A year ago, at the Open Compute Summit, Hewlett-Packard Enterprise, which was not even called that yet, unveiled its bare-bones, vanity free, hyperscale-class Cloudline server lineup, which had the double-edged task of keeping the company selling minimalist machines in China in conjunction with manufacturing partner Foxconn while at the same time giving HPE a chance to defend against the unrelenting pressure of the handful of original design manufacturers (ODMs) that want to topple the world’s largest server maker from its perch.

We did a deep analysis of the Cloudline servers that HPE created in conjunction with Foxconn last March, and drilled into the ProLiant Apollo machines that were aimed at similar hyperscale and service provider customers when they were revamped back in May last year.

The Cloudline machines included two rack-mounted, two-socket “Haswell” Xeon E5 v3 servers with various form factors and storage configurations for standard 19-inch server racks – these were the CL1100 and 2100 – as well as a CL7100 that is compatible with Facebook’s “Leopard” Open Compute server sled and the CL7300 which is a variant of Microsoft’s Open Cloud Server, which was donated to the Open Compute project as well.

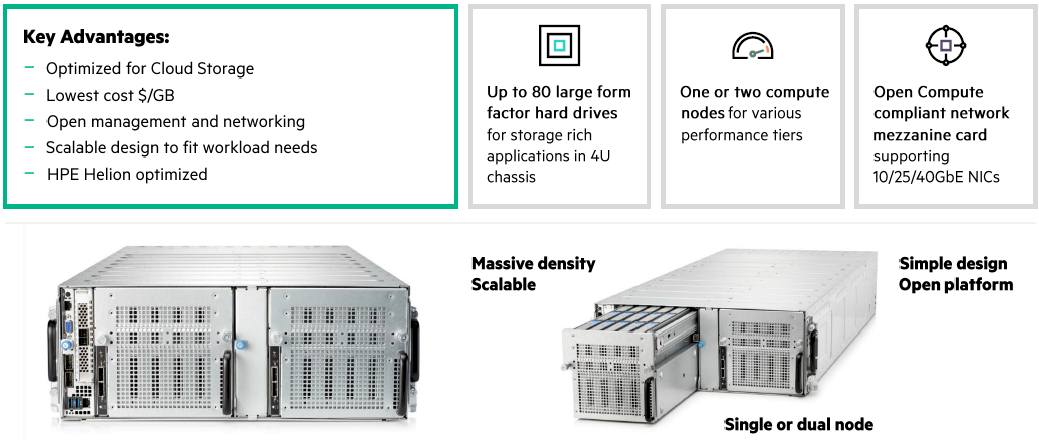

At this year’s Open Compute Summit, HPE is rolling out a new high density storage server, called the CL5200, which is not compatible with the Open Rack specification put out by Facebook and its hardware friends, but which uses a modified, deep rack sometimes used by service providers to cram more get into a rack. By moving to a deeper rack, HPE can cram more storage into each storage node, and help cloud builders and service providers lower the cost per unit of storage at the same time.

How much, John Gromala, senior director of hyperscale product management and service provider marketing at HPE, is not saying, but suffice it to say it is lower enough than the Apollo 4500 storage arrays in the company’s commercial line ProLiant lineup to warrant a different product design to get to that price point.

Normal server racks are 1 meter deep, but Gromala says that service providers sometimes use a racks with 1.2 meter depths, which obviously allows for a server node or storage array to have around 20 percent more space. In this case, the Apollo 4500 storage servers (that is what they are, just two-socket servers with a large number of directly attached disks) are normal depth and with their 4U of rack height they can house 60 3.5-inch SATA drives. The new CL5200 storage servers in the Cloudline family are also 4U tall, but can have 80 such drives, which is a 30 percent increase in capacity using identical drives. (That extra 10 percent more capacity gained comes through clever engineering.) Because of the weight of the drives, the disks are housed in two separate sleds.

For cold storage workloads, which are not particularly compute intensive, hanging a large number of drives off a respectable (but not ridiculous) amount of compute is the name of the price/performance game. So HPE has engineered the CL5200 storage server such that it can have one two-socket Xeon E5 server node spanning all 80 drives or two such nodes, with 40 drives attached to each one. Different applications want different compute-to-spindle ratios, which is why HPE is offering these different compute modes. The CL5200 only supports SATA drives (in 4 TB, 6 TB, and now 8 TB capacities), and comes with two 2.5-inch bays that can be used as boot devices for the server nodes, employing either disk or flash drives, or as caching for the disks with flash drives. The CL5200 has a 12 Gb/sec SAS drive expander and a SATA RAID controller to manage the drives.

Interestingly, the CL5200 storage server can be configured as an all-flash device, too. “It has enough performance for this,” Gromala tells The Next Platform, “and if you have the budget to buy 80 flash drives, HPE will be very happy to sell them to you. But to balance out the flash performance, the network pipes will have to be beefed up. You can also configure it with slower SSDs, too.” It would be interesting to see what networking would be required for such a flashy beast.

While the CL5200 is not compliant with the Facebook Open Rack enclosures, the storage server does use OCP-compliant network mezzanine cards to provide 10 Gb/sec, 25 Gb/sec, and 40 Gb/sec links from the storage server to the outside world. The server nodes have 16 memory slots and top out at 512 GB of main memory, and have to additional PCI-Express 3.0 x16 slots for peripheral expansion. The nodes employ Aspeed 2400 baseboard management controllers instead of the fancy schmancy Integrated Lights Out (iLO) controllers used in enterprise-class ProLiant systems. Like the other Cloudline series machines, the CL5200 is using Haswell Xeon E5s today, which are socket compatible with the impending “Broadwell” Xeon E5 v4 processors from Intel.

HPE has been reselling Scality’s RING object storage since October 2014, and is positioning the new CL5200 as a perfect platform for this, although Gromala points out that the 4U Apollo 4500 and 2U Apollo 4200 storage servers have been popular for running the RING object storage. HPE is not in a mood to make decisions for customers, but instead is offering a broad portfolio of machines with different form factors and disk options and letting customers decide. The company did point out that the CL5200 would be a good fit for OpenStack Swift object storage clusters as well, and reminded everyone that it has its own Helion brand of the OpenStack cloud controller for private cloud storage.

Making It Up In Volume

The Cloudline servers debuted last March and first shipments of the Open Rack and Open Cloud Server machines occurred last summer; the rack versions started shipping in the fall and now the line is in full production coming out of Foxconn’s factories. The minimalist, hyperscale-inspired designs are the fastest growing part of the server market, and one that HPE had to chase, even if it meant giving up on manufacturing to preserve its dominant footprint in the datacenter. HPE wants – and needs – to make it up in volume to keep the most leverage in its supply chain.

Here’s the funny bit. HPE is making it up in volume in a way with the Cloudline machines. “Everyone thought server virtualization was going to be a problem, but virtualization drove richer server configurations,” explains Gromala. “With the Cloudline machines, customers want bare iron and they are driven by an architectural decision to deal with resiliency at the software layer, not in the hardware. But the funny bit is that the typical customer buys 5 percent or 10 percent more servers in their aggregate hyperscale environment to provide the underlying hardware to support that resiliency.” So they may pay 10 to 25 percent less per server than if they bought enterprise-grade ProLiant machines, but they buy 5 to 10 percent more systems. So HPE makes some of it back. This is one of the reasons why the Cloudline family is the fastest growing part of the HPE server business today.

The CL5200 has been shipping to selected customers for a while and is now ramping and will be in full production in a few weeks.

In addition to the cold storage array, HPE also has rolled out a bunch of new switches in its open, whitebox switch family, called Altoline, that it manufactures with partner Accton using the “Trident-II” and “Tomahawk” switch chips from Broadcom. (We detailed the HP-Accton partnership last February as The Next Platform was launching and HPE was opening up its switches.) In February, HPE released the Altoline 6920 top-of-rack leaf switch, which has 48 ports running at 10 Gb/sec and six uplinks running at 40 Gb/sec, and the Altoline 6940, which is a spine switch that has 32 ports running at 40 Gb/sec. Because of demand from customers, HPE is bringing out a retro Altoline 6900, which has 48 ports running at the meager 1 Gb/sec speed with four 10 Gb/sec uplinks. The most interesting new switch is the Altoline 6960 which uses the latest Tomahawk ASIC and has 32 ports running at 100 Gb/sec that can be backstepped to 50 Gb/sec or 25 Gb/sec using cable splitters. These switches are certified to run the Pica8 and Cumulus Linux network operating systems and later this year will also support HPE’s own open source OpenSwitch software stack, which was announced last fall. HPE engineers provide the tech support for all three NOS options.

As with the Cloudline servers, the Altoline switches are designed with lower prices in mind, but HPE was not inclined to give out list or street pricing for the machines. It is hard to imagine that the price per port on these machines is more than 20 percent lower than for a regular HPE FlexFabric (formerly 3Com) switch in single unit quantities.

Be the first to comment