in revenues to the bottom line, which is the kind of margin you see from software companies. That kind of money obviously attracts staunch competition – particularly from the Open Compute movement that has opened up servers already and that has been driving open switching. Others have tried, and others have failed.

This time around, open switching might be more like Linux going up against Cisco as Unix, but this might be the wrong analogy to draw. Perhaps the better analogy is that just as Linux took over the high-end of the systems – with HPC, hyperscale, and cloud – and Windows – this would be the Cisco analog in networking – retained control of a lot of enterprise and the bulk of the midrange and entry systems market. Linux didn’t kill Windows on systems, after all. Many of us believed it might, and Microsoft reacted effectively and leveraged that vast installed base of applications. All bets are off when applications move to the cloud, which is why Microsoft built Azure.

In the quarter, Cisco said that its high-end Nexus 9000 core switches, including those that are equipped with its Application Policy Infrastructure Controller (APIC) software-defined networking hardware and software and those that are not, saw orders grow sequentially by 27 percent and that it expects for the growth to accelerate sequentially in its final fiscal quarter. Chambers said on the call with Wall Street that the company added over 970 customers for the Nexus 9000, bringing the base up to 2,650 customers. Of these, 580 are using the APIC SDN features, up from 300 in the fiscal second quarter. Adding up the Nexus 3000 top of rack switches together with the Nexus 9000s, Cisco saw 144 percent growth compared to the year ago period. Cisco did see some pressure in the Nexus 7000 modular switches, which have not yet been upgraded with APIC features, and Chambers said to expect that the transition here will take a few quarters. On the routing front, the new CRS-X and NCS routers tripled their revenues (from a small base) and high-end routing across all relevant products saw a 5 percent bump year-on-year. Overall, routing revenues rose 4 percent to just a hair under $2 billion.

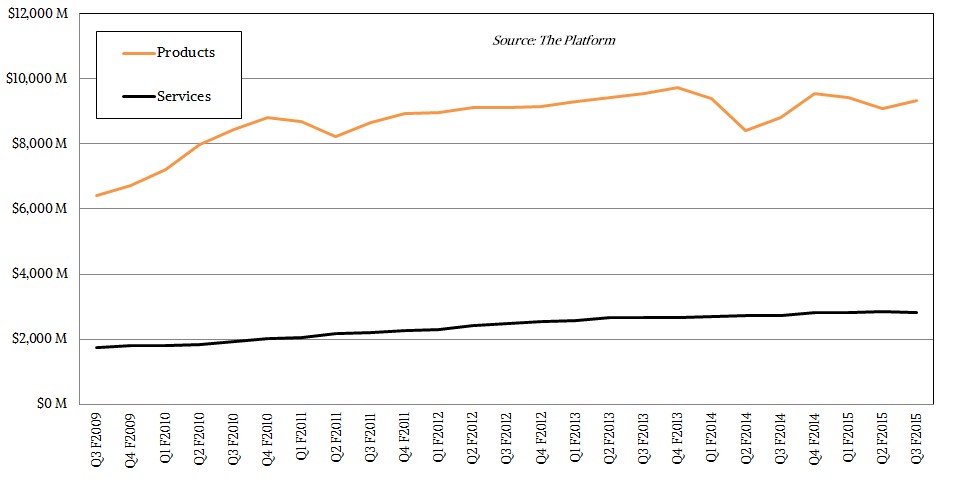

Datacenter Fills In Networking Gaps

It is safe to say that the advent of the UCS blade and now hyperscale systems has given Cisco a chance to take a much bigger piece of the IT wallet than perhaps it would have been able to do had it just stuck to its switching and routing and knitted network fabrics. The UCS business gave Cisco lots of new things to talk about during the recession and after it, and its credibility with Cisco switching and routing customers – who are not afraid to pay a premium for a product, obviously, with Cisco commanding north of 60 percent gross margins consistently – gave it leverage to take market share away from Hewlett-Packard, Dell, and IBM.

Cisco’s data center business unit, which is comprised largely of UCS blade servers and related converged Nexus switching, posted 21 percent growth in the fiscal third quarter, hitting $801 million in sales. While the growth has slowed for this business in recent quarters, as it must as the UCS business finds its own natural share of the market, Cisco now has 43,800 customers who have adopted its UCS machinery and that business has a run rate of over $3 billion.

Chambers said that 85 percent of the Fortune 500 have UCS gear, and that the number of repeat customers for UCS rose by 34 percent in the quarter. (He did not elaborate on how much revenue these customers drive.) Cisco sells the UCS machinery mostly through VCE (the partnership that it set up with EMC when UCS was launched in March 2009 and that is now part of EMC) and a partnership with NetApp and as of late last year, with IBM, which sold off its own modular systems and switching business to Lenovo.

Cisco’s revenue growth in the datacenter has been driven come largely from this UCS business, as you can see from the chart above. After a spurt of growth coming out of the Great Recession in late fiscal 2009, Cisco’s switching business has settled in at around $3.5 billion per quarter, and its routing business hovers at around $2 billion a quarter after a similar jump. Security products (which include hardware and software) kiss $500 million a quarter, and by this time next year, if trends persist, the UCS and related data center business could reach a run rate of $1 billion a quarter. That is probably the peak, unless Cisco can somehow break into the hyperscale market, as it has been trying to do with servers, more effectively.

“If you watch our ability to bring new products to market, you are going to see us have all ten of the major players as key customers shortly. And up to recently, as you know, we were missing largely in one of those.”

Chambers gave the distinct impression that Cisco was not about to give up on either the hyperscalers or cloud builders when it comes to switching or routing, either. Cisco’s soon-to-be executive chairman said that it used to take Cisco three to five years to design and produce a high-end product, and that it took about 3,000 people to do it, but moving at hyperspeed with a new process, Cisco is creating its next generation of routers in under a year with around 225 people.

“If you look at where we are in let’s call it the massively scalable datacenters – the top ten – our role in that is evolving, and candidly we’re starting to move much faster,” Chambers explained. “If you watch our ability to bring new products to market, you are going to see us have all ten of the major players as key customers shortly. And up to recently, as you know, we were missing largely in one of those.” As to how Cisco would get into the large accounts or extend its presence in them, Chambers added that Cisco would do it “with software independence where appropriate or a combination of software, hardware, and ASICs.” Dropping names a bit, which Chambers would not normally do, Chambers said that he liked the company’s momentum in these accounts, ranging “from the Microsofts of the world to the Googles of the world to the Facebooks, to the Amazons.”

Because Microsoft does not – and will not – have its own switch operating system based on the Windows kernel, it is not hard to understand that Cisco might have a tight partnership with Microsoft. But then again, Microsoft is part of the Open Compute club now and seems just as likely inclined to use open switches if there are advantages. Microsoft could even go wild and endorse one of the Linux-based open switch operating systems, such as Big Switch Networks’ Switch Light, Pluribus Networks’ Netvisor, or Cumulus Networks’ Cumulus Linux. Stranger things have happened.

As for the other hyperscalers, Facebook has loads of Cisco switches these days, but is committed to having its own Wedge top of rack and 6-pack modular switches installed and doing away with its Cisco gear, as Najam Ahmad, director of technical operations at Facebook and the person in charge of the networks at the social network, told The Next Platform back in March. Amazon has been building its own switches and routers for years, too, and it likes its own switches and routers because they only have the features it needs. It is hard to imagine those switch genies going back into the bottles, but there is probably no question that hyperscalers would consider a Cisco router if it made sense. Many of them use Cisco router gear today because this is a lower-volume, higher-cost item to invent on your own than switches.

Be the first to comment