Enterprise spending on servers was a bit soft in the first quarter, as evidenced by the financial results posted by Intel and by its sometime rival IBM, but the hyperscale and HPC markets, at least when it comes to networking, was a bit soft, according to high-end network chip and equipment maker Mellanox Technologies.

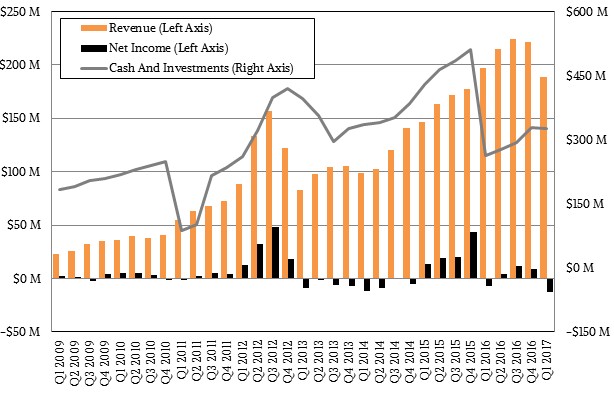

In the first quarter ended March 31, Mellanox had a 4.1 percent revenue decline, to $188.7 million, and because of higher research and development costs, presumably associated with the rollout of 200 Gb/sec Quantum InfiniBand technology (which the company has talked about) and its companion 200 Gb/sec Spectrum Ethernet (which it has not as yet), and despite cutting its back office costs by more than half, the company was pushed to an operating loss that translated into a net loss of $12.2 million, a bit larger than the $7.2 million loss it reported a year ago against $196.8 million in sales.

Mellanox attributed the revenue decline to a number of factors, which affect different aspects of the high end arena that The Next Platform covers. Mellanox said that delays in the next generation X86 processors adversely impacted sales of InfiniBand equipment in the first quarter, and it was not explicit about what X86 processors it was talking about. Intel is only now talking about a mid-2017 launch date for its “Skylake” Xeon processors, which will be a converged Xeon E5 and Xeon E7 product line, but it has not provided a more precise or earlier launch date so it is tricky to call Skylake a delayed product. (That said, we think Intel would have preferred to launch Skylake last September or this March.) The AMD Naples processor, which will probably not bear an Opteron label, are expected to start shipping at the end of this quarter and offer compelling advantages over the Skylake Xeons but also fall behind in certain areas, such as floating point performance.

The networking company also said on a call with Wall Street analysts that InfiniBand product sales were affected by seasonal trends in the HPC market and technology transitions at big OEM accounts as well as some end users.

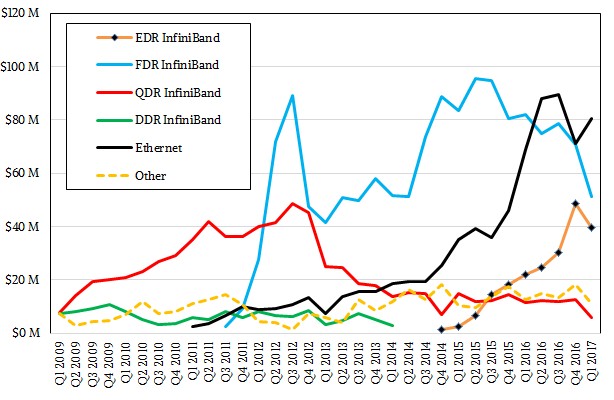

In the quarter, InfiniBand product sales came to $97 million, off 14.3 percent for the year and representing 51.4 percent of total revenues for the thirteen week period. The top-end 100 Gb/sec EDR InfiniBand products that Mellanox has been peddling since November 2015 rose 89 percent, year on year, but as you can see in the chart below, they were off sequentially from the final quarter of 2016, which had a big spike thanks to some big HPC system deployments:

The drop in sales of prior generations of 20 Gb/sec DDR, 40 Gb/sec QDR, and 56 Gb/sec FDR InfiniBand products in the period are absolutely consistent with prior generational transitions at Mellanox, and it would only have taken a few Skylake clusters shipping in the March quarter to radically alter these InfiniBand numbers.

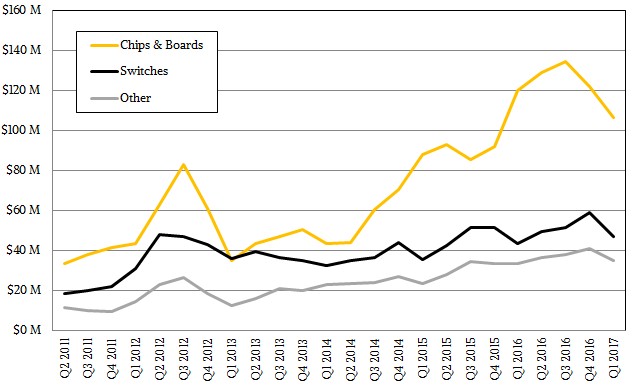

The Ethernet switch business, which declined a bit in the fourth quarter, resumed its growth path in the first quarter, with sales of $80.5 million, up 17.3 percent year on year and up 13.3 percent sequentially. Ethernet products, dominated by its Spectrum 100 Gb/sec products we presume, accounted for 42.7 percent of the company’s total revenues in Q1 2017. Sales of products based on the 25G standard (including both switches and server adapters) rose by 20 percent secquentually.

Eyal Waldman, chief executive officer at Mellanox, took the quarter in stride, pointing out that the company expected for both its InfiniBand and Ethernet products to grow in the full 2017 year.

“While we are disappointed with the first quarter results, we believe revenues will see sequential growth in coming quarters,” Waldman told Wall Street. “We continued to see multiple design wins for our products in multiple platforms that we expect will ship later this year and in 2018. These design wins include more than ten storage platforms, more than twenty artificial intelligence projects, and multiple Web 2.0 and cloud provider platforms worldwide.”

Waldman said that Mellanox had no large HPC system deals in the first quarter, but had deals slated for the second and third quarters of this year, which would help the EDR InfiniBand ramp. He added that some of these deals were scheduled for the first quarter, but had been pushed out to Q2 and Q3, and that this push out was why Mellanox was being a bit cautious with its guidance for the second quarter and why it had a revenue shortfall. To be specific about Q2, Mellanox expects for revenues across all of its products to fall between $205 million and $215 million, which at the top-end of that range would match its sales in Q2 2016. The presumption is that Intel was not able to ship Skylake Xeons to early adopter HPC shops, as it often does with each chip generation, and that this stopped Mellanox from making its InfiniBand sales. It could also turn out that with Skylakes coming in the middle of the year, some HPC shops want to wait and get their hands on 200 Gb/sec HDR InfiniBand, which is slated for delivery at the end of this year in the “Summit” and “Sierra” systems that IBM, Nvidia, and Mellanox are building for the US Department of Energy. Waldman did not say anything specific about this, but clearly if an HPC shop has to wait for CPUs with twice the floating point performance it might as well wait for twice the bandwidth.

We shall see what happens.

On the Spectrum 100 Gb/sec Ethernet front, Waldman said that the company was selling more switches than it was selling raw chips into the market, showing that it is getting traction as an Ethernet switch vendor against numerous and generally larger competitors. He added that several hyperscalers in Asia were looking at adopting Spectrum Ethernet products, and there were two hyperscalers in the United States that were going to deploy Spectrum at scale as well.

Be the first to comment