With a new generation of Xeon processors coming out later this year from Intel and AMD trying to get back in the game with its own X86 server chips – they probably will not be called Opterons – it is not a surprise to us that server makers are having a bit of trouble making their numbers in recent months. But we are beginning to wonder if something else might be going on here than the usual pause before a big set of processor announcements.

In many ways, server spending is a leading indicator because when companies are willing to invest in new hardware they are supporting new projects as well as expanding the foundation of existing software in their datacenters. Interestingly, server spending is also a lagging indicator because whenever there is a recession, things kind of hum along for a bit and then when the recession hits, as it did in 2009 during the Great Recession, then spending falls off a cliff and when the economies of the world rebound, it takes a quarter or two for people to believe that the recovery is real and then start investing in projects again.

What can be honestly said is that if the economies are rolling along, then server makers, whether they are OEMs or ODMs, seem to find enough business to all do reasonably well. We seem to be in a different period now at the beginning of 2017, and it is hard to say if this is due to several economies being challenged, new architectures coming out, or capacity buying patterns changing – or a little bit of all three. But what we can tell you is that something is definitely up.

Hewlett Packard Enterprise is a case in point. The company reported its financial results for its first quarter of fiscal 2017 ended in January last week, and the server and storage numbers were not great. Supermicro, which had three tough quarters last year, turned in a very good one as it closed out the second quarter of its fiscal 2017 year in December. IBM does not have an X86 business any more, but as we have recently written, its Power Systems and System z mainframe lines are stalling, and perhaps not just because there are future Power and z processors on the horizon. We no longer have visibility into Dell, the second largest maker of servers on the planet, which bypassed Big Blue a little more than two years ago when IBM sold off its System x server division to Lenovo, but apparently Dell is being aggressive in trying to take share away from both HPE and Lenovo in North America and Europe. Chinese upstarts Inspur and Sugon along with a revitalized Lenovo are eating share in China, making it tough for Dell and essentially driving HPE into the arms of Foxconn and Tsinghua for its partnerships for hyperscale iron and indigenous sales, respectively. And Huawei Technologies is expanding out from its home market in the Middle Kingdom into the Middle East, Africa, and South America as well as into parts of Europe where there is not a strong, indigenous local server maker.

Across the board, there is top line pressure on revenues and, from various reports across the server makers who are publicly traded, we hear about shortages in DRAM main memory and NAND flash memory that are driving up component prices for all OEMs and ODMs, putting profit margins on a tight squeeze.

In a conference call with Wall Street analysts last week, Meg Whitman, chief executive officer at HPE, called out the strong dollar against the euro and the yen as a headwind for its overall business, and added that the flash and memory price increases we a big challenge and that it was able to mitigate some of the effects in the quarter thanks to its expanded supply chain. But Whitman also added that she expected DRAM prices to continue to rise and that this would create “near-term challenges” to HPE’s profitability.

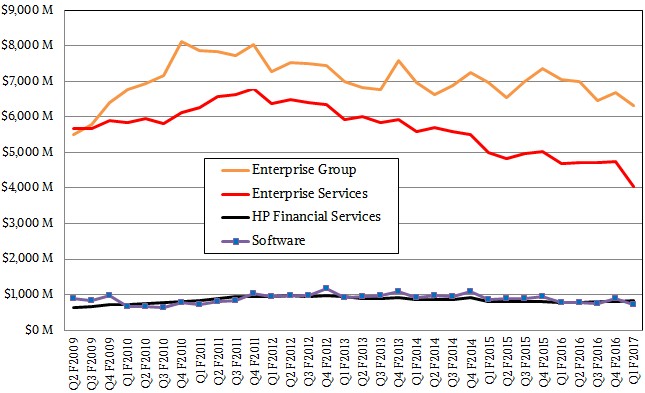

But HPE, being a large conglomerate even after it spun out PCs and printers and continuing to be a large company even when it finishes its spin out of its Enterprise Services group to CSC and most of its Software group to Micro Focus later this year, has other issues. For one thing, Whitman said that the Enterprise Group had some execution issues as it works with Enterprise Services on the separation, overloading its top executives. (We would point out that sales people should still be able to sell what is on the truck, no matter what is happening back in HQ.)

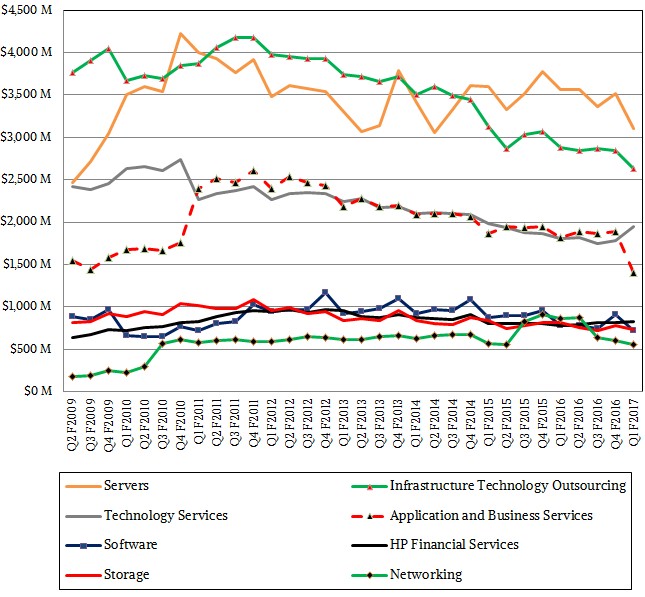

The drop in server and storage revenues in HPE’s fiscal Q1 was unexpected, and is probably not due to high DRAM and flash memory prices, which Tim Stonesifer, chief financial officer at HPE, said rose by more than 50 percent in the last month of the year. People will usually buy slightly fewer machines or skinnier ones if a component price spikes, but when you are buying an all-flash 3PAR server, this has a direct effect on the revenue and capacity sold. And Whitman said that sales of all-flash arrays rose by 30 percent in the quarter and would have climbed higher had it not been for the flash shortage. HPE’s overall server sales fell by 12.3 percent to $3.1 billion in the quarter, and storage revenues were off 12.8 percent to $730 million.

HPE was apparently hurt by one of its tier one cloud/service providers not spending as much as expected in the first quarter; it did not identify that customer. Whitman said that HPE is also being much more selective about doing deals that have some margin in them, which also has an impact on the top line, and she added that HPE’s main rival, Dell, was being particularly aggressive. But it is a complex situation.

“Lenovo is around, but they have got their hands full on a couple of other things – the server business and Motorola,” Whitman explained. “But Dell is being very aggressive, particularly in the server side of things. And we are countering that. When we think it makes the right sense, we are not doing share for share’s sake here but we are being smart about it. And then in Europe, we actually are seeing the Chinese, with Huawei being more aggressive. And we are trying to avoid what we learned in the PC business, which is they do the land and expand. If you can keep them from landing, then that is a much better long term strategy. So, we’re working hard on that too. I would also say that joint venture in China is actually working quite well. There has been some growing pains there but actually we’re quite optimistic about that and optimistic about the Tsinghua team that is now in charge of that business. And listen, given the trade situation and what may or may not happen with the administration, I am very glad I am part of a joint venture in China.”

There is no shortage of uncertainty, that’s for certain.

We also think that the public cloud is finally coming home to roost just a bit. It has been our contention that shifting to a utility consumption and pricing model where many customers essentially share a global compute and storage farm could ultimately have a downdraft effect on the need for compute capacity. If we didn’t have server virtualization and cloud, the world would, in theory, have bought maybe 2X or 3X more physical servers than it did over the past decade. Or, maybe projects simply would have not got done at all and many famous startups whose services we all use daily would not exist, or be as large as they are now. But we think cloud is finally having an impact, as server virtualization certainly did during and right after the Great Recession. And the cloud hits OEMs like HPE twice in a lot of cases because cloud builders of any scale tend to go to ODMs like Quanta and Wistron, so they don’t get the server sale, and then customers who buy infrastructure, platform, or software services from the cloud builder don’t buy as much server capacity for their own datacenters, either.

Whitman more or less concurred with this, but said it was no worse than anticipated.

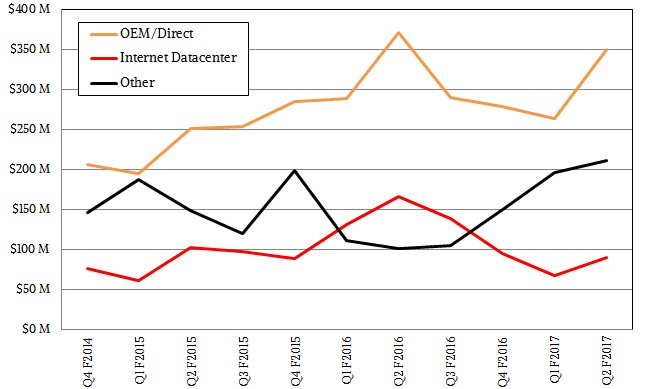

The View From Inside The Whitebox

Supermicro sometimes behaves like an OEM, sometimes like an ODM, and sometimes like a parts supplier willing to sell ammunition to those who compete with it in the systems racket. The kind of slowdown that HPE experienced during the quarter that ended in January is something that Supermicro lived through in the wake of the “Broadwell” Xeon processor rollout last spring and summer. That slowdown was just as unanticipated, and shows the capriciousness (or at least the lumpiness) of spending among the service providers, cloud builders, hyperscalers, and HPC centers that represent a big chunk of the business at Supermicro.

The last time Supermicro had a slowdown like it experienced in the prior three quarters it was when Intel pushed out the launch of the “Sandy Bridge” Xeon launch in 2012 because of a bug in an integrated storage controller and the disk industry was in turmoil because of shortages due to flooding in Thailand. There must be something of a déjà vu feeling going on here for the executives at Supermicro, but the company finished out the calendar year (which is more important than its fiscal year because many customers still do big acquisitions on a calendar year).

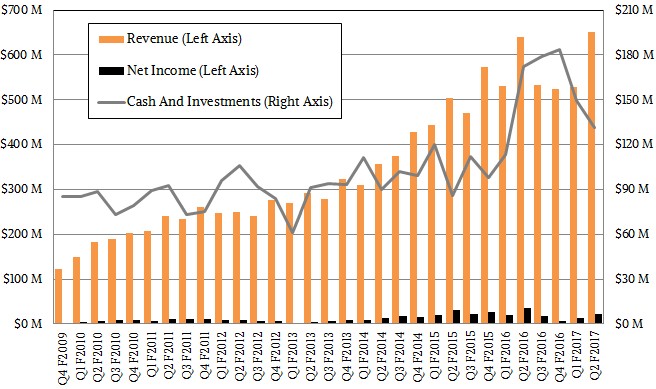

In the December quarter, Supermicro’s revenues rose by 2 percent to $652 million, but thanks to the memory and flash shortages and price increases, which Supermicro founder and chairman Charles Liang said rose by as much as 40 percent as 2016 was coming to an end, net income fell by 37 percent to $22 million. (Supermicro spent $100 million on parts in its fiscal second quarter, and a lot of that was for DRAM and flash to tide it over until the shortages are over.) We think intense competition with HPE, Dell, and others also put some pressure on the bottom line, and so did investments in the X11 product line, which will support Intel’s forthcoming “Skylake” Xeons. Liang said that Supermicro was committed to be the first major server player to get Skylake systems out the door.

It is probably not a coincidence that Supermicro more than tripled its sales of whole systems to enterprises and more than doubled its sales of systems into HPC centers while HPE was under pressure. Like HPE, Supermicro stomached a decline in its Internet/cloud provider business.

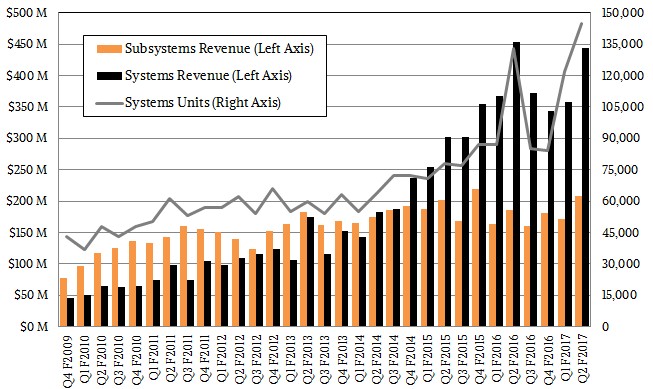

In the final quarter of 2016, which is the one that is most similar to that which HPE just closed in January, Supermicro sold 144,000 servers, up 9 percent from the year-ago period and up 19 percent sequentially. But the systems business was pretty slow in the June and September quarters last year, which is a bit perplexing considering that Broadwell Xeons were ramped and ready to sell. Subsystem sales were stable during this period and ramped in the final quarter, but we don’t think it is necessarily due to the buildout of components for Skylake Xeon systems. In fact, Liang said on his call with Wall Street that it would start seeding Skylake iron to selected customers in its March quarter and that it expected to see the usual revenue ramp for the Skylake machines in its September quarter.

So while someone is building motherboards for the early Skylake machines, like those that Google announced last week it has started to deploy in its Cloud Platform public cloud and that it has committed to delivering first on the cloud, it doesn’t sound like Google is using Supermicro motherboards.

We find the lag between when Google is selling Skylake capacity and when enterprises will be able to buy it for themselves intriguing. We will have more to say about this shortly.

On constant assessment HPE must have over procured, or gotten stuck with a heap of E7 v4 opening up HPE direct eBay sales channel. That is a first in prior four years. Could speak too overzealous anticipation of the demand, or, a shift about too occur in Intel multiprocessing platform expected with Skylake ahead of schedule? Or an Intel bundle deal including E7 that was too good to be true?

“it is hard to say if this is due to several economies being challenged, new architectures coming out, or capacity buying patterns changing – or a little bit of all three. But what we can tell you is that something is definitely up.”

In its 47th week of supply E5 2600 v4 production shows two supply spikes appears to have peaked in the 38th and 45th week. 1st Tier and cloud offing may drive up broker channel volumes on which this assessment is calculated, yet, appears Broadwell v4 has entered run down.

Haswell 2600 v3 in its 130th week of supply shows a production hinge right before the initial ramp at 31st week as channel supply goes dry, then crests between 79th and 88th week. Falls into a trough through 100th week, ramps into 121st week and peaks in 128th week. I seriously doubt we will see supply runs this long in the future as Intel time continues to compresses on product duration shortened on generation period doubling following Ivy Bridge.

What happened is the commercial channels of distribution just consolidated and unless your server aftermarket, on just in time procurement, or volume contract manufacture some Intel channels just got caught holding excessive inventories as Broadwell supply train rammed in Skylake.

Telling, “There is no shortage of uncertainty, that’s for certain.” MW.

When designing your supply train be aware the Intel enabling engine, as Intel Express rams into an embankment and allocation shifts. Beyond Intel club car, coach cars are stacking, baggage is flying, and now must successfully land on new tracks.

A strategic inflection point presents. Stay a coach player as Intel suspends or intervenes in completion. Or where compliments persist in old behavior that is group think no longer contribute to competitive advantage.

Driven by the beat of Intel drum though ever shorter cycle’s is the cost of accelerated development outrunning the ability to fund next generation development? Like a clock regulator as Intel swings compliments must keep the pace. Financially beaten too row faster and faster so Intel can win the race.

That vicious spiral where coach passengers and alternate line’s important too industry innovation are eliminated. Stifle competition and close the switch to alternate routes. The server business falls into fewer hands. Product market and enterprise financial shares are redirected. Profit falls to Intel club car passengers. But only on Intel Express.

Mike Bruzzone, Camp Marketing