Broadcom may not have wanted to be in the Arm server chip business any more, but its machinations since it was acquired by Avago Technology two years ago have certainly sent ripples through that nascent market. It did it in the wake of buying Broadcom, and now it looks like it is doing it again with Qualcomm.

Before it shelled out a stunning $37 billion to buy Broadcom, best known for its datacenter switch ASICs but also an Arm server chip wannabe at the time, Avago was a conglomerate that made chips for optical networking, server networking, and storage controllers as well as for many other functions. Avago made about $6.6 billion a year peddling its chips, and Broadcom made about $8.5 billion, ranking them fifth and eight in worldwide semiconductor sales, and far behind the $55.9 billion that Intel generated and the $27.5 billion that Qualcomm raked in during 2014. Avago has a long history and is comprised of many different chip making businesses, as we explained back when the Broadcom deal was done, but Broadcom was the better brand and so the combined entity took the Broadcom name.

Avago is all about taking exiting businesses and squeezing the most profits out of them, which Wall Street loves, and after some consideration, the company decided to sell off the “Vulcan” Arm server chip business just as Qualcomm was starting to reveal the details of its own “Amberwing” Centriq 2400 processor designs. (Funny coincidence, that.) And we heard through the grapevine that the new Broadcom actually tried to shop the business and engineers behind the project to Qualcomm – one of the few easy and obvious potential buyers – but it declined and they were snapped up by Cavium.

This convoluted story did not end there. No way. In the interim, Qualcomm tried to buy NXP Semiconductors for $44 million and is still at it. NXP bought Freescale, the old Motorola chip business that was spun out of that conglomerate in 2004, years before Google bought Motorola for its patent portfolio and smartphone business and then sold it off to Lenovo, keeping the patents. Based on those 2014 revenues, Qualcomm plus NXP plus Freescale would have been ranked a more solid second to Intel at $38 billion. (In the interim, memory and flash prices have gone through the roof and Samsung Electronics has bypassed Intel to be the world’s largest chip maker, bumping Qualcomm to third place. But that is a different story.) This was still considerably larger than the $15.1 billion new Broadcom powerhouse (again, in 2014 dollars).

Hock Tan, chief executive officer of Avago and now the new Broadcom, doesn’t like to lose and he surely doesn’t like to lose money. While we were enthusiastic that the new Broadcom would be a counterweight to Intel’s growing hegemony in the datacenter, that would not necessarily be the best way for the embiggened company to boost its profits, and hence the spinoff of the Vulcan chips to Cavium. Which, by the way, seem to have a very good design that is indeed able to take on Intel, even the latest “Skylake” Xeon SP processors.

Since the Avago-Broadcom deal went down, a lot has happened, and it has all affected the Arm server chip ecosystem in one way or another. AMD has silenced (but not officially canceled) its “K12” Arm chip project to focus on its Epyc X86 server chips, which frankly present a healthy alternative to Intel’s Xeons without requiring companies to change instruction sets and therefore have been their own kind of deflation of the potential for Arm server chips. Applied Micro was sold to Macom, which in turn sold the X-Gene Arm server chip business to a startup called Ampere, which is backed by private equity giant The Carlyle Group, run by former Intel president Renee James, and preparing to bring a tweaked version of the 32 core “Skylark” X-Gene 3 processor to market this year. Last November, Marvell, which makes its own Arm chips, some of them used in servers but not truly server-class, offered $6 billion to acquire Cavium, which in addition to the ThunderX line of Arm server chips also has the XPliant Ethernet switch ASIC business, each of which generated about $3.4 billion in the trailing twelve months prior to when the deal was announced against a total addressable market of $16 billion. And then things really got interesting when the new Broadcom offered $130 billion to buy Qualcomm, which was in the middle of buying NXP. After much back and forth, Broadcom sweetened its bid a little in February, but President Trump put the kibosh on the deal for national security reasons, since the new Broadcom, like Avago, was based on Singapore. (The company is in the process of relocating back to Silicon Valley, to be fair.) So Broadcom called off the Qualcomm acquisition deal in March – something that many thought it was going to do from Day One, by the way.

But, the damage to Qualcomm was already done. To defend itself against the takeover, Qualcomm had to justify the way it was running its business and the expectation was that it would make some cuts to boost profitability – $1 billion in cost cuts, to be precise. Taking on Intel in the datacenter compute market is a long game, with lots of investment in chip design and manufacturing and, importantly, building an ecosystem of hardware and software partners who will buy the Centriq 2400 chips and its successors. This may prove to be more of an investment than Qualcomm was willing to make, particularly in a world where AMD Epyc chips are able to take some share and probably will represent 5 percent of shipments by the end of the year and maybe 10 percent within a quarter or two. And in a world where Qualcomm has authorized a $10 billion share repurchasing program to keep Wall Street happy. (There are better things to do with $10 billion, but this is the reality of publicly traded companies.)

So the rumor this week that Qualcomm may be shutting down or selling off the Centriq processor business did not come exactly as a surprise. A spokesperson for Qualcomm neither confirmed nor denied the rumor, but did say that the company was preparing a statement in response to the story published on Bloomberg. When asked for a timeframe for this statement, we were told that this was still up in the air. So much for addressing material issues in a timely fashion; then again, the Centriq line is so small compared to the rest of Qualcomm’s other lines that it could be argued that it is not material and therefore not subject to disclosure laws in the United States for public companies.

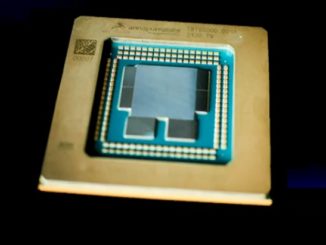

The Amberwing Centriq 2400 processors were announced last November, when all of this stuff was going down. It took Qualcomm four years and probably somewhere on the order of $100 million to $125 million to bring the 48 core Amberwing chip, which is based on its own “Falkor” core, a derivative of the 64-bit Armv8 core licensed from Arm Holdings that Qualcomm has tweaked for high throughput datacenter jobs. The Amberwing chips are noteworthy in that they are etched using Samsung’s 10 nanometer chip making processes, and are the first server chips to hit 10 nanometers. With over 18 billion transistors and a fairly new process, it seems likely that the yields are very low for the Amberwings, which made the choice of only selling versions with 40, 46, and 48 cores a bit peculiar. Chip makers have a wide SKU stack so they can increase the effective yields on the chips that come out of the gab, and it is a wonder that Qualcomm didn’t sell Amberwings with 12, 24, and 32 cores, or even more varied SKUs than even this. But it didn’t. As we previously reported, the Amberwings stacked up well against the “Broadwell” and “Skylake” Xeons from Intel, and given that this is the first commercial version of the chip, the hardware and software ecosystem for the Centriq 2400 was building pretty well.

But all may not be lost. If the rumors are true and Qualcomm does indeed shut down or sell off the Centriq line of processors, they could end up in the hands of some company that does want to push Arm into the datacenter. Any one of the Super 8 hyperscalers or cloud builders – Google, Amazon, Facebook, Microsoft, Alibaba, Baidu, Tencent, and China Mobile – that wanted to design its own chips could pick up the intellectual property and chip designers for pocket change. Amazon already bought Annapurna Labs back in January 2015 for an estimated $350 million, so it seems unlikely it would go there. Microsoft seems like a logical choice, given it is porting Windows Server to the Centriq chips. But the reality is that none of the Super 8 want to build their own processors; they want to grind chip makers against each other and thereby drive down the cost of compute.

If anything, come of the Super 8 (probably the half in the United States) should invest in another existing Arm server chip maker to find the Centriq line a home. In this case, Ampere, the former Applied Micro business that now has the deep pockets of Carlyle, is the obvious choice. Cavium has two ThunderX2 product lines already – one with relatively beefy cores and high memory bandwidth that came from Broadcom’s Vulcan project and the other homegrown with more cores and lower memory bandwidth that will compete with Centriq and Xeon D and similar chips – so it probably does not need a third. Samsung could pick it up and run with it, but that seems unlikely. (Samsung did, a number of years ago, want to enter the Arm server arena, but it never made its precise plans known and quietly backed away.) AMD doesn’t need another Arm server chip after having done the work on K12 already. IBM or Oracle could pick it up to make trouble, but this seems extremely remote. Fujitsu is working on an Arm variant for HPC that has vector extensions and could decide it wants to make Arm server chips to replace its slowing Sparc64 line. Anything is possible. Very little of this is probable, aside from Ampere snapping it up.

We think that the market can probably sustain two volume Arm server chip suppliers, and if it can’t, then it wasn’t that much of a market after all. It is tough to compete against Intel and AMD at the low-end and midrange of datacenter compute, and against IBM at the high end, where most of these Arm processors are not going anyway.

The question now is what would Qualcomm charge for the line, and can Ampere – or anyone else – pay for it?

“Freescale (the old Motorola chip business that Google spun out)”

Freescale was spun out of Motorola years before Google bought the handset business.

As for the future home of Centriq, my feeling is that selling Centriq to Alibaba or Tencent might be the only way Q will get Chinese approval to acquire NXP.

True. Brain fart. Fixed. Those are three of the shortest sentences I have ever written.

The question now is what would Qualcomm charge for the line, and can Ampere – or anyone else – pay for it?

I think the answer is YES (just in my opinion).

Anw, thanks for the article!