Sales of HPC systems were a lot brisker in 2015 than anticipated, and according to the latest prognostications from the market researchers at IDC presented from the International Supercomputing Conference in Frankfurt, Germany this week, growth in the HPC sector will continue to outpace that of the overall IT market for many years to come.

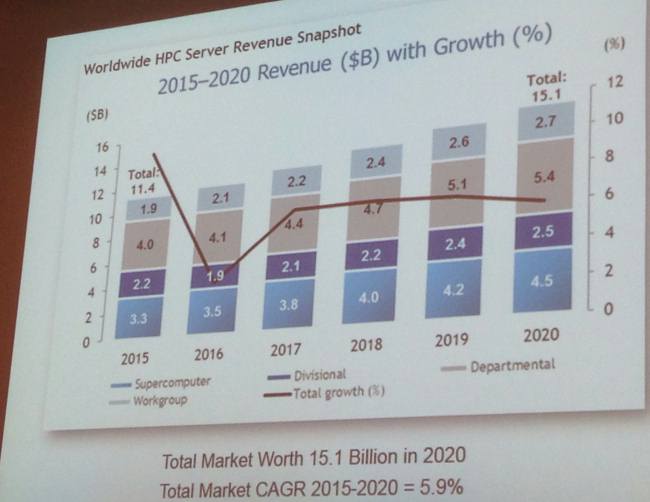

In a sense, the good numbers that the HPC market turned in last year are perhaps a little undercounted. In his traditional early morning breakfast briefing at the conference, Earl Joseph, program vice president for high performance computing at IDC, said that he had been projecting that the HPC server sales might turn in 7 percent or 8 percent overall growth across hardware, software, and services last year. But after running the numbers, Joseph reckons that the market grew by a much higher rate of 11 percent for all of 2015, hitting $11.4 billion, consistent with the revised projection that he put out in November.

The growth in HPC system revenues and a big bump in spending by hyperscalers and cloud builders is what propelled the overall server market up 8 percent last year to $55.1 billion; worldwide server shipments across all sizes, architectures, and segments were up 4.9 percent to 9.7 million machines.

As we have pointed out time and again, the very high end of the HPC market, like that of the hyperscale market that it most resembles in many respects, can be choppy, with relatively large swings compared to the overall server market.

But still, as the chart above shows, the overall trend has been upwards, which is good for the industry, particularly considering that with every new generation of processors and interconnect the amount of computing that organizations can get for the dollar continues to grow. This suggests that there is indeed a certain elasticity of demand for scalable computing dedicated to the core simulation and modeling applications that have defined the HPC sector since it emerged five decades ago as distinct from mainframe-driven commercial computing.

IDC breaks down server revenues and shipments by price band, and in the case of HPC systems, it tries to track the sale of every machine as well as try to figure out what the value is of self-built systems because the HPC market has always had a segment of the customer base that buys components and builds their own systems. This, in fact, might be how the new Sunway TaihuLight system in China, which has the top performance ranking in the world at 125 petaflops, is characterized, meaning that the portion of the $270 million that the Chinese national, regional, and city governments spent on the system and its facilities that was dedicated to hardware will not be counted as revenue by IDC because there is no vendor to attribute it to. If a third of the budget was for hardware – that is our guess – then a big portion of the potential revenue growth for 2016 will not be counted. We suspect that there are a significant number of such self-built or classified machines that don’t make it into IDC’s market stats, so the market could be stronger than we think.

IDC believes that last year supercomputers (meaning machines that cost over $500,000 and that typically have advanced features for scaling out workloads) accounted for $3.3 billion in sales worldwide. Smaller divisional machines (which cost between $250,000 and $500,000) comprised $2.2 billion, and departmental machines (which sell for between $100,000 and $250,000) totaled up to $4 billion in revenues. Workgroup systems, which cost under $100,000 the way that IDC breaks up the market, made up $1.9 billion in revenues.

As you can see, 2012 was a particularly good year for supercomputing, with a massive investment in petaflops-scale systems around the world:

It will be very tough indeed to top that spike back in 2012, but it could happen, particularly if governments decide to invest more heavily and concurrently in exascale-class systems in the 2020 timeframe. This is very tough to call, given the vicissitudes of governments and the capriciousness of economies.

Making such predictions is, however, what Joseph and his team do for a living, and at the ISC16 conference he released the projections for HPC server sales between now and 2020, the endpoint being what could be the beginning of the exascale era. Take a look:

As you can see, IDC is projecting that growth for HPC server spending will slow a bit this year, much to the chagrin but probably not to the surprise of the dozens of vendors who participate in the market. Interestingly, it is sales of divisional-class machines that will decline and bring down the overall average for the HPC sector. Sales of supercomputers, departmental, and workgroup systems are all expected to grow modestly. Across all system types, Joseph said that he is forecasting that HPC server sales will grow at a compound annual growth rate of 5.9 percent in the forecast period over the next five years. We have not seen IDC’s latest forecast for the overall server market, but we suspect that HPC will continue to outgrow the overall market, and if you could take the hyperscalers and cloud builders out of that overall data as well as the HPC systems, we suspect that the core enterprise segment would be flat to declining over the next five years.

In other words, HPC is a bright spot in the server sector, even if it is a bit wiggly.

Revenues from supercomputers in particular are expected to expand, rising from $3.3 billion in 2015 to $4.5 billion in 2020. This growth is coming from increasing investment from the financial services sector, and Joseph said that last year growth in this segment of the economy for HPC systems in general was 50 percent higher than expected compared to the initial forecasts that IDC put together for last year at the end of 2014. The emerging and adjacent high performance data analytics market, which is included in the HPC segment and which is comprised of systems with architectural similarities to HPC machines even though they are running analytics jobs instead of simulations, is also pushing up the overall HPC segment. The new HPDA workloads that IDC has added to its HPC area includes fraud and anomaly detection systems, marketing systems, business intelligence systems, and visualization and rendering systems.

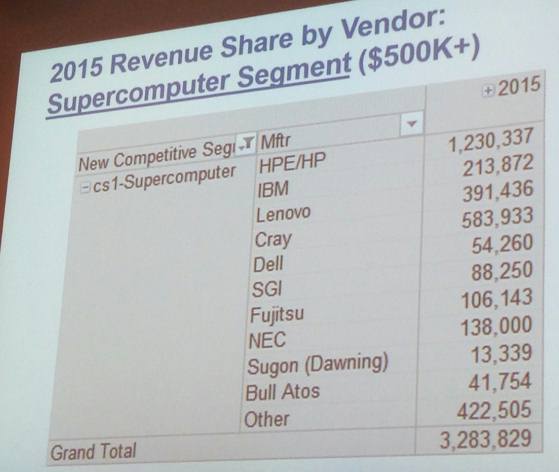

One of the themes of The Next Platform is that high end technologies developed by HPC vendors or hyperscalers eventually trickle down to enterprises or are cross pollenated between HPC centers and hyperscale operators, so we are keen on watching what happens in the supercomputing segment in particular. (This is also where the biggest and baddest machines are sold, and often where interesting and new architectures are developed first.) Here is how IDC breaks down the supercomputing segment by vendor:

Hewlett-Packard Enterprise is by far the largest peddler of supercomputers, with $1.23 billion in sales in 2015. In the wake of selling off its System x business to Lenovo at the end of 2014, IBM’s supercomputer revenues have dropped significantly, and as you can see Lenovo now has a larger HPC business than Big Blue. Dell is aggressively pursuing supercomputer-class sales and has inked some big deals in recent months, notably the Stampede 2.0 upgrade at the Texas Advanced Computing Center, so it should post some good growth in 2016, and the executives that we have spoken to at Lenovo this week also indicate that they are expecting to grow as well.

The several dozen vendors that comprise the Others segment of the supercomputer space – many of whom do not want their revenues divulged by IDC, according to Joseph – make up a fairly large part of this supercomputing segment of the market and are a testament to the growing diversity in the supercomputing arena.

Be the first to comment