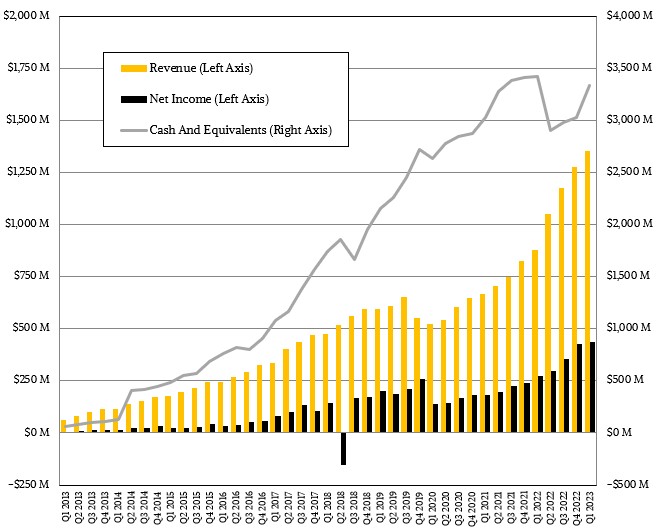

For Arista Networks, the poster-child of hyperscaler and cloud build networking that, more than any other vendor, has championed merchant silicon and Linux as the basis of a modular network operating system, 2022 was a bumper crop year. This year, there are many new things going on, but the compares are going to get tougher and tougher as the 2023 year goes on because the kind of growth that Arista had last year is just not doable this year.

That is just now how the hyperscalers and cloud builders consume – or perhaps intentionally overconsume to drive prices down – technology. And so, in its call going over the financial results for its first quarter of 2023, the top brass at the network upstart made it clear that all signals were pointing towards getting back to normal, including working down its deferred revenue and customer purchase commitments and getting its supply chain back in order as the world settles down at least somewhat in the wake of the coronavirus pandemic.

In one sense, however, this reset to something akin to normal conditions will be worse for companies like Arista Networks.

“As we move through 2023, we expect to resolve the final kinks in the supply chain, allowing for more consistent manufacturing output and improving lead times to our customers,” Ita Brennan, chief financial officer of Arista Networks, explained on a call with Wall Street analysts. “We do however expect these reduced lead times to also result in reduced visibility since customers no longer need to make purchase decisions so far in advance of deployment. In addition, we expect some moderation in customer spending, especially with our cloud titan customers following a year of accelerated demand in 2022. All of that being said, we believe customer engagements and current deployments across business support the current consensus revenue growth rate for 2023 of approximately 26 percent. In terms of quarterly trends, you should expect moderating year-over-year growth as the year progresses with more difficult prior year comps.”

In a sense, if you look at revenue and net income growth, the first quarter of 2023 was part of the same upgrade cycle bump that started to build momentum in Q2 2022 and pushed Arista Networks to continue set new records for revenues and profits as it has been doing each successive quarter for more than two years now. But the period from Q2 2022 through Q1 2023 was even a little more extra, thanks in large part to the 400 Gb/sec Ethernet upgrade cycle at the hyperscalers and cloud builders, and in the case of Arista Networks, particularly thanks to key customers Microsoft and Meta Platforms.

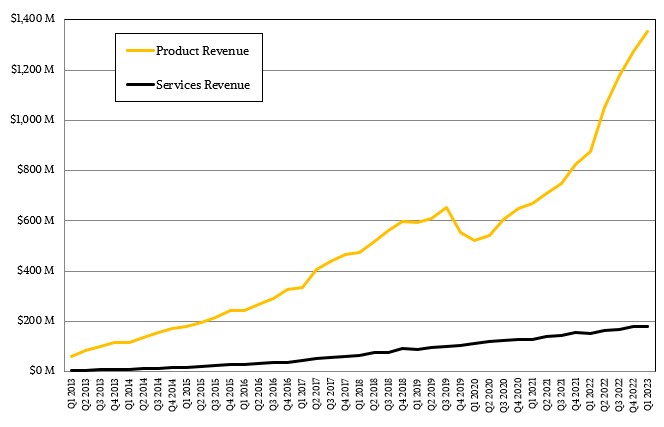

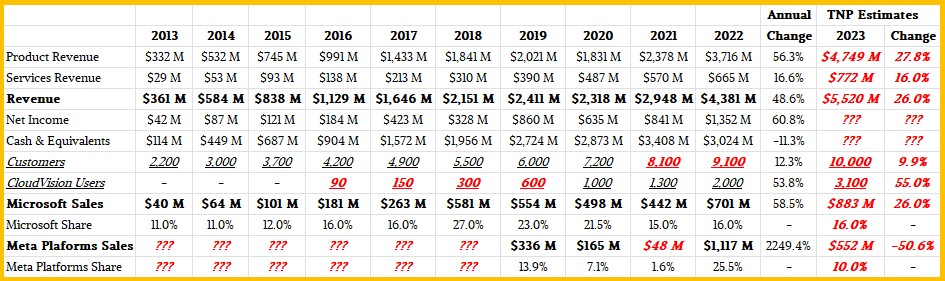

In 2022, after skipping the 200 Gb/sec generation of Ethernet switching, Meta Platforms went all-in with 400 Gb/sec networking, and increased its spending with Arista Networks by what we estimate was a factor of 23.5X, to $1.12 billion. Microsoft increased its spending at the company by 58.5 percent in 2022 to $701 million, growing a little slower than overall sales Arista Networks but we reckon Microsoft got a lot more bit shifting capacity for the dollar than did all other customers excepting maybe Meta Platforms. The other customers aside from Microsoft and Meta Platforms are paying a higher premium for the company’s products and hence net income grew faster than revenue for Arista Networks. Overall product sales rose by 56.3 percent last year, to $3.72 billion, and services revenues increased by 16.6 percent to $665 million, making overall revenues rise by 48.6 percent to $4.38 billion.

With a 26 percent growth rate, that means Arista Networks (along with Wall Street) is only expecting to see revenues of around $5.52 billion. We think that both Meta Platforms and Microsoft are extremely keen on looking at the new Jericho3-AI chip from Broadcom as an alternative to the Nvidia InfiniBand backbones that are used in their respective AI training clusters today, and we will be very interested to see if Arista Networks can use these chips to flip them from InfiniBand to Ethernet. (And if Arista Networks can’t do that with the Jericho3-AI ASICs at these key accounts, that will be telling.)

All things being equal, the hyperscalers and cloud builders would always use Ethernet and never deploy InfiniBand. And the good news for Mellanox and then Nvidia is that all things have most definitely not been equal between Ethernet and InfiniBand when it comes to HPC and AI interconnects. But the Jericho3-AI is not an HPC network that has been moved over to AI, but rather one that has been created for AI that might be useful only for some HPC workloads. (As Broadcom has explained it, at least.) The test is in who will make switches using the Jericho3-AI chip and who will buy them. One thing we know for sure: Unless and until one of these two big customers adopts the Jericho3-AI chip, Arista Networks is not going to launch a chip using it. And another thing we know for sure is that Broadcom didn’t create the Jerischo3-AI unless some big clouds and hyperscalers were asking it to do so as an alternative to InfiniBand.

Nothing moves all that fast, even in the hyperscaler and cloud datacenters.

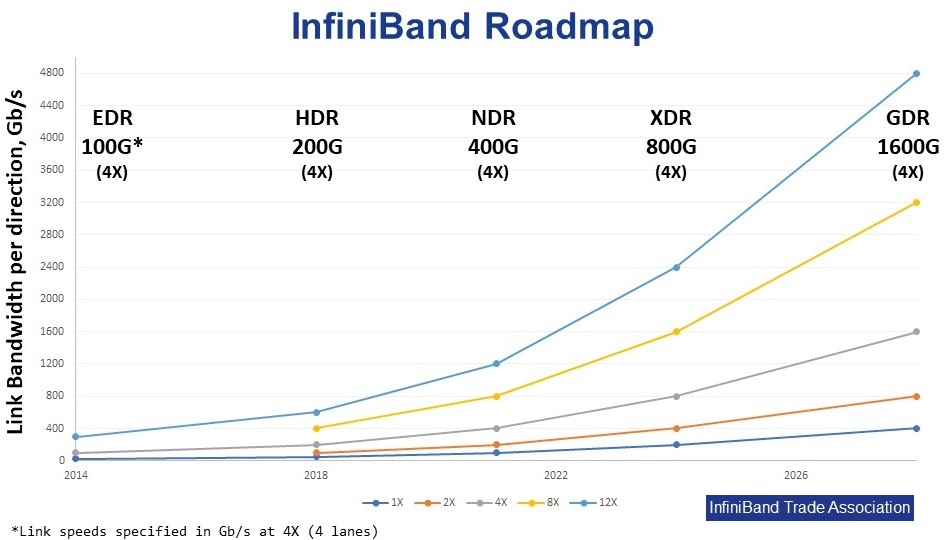

“A good way to look at this market and the introduction the Jericho3-AI is that 400GE is not going to end quickly and suddenly get replaced with Jericho3-AI,” explained Anshul Sadana, chief operating officer at Arista Networks, on the call. And we will remind everyone that the Jericho3-AI chip is really designed to drive 800 Gb/sec ports and that the network interface cards are not there yet, either. “So 400 Gb/sec will go on for some time, customers will take time to make changes – especially when they don’t need more bandwidth just yet. At the same time, you will see a quick adoption of 800 Gb/sec technology. The AI teams will absolutely consume these as quickly as the market can get them out there.”

Sadana reminded everyone that Jericho3-AI networks, including Ramon3 fabric elements, span across 4,000 GPUs in a single cluster and drives AI workloads around 10 percent faster than InfiniBand across sixteen 200 Gb/sec adapter cards in a server. And he reminded everyone that it takes time.

Given the AI hype cycle, and the speed with which Broadcom was able to get its 800 Gb/sec Tomahawk5 switches into machinery from Arista Networks and others, possibly as 2023 comes to an end, possibly in early 2024. The race is now on for Nvidia to get 800 Gb/sec Quantum-3 XDR InfiniBand out in the field sometime in late 2023 to early 2024, and the heat will be on to get 1.6 Tb/sec GDR InfiniBand into the field before its current expected delivery of late 2027 in the roadmap from the InfiniBand Trade Association shown above.

What Arista Networks sees is a trifurcation of the market, and it does not have much of an HPC business to speak of, which is why the company doesn’t see a quadfurcation.

“It is a very exciting multiyear journey, and we really value our partnership with Broadcom,” Jayshree Ullal, chief executive officer at Arista Networks, said on the call. “But what you’re seeing here is 100 Gb/sec for mainstream enterprises, 400 Gb/sec for the cloud, and 800 Gb/sec and beyond for AI use cases.”

What Ullal did not say, and what is certainly true, is that most of the AI buildout will be at those cloud builders and hyperscalers. The split Ullal speaks of is really a breakdown of Ethernet by workload, not by customer, since AI is still largely in the cloud titans, as Arista Networks calls hyperscalers and cloud builders. And will be for the foreseeable future with very few notable exceptions, such as the national HPC labs around the globe. Ullal added on the call that there will be some production use of Ethernet in AI clusters this year, with trials starting last year, and deployments will accelerate in 2024 and 2025, and reminded everyone that this AI buildout will be considerably smaller than the normal cloud buildout.

But every new business starts out small. Arista Networks was not in campus and edge networking at all, which represents a $10 billion to $15 billion opportunity over the next few years, and the company’s campus network business is expected to nearly double to $750 million by 2025. The company’s foray into AI networking, which it has been talking about for the past year, will get traction. And the WAN Routing System that the company launched in March and that it is co-locating in Equinix datacenters gives Arista Networks another edge play and a new market to chase.

This all started out in 2011 with a 10 Gb/sec top of rack switch running Linux and using Intel and Broadcom chips, and no customers. Arista Networks plays the long game, and doesn’t mind grinding it out.

Be the first to comment