Hewlett Packard Enterprise has been an early and enthusiastic supporter of alternate processor architectures outside of the standard Xeon X86 CPUs that comprise the vast majority of its revenues and shipments, particularly with Arm server chips starting in 2011. Maybe now, the fourth time will be the charm as it adds Ampere Computing’s “Mystique” Altra Max Arm server chip as a motor in a standard ProLiant rack-mounted server.

The CPU supplier agreement with Ampere Computing is definitely a water-shed event for that particular Arm server chip maker, landing its first big OEM server maker after having some success getting Baidu, Tencent, Alibaba, Oracle, and now Microsoft to adopt its 80-core Altra and 128-core Altra Arm CPUs in their custom server infrastructure – mostly for inward facing workloads, but increasingly for outward facing ones sold as raw infrastructure for clients of their clouds who want to know more about Arm servers.

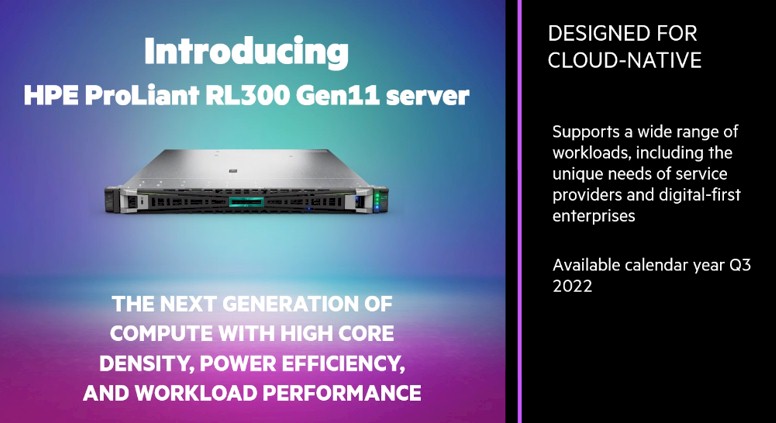

The announcement, made at HPE’s Discover 2022 customer and partner event, is fairly modest as these things go, with only one machine – the single socket, 1U rack server known as the ProLiant RL300 – in the lineup. And given HPE’s history with Arm servers, you can probably understand why the company is playing it a little more cautiously.

Back in November 2011, the company was known just as Hewlett-Packard and it had adopted the four-core EnergyCore ECX-1000 Arm server chip from Calxeda, which was really a system-on-chip with a single DDR3 memory controller, an integrated management controller, four PCI-Express 2.0 controllers, a SATA 2.0 controller for flash and disk storage, and a fabric switch with eight 10 GB/sec Ethernet channels (three for interconnecting with three other ECX-100 chips on a board, and five to talk to the outside world, including other boards interlinked in a mesh). The “Redstone” server cards using the Calxeda processor were part of the “Moonshot” hyperscale server design effort launched with much fanfare by Hewlett-Packard at the same time Calxeda uncloaked. But the Calxeda chips only had 32-bit processing and memory addressing, and while 48-bit chips were on the roadmap, it was going to take years to add 64-bit chips and that was just too long for either Calxeda or Moonshot to get off the ground.

Back in 2017, Hewlett Packard Enterprise, as the company was called after the spinout of its PC and printer business, anointed Cavium’s ThunderX2 server chip as the next great Arm hope. (Well, it was really Broadcom’s recycled “Vulcan” Arm server chip.) The ThunderX2 was put into HPE’s “Comanche” Apollo 70 dense, barebone servers. A bunch of these systems were sold, but nothing close to volumes, and a while after Marvell bought Cavium for $6 billion and a few HPC systems were up and running testing out the ThunderX2, Marvell was getting set to launch the “Triton” ThunderX3 follow-on and then, as 2020 came to a close, Marvell spiked ThunderX3 like Broadcom spiked ThunderX2, and this time, no one picked up the pieces. Although there were some rumors that Microsoft might do it at around the same time.

And then, a little more than two years later, Microsoft tapped Ampere Computing as its Arm server chip supplier. We did a thorough analysis of the Altra instances running on the Azure cloud, and calculated they are delivering somewhere between a quarter to a third better price/performance than instances based on the AMD “Milan” Epyc 7003 processors on Azure. And for all of the reasons that we have discussed in the past about the Altra line of chips, and mainly because it is a chip aimed at hyperscalers and clouds and cloud native workloads that perform more consistently on a core with a set clock speed and no simultaneous multithreading, HPE is adding the Altra chips to its mainstream ProLiant machines.

(An aside: As we have discussed here in the past, HPE is also an enthusiastic supporter of Fujitsu’s A64FX Arm processor, designed with big fat vector math units and used in the “Fugaku” supercomputer at RIKEN Lab in Japan, which is has added to its Apollo 80 systems.)

It is that deterministic performance and that price/performance that has attracted HPE to the Altra CPUs, and the fact that HPE is not selling this as a special Moonshot type of server, or one of its Cloudline el cheapo hyperscaler boxes, but in a standard ProLiant machine that comes with an iLO or OpenBMC baseboard management controller commonly used in enterprises, shows that HPE is serious.

“HPE and ProLiant have brought 30 years of leadership and innovation in compute in a sea of followers,” explains Neil MacDonald, executive vice president and general manager of the Compute group at HPE. “We’ve been committed deeply to innovation in compute, whether that’s automation management, performance, security, or power efficiency. And this is a very, very natural next step in our journey to bring compute solutions with cloud native silicon to support these emerging markets and out changing customer needs. We’re thrilled to be working with Ampere, who are delivering that next generation compute driven by the cloud for the datacenter, and Ampere is modernizing that core compute for cloud software and cloud workloads.”

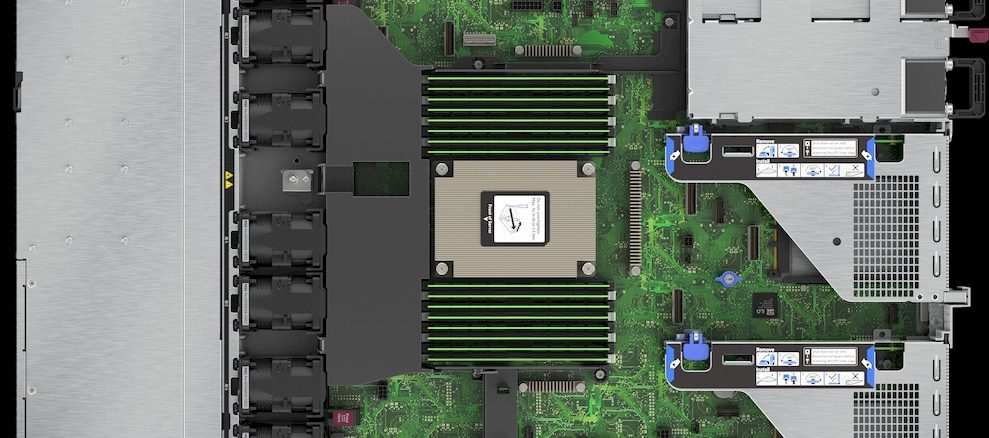

There are not a lot of feeds and speeds available for the ProLiant RL300 server, but it is a single socket server in a 1U chassis that has 16 DDR4 memory slots with up to 4 TB of main memory, which is a lot for a single-socket machine. Both the 80-core Altra and 128-core Altra Max chips will plug into the socket of the box, which has three PCI-Express 4.0 slots and two OCP 3.0 slots. The machine has up to two M.2 NVM-Express flash memory sticks and ten small form factor NVM-Express SSDs.

The ProLiant RL300 will be available in the third quarter. Pricing was not divulged, but we presume it will be aggressively priced against ProLiant machines using Intel Xeon SP and AMD Epyc processors – and that in this case, more of the margin will hit HPE’s bottom line than has happened in the past with Xeon SPs.

We also presume that HPE will do a broader product portfolio, including a two-socket workhorse machine that competes against the flagship ProLiant DL380 using Xeon SPs and its rival, the ProLiant DL385 using Epycs. We also expect more compact sled servers for the Apollo line for those who want more density than these ProLiants offer. A 1U box at full width with only one server socket in it is not all that dense, and it is reasonable to expect a 2U chassis with four sleds in it at some point. If HPE is as serious about the Ampere Arm server chips as MacDonald definitely wants us to believe. When asked about the delivery of such a full line, MacDonald smiled and said this:

“When we make decisions on technology, we are making them very thoughtfully with a lens to the future. And there are other activities already in the works, that I’m not going to be talking about today in terms of things that we can do in the future. But we’re very excited about the opportunity and the ecosystem that is in place around this platform.”

Like we said: When we see a ProLiant RL380 and an Apollo 2000 using Ampere Computing’s Altra CPUs, we will know that HPE is really serious.

I hope that in near future HPE will manufacture 80/128 core Altra CPU based workstations and why not laptops.