In the early days of computing in the datacenter, vendors of systems pretty much owned their platforms, from the chip all the way up to the compiler.

When you invested in an IBM, Sperry, Burroughs, NEC, Bull, Hitachi, or Fujitsu mainframe, or one of the myriad minicomputer systems from Big Blue, Digital, Hewlett-Packard, or eventually Unix systems from Sun Microsystems and its competition (mainly Data General, SGI, HP, and IBM), you were really investing in a way of computing life. A lot of the decisions about what to buy were already made, and you didn’t have to think much about it. Over the years, systems opened up. Operating systems were separated from the underlying hardware, and myriad file system, transaction processing, database, and other middleware. IBM was actually compelled by a Consent Decree with the US Department of Justice to open up its system interfaces and allow for their party peripherals to be used with its systems, and many other platforms also had third party alternatives for memory, storage, networking, and other functions. Part of the fun of getting a new system was looking at all of the possibilities and picking the best elements that you could afford to build it.

A little less than a decade ago, the tide in the enterprise began to shift away from having best-of-breed systems that required system integrators and fleets of consultants to put together machinery and its software. With its “California” Unified Computing System launch in March 2009, Cisco Systems was among the first to create a converged system in the modern era, which put virtual compute and virtual networking into the same system, integrating and simplifying both. Around the same time, Nutanix went up a little higher in the stack, creating a virtualized compute cluster that also had virtual storage area networking software embedded in that cluster, what is now commonly called hyperconverged infrastructure, or HCI. These are two independent but related waves of re-integration of enterprise systems, the purpose of which is mostly about saving companies the time and hassle of integrating systems while also charging a reasonably hefty premium for that luxury to compensate those making these various kinds of converged systems.

The appetites for these converged systems are changing, it looks like, with full-on integrated platforms waning and hyperconverged storage systems on the rise and the mix of machines that are somewhere in the middle growing fast in the past couple of years but now being stable. This assessment of the state of converged systems is something we hear about anecdotally from both vendors and customers, but it is also backed up by some recent data coming out of IDC.

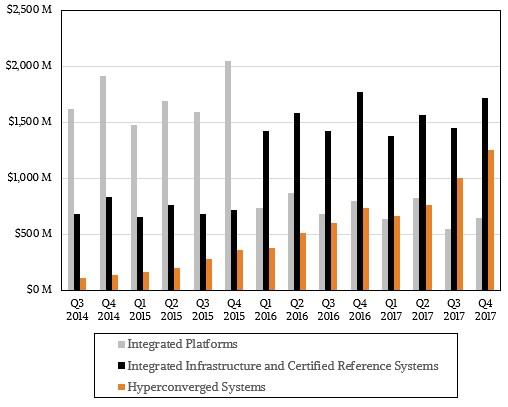

To interpret this chart above, we need to first talk about some definitions.

Way back in the day, IDC used to track two different types of converged systems. Integrated infrastructure was what IDC meant by a system that had its hardware converged – it could be networking and storage, like the Cisco UCS or equivalent machinery from IBM (FlexSystem), Dell (Active System), HPE (VirtualSystem and CloudSystem), and others when this idea took off in response to the Cisco server launch. Integrated platforms went one step further, adding systems software, such as databases and middleware, to the iron so it could be immediately used to run applications; Oracle’s Exadata systems and IBM’s PureSystems are two good examples of this. Finally, hyperconverged storage was a third component added to the mix, and so were certified reference systems, which are pre-integrated, vendor-certified systems containing servers, storage, networking, and very basic elements for system management software

In its latest dicing and slicing of the converged systems market, IDC is putting integrated infrastructure and certified reference systems into one bucket, and keeping integrated platforms and hyperconverged systems in their own buckets. That chart above reflects the new way of looking at the data.

As you can see, sales of those integrated platforms are on the downward slope. When IBM sold off its System x business to Lenovo in 2014, that pretty much put the kibosh on its PureSystems line, although there are, technically, some variants based on Power processors that were in the IBM product catalog for a number of years. This market is falling off so fast that IDC is not breaking out any detail on it separately any more, but we expect that Oracle dominates this category, which generated $642 million in revenues in the fourth quarter of 2017, down 19.1 percent compared to the prior year’s period. The combined integrated infrastructure and certified reference systems category had a more modest decline, off 3.4 percent, to $1.71 billion. Hyperconverged systems, however, had a 69.4 percent growth rate in the final quarter of last year, hitting $1.25 billion.

If you look at the HCI market share based on the vendor peddling it instead of the maker of the underlying hardware, then Dell (including both VMware, ScaleIO, and other products) accounted for $501.6 million in HCI sales, up 83.5 percent, passing by Nutanix, which had $368.4 million in sales, up 59.2 percent. HPE, thanks to its acquisition of SimpliVity and some lingering LeftHand Networks virtual SAN software, had $62.2 million in HCI sales, up 340 percent. All other players in the HCI space added up to $316.5 million in revenues, up 45 percent.

All told, converged systems drove $3.61 billion in revenues worldwide, rising 9.1 percent on the strength of HCI.

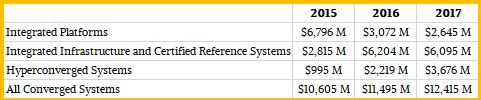

Like many parts of the IT sector, such as sales of systems to HPC centers, cloud builders, and hyperscalers, it is probably best to look at sales of converged systems on an annual rather than a quarterly basis. Here is a table showing sales for these three different types of converged systems in the past three years:

You never say never in this IT racket, but it is probably safe to say that integrated platforms have peaked and HCI is on the rise. The two do not necessarily replace each other, and are not necessarily mutually exclusive, either. It is hard to call what will happen with that integrated infrastructure and certified reference systems middle category. It could have peaked in 2016 and is starting to do its slide, or it might be a temporary dip caused more by the timing of configurations from vendors in the wake of so many different processor announcements last fall. It is hard to say.

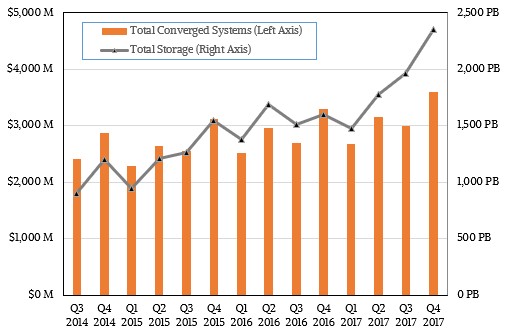

What we can say for sure, across all manner of converged systems, is that the cost of storage is going down as the revenues are going up and the capacity installed each quarter is on the rise. Check this out:

Not all converged systems have a lot of storage on them, so this is not precisely an apples to apples comparison, but if you tracks the exabytes of storage against the billions of dollars spent, you can see that the storage capacity is rising faster than the revenues, and that means the cost per unit of capacity is falling. It wiggles around quite a bit, but for the data we have culled from IDC reports, a terabyte of storage across all types of converged systems was $2.68 back in the third quarter of 2014, when a total of 898 petabytes was shipped and when we first started seeing capacity shipped data. It has been trending down gradually since then. In the third quarter of 2017, three years later and the last time IDC gave a hard number of storage capacity shipped on converged systems, all vendors shipped a total of 1.96 exabytes of capacity in the period, which worked out to a cost of $1.53 per terabyte. Yes, we realize that this is a simplistic way of looking at this, as if the compute capacity didn’t mean anything at all. But it does show the downward trend, and the cost per actual terabyte is probably half this level.

We don’t know how many exabytes was shipped on converged systems in the final quarter of 2017, but if the pricing levels stayed about the same, then it would be 2.35 exabytes in total across all types of converged systems.

While these are some pretty big numbers, with converged systems adding up to $12.5 billion in revenues and 7.57 aggregate exabytes of capacity, we have to remember that $65.2 billion in revenues, driven by 10.1 million shipments, came from server sales in the same period, and the enterprise storage market accounted for $45.3 billion in sales and 299.1 exabytes of capacity shipped over the same time. (That’s about 16 cents per terabyte, by the way, averaged across all storage array types for the full 2017 year.) Ethernet switching was another $25.8 billion in sales over this time. The point is: servers, storage, and networking together drove $136.3 billion in sales last year, and that means converged systems drove about 9.1 percent of the aggregate datacenter pie.

It will take a long time before converged systems eat the market, unless you count the racks and racks and racks of preconfigured machines, designed to specifications set by the cloud builders and hyperscalers and delivered as completely integrated server and storage pods, linked together by vast networks and basically sold as a scalable datacenter. In essence, a big wonking converged system. It is just that the skin that defines a unit of compute is the walls of a datacenter instead of the metal shell of a single node chassis or a rack enclosure. And yes, the storage and serving jobs are disaggregated into different nodes, but within the walls of that datacenter they are converged across those vast Clos networks the hyperscalers and cloud builders are so proud of. (Hmmm. . . . )

If you look at it that way, then probably more than half of the shipments for “servers” in the world are converged systems, and probably a little less than half of the revenues come from them, too. This is not a specious argument, either. It is just that the customer sets the reference architecture instead of the vendor, and the skin is that of a datacenter, not that of a node or a rack. It is food for thought.

Be the first to comment