While chip designer and maker Intel has a new strategy and a new executive team to implement it, it is going to take a long time for changes made last year and this year to be felt and for product and process roadmap changes to put the company into a better competitive situation.

And even when it does, competitive pressures in the datacenter, in the client, and at the edge are all going to make it very difficult – we are intentionally hesitating to say impossible – for the company to make the 50 percent or so operating margins that it enjoyed when AMD was not selling server CPUs and Arm server chips were still a dream, not an increasing reality among the hyperscalers and cloud builders who dominate server spending in the 2020s.

Intel has a new financial organization for itself in the wake of Pat Gelsinger rejoining the company as chief executive officer a little more than a year ago, which makes it easier to see some things about its datacenter business and harder in other ways. And it will be a while before we have four quarters of data and four quarters of the backwards compare to create a new model of Intel’s “real” datacenter business, which did not change just because Intel rejiggered the categories and labels for its businesses that it uses when talking to Wall Street. So for now, we will focus on what the company has said about its first quarter 2022 and get used to the new language.

In the quarter ending in March, Intel’s revenues were down 6.7 percent to $18.36 billion. Despite $1.21 billion in restructuring charges and rising research and development expenses (up 20.4 percent to $4.36 billion in the period) and thanks to $4.32 billion gain on equity investments, Intel was able to report a net income of $8.11 billion, 2.4X higher than the year ago quarter. Intel is out of the security software business and out of the flash storage business, which were distractions largely engendered by its dominance of server CPU compute between 2009 and 2017, and now it is looking to take its Mobileye self-driving vehicle compute business public to “unlock value” inherent in it, and we will once again point out, as we did with VMware being acquired by EMC and then going public, that Intel shareholders already own Mobileye and it is therefore already public.

In any event, there is a new Datacenter and AI group, which has Xeon SP CPUs, chipsets, and motherboards, with the Altera FPGA business, the Habana matrix math engines, and other ASICs tossed in there, too. (Where they belong.) Revenues for the Datacenter and AI group rose by 22.2 percent to $6.03 billion, but operating income was down 1.2 percent to $1.69 billion due to the ramping of Intel 7 processes (10 nanometer SuperFIN) and Intel 3 manufacturing processes and the increasing R&D costs relating to the Xeon SP server roadmap. We also think that the bundling practices that Intel has relied on to keep Xeon SP prices higher than they might otherwise be are less effective since Intel is suffering shortages of its Ethernet controllers just like other NIC makers, which is having a ripple effect on server sales. In the conference call with Wall Street analysts, Gelsinger said that the company expected “headwinds” with Ethernet NIC sales (and therefore the consequent pressure on Xeon SP CPU sales) for the remainder of 2022.

Here is the important math. In Q1 2021, operating profits were 34.5 percent of revenues, which is a long way down from that 50 percent level Intel’s Data Center Group had in the heyday between 2010 and 2018, with a few bad quarters in the mix. In Q1 2022, operating profits fell further to 27.9 percent of revenues.

It is very hard to for Intel to throw off the cash it needs to build foundries just at the time it needs a lot of cash to build foundries. If Intel had used its cash to build foundries over the past decade and did more investing in research and development and did not rest on its 22 nanometer and 14 nanometer laurels, it might not be in this bind. All of those share buybacks and expensive acquisitions that did not lead to revenues and profits now come home to roost.

With Gelsinger at the helm, it seems there will be a lot more focus on the core businesses, but as we said above, it seems unlikely that competitive pressures and the ever-higher costs of manufacturing compute, networking, and storage engines will allow Intel to return to anything like the profitability it once enjoyed in the glass house.

Intel is no longer giving out growth rates for shipments of datacenter products to hyperscalers and cloud builders, telcos and other suppliers, and enterprises and governments as it used to, which is a shame. But as you can see in the chart above, the company said that hyperscalers and enterprises were buying products even though they know that the “Sapphire Rapids” Xeon SPs, the third generation in this server CPU line, is due in the second half of this year. Sapphire Rapids CPUs have begun initial shipping to selected customers, and the Habana 2 matrix math engine is also sampling, according to Gelsinger.

The Network and Edge group, which is called NEX for short for some strange reason, had sales of $2.21 billion in the quarter, up 23 percent year on year, with operating profits of $366 million, up 50.6 percent. The NEX group includes the Barefoot Networks switching business, silicon photonics such as used with Ethernet transceivers, and the Xeon D compute engines – things that are generally sold to network equipment makers or network operators directly. Operating profits rose from 13.6 percent of revenues a year ago to 16.5 percent of revenues this quarter, but that is still not the kind of middle line that Intel and its shareholders are used to, and it is arguable, given the products and customers here that it will be anywhere close to as profitable as Data Center Group once was.

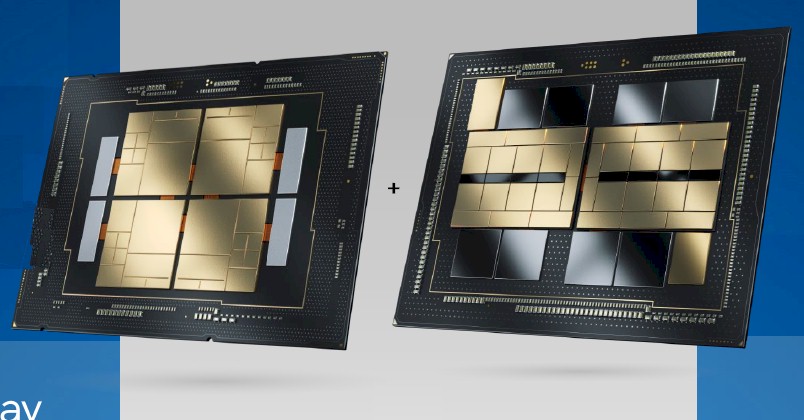

The Accelerated Computing Systems and Graphics group, shortened to AXG for some strange reason, is bleeding money at the moment, and quite heavily as Intel tries to build a discrete graphics business from scratch and incurs the development costs of bringing compute engines specifically for HPC and AI customers, such as the Sapphire Rapids Xeon SPs with HBM memory or the “Ponte Vecchio” Xe HPC GPU complex to be used in the “Aurora” supercomputer at Argonne National Labs, to market. Ponte Vecchio is sampling and presumably so is the HBM memory variant of the Sapphire Rapids CPU, which is also being used in the Aurora system. Intel reminds everyone that it has a generic datacenter GPU, called “Arctic Sound,” aimed at media processing and inference, coming out in the second half the year.

Gelsinger said that Intel was on track to hit $1 billion in revenues for AXG this year, but we wonder at what cost. In the year ago quarter, AXG had $181 million in sales but posted a $176 million loss. And while Intel was able to grow AXG sales by 21 percent to $219 million in Q1 2022, the losses grew by a factor of 2.2X to $390 million. We wonder what affect Aurora will have on the AXG group’s revenues and profits when it gets booked. It looks like, based on Intel’s statements, that building up an inventory of Sapphire Rapids HBM and Ponte Vecchio parts for Aurora has taken a toll on operating profits, and so has production ramp for these parts and investments in the specialized CPUs and discrete GPUs that Intel is creating under the guise of AXG.

David Zisner, Intel’s newly appointed chief financial officer, said on the call that the Datacenter and AI group “expects to see a stronger second half of the year as hyperscale customer demand remains robust, component supply improves, and the ramp of Ice Lake, and Sapphire Rapid’s increased competitiveness.” And speaking of Ice Lake, Intel has now sold nearly 4 million units of this Xeon SP and Gelsinger said that Intel would be ramping Ice Lake “more aggressively with higher volumes” as Intel moves into the second half of the year. Gelsinger added that there were some DDR5 memory interface issues with Sapphire Rapids – apparently with the memory vendors, not Intel – and now multiple vendors are qualified to have their memory inside of Sapphire Rapids platforms. And, Gelsinger said that Sapphire Rapids would ramp faster than Ice Lake, but this is a given considering how much better at 10 nanometers Intel is compared to where it was even a year ago.