In the first article outlining some of the results from our AI survey, we discussed how most customers are just beginning their journey into AI and that very few have actual AI applications in production. In this article, we are going to talk about the whats and whys behind AI. In other words, why customers are looking into AI, what problems they are trying to solve, what they expect to get out of it, and what sort of data they are analyzing.

One of the more interesting aspects of the survey is that it shows how real-world customers are looking to use AI. This is an industry of waves. We have seen the client/server wave back in the late 1980s and early 1990s, when customers raced off load some of their compute to PCs, and in the late 1990s came the ERP wave, where customers embraced massive software suites designed to manage every aspect of their business – and also required customers to change the way they did business to adhere to the software structure.

We’ve also seen the big data wave, with the accompanying enterprise analytics wave. Many in the industry press and punditry seem to believe that most customers have solved big data and analytics and are now implementing deep learning, image recognition, and inference.

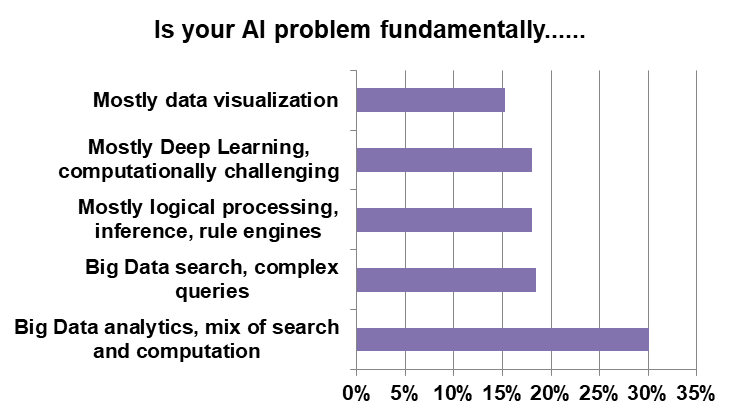

However, the OrionX.net survey data shows big data and analytics issues are still uppermost on customer minds and that their initial AI projects are aimed at these areas.

As can be seen by the chart, almost 50 percent of our survey respondents say that their projects involve either big data analytics or big data search and processing highly complex queries against datasets. While there are a significant number of folks investigating deep learning, visualization/image recognition, and logical processing, the bulk of respondents are looking to improve their big data operations with the addition of AI.

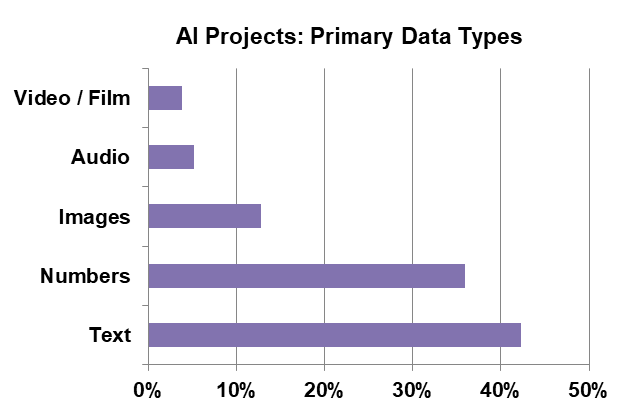

As we mentioned in our previous story, the usual types of AI (image recognition and speech recognition) that you hear about in the industry press aren’t what customers are actually doing today. In fact, just over 20 percent of the users we surveyed are doing anything with images, audio, or video. The vast majority of current AI projects are using numbers or text as base data for their AI applications.

Together with the results in the first chart, it’s safe to say that real world customers are still looking to optimize their big data infrastructure by adding AI routines in order to squeeze more insight out of the data they have laboriously gathered over the years. It is easier to find stories about users doing image and audio recognition, these are fairly high profile and the developers want attention. However, today it’s the deep big data analysis that’s truly driving the AI market.

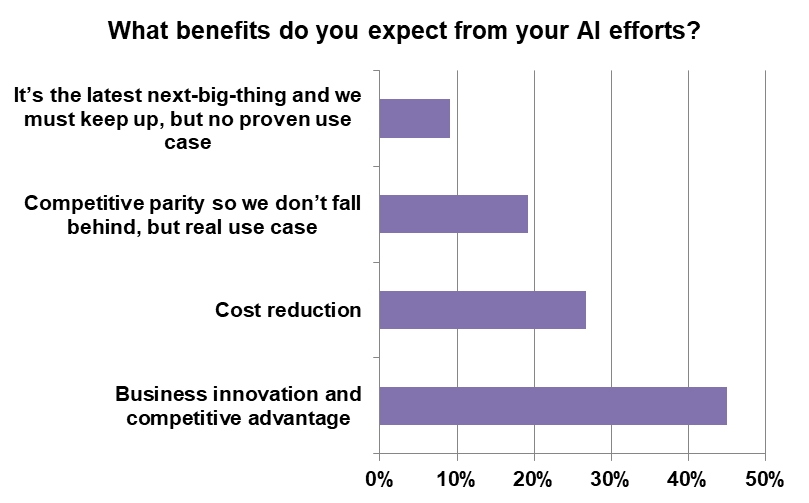

When it comes to AI benefits, customers expect to get tangible return on their AI investment. Only 9 percent of users confess that they are investigating AI just because it is the next big thing.

Just under 20 percent are working on AI to keep up with the competition, but it’s not just busy work, they have a real use case in mind. The large majority of users, nearly three quarters, see cost reduction and business competitive advantage arising from their AI efforts. A few respondents mentioned using AI to improve maintenance and repair operations, assumedly using AI to discover the optimal time when to replace parts or maintain equipment in order to save costs and streamline operations.

Not surprisingly, customers aren’t so eager to talk about these AI efforts, since they’re seen as providing a source of significant and sustainable competitive advantage.

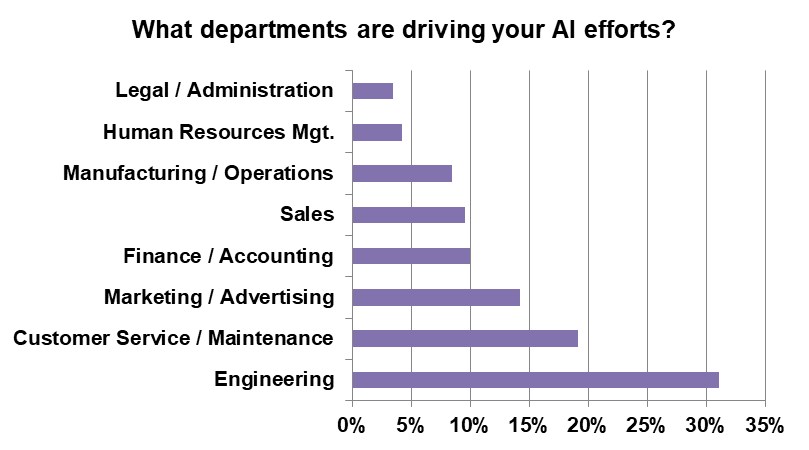

So who’s driving AI adoption in our respondent organizations? We asked the question and were a bit surprised by the results. We were expecting to see marketing and advertising as the dominant drivers for AI today, reasoning that users were anxious to use AI to increase their top line income.

However, marketing and advertising pulled less than 15 percent of our respondents, putting it solidly in third place. Sales organizations also aren’t big on AI yet. From a sales perspective, AI could be used to streamline the sales process, find better quality prospects, and discover more profitable opportunities. But fewer than 10 percent of the organizations we surveyed said that the sales department was driving AI adoption.

The number one driver of AI in the organizations we surveyed was engineering, the top selection of more than 30 percent of our respondents. These are customers who are using AI to improve their engineering processes, optimize their production lines, and improve their production mix. These are age old problems in the enterprise and there’s always room for improvement in these operations. Given that engineers are also techy folks, it’s natural that these departments will be first to use new technology like AI as a tool to improve operations.

Customer service and maintenance is the second place category, which also makes a lot of sense. Customers are using AI to reduce service calls, improve customer service, and make their products perform better for longer periods of time. This could mean applying AI to service call and product repair records in order to apply less expensive preventative maintenance (or redesign the product) to reduce costly repairs. It could also mean using AI to analyze sensor data in order to catch pre-failure conditions in components and repair them before an actual failure occurs.

So What Have We Learned?

There are a few big takeaways from this section of the survey. The first is that customers are applying AI to their traditional problems, like using their data to improve products, service, and reduce maintenance. The second is that the usage models we hear so much about, image recognition, video analysis, and speech recognition, aren’t high up on the list of real world customer priorities.

In our next article, we are going to take a look at a grab bag of data points from the survey, including what hardware and software they are using for AI, and which vendors are in the lead for AI engagements.

Dan Olds is an authority on technology trends and customer sentiment and is a frequently quoted expert in industry and business publications such as The Wall Street Journal, Bloomberg News, Computerworld, eWeek, CIO, and PCWorld. In addition to server, storage, and network technologies, Dan closely follows the Big Data, Cloud, and HPC markets. He co-hosts the popular Radio Free HPC podcast, and is the go-to person for the coverage and analysis of the supercomputing industry’s Student Cluster Challenge. Olds is founder and principal analyst at Gabriel Consulting Group (GCG), a boutique IT research and consulting firm whose activities are now part of the OrionX.net offerings. Dan began his career at Sequent Computer, an early pioneer in highly scalable business systems. He was the inaugural lead for the successful server consolidation program at Sun Microsystems, and was at IBM in the strategically important mainframe and Power systems groups. He is a graduate of the University of Chicago Booth School of Business with a focus on finance and marketing.

Be the first to comment