There is no question that information technology is always too complex, and that people have been complaining about this for over five decades now. It keeps us employed, so perhaps we should not point this out, and moreover, perhaps we should not be so eager to automate ourselves out of jobs. But if the advance of computing from mainframes to artificial intelligence teach us anything, it is that we always want to make IT simpler to get people out of the way of doing business or research.

The founders of hyperconverged systems maker Nutanix learned its lessons from hyperscalers like Google and created a platform that mashed up virtual compute and virtual SAN functionality into a single cluster, and pioneered the commercialization of the hyperconverged storage segment. (Arguably, LeftHand Networks, which has been part of Hewlett Packard Enterprise for years, had a hyperconverged platform years ahead of Nutanix.) Its pole position in this fast-growing segment of servers and storage is what enabled the company to raise an astounding $393.7 million in eight rounds of venture funding and debt financing since it dropped out of stealth mode in 2009 and to go public at the end of September and raise another $238.4 million, giving it a market valuation at $2.2 billion, which has grown to $3.7 billion only a little more than a month later.

This is a remarkable feat for a company that has not shown a profit in the past three years that it has reported its financial results, but it is not unusual for a tech startup to have such losses. The main thing that investors, who now own Nutanix, focus on is the total addressable market and to ensure that revenues are growing faster than losses are mounting. At some point, the lines cross, and Nutanix shifts to a profit and the stock goes even more through the roof, and that is how investors benefit. The venture capitalists that pumped those huge sums into Nutanix have already got at least some of their money back, and they can ride Nutanix shares up if and as the market for hyperconverged storage grows across enterprises of all sizes that hope to get a better and simpler private cloud experience and one that perhaps offers better bang for the buck than the combination of VMware’s ESXi, vSphere, Virtual SAN, and vRealize wares.

It is a big bet, and not an unsafe one, but with tens of millions of potential customers and with VMware already having 500,000 of them using its server virtualization tools, it is not a sure thing.

What we think is that Nutanix will get its fair share, which could be as high as 50 percent of a market that is expected to grow to maybe $3 billion to $4 billion by 2019. (This is approximately the revenue share that Nutanix enjoys today, but as we discussed when Nutanix pivoted from a hyperconverged system supplier to a platform provider in the past year, it has 37 different competitors chasing it now, and anything goes. Particularly with Dell, one of its key partners, now owning EMC and VMware.) Nutanix has 3,768 customers, and the repeat customers that are coming back typically spend 3.6X as much on Nutanix wares 18 months after they buy, which is a very good number and reminiscent of the ramp of the Unified Computing System converged system from Cisco Systems, which was first productized back in March 2009 when Nutanix dropped out of stealth and which in five years carved out a tidy $3.5 billion business. And interestingly, as the Dell deal for VMware and EMC was going down, Nutanix certified its Enterprise Computing Platform stack to run on Cisco iron, and it has over 3,000 partners that are pushing its iron and hundreds of large enterprises that have adopted its platform for key strategic workloads. (This used to be called the Xtreme Computing Platform and has had other names in years gone by, but it is based on the same storage stack.)

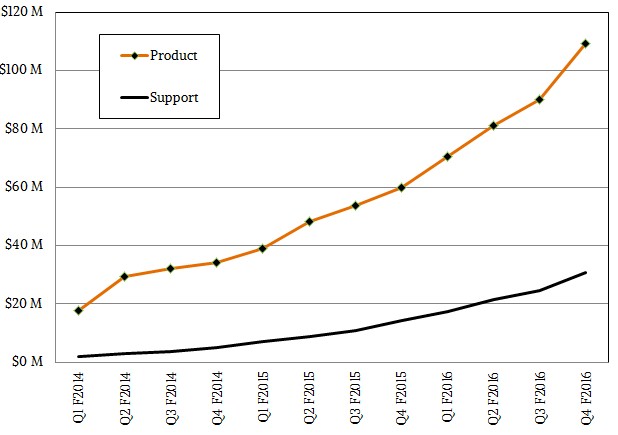

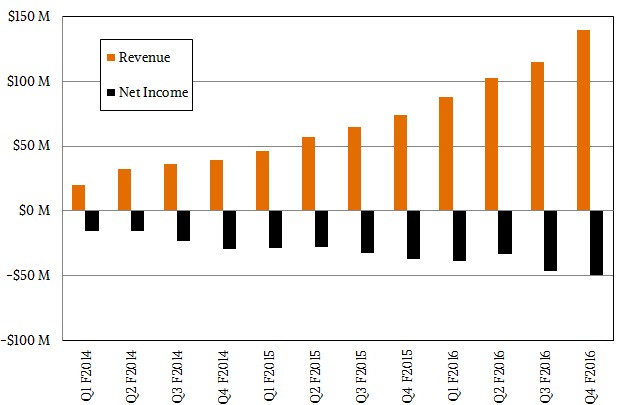

We did some back of the drink napkin math and this is what the situation could look like for Nutanix if current revenue growth continues and the company continues to shrink its losses relative to revenues and eventually they will, so everyone at Nutanix undoubtedly hopes, turn from losses to profits. While the charts above shows quarterly results, it is perhaps illustrative to look at Nutanix on a fiscal year basis. In terms of revenues, the growth has been fairly steady: $127 million in 2014, growing by 90 percent in 2015 to $241 million, and by 84 percent in 2016 to $445 million. We think Nutanix could grow by 86 percent in its fiscal 2017 (which will end next July) to $826 million and maybe by 88 percent in fiscal 2018 to $1.55 billion. If the loss shrinkage was consistent – and is has been over the past three years – then Nutanix would post a loss of $197 million in fiscal 2017 and a loss of $153 million in fiscal 2018. We think that Nutanix will be able to cut costs and get to breakeven earlier than this, perhaps in fiscal 2018, and it could even hit a profit if more of its channel starts peddling its wares. We think that breaking Nutanix free from appliances and letting customers install the Enterprise Computing Platform on any server that has appropriate compute, memory, flash, and disk, is a key factor in the growth looking ahead. That doesn’t mean Nutanix will – or should – abandon its appliance approach, but as we have pointed out before, the advent of the Community Edition of the Nutanix stack, which is supposed to be a tool for evaluating Nutanix and not running it in production, means that the company is gaining experience on a variety of hardware and building its hardware compatibility list.

Broadening the automation and integration in the Enterprise Computing Platform is one of the key levers driving the adoption of hyperconverged storage. With this week’s announcements at the .NEXT Europe conference, Nutanix has done a bunch of things to enhance the networking stack in the platform.

First up, it has added the ability to visualize the network through the Prism management tool that is at the heart of the Enterprise Computing Platform. Prism shows the CPU and storage capacity and usage, by clusters, nodes, and applications, and now it can do the same thing with physical networks that comprise the cluster as well as virtual ones that lash together the VMs that run the platform and expose empty VMs for applications to run in. In addition, the platform now has extended REST APIs that can automate the underlying network paths between VMs running apps and the load balancers, firewalls, and other gear that runs on the network, and in many cases, Greg Smith, senior director of product and technical marketing at Nutanix, these services are increasingly running not on distinct hardware appliances, but within VMs on the Enterprise Computing Platform cluster itself. As these things are linked to apps, and the VMs running those apps move around the clusters, the links are automagically maintained. This is a big deal in terms of ease of use and automation. These features will be available in an upcoming feature release due before the end of the year.

In 2017, Nutanix will add native microsegmentation of network services to secure east-west traffic between VMs running on the platform, meaning that customers will not have to deploy a complex software-defined networking overlay, such as VMware’s NSX, on top of the cluster to provide this service. This is akin to the Acropolis variant of KVM that Nutanix developed and integrated into its stack so customers would not have to buy VMware’s ESXi, Microsoft’s Hyper-V, or Red Hat’s KVM. As we have suggested before, we think Nutanix needs to integrate one or more container management services within the platform, with Kubernetes and Docker Swarm being the obvious choices and Mesos being a third.

We also think that Nutanix has to do something akin to what VMware has done in its partnership with Amazon Web Services, which is building a public cloud based entirely on the VMware stack to allow VMware shops to have a consistent stack – in this case, ESXi plus Virtual SAN plus NSX – in their datacenters and on the public cloud. Smith says that Nutanix is relying on its App Mobility Fabric, which was announced in June 2015, to allow workloads to slide from private datacenters running the Enterprise Cloud Platform onto AWS and Azure clouds. App Mobility Fabric offers conversion tools to change VMs from one format to another, and while this is neat, what Nutanix customers probably want is to be able to have the Nutanix stack on both sides of the corporate firewall and move things across without any conversion at all. Getting one of the big public clouds to give Nutanix the kind of favored status that VMware got could be problematic. VMware has 133 times as many customers as Nutanix, so AWS is probably not going to do it, and with Microsoft focused on Azure Stack for on-premises, it seems unlikely that Microsoft is interested. So that leaves Google Cloud Platform.

“If the loss shrinkage was consistent – and is has been over the past three years – then Nutanix would post a loss of $197 million in fiscal 2017 and a loss of $153 million in fiscal 2018. ”

Q1 down and already over 3/4 way to that FY17 loss projection!