The slowdown in server sales ahead of Intel’s July launch of the “Skylake” Xeon SP was real, and if the figures from the third quarter of this year are any guide, then it looks like that slump is over. Plenty of customers wanted the shiny new Skylake gear, and we think a fair number of them also wanted to buy older-generation “Broadwell” Xeons and the “Grantley” server platform given the premium that Intel is charging for Skylake processors and their “Purley” platform.

Server makers with older Broadwell machinery in the barn were no doubt happy to oblige customers and clear out the older inventory – a story we keep hearing again and again – as well as sell new Skylake systems. It is a win-win for server makers, and in the short term it is good for Intel, too, at least on paper. If the hyperscalers and cloud builders that are driving the server market are just getting deeper discounts, as we think is probably the case, then what it means is that Intel is shifting the burden of extracting profits to enterprise clients who individually buy far less iron but that collectively still buy more gear than the hyperscalers and cloud builders. This shift would be happening as sales of systems to enterprises is still in a slump and customers are also reeling from higher prices on main memory and flash storage.

In the short run, this situation is tenable, but over the long haul, it will just drive more customers to clouds, not only because enterprises can’t compete on technology and flexibility, but because they cannot compete on price when it comes to building and running their own infrastructure. This, over the long haul, is not something that Intel wants to see. Intel needs tens of millions of companies to still buy servers and tens of thousands of midrange and large enterprises to still buy clusters if it is to retain its profit margins.

This seems increasingly unlikely given the situation and given the improving CPU alternatives from AMD, Cavium, Qualcomm, and IBM. But for now, according to the latest statistics from IDC showing what it thinks happened in the server market in the third quarter, it is all boom town.

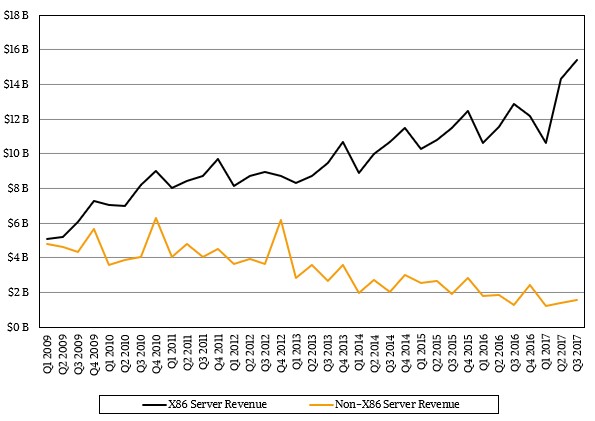

In the quarter ended in September, which ended only nine weeks after AMD rolled out the Epyc chips, only six weeks after Intel launched the Skylake Xeons, and only two weeks after IBM started shipping its System z14 mainframes, both the X86 and mainframe parts of the business both skyrocketed after being in the doldrums for several quarters. IDC has restated its numbers for the year-ago period, showing that the original design manufacturers (ODMs) have made more sales than originally anticipated, and even with that restating, IDC believes that server revenues in Q3 2017 rose by an astounding 19.9 percent to just a hair under $17 billion, the highest level for any quarter that we can remember, and shipments rose by 11.1 percent to 2.67 million units, the highest level we can recall as well and besting the 2.6 million units shipped in the fourth quarter of 2015 when the “Haswell” Xeons were selling like hotcakes despite the impending Broadwell launch the following March.

Sometimes, the hyperscalers and cloud builders can wait, and sometimes they cannot.

For a while there, it looked like we might be repeating the slowdown in server sales from early 2011 through early 2014, when the “Sandy Bridge” Xeons were pushed out a bit and the “Ivy Bridge” Xeons were similarly delayed. But Haswell Xeons saved the day, even if there was a flattening during the Broadwell generation. We think the elimination of uncertainty – not the Skylake Xeon launch per se – is what has unleashed some pent up demand for servers. People now know what to do, based on the feeds, speeds, and needs. And the prices, at the list ceilings and out on the streets.

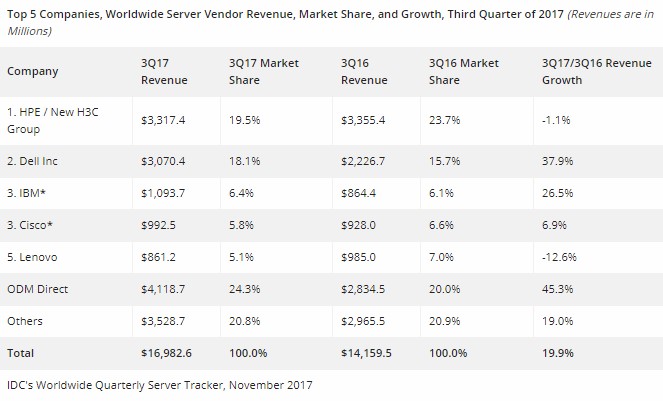

A couple of things stand out in the figures for the third quarter from IDC. Take a look at the revenue numbers by vendor:

And then the shipments by vendor:

Something very profound is going on at Dell, and we think it is more than benefitting from any synergies from its combination with enterprise storage juggernaut EMC and enterprise server virtualization behemoth VMware. We suspect that more than a few hyperscalers and cloud builders are buying machines from Dell’s custom server business unit, and the leverage it has with Intel because it sells both PCs and servers based on the X86 architecture – unlike IBM and now Hewlett Packard Enterprise – is one reason it can be so aggressive in the server racket. In the quarter ended in September, Dell grew its server unit shipments by 11.2 percent to 503,000 machines, beating HPE (along with its H3C Group partnership in China), which shipped 501,400 machines according to IDC, down 1.7 percent year on year. This is the first time that Dell has beaten HPE or its predecessors since the Compaq merger in 2001. And while HPE/H3C saw revenues decline by 1.1 percent in the period, Dell saw them rise by 37.9 percent to $3.07 billion, right on the heels of the $3.32 billion that HPE/H3C together raked in during the quarter.

Closing that much of the revenue gap should have taken years, and should have taken a lot more servers, we think. So Dell must be selling a lot of beefy machines to someone. To a lot of someones. And moreover, Dell’s average selling price is up by around 24 percent, and that probably means it sold a lot of really cheap boxes and a lot of really expensive ones, perhaps laden with GPU and FPGA accelerators and lots of memory.

The other thing that jumps out, especially in the following chart that plots server revenues since the end of the Great Recession, is the giant spike in ODM server sales – as we said, up 45.3 percent even after a significantly large restatement for Q3 2016. Look at that spike:

We think that IDC will eventually make public its restatement of ODM revenues for Q4 2016 and Q1 2017, but we do not have that data yet. This will smooth out that thick green curve, which is growing fast and shows again that the ODMs, as a group, push more iron than any single vendor in the market – HPE or Dell. This has been true since the second quarter of this year, by IDC’s reckoning. And that ODM figure is understated, we think, because parts of Dell, Lenovo, HPE, Inspur, and Sugon act like ODMs more than like traditional OEMs.

If you want to know why Meg Whitman is stepping down as CEO at HPE, it is not so much that the turnaround is done as it is that HPE and its Foxconn partnership has not helped boost its presence at hyperscalers and cloud builders, and Dell is making huge inroads along with the ODMs and the Chinese OEMs. Every one of these players is eating HPE’s server lunch right now, and it is a problem that HPE’s new CEO, Antonio Neri, is going to have to tackle.

IBM is back above $1 billion in sales in the third quarter, mostly because it closed so many System z14 mainframe deals in the quarter to ship a bunch of machines in the last two weeks of September, which allowed it to book $673 million in System z revenues, up 63.8 percent year-on-year. If you do the math, that means IBM’s Power Systems business generated $421 million in sales, down 7.2 percent. IBM is getting ready to fire off its first salvo of Power9 systems for commercial customers, and has already begun shipping Power9 iron for the “Summit” and “Sierra” supercomputers for the US Department of Energy, although the numbers are modest.

On the shipment side of the server business, Lenovo contracted by a gut-wrenching 33.1 percent while Inspur rose by 37.9 percent, and the two companies are neck-and-neck for the number three position in the market in terms of systems sold rather than revenues generated. Supermicro and Huawei Technologies are, technically speaking, in a statistical four-way tie with Lenovo and Inspur by IDC’s standards, which is when the vendors are within one point of share across vendors. By this metric, in terms of boxes shipped, Dell and HPE/H3C are tied, too.

Thanks to the System z spike, sales of non-X86 servers rose by 15.1 percent to $1.5 billion in the quarter, but sales of X86 servers grew at a faster pace of 20.4 percent to reach $15.4 billion.

The big question is what will happen in Q4 and beyond, and if this new level of shipment and revenues represents an apex or a new floor. The average ODM server price has been raised in the IDC numbers, which reflects, we think, the heftier GPU laden machines that hyperscalers and cloud builders are buying as well as more than a few HPC centers. But the ASP for ODMs did not really grow year on year – around $6,200 per node on average. We think there are plenty of $2,000 infrastructure boxes in that mix and a smaller but significant number of systems with lots of GPUs that probably cost out at something more like $50,000.

This may be the shape of things to come for all server buyers. But it has as much to do with the reaction to Intel’s Skylake Xeons as it does with the Skylake Xeons themselves.

AMD rolled out EPYC weeks ahead of Intel’s Skylake CPU, and Dell was on stage in the June EPYC launch event to say “Poweredge with EPYC shipping 2H’17”. Here we are days before 2017 ends, Dell has shipped Poweredge with Intel chips and no words whatsoever about EPYC. It stinks to smell Intel and Dell are up to shady handshakes to put down the competition. Time for Trump and the Justice Department to ensure no violation of anti-trust practice is re-occurring.