What is the difference between a row of servers at one of the 80 availability zones in 25 geographic regions run by Amazon Web Services and a printing press at one of the four facilities run by the US Mint? I don’t know, but it sure looks like somebody is gonna make a whole lotta money.

In the quarter ended in March, online retail giant and IT capacity supplier Amazon just made it all look easy, and admitted openly that the company is benefitting mightily from the cultural and business changes that have happened – and will be in some cases permanent – in the wake of the coronavirus pandemic.

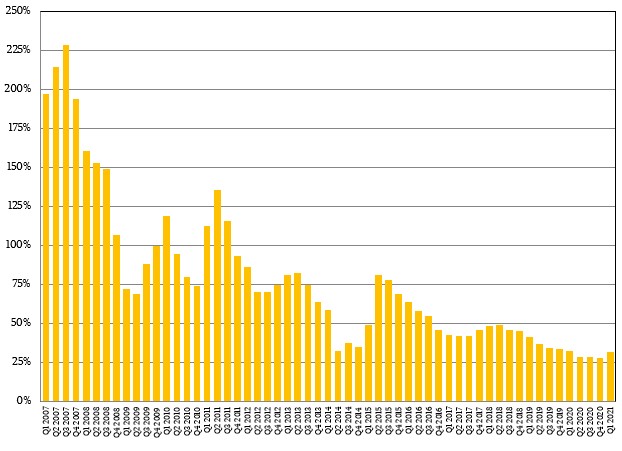

What is amazing to contemplate is that Amazon’s overall sales grew faster than its Amazon Web Services unit, which is long outside of the triple digit growth rates that the company enjoyed in the early years, from 2006 through 2010. Still, the various retail and media businesses of Amazon and its AWS IT infrastructure subsidiary are growing much faster than its peers, and are both the retail/media and cloud businesses are forces to be reckoned with inside the respective markets, and ones that reinforce each other as they continue to swell.

In Q1 2021, Amazon’s overall sales rose by 43.8 percent to $108.52 billion, and operating income rose by an impressive 2.2X to $8.87 billion, or about 8.2 percent of revenues and the highest level seen in two years. (You are welcome, Jeff Bezos, on behalf of families who buy online all over the world now who didn’t before the pandemic.) If you subtract out the AWS cloud business and just focus on those other parts of Amazon, revenues rose by 45.7 percent to $95.02 billion, and operating income rose by 5.4X to $4.7 billion, representing 4.9 percent of sales.

“In the first quarter, AWS revenue growth accelerated across a broad range of customers,” explained Brian Olsavsky, chief financial officer at Amazon, during a call with Wall Street analysts going over the numbers. “During COVID, we have seen many enterprises decide that they no longer want to manage their own technology infrastructure. They see that partnering with AWS and moving to the cloud gives them better cost, better capability, and better speed of innovation. We expect this trend to continue as we move into the post-pandemic recovery. There’s significant momentum around the world, including broad and deep engagement across major industries.”

The thing to remember about AWS is that it throws off more operating income as a percent of revenue compared to those other Amazon businesses.

In the quarter ended on March 31, AWS had $13.5 billion in sales, up 32.1 percent, and operating income was up 35.5 percent to $4.16 billion. The other funny thing is that AWS has been the most profitable part of Amazon for a long time, not just in recent years. Our data only goes back to 2016 when AWS had its numbers formally carved out so Wall Street could see them, but even then, AWS was contributing twice as much to the company’s overall operating income as the non-AWS pieces of Amazon. This quarter is the first time that we know about since the founding of AWS in March 2006 when the non-AWS pieces of Amazon were more profitable, in an absolute dollar sense, compared to AWS. But as we said above, AWS itself is more profitable in terms of its share of its own revenue stream. In the March quarter, AWS represented only 12.4 percent of Amazon’s overall revenue, but accounted for 47 percent of its overall operating income, which makes it 6.2X as profitable at that operating level of the books.

It is no surprise, then, that AWS is interested in adding 15 more availability zones in five new global regions. We wonder if there will be a point where there are marginal returns for adding new capacity around the globe, but so far that has not seemed to happen. A lot will depend on how the core 195 countries in the world think about public clouds as a nationalistic endeavor. At some point, governments may want to have some sort of stake in the Amazon sites inside of their borders and therefore some sort of control.

The growth rate of AWS has decelerated considerably over the years, but has stabilized in recent quarters at what amounts to a really high level for an IT supplier.

But the thing to also consider is that AWS has a huge backlog of revenue on the books that goes out, on average across all customers, across a little more than three years and that weighs in at $52.9 billion. AWS did not have to convert revenue streams from hardware sales and software perpetual licenses to subscriptions; it has been subscriptions by definition from the beginning in 2006 and is actually the touchstone for how you do subscriptions for infrastructure. The backlog is growing fast, and that is because more customers are doing longer engagements, according to Dave Fildes, director of investor relations at Amazon, who was also on the call.

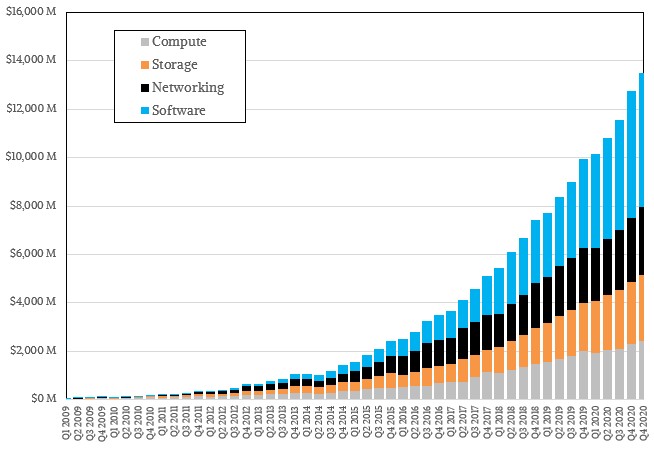

Amazon does not provide a revenue breakdown by service type for AWS, but we have built a model out of thin air and based on a bunch of hunches to see what it might be shaped like – perhaps at some point we will get some comment on this so we can tune out model.

The point is, AWS has the perception of being just a supplier of raw infrastructure by the slice, like New York City pizza shops, when it is really doing a lot more at the software layer, with various platform services and in some cases actual applications.

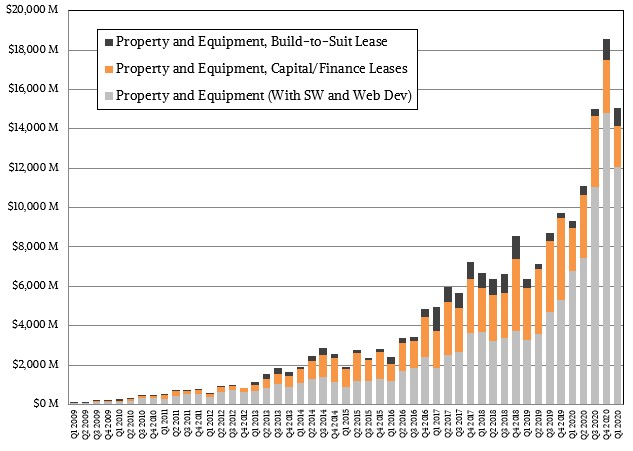

If you want to compete with AWS, you had better get one of those US Mint printing presses, and make sure you steal the one that is printing Ben Franklin on the bills instead of George Washington, Abe Lincoln, or Andrew Jackson. If you get the Ulysses Grant press, you will have to print twice as many bills, but it is not too bad. In any event, take a look at the capital investment that the Amazon conglomerate takes:

We have no idea how much of this is for warehouse-scale computing facilities run by AWS with hundreds of millions of compute cores or actual warehouses that Amazon uses to distribute a half billion packages a year to buyers from its online store. Whatever the share of AWS is of this capital spending, it is not a small amount. That much we know for sure.

Be the first to comment