Call it a phase that companies will have to go through to get to the promised land of the public cloud. Call it a temporary inevitability, as Microsoft does. Call it stupid if you want to be ungenerous to IT shops used to controlling their own infrastructure. Call it what you will, but it sure does look like all of the big public clouds are going to have to figure out how to offer private cloud versions of their public cloud infrastructure, and Amazon Web Services be no exception if it hopes to capture dominant market share as it has done in the public cloud arena.

The chatter is going around, once again, that AWS is looking to deliver a private version of its public cloud infrastructure, something that is not as easy to do as it sounds. Once you have built something that can scale to dozens of regions and multiple datacenters per region with perhaps millions of servers, it is not a simple thing to scale that back to a few thousand or even tens of thousands of machines and provide the same flexibility and margin profile that any of the big public clouds deliver. That scale is what allows the AWS platform to be resilient, and cutting it back means making it less cloudy and less resilient by default.

These prospective AWS pods, as people are talking about them, would be chips off the AWS block that customers could store in their own facilities and manage exactly as they would compute, storage, and networking capacity on the AWS public cloud, and they would represent a big change for the company – even if it ultimately proves to be a temporary diversion (perhaps as long as a decade) until companies can move completely to the public cloud. It will be better for AWS to make the money by selling private cloud chunks, perhaps called AWS Prime if you want to be clever, than let Microsoft, Google, and IBM create private versions of their public clouds and get the money.

Amazon’s top brass has been very clear since the company started AWS a decade ago that cloud means public cloud. Despite the more than 1 million customers that AWS has and a growing list of “all-in” customers who are either born on the cloud and never have their own infrastructure or who have decided to port their in-house applications from internal infrastructure to the AWS public cloud, it could be that by taking such a hard line about public cloud AWS will be leaving money on the table. With Microsoft pushing out the delivery of its Azure Stack private cloud until next year – it was supposed to follow Windows Server 2016 to market in the fall of this year – and Google still building a rebel alliance around the Kubernetes cluster controller that will feature OpenStack, Prometheus, and other elements. AWS has time to get AWS Prime to market before the competition has dug in.

For now, all that AWS is talking about is the need to support hybrid cloud, which is not the same thing as puffing up baby AWS clouds in tens of thousands of corporate datacenters.

“You can see us continue to invest in things like new application services higher up the stack, additional technologies that will make integrating with AWS seamless for those companies that have a hybrid IT environment,” Brian Olsavsky, chief financial officer at Amazon, said in a recent call going over the financial results for the online conglomerate. “And then continuing to add functionality for data analytics, mobile, Internet of things, machine learning offerings, things like that which will add greater and greater value for AWS customers. And I would say the rapid pace of innovation continues to stretch our lead in that dimension.”

AWS brags about the new features it is adding to its cloud platform, and will no doubt be doing it again when it hosts the AWS Summit in New York next week. AWS added 722 services and features last year, and through the end of June it has beat that pace with 422 new services and features, Olsavsky said. And while he talked about doing things to make hybrid cloud more seamless between corporate datacenters and AWS, the best way to do that would be to emulate what Microsoft is doing with Azure Stack. Rather than trying to make a Windows Server or Linux cluster interface with the Azure public cloud, Microsoft is instead bringing out a baby version of Azure hardware and software that will look and feel and run just like the real Azure. If customers go for it, then they will be tied all that more tightly to both Windows in the datacenter and Azure on the public cloud.

We understand why Amazon has taken such a hard line historically about cloud meaning public cloud, but even Intel now thinks that there will be 50,000 private clouds and is working to make sure there are. We think this is self-serving as well as prophetic, in that Intel absolutely wants to have tens of thousands of customers buying its chips (with much diminished leverage over pricing) rather than a few dozen big public clouds with tremendous buying power and influence over what Intel does. (See Intel Cultivates The Cloud Future It Predicts for our thoughts on this.

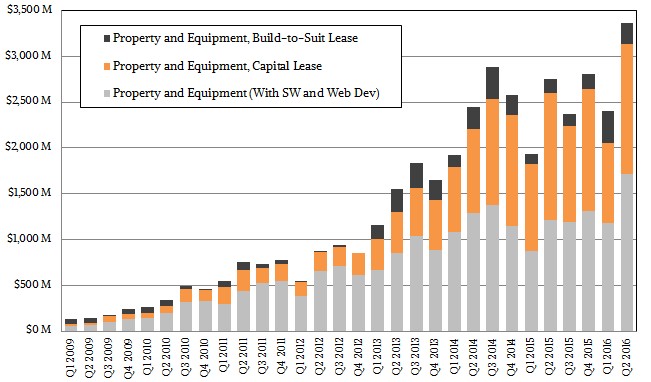

The trick for Amazon is to be able to give customers a private AWS cloud that is less expensive than what they pay to operate their own infrastructure today but still more expensive than the actual AWS public cloud. And the first step in that process is to be able to wring the most money possible out of the AWS public cloud so the profits there could subsidize the private cloud expansion. Once customers have private AWS slices, then it will be a lot easier to move them onto the AWS public cloud, and if customers can be convinced to finance the gear on their own books rather than Amazon’s and make the finances look cloudy just the same, then Amazon will no wreck its balance sheet.

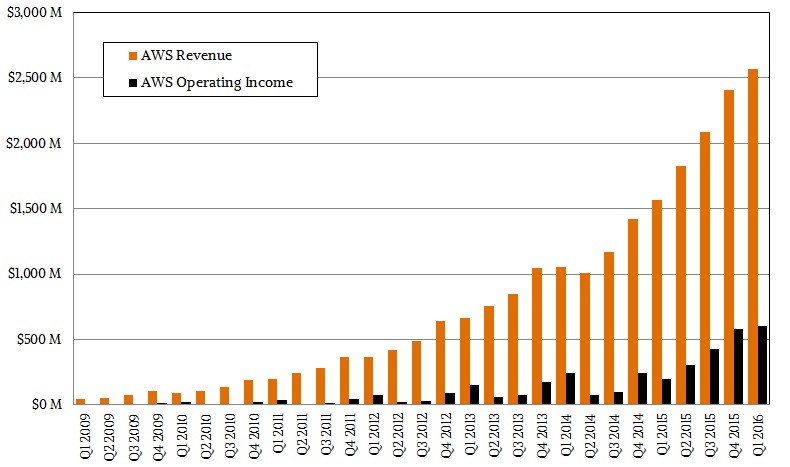

It seems clear from the second quarter financial results at AWS that the company is doing a great job at squeezing more revenues and profits out of the AWS infrastructure. In the period ended in June, revenues for AWS rose by 58.2 percent to $2.89 billion and operating income rose by 135.9 percent to $718 million. Anytime an IT supplier is growing profits twice as fast as revenues, that is a win, and growing at these rates only happens at the beginning of a new market. (It is hard to believe, but cloud computing is still, even after ten years, nascent.) The growth rates for AWS are cooling a bit, but there are so many price cuts and efficiency gains that customers themselves are doing that it is not surprising at all that the curve will wiggle up and down. The thing to notice is that AWS is getting more consistent operating profits as a percentage of revenues, which suggests that it has found the magic critical mass where the business behaves more like an annuity (like IBM’s mainframe business has historically done) than a new product that has to be sold feature by feature, day in and day out.

“We have been seeing some great efficiencies in our infrastructure, both internally as Amazon and also as part of AWS,” Olsavsky said on the call with Wall Street. “We have great people working on not only better efficiency, but also driving cost out of our acquisition prices. So, there is a lot of great work going on there and I think that is what you are seeing reflected in the tech and content line. Again, this can fluctuate quarter-to-quarter, but we’re happy with the current trend and you see it in the AWS margins.”

It still takes a massive amount of capital investment to be in the public cloud game, and it is hard to reckon what it would take to create private versions of public cloud infrastructure. But if anyone can leverage its supply chain of parts and systems partners, its software stack, and its massive and global logistics system to deliver baby AWS datacenters to the world, it is Amazon. That online sales presence and logistics expertise are assets that neither Microsoft nor Google have to the same degree; IBM has global reach, but SoftLayer is a relatively small cloud compared to AWS.

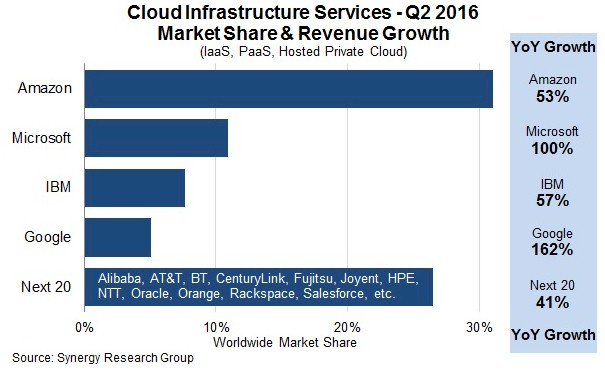

In the wake of the financial reporting by Amazon, Google, Microsoft, and IBM, the folks at Synergy Research Group, which tracks spending on public and private cloud infrastructure, put out their latest casing of the market. Adding up infrastructure and platform services on public clouds plus hosted private clouds, Synergy reckons that the entire market hit $8 billion in revenues in the second quarter, up 51 percent, and for the trailing twelve months, aggregate revenues for these services accounted for nearly $28 billion in revenues.

Microsoft doubled its Azure cloud revenues in the second quarter, and Google grew even faster at 162 percent. But both are significantly smaller than AWS, as is IBM’s SoftLayer, which grew 57 percent and a tad faster than the market at large. The top four cloud providers accounted for 54 percent of the market, and their share of the public cloud pie (if you consider hosted private cloud public) rose by 68 percent. The next 20 providers made up another 25.5 percent of the market and grew their revenues by 41 percent, which is a lot faster than the revenue growth for the IT infrastructure market overall to be sure, which is limping along at a few points growth each quarter, and mainly only because of the heavy buying by cloud builders and hyperscalers. The remaining cloud providers accounted for a smidgen more than a fifth of the market, or about $400 million in revenues, and they grew in aggregate of about 27 percent.

Clearly, the big are getting bigger here. Which is what happens at scale. The question now is what the next phase in scale will be. Will companies want to drop in baby AWS, Azure, Cloud Platform, and SoftLayer clouds into their own datacenters? The answer, of course, depends on the price and just how much companies want to be cross cloud rather than just hybrid.

If AWS does launch a private version of its public cloud infrastructure, that will be a pretty good indication of what the retail giant thinks the answer should be. In the long run, hybrid might be more about running across different clouds than running internal and external, and this is certainly an idea that AWS is much more allergic to. As Intel has pointed out, you create the future you envision, and we think with Intel sowing cloud seeds around the top datacenters of the world and telling customers that if they have 1,200 to 1,500 servers they have enough scale to justify building their own clouds, this will be a lot easier to sell than a wholesale move to a retail public cloud. In the meantime, everyone can build out their public cloud regions and capture the money that is there just from adoption of such infrastructure. It is hard to say when the growth will peter out here, but no market quadruples, triples, and doubles forever.

Honestly I am rather disappointed with Amazon AWS and most other public cloud provides they are really not that cheap. They are only if you need some low-power server to run a bit of back office or web servicing but if you need some actual compute power something that has more than 4 cores and 8GB of RAM price starts to explode very quickly that you are often cheaper of just buying the equipment yourself.

Some it’s cheaper to buy it yourself, that’s true. But it’s not always about the raw cost. AWS provides flexibility that you couldn’t achieve internally. If you had 5000 cores dedicated to a computer application, how easy would it be to try out new hardware at scale just to evaluate? In AWS, it’s a trivial change to make.

More importantly is the flexibility in scale. If you have 5000 cores internally, what happens if you have occasional need for 10000? Do you buy twice as much hardware as you need?

It seems to me that if AWS does create “AWS Prime”, it would be flinching at the wrong time. Momentum for public cloud continues to build, and even cautious enterprises are moving that way. AWS leadership is not perfect, and maybe they’re due to stub their toe, but this doesn’t seem like where they’d do it. On the other hand, Pixar made “Cars 2″…

The big are getting bigger because their anchor tenants are growing exponentially on hyperscale bases.

Cloud infrastructure can go bad (decay like a bad apple) in one or two product life-cycles and the assets are then quickly underwater and pricing power – puff..gone.

That’s a big risk for BODs and bankers. And everybody has access to nearly free money (e.g., Dell). The stable underpinning to AWS and GPC is Amazon and Google. Like real estate development, these big bets don’t get off the drafting table without big, reliable anchor tenants – i.e,. a strategically aligned reason to make the bet in the first place.

But, private cloud — with hybrid features — could be a big winner because, in theory, it can be far cheaper than a public cloud at even lower scale than Intel talks about.

Of course, that means enterprise IT has to get far more competent at running efficient infrastructure (i.e., a real factory of sorts) – not just buying stuff. Or the CEO is going to look around someday and conclude that after the CIO built an inefficient, high-cost private cloud, all these portable workloads can be easily moved to a cheaper factory. So why not move them?

Think of this way. Anyone can buy a fleet of aircraft – or the promise of better aircraft. Running an airline without going bankrupt is another story. Intel is buying some time. Those enterprise IT customers may still disappoint.

We should all understand the hype that has permeated the industry over the last few years.

Public Clouds are simply selective IT Outsourcing that utilizes more current provisioning & mgmt technologies. Like outsourcing, there are pro’s and con’s associated with Public Clouds. While some will raise general security concerns with public clouds, the bigger issue to companies is the loss of control over Security AND Data Management POLICY that are really the bigger issues.

Private Clouds are simply internal shared services which has been around for decades under various names. This model is based on one internal org being tasked with providing internal IT services to other BU’s in the company. Remember the “IT Utility”, “Adaptive Enterprise”, “Real Time Enterprise” (Gartner, 2002) from years gone by?

The real advantage private clouds provide is control over security and data management policies, reduced costs (vs. current state) and a much better integrated and proactive service management model that resolves issues before they impact the business.

As an example of data management policies, very few public cloud providers differentiate between data backups, replication, retention and off-site archiving – all critical considerations in any mission critical environment. That is because these are hard to implement and drive up costs.

While some companies might outsource / move lower risk components of their IT (Email, HR, Accounting) to a Public Cloud, the future is really going to be about assisting companies to enhance and improve their private clouds (aka internal shared services).

Well, the only private hybrid cloud to the AWS public cloud has been Eucalyptus, which is now owned by HP. At one point in time Eucalyptus had a technical support agreement with AWS, but AWS was not directly supporting Eucalyptus customers.

Microsoft, which has tens of millions of customers, really needs to push their “Azure-in-box” hybrid cloud versions out to their SMB and enterprise customer base. If Microsoft gets this done sooner rather than later, it could be a significant factor in Microsoft being able to keep its customer base from defecting.

If Microsoft is able to get some traction with its “Azure-in-a-box” hybrid private clouds, AWS will be forced to re-think their commitment to a public cloud only strategy.