As the dominant supplier of switches and routers to enterprise and service provider datacenters and as an upstart server maker that has carved out a hefty slice of the systems market in the past seven years, Cisco Systems is a harbinger of what is going on in terms of architectural shifts and spending among the world’s largest companies.

And in late January, as the stock market was roiling and there was plenty of concern about the economies in the United States and China, it looks like key customers took a bit of a breather.

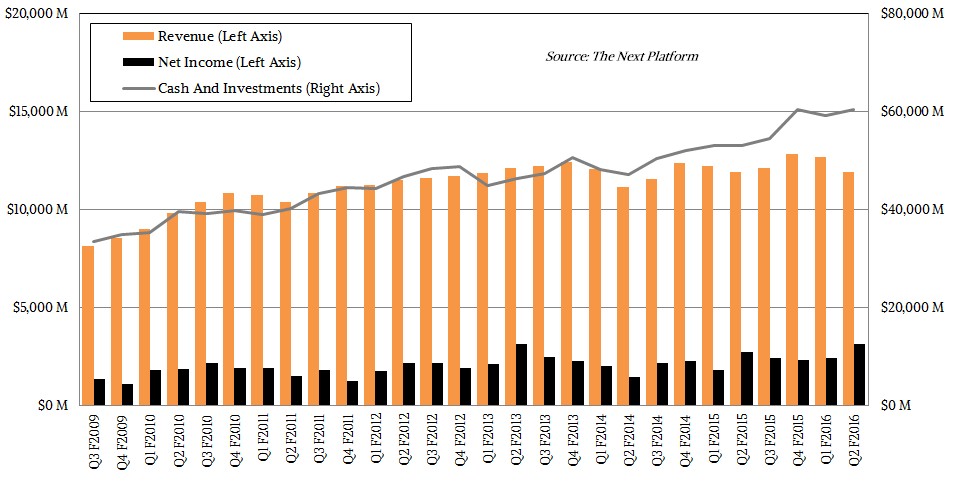

The pause, which happened during the first three weeks of January, knocked down sales for Cisco’s second quarter of its fiscal year. But thanks to cost controls implemented by relatively new CEO Chuck Robbins and CFO Kelly Kramer, Cisco actually managed to boost its net income and its impressive cash hoard even as sales dipped. This suggests that there is plenty of room for intense competition in the switching, routing, and server businesses where Cisco fights for business, but taking down Cisco, which is a trusted provider of equipment, is hard, and as the advent of the Unified Computing System blade servers in March 2009 illustrate, a tough competitor that can break into new markets when it innovates.

The question now is whether Cisco’s numbers are foretelling a prolonged slowdown in enterprise spending or just a blip as we came back into the new year with a bit of chaos to process. Cisco doesn’t know, either, by the way, and is being cautious with its guidance looking forward.

“After week ten through those three weeks, we saw customers as they were trying to just digest what was going on, they just paused a bit,” Robbins explained on a call with Wall Street analysts. “And you see customers say I want to just wait and see what’s going on. Let me take a look at this, we want to understand this a little better.”

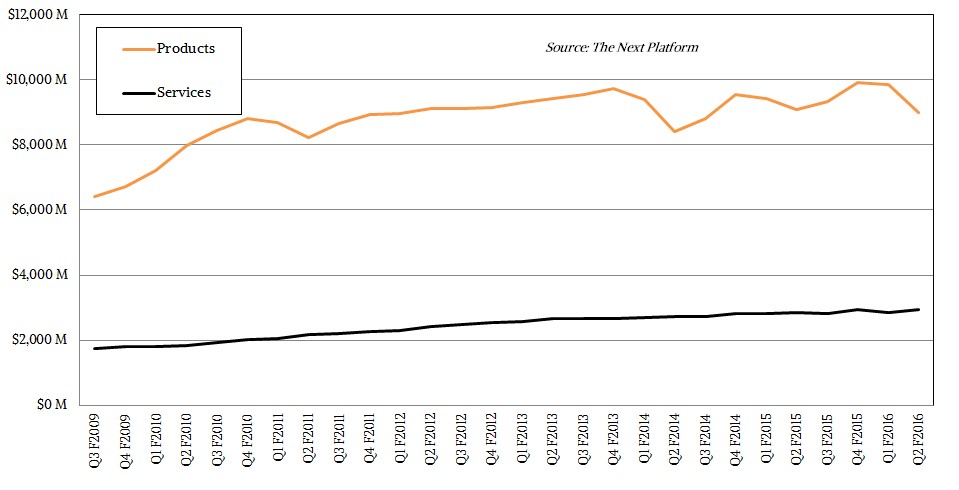

The slowdown affected datacenter products like UCS and switching, and the campus switching business – which is sales of gear that links offices to datacenters, not the switching inside of datacenters that links servers to each other, to storage, and to the outside world – was particularly hard hit, according to Robbins. For the purposes of The Next Platform, we don’t care about campus switching. But we do care about how the UCS business is maturing and how Cisco is competing against whitebox server and switch makers, those who make their own gear, and the incumbent server makers that have built their own switching businesses in the wake of Cisco taking share away from them when it launched the UCS line seven years ago, upsetting the datacenter détente a bit.

Most of the server incumbents do not sell their own routers and rely on Cisco and Juniper Networks for these when they do get involved with this part of the networking business.

In the second quarter of fiscal 2016, Cisco’s sales were off a smidgen to $11.93 billion, but net income rose by 14.6 percent to $3.15 billion, with a stunning 26.4 percent of revenue dropping to the bottom line. Cisco has not seen this level of profitability in three years and it very rarely hits this level because of its constant expansion in new markets and the companies that are trying to take market share away from it in its core switching and routing businesses.

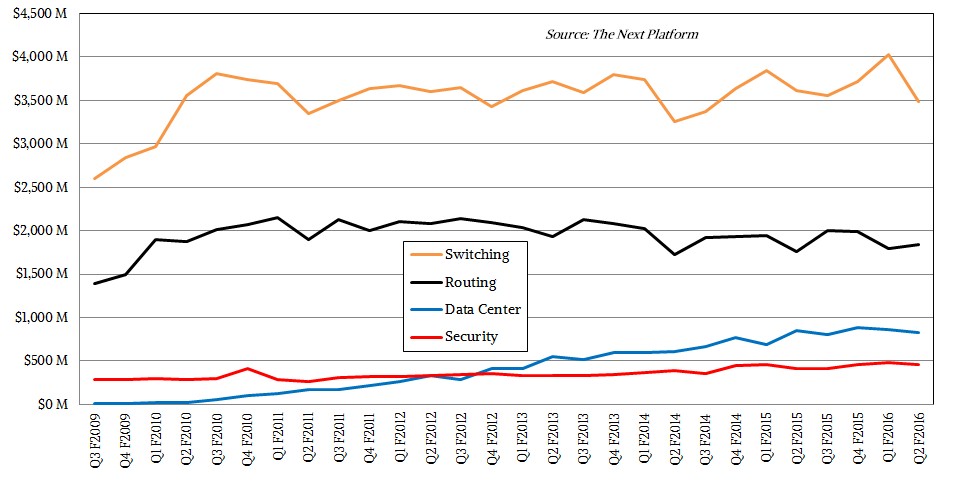

While routing is what got Cisco into business at all, during the start of the dot-com boom it bought itself into datacenter switching and changed the course of the company, and equally importantly, set it on a course to build the tremendous $60.4 billion cash hoard shown in the chart above. In the quarter just ended, switching products accounted for $3.48 billion in revenues, down 4 percent and comprising 29 percent of total revenues. Aside from the comments about the decline in the campus switching business, which tends to happen when the economy stalls, Cisco did not say much more about particulars except to point out that its high-end Nexus switches with embedded Application Centric Infrastructure (ACI) software-defined networking baked in, which The Next Platform has talked about here, has grown to a $2 billion annualized run rate in about two years and, according to Robbins, more than doubled in the past quarter. That suggests that ACI products contributed about $500 million in sales in the second fiscal quarter, or about one-seventh of total switching.

As for the core datacenter switching business, Robbins said that Cisco was “aggressively focused on winning in the 10G, 40G, and 100G transition, and firmly establishing our leadership in the next-generation datacenter.” New orders for datacenter switches rose in the quarter, which was good news, and Robbins added that Cisco was “cautiously optimistic” about enterprise spending looking ahead, which was down 2 points in just-ended period.

China, which was a boon to many behemoth IT vendors for the past decade but which became somewhat problematic in recent years as indigenous companies and the Chinese government sought to buy more local equipment, did comparatively well for Cisco in the second quarter. Robbins said switching, routing, and wireless gear all saw double digit revenue growth in the Middle Kingdom, which is good and which is the second quarter in a row where this happened. What we don’t know is how far it has fallen and where it can climb to again. (Cisco knows the former, but not the latter.)

As for hyperscalers, Robbins said that Cisco had changed tack with them about 18 months ago and was “moving into a collaborative co-development mode” with these big consumers of switches and servers. We don’t think Cisco sells any servers to hyperscalers, but it certainly has ins at the service providers of the world. In any event, these “Web-scale guys,” as Robbins referred to them, had a 17 percent jump in sales in the quarter.

That tighter collaboration is a necessity since many of the hyperscalers are getting behind the 25G Ethernet standard that Google and Microsoft started two years ago and that Mellanox Technologies, Broadcom, and Cavium are all going to start shipping this year as alternatives to the older, more expensive, less dense 40G Ethernet switching that Cisco and other switch makers are currently peddling. (Cisco has not announced support for 25G ASICs from the above suppliers or its own plans.) These same hyperscalers are also driving the adoption of open network operating systems, and if this idea catches hold, it will have a radical effect on Cisco’s service provider switching business as well as its enterprise switching business. While ACI is technically elegant and an interesting, hardware-assisted version of SDN, no one can call it open source or collaborative.

The Datacenter Takes A Dip, Too

The B Series blade servers and their integrated networking are at the heart of the UCS business, of course, but Cisco also sells C Series rack machines and the M Series systems aimed at more frugal web-scale customers who do not want to design and make their own machines like the top hyperscalers do but who want similar attributes in their systems. (We told you about the M Series back in November, and they represent Cisco’s next big growth opportunity for so-called composable infrastructure, something that Hewlett Packard Enterprise is talking up, too, with its Project Synergy efforts.) The M Series are just at the beginning of their ramp, and as it took some time to get companies used to converged infrastructure as embodied with the UCS platform, it is going to take time for them to get their brains wrapped around composable infrastructure. And, now that we think of it, the move from relatively static to composable infrastructure will probably take longer.

Cisco’s Data Center group, which includes UCS systems as well as related Nexus switching products associated with them, saw a 2.8 percent decline in the fiscal second quarter, to $822 million. This business also succumbed to uncertainty in the final three weeks of the quarter, according to Robbins, which is no surprise, but Intel is also widely expected to be launching its “Broadwell” Xeon E5 v4 processors sometime before spring is in full swing, so that may be a factor, too.

The important thing to consider is that this business has generated $3.36 billion in sales in the trailing twelve months for Cisco, which is impressive considering that Cisco was a total server newbie (albeit with lots of help from people from the former Sun Microsystems). The UCS machines were launched in the belly of the Great Recession and did the classic exponential growth curve. In the first full fiscal year of sales in 2010, the Data Center division had $196 million in revenues, and a year later it was at $696 million, up by a factor of 3.5X. A year later, this part of the business grew by 1.9X to $1.3 billion, and rose by 1.6X in fiscal 2013 to $2.1 billion. The business grew by 30 percent in 2014 to $2.64 billion and by 20 percent to $3.22 billion in 2015. Cisco is now an established player and has found its natural market share, and it is no surprise that revenues for the Data Center division are going up and down along with enterprise and service provider spending. These are the markets that Cisco serves, after all. It does not have much in the way of sales into HPC centers and it does not do hyperscale – at least not for UCS B and C series systems. But this in no way diminishes the accomplishment of having many tens of thousands of customers using its UCS gear.

Be the first to comment