Makers of tightly coupled, shared memory machines can make all of the arguments they want about how it is much more efficient and easier to program these NUMA machines than it is to do distributed computing across a cluster of more loosely coupled boxes, but for the most part, the IT market doesn’t care.

Distributed computing, in its more modern implementation of frameworks running on virtual machines or containers – or both – is by far the norm, both in the datacenter and on the public clouds. You don’t have to look any further than the latest server sales statistics from IDC. The analysts at the box counter have revamped their market models, and now believe that the original design manufacturers (ODMs) that predominantly sell their server iron to the major hyperscalers and cloud builders of the world have been selling a lot more iron to these customers than was previously believed. These are very secretive manufacturers and customers alike, so figuring out the numbers is a bit tricky.

In its latest figures, for the second quarter of 2017, IDC says that it has backcast the ODM sales all the way back through 2013, and on average across the past five years, the ODMs who sell directly to these large customers as a group saw an average increase in reported revenues to the tune of $1 billion. (We presume that a lot of this was incremental revenue to the model, and some of this came out of other suppliers.) That is a huge shift in server market share for Quanta, Wistron, Inventec, Foxconn, Delta, Jabil Circuit, and the other key players in this space.

It is important to not equate sales of the ODM Direct suppliers to the sale of all servers to Google, Amazon, Facebook, and Microsoft in the United States and Alibaba, Baidu, Tencent, and China Mobile in China as well as the next tier down of near-hyperscalers at various cloud builders and telecom companies. Microsoft, for instance, still buys lots of iron from Dell and Hewlett Packard Enterprise, so long as the price and the configuration is right, and for all we know, other hyperscalers do, too. Inspur, Sugon, and Lenovo also sell lots of iron to these very large scale companies. So all of the ODM Direct sales probably go to hyperscalers and cloud builders, and this is a proxy for the growth in server investments at these companies, but it does not characterize the entire market.

Just to give a tidbit of information, Kuba Stolarski, who is research director of computing platforms at IDC, reckons that Amazon, all by itself, accounted for more than 10 percent of worldwide shipments in the second quarter, which amounted to 2.45 million machines. Call it a cool 250,000 servers that shipped to Amazon. That is nearly three to five full datacenters worth of gear, if Amazon can cram 50,000 to 80,000 servers per datacenter, as we think it can do. We think Amazon has millions of servers (maybe somewhere between 3 million and 5 million), so doing 250,000 machines in a quarter is actually not a big deal when you tend to want to replace on third of your fleet doing every year on a rolling basis.

While Intel did not launch its “Skylake” Xeon SP processors until July, that launch was largely a formality for the enterprise market and its timing had nothing at all to do with when the chip maker was actually shipping Skylake processors in reasonably high volumes – and for revenue – to the hyperscalers and cloud builders. In the first quarter numbers, IDC said that one hyperscaler accounted for around 250,000 units and we think it was Google, which has been bragging since late last year it would be the first to get Skylakes on its cloud and available to customers to play with. In reporting its own second quarter financial results, Intel’s chief executive officer, Brian Krzanich, said that the company had shipped over 500,000 Skylake “pre-production units” to over 30 customers, and it looks like Google and Amazon got most of these.

It is noteworthy that Microsoft, which has embraced ARM servers and has ported Windows Server to ARM chips for its Azure cloud, is not mentioned as an early big volume customer for Skylakes at the same time as its key server maker, HPE, is reporting that its Tier 1 server business is tough and it is re-examining its whole Cloudline family and its relationship of rebadging gear from Foxconn to chase the hyperscalers and cloud builders. There is more margin in the enterprise, to be sure, but that market is shrinking and Intel doesn’t think that will stop, unlike in years gone by. And hence, it is charging a pretty hefty premium, at least at list price, for Skylake Xeons compared to prior generations of Xeon chips. If the hyperscalers and cloud builders get the Skylakes at 50 percent of list price and can consolidate servers maybe three or four to one, this works well for them; and if enterprises buy from the middle of the Skylake line or near the top but in low volume, they will have to pay a premium and that will fill Intel’s coffers with revenues and profits in a declining market.

Intel wins.

That, pretty much, sums up the current state of the server market. At least until AMD Epyc, IBM Power9, and ARM server chips from Cavium and Qualcomm get a little traction in the market, which has not happened as yet. As long as the premium can be justified, through lower risk and better consolidation ratios or lower software pricing because the socket counts go down, then Intel wins.

In the second quarter, IDC thinks that the world consumed 2.45 million machines, an increase of 1.9 percent compared to the year ago period. That also means that IDC revised its server shipment number upwards by about 100,000 machines for Q2 2016, and we are waiting to hear back from Stolarski to update our own models, which take IDC data back to the Great Recession. We presume those incremental machines went to the ODM Direct crowd; we can see that IDC revised the ODM Direct revenues upwards by just a tad under $1.3 billion. The other vendor revenue numbers wiggled a bit, here and there, but were largely the same, and what it looks like is that these hidden ODM revenues are now being added into the overall market.

It would be almost as interesting to see quarterly figures of who bought servers as who sold them.

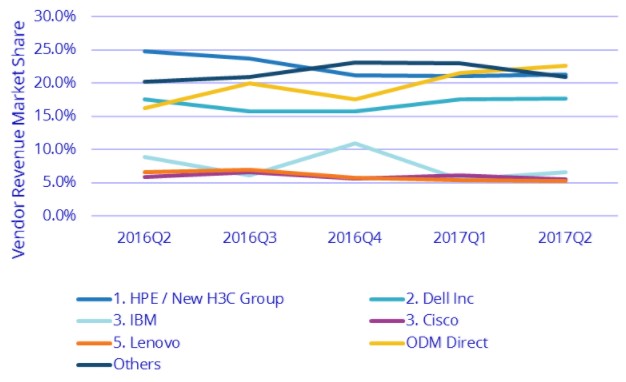

Here is the revised data going back a few quarters that IDC is providing with its latest report:

For those of you who don’t have issues with color blindness (I do), what is immediately obvious from the chart above is that ODM Direct vendors, as a group, outsold Dell starting in the first quarter and outsold HPE starting in the second quarter, and if current trends persist, they will account for about a third of total worldwide server revenues a year from now.

It would be interesting to back out all of the hyperscale and cloud builder revenues separate from the rest of the market, and frankly, this might be a lot more useful than the volume, midrange, and high-end breakdown that IDC has been doing for the past two decades. IDC does not do this in its publicly available data, but you can rest assured that it has such information.

In any event, volume servers – meaning machines that cost less than $25,000 – accounted for $12.9 billion of revenues, up 8.3 percent, in the second quarter, and as we all know, this part of the market is dominated by two-socket, Xeon workhorses. The midrange portion of the market, where systems cost between $25,000 and $250,000 and which include a fair number of four-socket and eight-socket X86 machines that have their places even in hyperscaler and cloud datacenters, saw a tremendous 19.6 percent revenue jump in the quarter to $1.5 billion. The midrange has been in decline for years now, but should see a rebound as Power9 and Sparc M7 chips come into the field and as multiple-socket Xeon machines (particularly for in-memory processing) see some uptake. The high-end market, where machines cost more than $250,000, had an 18.9 percent decline in the period to $1.3 billion, but IBM has just launched its System z14 mainframe in the quarter and that will provide a bump of sorts to this portion of the system market.

The ODM Direct vendors had an amazing quarter, with revenues up 48.1 percent to $3.55 billion, and we presume that Quanta Computer, Wistron, and Inventec were the big beneficiaries here. IDC does not provide vendor breakdowns for shipments in its public data, but here is the breakdown of the top five plus the ODM Direct players for the second quarter:

There are a few interesting things here. First, the gap between HPE and Dell keeps shrinking, and IBM continues to shrink as it is at the very tail end of the System z13 cycle and is still not yet shipping Power9 systems in volume. (Yes, we know that Oak Ridge National Laboratory started receiving its first Power9 “Witherspoon” system racks at the end of July for the “Summit” supercomputer. But Big Blue has not formally launched these, or other Power9 systems, as yet and that means no one else can get them.) There are rumors going around that IBM may launch its initial Power9 iron soon, and then do a rolling thunder upgrade across its Power line in 2017 and 2018. Cisco Systems and Lenovo are neck-and-neck for a tie for fourth place, and they are both within spitting distance with IBM in terms of quarterly revenue. But we think IBM will rebound once the Power9 and z14 systems are both shipping in volume late this year and into early next year. Another interesting note: IDC has begun tracking whitebox and system component maker Supermicro for the first time, and says that it raked in $448 million in system sales in the second quarter, up 49.8 percent from the year ago period and giving it a 2.9 percent share of server revenues this time around.

Add all of the money up across those 2.45 million machines and revenue was growing faster than shipments, with sales worldwide up 6.3 percent to $15.72 billion, which suggests the market as a whole is consuming richer server configurations. This is consistent with the basic premise that Intel Xeon SP processors are pricier and companies are adding more memory, more flash storage, and in some cases more GPU and FPGA accelerators to their machines, which has the effect of raising average selling prices. A GPU-heavy system might cost an order of magnitude more than a reasonably heavy configured server, which might weigh in at $15,000 to $20,000. Nvidia’s DGX-1V, with eight “Volta” Tesla GPU accelerators and two Xeon E5 processors plus a decent chunk of main and flash memory and 100 Gb/sec InfiniBand interconnect, has a list price of $149,000. Just as an example.

If you do the math, X86 servers accounted for 99.1 percent of shipments, for just over 2.4 million machines, and at $14.3 billion in aggregate sales, accounted for 89.8 percent of server revenues in the period and up 10.4 percent. That is about as much market share and growth as the Intel Xeon line can push until mainframe and RISC/Unix machines are abolished from the datacenters of the world.

And where’s Supermicro in the table above? They had revenue above 700M$ in the last quarter and the way it’s going may have bigger server sales than Lenovo fairly soon.