The cloud gives, and it takes away.

The big hyperscalers, public cloud builders, and telecom, wireless, and cable service providers who are all collectively called “cloud” when it comes to the infrastructure they build, and they are increasingly driving shipments and revenues of all manner of components. But they command, by virtue of their huge volumes, discounts that are much deeper than the typical enterprise customer can get when they buy through an OEM or, if they are large enough, an ODM.

The fact that Intel’s Data Center Group is managing to profit pretty handsomely and reasonably predictably despite this tectonic transformation of the IT supply chain is a testament to its engineering, marketing, and sales organizations. So far, despite the fact that the market keeps indicating its wants an alternative to Intel in the datacenter, the market doesn’t seem to be buying into those alternatives except, thus far, as leverage to make deals.

That could change, of course. But it sure didn’t in the third quarter of 2017, when Intel set all-time sales records for Data Center Group.

In the quarter ended in September, Intel’s overall revenues rose by 2.4 percent, to $16.15 billion, and thanks to a cut in marketing, administrative, research, and development costs as well as the fact that Intel has restructured and had to book those costs in the year-ago period when it started that restructuring, the company was able to boost net income by 33.7 percent. It didn’t hurt that revenues were about $400 million higher than expected, with the cost cutting being better than expected, operating income during the period was $700 million better than Intel was anticipating for Q3 2017. Business is so good right now that Intel told Wall Street that it was raising its revenue guidance for the year to by $700 million to $62 billion flat, with operating income now guiding up $900 million to $18.8 billion for the year. Whatever competitive threats Intel has had in PCs and servers, it has dealt with them successfully, even if it has not cracked the smartphone market as has long been its desire.

As Brian Krzanich, Intel’s chief executive officer, told Wall Street in a conference call this week going over the numbers, the amazing thing is that even with 25 percent of the unit volumes coming out of the PC business in the past few years, Intel has managed to grow its profits as it has stabilized its revenues in PCs. And because chip manufacturing is a volume business because volumes drive down unit costs as they drive up chip yields and therefore profits, the PC is vital to Intel’s Xeon server chip line, just like the PC is vital to Nvidia’s Tesla GPU accelerator line.

Data Center Group is a big contributor to profits but is, as we point out above, dependent on its Client Computing Group and still does not deliver as much operating income as this PC business. But if trends persist, it will not be long before they cross. Perhaps in two years, maybe less. In Q3, the “Skylake” Xeons and their “Purley” server platform components of chipsets and motherboards were still ramping, and it is not clear how much revenue the Xeon SP line drove. It is not the kind of bump we have seen in years past, but then again, Intel has been shipping Skylake Xeons to big cloud builders since about this time last year, notably starting with Google and then Amazon Web Services before the Skylake chips were formally launched in July of this year, so the curves have to, by definition, be a little flatter.

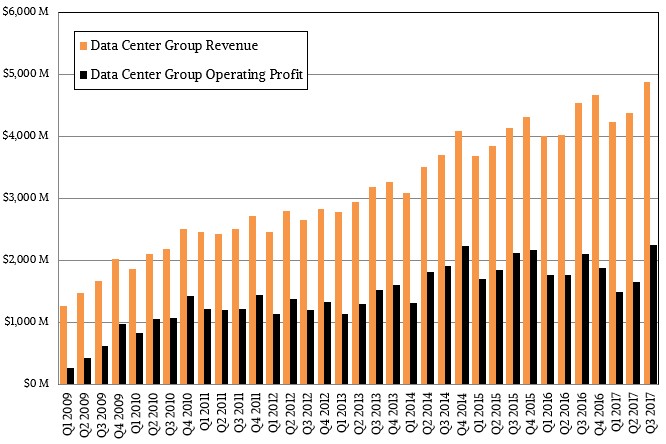

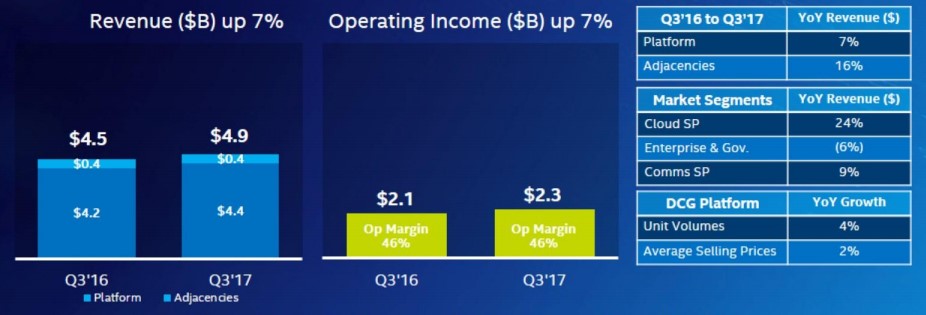

In the third quarter, the platform sales at Data Center Group – meaning Xeon and Xeon Phi processors, chipsets for them, and motherboards based on them – rose by 6.6 percent to $4.44 billion. Other revenues within Data Center Group, including stuff such as Intel’s Omni-Path switches and adapters among other things, rose by a more modest 16.1 percent to $439 million. Add it up, and Data Center Group had $4.88 billion in revenues, up 11.7 percent year on year and against a pretty tough compare when the “Broadwell” Xeon E5 v4 chips were shipping in volume. Operating income for Data Center Group was up 6.9 percent to $2.26 billion, and that was higher than the previous record for profitability for the glass house part of the business back in the fourth quarter of 2014, when it had $4.09 billion in sales and brought 54.5 percent of that to the middle line as $2.23 billion in operating income. Because of the restructurings, the costs of putting 14 nanometer processes in production for the Skylakes, and Intel’s work on 10 nanometer processors for all of its chips (with more allocation going to the servers than the PCs now that the Xeons are moving to the front of the process line, rather than the rear), the Data Center Group is not as profitable as it had once been. But, again, the PC business was shouldering the costs of ramping up yields, which made it look less profitable than it was and made the datacenter business look more profitable than it was.

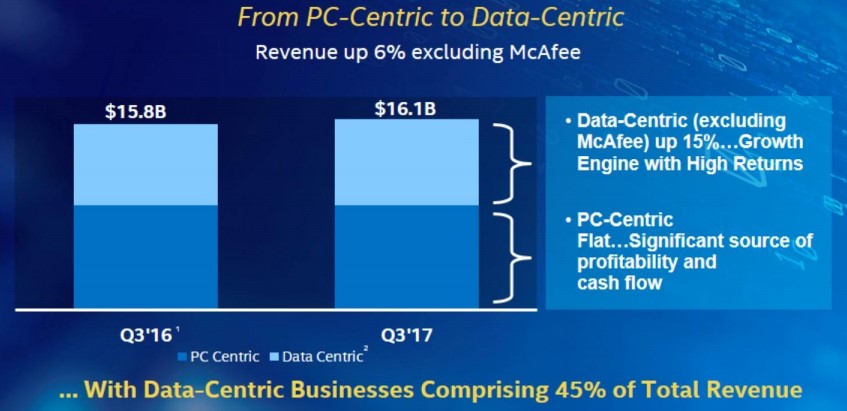

The way Intel talks about its business these days, it breaks the business into two pieces: the PC-centric part and the data-centric part, and here is how the breakdown looked in Q3:

The Q3 2016 data for the PC-centric part of Intel includes revenues for its former McAfee security software business and PC chips and chipsets and very likely some other peripheral sales. The data-centric parts of the business, according to Intel, include Data Center Group, IoT Group, Non-Volatile Solutions Group, Programmable Solutions Group, and a smattering of other stuff. (We have a slightly different way of characterizing this split.) The interesting bit is that the data-centric part of Intel is now driving 45 percent of its revenues, and has grown 15 percent this year and has higher returns in the aggregate compared to the PC-centric part of the business, which has flat revenues and profits. Those are still good profits, mind you. Client Computing Group as a whole had $8.86 billion in sales in Q3, down four-tenths of a point, but operating profits expanded 8.2 percent to $3.6 billion thanks to launches of desktop and laptop processors that are biting into AMD’s share of the PC segment.

“Our strategy is to be the driving force of the data revolution across technologies and industries,” explained Krzanich on the call. “Our data-centric businesses are the company’s growth engine. Individually, these businesses provide great value to our customers, and collectively, they are solving our customers’ problems in a way that no individual business or product could. We have built a collection of capabilities that is unmatched. At the same time, our PC business remains central to our success. It is a source of great profit, cash flow, scale, and intellectual property.”

Here at The Next Platform, we don’t much care about a technology until it passes through the glass house wall. So we are all about watching Data Center Group, and the adjacencies like FPGAs, flash and 3D XPoint memory, and the bits of IoT that relate to the datacenter.

The interesting bit about this chart is that revenues for Intel datacenter products sold to cloud service providers rose by 24 percent, and sales to communications service providers were up by 9 percent. Sales to OEMs and ODMs who build products for enterprise customers and government agencies dropped by 6 percent. As has been the case for several years now, the enterprise sales have been a drag on Intel, and that is not a coincidence. The cloud and comms service providers now account for about 60 percent of Data Center Group Revenues, up from around 35 percent four years ago in 2013. This flipping of the revenue stream size between enterprises and service providers is the direct result of the cloud revolution, where infrastructure, platform, and software services are now commonly available and are being employed.

A few years ago, Intel though it could have its cloud and eat its enterprise, too, and grow revenues at 15 percent annually. But that is not happening because enterprises are shifting more and more compute and storage to the cloud. Enterprises pay more for technologies and give Intel and its OEM and ODM partners higher revenues and margins for any given product, and that is why Intel is only expecting operating margins to be a little north of 40 percent and revenues to grow in the high single digits for Data Center Group going forward.

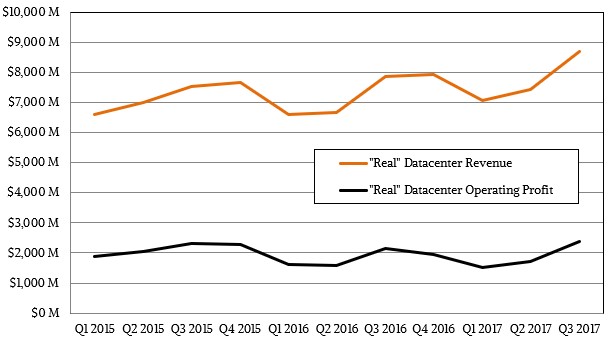

We like to try to reckon how much of Intel’s revenues are in the glass house, and add half of the IoT and 75 percent of the FPGA and non-volatile revenues together, and do a similar proportion of the operating incomes, to try to figure out what Intel’s “real” datacenter group revenues might look like. Here is the curve we come up with based in its 2015 financial formats:

And here is the raw data for this in a table:

Despite the huge premium that Intel and others are charging for flash memory, Intel’s Non-Volatile Solutions Group is still not quite making money, but it is getting closer. Intel says that its core NAND flash business is profitable. For Programmable Solutions Group, revenue was up 10 percent and the former Altera FPGA business had its largest quarter for design wins among large customers in the past three years. Operating margin growth outstripped revenue growth here, rising by 45 percent. This business is finally finding its feet inside of Intel and getting some traction.

In any event, the way we do the math, Intel’s “real” datacenter business had $6.32 billion in sales, up 11.1 percent, and operating income hit $2.37 billion, up 9.7 percent.

The cloud has not hurt Intel any more than anyone else, but the pressure from such customers is always going to be intense, and increasingly so as they grow. Intel may find itself wishing, some day, that enterprises wanted to own their systems rather than rent them. By then, Intel might also be wishing it had started the second cloud revolution – the one that stuck – in 2006 itself instead of leaving that to Amazon Web Services.

Great article! Love the detailed discussion, the visualization was quite poor (the first 2 especially w/o any axis marks to show the scale of the bars) but overall interesting dissection of INTC’s shares

“Whatever competitive threats Intel has had in PCs and servers, it has dealt with them successfully, even if it has not cracked the smartphone market as has long been its desire.”

What does this even mean as Intel’s competition in the x86 server market is mostly Intel currently because AMD’s Zen/Epyc/Ryzen products are just now to market in the past 6 months and AMD’s Epyc SKUs as well , a little later, have not even been on the market long enough to register enough revenues but just to make AMD’s Q3 Semi-Custom/Embedded/Enterprise revenues relatively flat instead of shrinking as that group would have done without any Epyc sales to add in. Epyc’s market share numbers will take more than one partial revenue producing business quarter to even allow for any proper revenue growth rates to be established and any reasoned future server revenue growth figures extrapolated. So How can Intel be said to have any real competition in which to overcome in the x86 based server/workstation/HPC markets so soon after AMD’s Zen/x86 competition is just come on the market. Even the power9 SMT4 variants at 24 cores are not really there yet and the Power9/SMT4/24 core variants are what are expected to compete more with Intel’s Xeon SKUs on a offering to offering basis more so than any SMT8 power9/12 core variants, or Power8/SMT8/12 core SKUs. There are some server workloads where having more cores and not necessarily more processor threads have Intel at an advantage compared to Power8(with 12 cores and SMT8) so those Power9 SMT4/24 core variants will need some time to even be available before Intel’s server competition can be outright dismissed without qualification.

My does Intel’s positive Mind Share have its way when Intel’s ability to Contra Revenue its way into the larger phone/tablet mobile markets failed and even part of Intel’s Q3(2017) Revenue Stream record show up as due to cost cutting rather than sales based has Intel coming out all looking so well.

Intel’s Coffee lake is but a dog and pony show currently with the actual number of Coffee Lake based SKUs actually available not so high in the retail channels with the remainder of the Coffee lake variants not scheduled until the first part of 2018. And yet Intel’s Coffee Lake is pounding AMD’s Ryzen/Threadripper sales down if you believe what some analysts are saying! Even with AMD setting high sales figures with the big online retailers in the US and the EU with its Ryzen 7, 5, and 3 SKUs and Threadripper SKU sales AMD’s is prematurely declared out of the running even with not much Coffee available quite yet for purchase.

AMD sure can not get any positive Mind Share even with turning a profit and that AMD Q4 revenue dip that is expected is seasonal and consumer related, with AMD’s year on year Q4 revenues still expected to be larger than the Q4(2016) revenues. AMD really needed to talk up its Epyc SKUs market potential rather that allow itself to be lead by the other end of the earnings conference call down a blind alley and so worked over by the market analysts. Intel is definitely the incumbent that has its way with the market analysts and AMD the greenhorn and not used to its new situation as a company with a definite future. If AMD can even get back to its past Opteron levels of server market share that had AMD’s stock price in the low to middle 90-95 dollar range on CPU sales alone, as at that time AMD had yet to acquire ATI. AMD really needs to post haste extricate itself from any total dependency on that fickle of fickle markets the consumer gaming market and get back to the real revenue producing sales in the enterprise CPU and enterprise GPU accelerator/AI markets. That Vega 10 die business that comes from the Radeon Pro WX 9100’s and the Radeon Instinct MI25(AI/Inferencing) SKUs that the Vega 10 GPU micro-arch was really designed for where the markups are there to produce the proper revenues and not any gaming market only revenues where the margins are terrible for AMD and will always be as the consumer gaming market is so price sensitive that AMD can barely eke out any margin growth quarter to quarter.

I’m seeing way to much accentuating AMD’s negatives and way too much ignoring any of Intel’s negatives online and especially among the online market analysts. And that online Mind Share business has overtaken any rational reporting objectivity as the number one objective of the majority of the online press. Louis Rukeyser is most definitely a spinning dynamo in his eternal resting place with the quality of objective market reporting as it exists currently.

And have you questioned why AMD is having a problem getting into those datacenters? Again AMD’s historical problem of delivery issues. Blame it on the slow ramp if you want but more likely AMD’s Epyc was hard launched because it was rather late in the evaluation, validation and finalization phase (thus full production ramp was not initiated much earlier before launch). Then look at AMD’s Q3 207 earnings on the EESC (Enterprise, Embedded, and Semi-Custom) division’s income versus revenue ratio. That doesn’t seem to show much earnings from AMD’s Epyc at all, given that datacenter chips always makes the most money and highest margins. Sure, we saw some AMD’s Epyc chips (for reviewers) but that’s just a very tiny trickle. And even with those 3 partners (Baidu, Tencent and JD), they still doesn’t seem to contribute much into AMD’s bottom line in EESC (Enterprise, Embedded, and Semi-Custom) division at all. That did not escape the notice of most (analytical) people, example https://finance.yahoo.com/news/sell-amd-post-earnings-plunge-133100985.html see the part…

“The bulls expected sales of new Epyc CPUs — which were squarely aimed at Intel’s market-dominating Xeons — to offset its weakness in consoles.

Unfortunately, AMD’s EESC revenues stayed roughly flat year-over-year at $824 million (even after adding a one-time gain from a patent licensing settlement which boosted revenue at both its business units for the quarter), extinguishing the notion that AMD would dent Intel’s 99% market share in data centers. By comparison, Intel’s data center revenues rose 9% annually to $4.4 billion last quarter on the strength of its new Xeon Scalable processors for AI and other data-intensive workloads.”

Additionally AMD’s lower Q4 2017 guidance, again suggests the same trend. So stop blabbering about positive or negative “mindshare” because it is the results that speaks loudly. In the datacenter and HPC market, there are many big factors that influences decisions in purchasing server hardware.

Next Platform real Intel DCG revenue remains low even adding division proximate contribution on sheer volume of Xeon production understated or underestimated by many concerns DCG total revenue.

Mr. Morgan himself knowledgeable of Intel disintegrated story problem supply cipher signaling Intel volume on his first public report in 2001, following FTC model work report in 2000, known earlier on reliance include Intel model for mobile by yet to be Tirias in 2001, and Micro Design Resource publishing model overall product category outcomes begins 1997.

Note this has nothing to do with the Intel Inside price fix.

Where none of the above on my knowledge contact SEC realizing INTC revenue questions?

Broadwell E5 26xx v4 volume at 33,500,000 units an Ivy Bridge Xeon half run, on supply signal cipher. is well less than what channel inventory data suggest by 3.1x.

Also must take into account commercial grade bin split. That amount up to 33.5 M to 105 M 26xx v4 capable / grade yields for satisfying commercial demand top bin.

At 33.5 M yield on bin split volume average weighed price $1335, 1K revenue is $44,722,627,538 minus commercial discount estimated on channel inventory holding and Intel financial by this analyst is 82%.

At 82% off $1K INTC $8,050,072,956 gross for 33.5 M E5 26xx v4.

Mr. Morgan’s recent statements, thought 50% Xeon volume discount, than DCG E5 26xx v4 gross is $22,361,313.760.

I suspect Intel model known sold-in by Intel employees, was originally supplied in Tanner servers as a gaming app bundled into investment banking beta validation platforms? Into 2007 the model is capable of projecting Intel revenue and margin calculation up to 12 quarters into future time for playing INTC.

There are better tools for DCG revenue estimates Mr. Morgan attempts to derive although I applaud the attempt.

Next Platform has never been one to succumb too misrepresentation or advertising for disinformation.

Mike Bruzzone, Camp Marketing