If we are ever going to know what affect the coronavirus pandemic has had on the IT sector, we have to keep track of what was going on before the outbreak started to hit us hard in the first quarter of 2020. This is, in part, why the data we have from 2018 and 2019 is going to be important. It establishes a baseline for what was normal then and it will help us reckon a baseline for what will be normal on the other side of this.

To that end, we have cast an eye on the latest cloud IT infrastructure spending statistics compiled by IDC, which cover spending on servers, storage, and switching for cloud and non-cloud deployments in both public and private clouds and in on premises datacenters for the plain vanilla, non-cloud (yet presumably still virtualized in some cases) systems. The lines are fuzzy between some of these categories, admittedly, but we are really most interested in the deltas, not the theological arguments over what is a cloud and what is not.

As we have reported previously, server infrastructure spending by hyperscalers and cloud builders was muted starting in late 2018 and continued into the first two quarters of 2019, rebounding strongly in the second half of 2019. We called this the last hurrah before the server recession, and our analysis of this can be found here. This latest cloud spending data from IDC talks about the market more broadly, adding in all core IT spending on the three main types of hardware (and removing double counting between servers and storage and servers and switching where they are converged) to give what could be a more accurate view of what is actually going on out there. We have also looked at IDC’s original IT spending forecasts, which predicted only curtailed spending growth, as the coronavirus outbreak was starting to build momentum and its revision of spending forecasts more recently, which show an actual decline in spending for 2020.

None of this data on cloud and non-cloud IT spending that we are talking about in this story has a specific forecast for 2020 or 2021, but the company did share some insight that echoes what was said in the more broad IT spending analysis and did offer an end state for spending way out in 2024.

“While the beginning of 2020 was marked by supply chain issues that should be resolved before the end of the second quarter, the negative economic impact will hit enterprise customers’ capex spending,” explained Kuba Stolarski, research director for infrastructure systems, platforms and technologies at IDC, in a statement accompanying the figures. “As enterprise IT budgets tighten through the year, public cloud will see an increase in demand for services. This increase will come in part from the surge of work-from-home employees using online collaboration tools, but also from workload migration to public cloud as enterprises seek ways to save money for the current year. Once the coast is clear of coronavirus, IDC expects some of this new cloud service demand to remain sticky going forward.”

Let’s go over the numbers for the fourth quarter of 2019 and all of 2019, and then take a look at the 2024 forecast.

The fourth quarter was a pretty good one, a kind of return to normal of its own after a downturn in spending. In the period ended in December, spending on infrastructure by public clouds (stuff meant to be rented out or to support services offered by companies) rose by 14.5 percent to $13.3 billion, while spending on private cloud infrastructure (installed on premises by enterprises, governments, and other institutions for their own use) rose by 8.2 percent to $6.1 billion, according to IDC. Add them up, and total cloud spending on infrastructure rose by 12.5 percent to $19.4 billion. Overall IT infrastructure spending was $38.1 billion in Q4 2019, up 3.3 percent, and spending on non-cloud (meaning traditional free-standing bare metal iron or perhaps only rudimentary server virtualization, depending on where IDC draws the cloud line) IT infrastructure was down 5.5 percent to $18.6 billion.

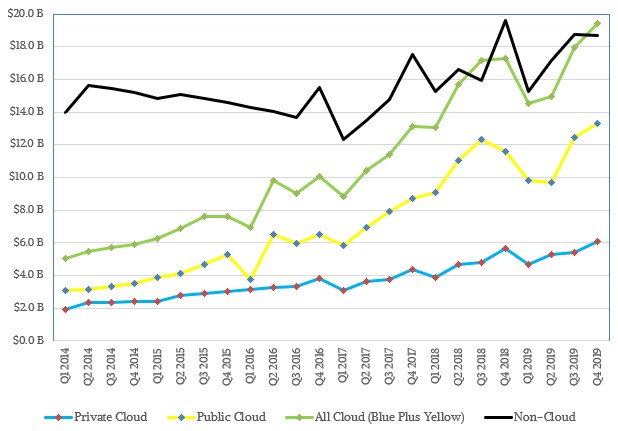

Here is what the data looks like since 2014, when IDC first started breaking down the market this way across these categories, including a sum of public cloud spending (yellow line) and private cloud spending (the blue line), which is the green line:

For all the talk about how spending on the cloud has taken over the world, by which people often hear “public cloud” when the word public is not there, it is important to remember how much traditional, non-cloud infrastructure is still acquired in the world. And it is also important to remember that in 2018, 66.4 percent of all spending was done by organizations other than hyperscalers and cloud builders, and in 2019, that level held at 66 percent. Yes, it is down from $89.6 billion to $88.1 billion from 2018 to 2019, but it is still about two-thirds of all infrastructure spending. So hyperscalers and public clouds have not taken over the world, and we can paint a scenario where organizations won’t want to pay the cloud premium after the Great Infection or worry about whether or not there is capacity available for them and will dig in on their own datacenters.

It will be interesting to see how this plays out. We don’t think anyone can call it quite yet.

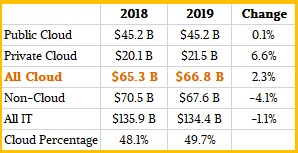

Here is what the full breakdown of IT spending for 2018 and 2019 by category, looks like:

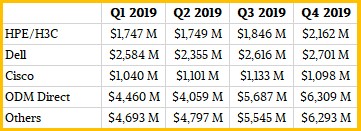

Here is what the breakdown by vendor for cloudy infrastructure looks like:

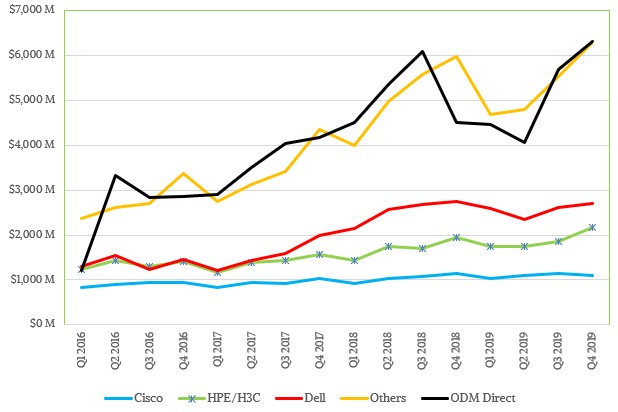

And here is the vendor trend since 2014:

The ODMs as a group are a proxy for hyperscaler and cloud builder spending, but some of these customers also go to large OEMs for some of their gear, too. So it is not a perfect fit. But what we also think needs to be remembered is that the ODMs account for somewhere between 30 percent and 35 percent of total cloud infrastructure revenues and this is only 13 percent to 17 percent of total spending on servers, storage, and switching. Perspective is important.

Within these three technology domains and within the cloud infrastructure category, IDC reckons that storage platforms grew by 15.1 percent in the fourth quarter of last year, to $6.6 billion, while compute platforms rose by 14.5 percent to $10.8 billion in aggregate sales worldwide. Sales of Ethernet switches fell by 3.9 percent to $2 billion. For all of 2019, compute comprised $35.5 billion in cloud infrastructure spending (up 1.5 percent), followed by storage with $23.1 billion of spending (up 1.9 percent) and by Ethernet switching of $8.2 billion (up 5 percent). What that tells us is the breakdown of spending for distributed computing systems: 53.1 percent of the budget for cloudy stuff was spent on compute, 34.6 percent was spent on storage, and 12.3 percent was spent on switching.

Now, you can reckon how you stand compared to the market at large. The hyperscalers and cloud builders spend more on compute and less on switching, so we are told. But that may be more of a reflection of uneven discounting than anything else.

And now, the forecast. Looking ahead to spending between 2019 and 2024, IDC says that cloud IT infrastructure spending will reach $100.1 billion a year by 2024, with a compound annual growth rate of 8.4 percent over that term. Non-cloud IT infrastructure spending will decline at a 0.7 percent CAGR over that same time to $65.3 billion, and total IT infrastructure spending will rise at a 4.2 percent CAGR to hit $165.4 billion in 2024. Presumably, this forecast has a pretty bad 2020 and a weak 2021 in it.

On channel including Intel managed ‘sales exchange’ of commercial market v3/v4 and Core Skylakes(s) x86 CPU monopoly surplus, deadweight and laundered values, and AMD reliant on ix86 secondary market displacement grabbing their fair share of channel’s financial infusion from managed exchange of capable Intel values inventory holding’s having found a new home, antitrust remedial has defused the potential of channel financial meltdown on the loss of accumulated capital values similar 2001, 2005, 2008.

Channel is flush with cash. Cash is what that funds innovation and primary procurement on resale of capable products found a home, and now financially enables new ‘primary procurements’ across the entire digital infrastructure spectrum.

Channel second half 2020 spend supporting enterprise and commercial procurements into 2021 is going to be a block buster.

Intriguing question being with all that cash in their pocket, what new products the channel will vote on and invest to sell in.

In relation primary product market, secondary market on accumulated capital, channel continues to run the show.

Mike Bruzzone, Camp Marketing