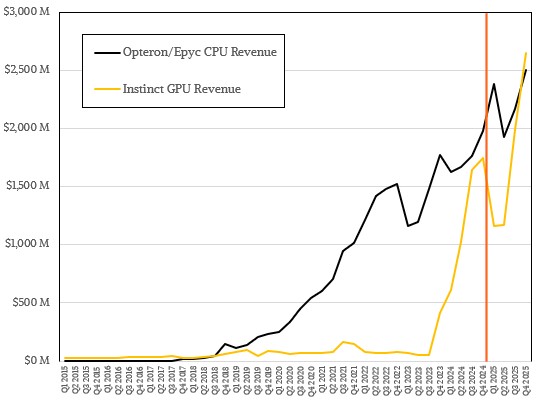

Pent up demand for MI308 GPUs in China, which AMD has been trying to get a license to sell since early last year, were approved so that $360 million in Instinct GPU sales that were not officially part of the pipeline made their way onto the AMD books in Q4 2025. And with that move, for the first time in the history of the datacenter compute business at the chip maker – and rival to both Intel and Nvidia – that sales of Instinct GPUs outpaced sales of Epyc GPUs.

This is a moment that has been more than a decade in the making, and a testament to all of the hard work that AMD has done with its hardware and its software to be able to compete with Nvidia at all in GPUs.

That assessment comes from our own financial model of AMD, which has its share of educated guesses in it. But so does every other model put together on Wall Street. Our pal Aaron Rakers at Wells Fargo Securities estimates that Instinct GPU sales were between $2.5 billion and $2.6 billion in the quarter, and puts Epyc CPUs slightly ahead of GPUs. Even if he is right and we are wrong, it will not be long before GPU revenues at AMD almost always beat CPU revenues, simply because GPUs are more expensive and in higher demand.

Admittedly, this may be a one-off situation until the “Altair” MI400 series starts ramping in the second half of this year, with three main variations and one spare, if what we hear and see is correct. (AMD uses MI400 and MI450 kind of fluidly as terms.) We went over the different variations on the Altair GPU theme back in November 2025 and are not going over all of that again. Suffice it to say that the Altair GPUs (which we gave their codename because AMD refuses to give us a synonym) and their “Helios” double-wide racks are going to be transformational to the AMD datacenter GPU business and foundational for the next level of that business.

Chief executive officer Lisa Su reiterated on a call with Wall Street analysts that its own datacenter business can grow at more than 60 percent per year over the next three to five years thanks to the two cylinder Epyc and Instinct engine, which will “scale our AI business to tens of billions in annual revenue in 2027.”

We took a stab at modeling AMD’s datacenter AI total addressable market and its business compared to Nvidia last November when Su started giving out broader guidance. AMD is being very careful not to forecast any particular number because of the vicissitudes of the component supply chain and the capriciousness of some customers. Which is actually the responsible thing to do for a public company. AMD is not alone in hoping that OpenAI comes through on its promises, which has the AI model maker committing to developing 6 gigawatts of AI compute based on AMD engines between the second half of 2026 and through October 2030.

We are not here to do all of that again, but to put 2025 into the financial history books and move on to 2026, which is 35 days old and counting. Let’s dive in.

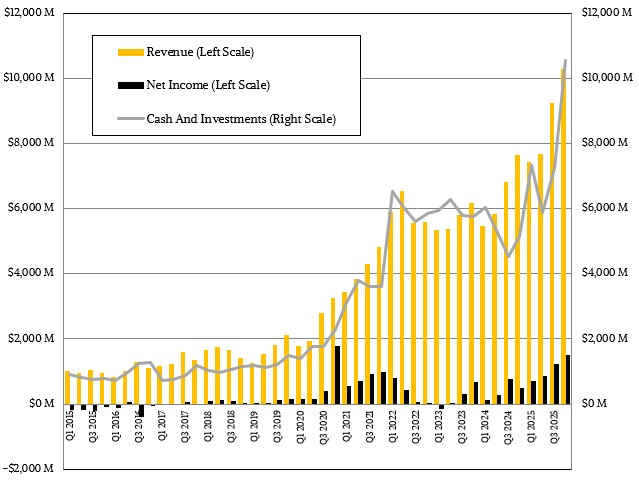

In the quarter ended in December 2025, AMD’s sales were $10.27 billion, a record quarter and up 34.1 percent year on year. This is the first time that AMD has broken through $10 billion in quarterly sales, and Q1 2026 might be the second if AMD can come in at the high end of its guidance, which is for $9.8 billion in sales, plus or minus $300 million.

After a strong Q4, the client and gaming chip business at AMD is going into a normal seasonal decline, and growth in the datacenter business will probably not be enough to offset that – but there’s a chance, as you see.

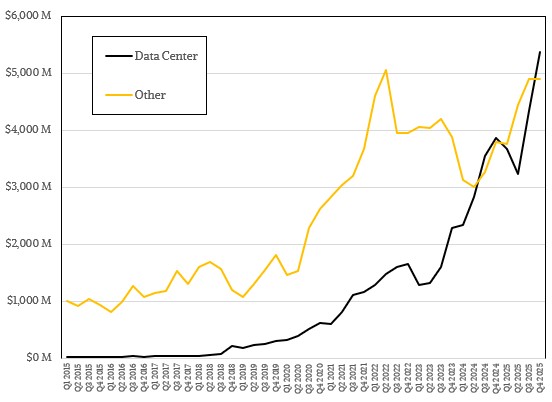

In the fourth quarter, the Data Center group at AMD posted sales of $5.38 billion, up 39.4 percent year on year and up 23.9 percent sequentially. Perhaps more importantly, operating income for the Data Center group was up 51.4 percent to $1.75 billion, representing a very healthy 32.6 percent of revenues. The Instinct MI355X ramp as well as healthy sales of both “Genoa” and Turin Epyc server processors are were the main drivers of sales.

Interestingly, all of the operating income for the other AMD groups – Client, Gaming, and Embedded – offset by corporate overhead of $1.08 billion in operating costs were perfectly balanced such that the same $1.75 billion passed through the Data Center group to the middle line for all of AMD. Even so, operating income more than doubled compared to a year ago, despite costs associated with the ZT Systems acquisition and spinout of its manufacturing business.

For the full year, the Data Center group had $16.64 billion in sales, up 32.2 percent, with $3.6 billion in operating income, up only 3.5 percent year on year. Wall Street is upset about that last bit where operating profits are not rising anywhere as fast for all of 2025 as they did in its final quarter. Hopefully the profitability curve is improving for 2026 and 2027.

The interesting thing to do is to calculate the revenue for the rest of AMD. The Other half or so of AMD that is not Datacenter had a tad over $18 billion in sales in 2025, up a healthy 36.3 percent. The rest of AMD was growing faster, on an annual basis, than was the datacenter business. This is why you have to look at Nvidia and AMD and Intel and Broadcom on an annual basis, which accounts for the large ups and downs that comes with the product cycles set up between the chip makers and their hyperscaler and cloud builder customers. The product cycles drive the investment cycles, give or take supply chain static.

The other neat thing we like to do is separate out Epyc CPU sales from Instinct GPU sales, which we have been doing for a number of years now. We extract out a little money for embedded FPGAs aimed at the datacenter and network interface card sales as well, and then use the hints provided by AMD to break CPUs and GPUs apart. This worked reasonably well until a year ago when AMD’s hints got a lot weaker as it got skittish about making too many promises and saying too much about its Instinct GPU business. (That vertical red line delineates this change.)

As far as we can tell, AMD’s Epyc CPUs and Instinct GPUs both turned in the highest sales in the history of AMD’s datacenter business in Q4 2025, and as we said at the top of this story, the GPU business was helped by a $390 million shipment of MI308 crippled GPUs into China. Without those GPU sales into China, Instinct revenues would have been $2.26 billion, up 29.4 percent, in our model. With that $390 million bump up, Instinct GPU sales for Q4 2025 were $2.65 billion, up 51.7 percent.

We think Epyc CPU sales in the period were $2.51 billion, up 26.4 percent.

Be the first to comment