Private equity firm Silver Lake Partners has an appetite for tech, and securing funding for Dell to take itself private and then go out and buy EMC and VMware is now going to take a backseat in terms of deal size – and in potential ripple effects in the datacenter – now that chip giant Broadcom is making an unsolicited bid, backed by Silver Lake, to take over often-times chip rival Qualcomm.

Should this deal pass shareholder and regulatory, it could finally create a chip giant that can counterbalance Intel in the datacenter – something that Broadcom and Qualcomm both desire.

Broadcom is best known in the datacenter as the dominant supplier of ASICs for 10 Gb/sec and faster switches, but it has a vast cornucopia of chips that are used in systems and in various wired and wireless communications devices. Qualcomm makes the chips in a lot of the smartphones of the world, and has grown fast because of that, but for years now has wanted to be a contender in the datacenter by supplying chips based on designs from Arm Holdings (the company has forgotten that its name means Advanced RISC Computing and has changed its logo in recent months). Qualcomm in is a legal spat between Apple over its smartphone modems that looks like it might drag Intel into the fray, which is a distraction, and the Broadcom taker, valued at a whopping $130 billion, is definitely going to be a distraction for the Qualcomm Cloud Technologies division that is getting set to formally launch its “Amberwing” Centriq 2400 server chips later this week. The news also comes as Intel and AMD are rumored to be launching a joint laptop chip this week that will combine Intel Core processors and AMD Radeon graphics chips, and Arm chip maker Marvell, which has not had much luck in the datacenter, is rumored to be buying rival Cavium, which has done the best of the lot with its ThunderX processors and has the XPliant switch chips to boot. And further complicating the situation, Qualcomm is in the middle of a $47 billion acquisition of NXP Semiconductors,

It is going to be a busy week, it looks like.

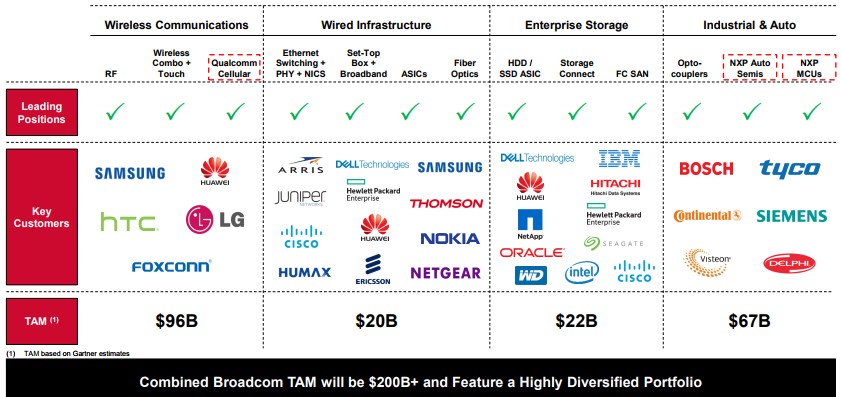

And all of these deals and partnerships might compel Intel to finally buy Micron Technology before Broadcom (which is really the Avago Technologies conglomerate that took the name of Broadcom when it acquired it for $37 billion back in May 2015. Hock Tan, Avago’s chief executive officer, has had broad backing from Silver Lake and other private equity firms and has been very good at milking its acquisitions for profits, fueling further acquisitions. The company that is now called Broadcom has a complex origin story, including the acquisition of Fibre Channel adapter and switch maker Brocade Communications earlier this year for $5.9 billion. This chart sums it up pretty well and also shows how Qualcomm and NXP would be added to the mix:

Suffice it to say that, by virtue of the pending Motorola/Freescale (through NXP) and Qualcomm acquisitions, and Broadcom’s $3.7 billion acquisition of massively parallel MIPS network processor maker NetLogic back in September 2011, which was the foundation of its “Vulcan” ARM server project, should this embiggened Broadcom come to fruition, has plenty of processor smarts. And if Intel doesn’t buy Micron, then Broadcom, which might have a taste for juicy main and flash memory that is driving revenues and profits for Samsung and other memory makers to record levels, might jump on it. Intel better hurry. Through the LSI Logic deal, it has control of storage processors, and while it is not on this chart, Avago bought PLX Technologies, the maker of PCI-Express switches, just before it bought Broadcom, so it has Ethernet, Fibre Channel, and PCI switching chops, too. Qualcomm will add a slew of wired and wireless chippery, and interestingly enough Broadcom’s second pass at Arm server chips.

Broadcom never said much about the Vulcan project, but the plan, as it was divulged back in 2015, was to leverage the on-chip interconnect and architecture of the NetLogic XLP900 series of parallel MIPS chips to create a 64-bit ARMv8 chip enhanced with cores that had a quad-issue, quad-thread, superscalar, out of order execution architecture – things that the homegrown ARMv8 chips lacked and that most server processors had. The Vulcan chip would have full virtualization of cores, memory, I/O, and accelerators, something that was already in the XLP900 network processors. Basically, Vulcan meant global replacing the MIPS ISA with the ARM ISA and keeping as much common as possible, and this would expand its total addressable market to $3 billion by adding storage and server processing to network processing. The Vulcan chip was meant to run at 3 GHz and higher speeds and implemented in a 16 nanometer FinFET process from Taiwan Semiconductor Manufacturing Corp.

Avago bought Broadcom in May 2015 and seemed poised to take on Intel in the datacenter, but the new Broadcom lost patience with the expensive idea of taking on Intel in datacenter compute, and in December 2016 as Qualcomm was ramping up its Arm server efforts, Broadcom shuttered the Vulcan project and sold off the Vulcan chip to rival Cavium, and the people working on the Vulcan project went to Qualcomm and Cavium, according to rumors.

Qualcomm launched its own assault on the datacenter back in November 2014, when rumors about its server intentions having been swirling around for months. Significantly, the company’s chief executive officer, Steve Mollenkopf, did his launch in New York when speaking to Wall Street analysts, making the case that the datacenter market that Qualcomm could address with Arm server and other chips would rise above $15 billion by 2020. At the time, Intel was still trying to make incursions into Qualcomm’s very profitable smartphone chip business for both processors and wireless modems, a market that Intel has pretty much walked away from in recent months here in 2017. Qualcomm has spent years building its Amberwing Centriq 2400 chip and lining up Microsoft as its first marquee customer among the cloud builders and hyperscalers, and will formally launch the server processor this week. There is no indication that Qualcomm’s commitment to servers is waning, and on the contrary, it is waxing. There is also no “server” word on the chart shows the four addressable markets – wireless communications, wired infrastructure, enterprise storage, and industrial and auto – that add up to $205 billion and that Broadcom wants to chase with the combination of itself and Qualcomm and NXP.

It is reasonable to wonder that Broadcom might do should it prevail in its bid to acquire Qualcomm. As far as we know from early press accounts, Qualcomm is going to fight the proposed deal. Under that deal, Broadcom is offering $70 per share to Qualcomm customers, with $10 per share of that coming from Broadcom stock and $60 per share coming from cash. And interestingly, Broadcom adds that the deal will stand pat whether the $110 per share deal to acquire NXP Semiconductor – the combination of the chip businesses of Phillips and Motorola – goes through or not. Broadcom is also willing to assume $25 billion in net debt on the books at Qualcomm and NXP, it says.

The deal is a 28 percent premium over the November 2 closing price at Qualcomm on November 2, which had the NXP deal, announced on October 27, in the price and predates rumors that something bigger was up relating to Qualcomm as the prior business week ended.

The combined Broadcom-Qualcomm-NXP would have revenues of approximately $51 billion and earnings before interest, taxes, depreciation, and amortization. Silver Lake is kicking in $5 billion to help the deal get done, which converts to Broadcom stock at a later date. And BofA Merrill Lynch, Citi, Deutsche Bank, JP MorganChase, and Morgan Stanley are all confident that they can put together the necessary debt financing to get the deal done. That just goes to show you how cheap money is these days – so long as you are rich. To sweeten the deal, Broadcom is going to move its headquarters from Singapore to the United States and to redomicile here in the USA, regardless of whether or not there is tax reform from the Trump Administration.

Now, it is Qualcomm’s move. Whatever happens, we hope it increases chip diversity and price competition, which helps the industry grow. But it is far likelier that big incumbents carve out their areas and not compete to drive down their own profits. Broadcom doesn’t want a strong competitor in Intel in wireless and wired networking, and Intel doesn’t want a strong competitor in compute. Even if these companies never speak of this and never collude, they can certainly walk away from a fight that will only get bloody. Like Intel just did in smartphones, for instance.

Here is the irony of it all. While it is not probable, there is an outside chance that Marvell, which has done a fair amount of innovation in the Arm chip area but very little with respect to servers, ends up with all of the relevant pieces. If Broadcom prevails in its acquisition of Qualcomm and jettisons the Centriq processor line and if Marvell buys Cavium, which has its own ThunderX as well as the former Broadcom Vulcan lines, then Marvell will have under its control three of the five important Arm server chip variants — the other two being Applied Micro’s X-Gene and Fujitsu’s Post-K HPC chip.

I wonder if Apple had a hand in this weird “partnership” … be nice Intel and give us decent mobile integrated graphics or we will seriously consider using our own ARM CPU and custom GPU’s in the Macbook line.

Yeah, we been thinking about that, too. Maybe Apple will start building servers again . . . .

Cavium (and hence Marvell, if that acquisition goes through) is not lacking Fibre Channel smarts itself, having acquired Qlogic.