Might doesn’t make right in this world, but it sure helps. If the modern datacenter has taught us anything, it is that scale matters and as it turns out it matters for the manufacturers of the devices that go into various systems in the datacenter as much as it does for those who deploy and use those systems. It is with this in mind that we ponder the implications of the $37 billion acquisition of networking and wannabe server processor maker Broadcom by the recently very acquisitive Avago Technology, a maker of chips for optical networking, server networking, and storage controllers, among other things.

Seeing how well that Avago has been doing in recent years as it amasses an arsenal of technologies that underpin the communications infrastructure in datacenters and service provider networks, Hewlett-Packard might be ruing the day that it spun out its semiconductor business as Agilent Technologies in 1999. Six years later, private equity firms Kohlberg Kravis Roberts and Silver Lake Partners shelled out $2.6 billion for the semiconductor arm of Agilent (the remaining lab equipment business from HP still exists under the Agilent name), which had $2 billion in revenues and 6,600 employees at the time. This core semiconductor business from Agilent is what was taken public as Avago Technologies in 2008, raising $400 million.

Things got interesting with Avago as far as the datacenter is concerned in December 2013, when it bought disk controller juggernaut LSI for $6.6 billion, doubling its annual sales run rate to $4.9 billion. The deal was funded by a $4.6 billion loan and a $1 billion loan from Silver Lake Partners that can be converted to stock. (Silver Lake is also a big partner in the recently privatized Dell, you will remember.) To raise a bit of cash last year, Avago sold off its solid state storage controller business to Seagate Technology for $450 million (it generated about $150 million in sales) and its Axxia wireless networking chip business that was part of LSI to Intel for $650 million in cash (this business generated about $113 million). Last June, after that cash was in hand, Avago turned around and paid $309 million to buy PCI-Express chip and switch maker PLX Technology, whose approach to in-rack server networking using PCI-Express links and eliminating top-of-rack switches we find intriguing. This February, Avago ponied up $609 million in cash to buy Emulex, which makes Fibre Channel and Ethernet adapter cards. Emulex had an annual revenue run rate of around $450 million, but was losing money. (Broadcom tried to buy Emulex in 2009 and failed, so the two will finally be united under Avago.)

With the $37 billion acquisition of Broadcom, Avago is making no bones about it and is firing right into the heart of the datacenter, one that is increasingly controlled by semiconductor giant Intel. This is not only the biggest deal that Avago or any of its predecessors have ever done, but as best I can recall, this is the largest deal that anyone has ever done for a chip maker. This is a big deal by any measure in the IT sector, and it just goes to show you how cheap money is out there right now and how all chip makers are trying to scale up their product lines to try to get a bigger piece of the IT wallet.

Intel has made no secret of its plans to extend out from server processors and into storage controllers and flash and has shelled out a fair amount of cash of its own to not only buy the Axxia business from Avago but also the Fulcrum Microsystems Ethernet switch chip business, the “Gemini” XT and “Aries” XC interconnect business from Cray, and the InfiniBand switch business from QLogic. Intel did these networking deals a few years back, and the company could be still pondering an expansion in compute out to field programmable gate arrays with a much-rumored takeover of Altera still possibly in the works.

The Fight For The Datacenter

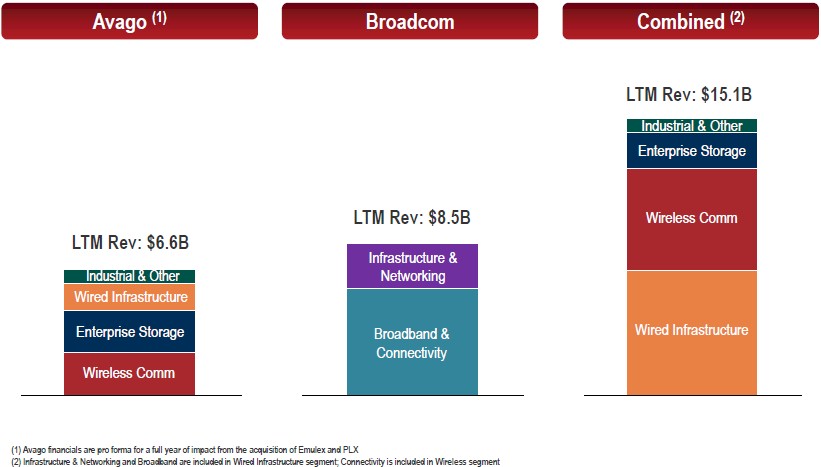

The combination of Broadcom and Avago, which will be taking the Broadcom name interestingly enough, makes a very powerful supplier of chips for various wares in the glass house. Broadcom’s Trident and Dune families of Ethernet switch chips have dominant market share in datacenter switching (which means not including campus and home networks and distinct from wireless networks), and it is estimated by many that Broadcom has about 65 percent share of the ASICs used in Ethernet top of rack switches.

The Broadcom Trident chips have quickly become the analog of an X86 processor for switches and are the preferred (although certainly not the only) ASICs for open switches. The forthcoming “Tomahawk” ASICs, due in iron later this year supporting 25 Gb/sec links on servers and 50 Gb/sec and 100 Gb/sec links on the switches, are going to transform hyperscale and cloud datacenters and probably more than a few large-scale and forward-thinking enterprises as well. (Dell has struck first with the Tomahawks and has committed to getting the cost of a 100 Gb/sec port down under $2,000 per port, which is a lot less than the $5,000 per port it costs with other ASICs right now.) Broadcom just upgraded the Trident family with the Trident-II+ ASIC, which will make it less costly for enterprises to move up to 10 Gb/sec switching, and back in March it upgraded the Dune family with the StrataDNX line of ASICs, which trade off switching bandwidth for deeper buffers and other features compared to the Trident and Tomahawk chips.

Broadcom has set its sights on compute as well, and will later this year deliver its “Vulcan” 64-bit ARM server processors, which are arguably better than the ARM chips coming from AMD and Applied Micro and will compete well against the ThunderX processors from networking rival Cavium Networks. Qualcomm, the second largest chip maker in the world, is also working to get its as-yet unnamed ARM server chips into the field, perhaps this year, because it also thinks that Intel is ripe for some intense competition. Broadcom’s ARM server processor efforts were no doubt pushed along by its $3.7 billion acquisition of NetLogic back in September 2011. NetLogic’s XLP II chips put 80 nxCPU cores (based on a variant of the MIPS architecture) on a single die, and the on-die symmetric multiprocessing (SMP) electronics on the chips allowed for up to eight of these XLP II chips to be lashed together as a single system with 640 cores running at 2.5 GHz and able to deal with 800 Gb/sec of bandwidth.

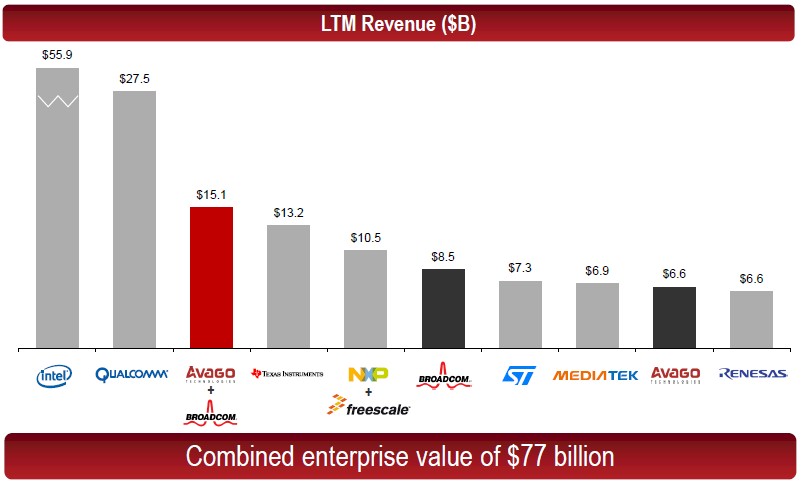

Here is how the big chip makers stack up if the Avago-Broadcom deal goes through:

From that chart, you might get the impression that Intel, which is the world’s largest semiconductor manufacturer by far, cannot be touched by what the new Broadcom will be. While Intel has a vast advantage from its chip fabs, it also has a very large PC chip business. In fact, if you drill down into Intel’s numbers, as we have done recently, you will find that the Data Center Group is humming along at somewhere around $4.5 billion per quarter, on average, and is bringing something on the order of $2 billion a quarter to the middle line as operating profits.

This is, quite honestly, the juiciest target in the IT sector. It is also the hardest one to hit and knock a chunk off of. But, Avago as well as AMD, Applied Micro, Cavium, and Qualcomm are going to give it a try.

The combined Avago-Broadcom will be a powerhouse of its own spanning enterprise storage, wired and wireless networks, and various embedded and industrial networking markets, and as we point out, a chunk of the server market if the Linux ecosystem matures on 64-bit ARM and chip makers get decent multicore ARMv8 processors into the field.

Linux represents maybe 25 percent of the server market, but it has a much larger share of the hyperscale market (basically, everything but Microsoft Azure and a few large VMware clouds) and it has nearly 100 percent share of the HPC market. The combination of integrated compute, networking, and storage running on a unified Linux substrate could be a very powerful combination for enterprises. Particularly if their applications are microservices running in software containers and they basically no longer care about the operating system so much.

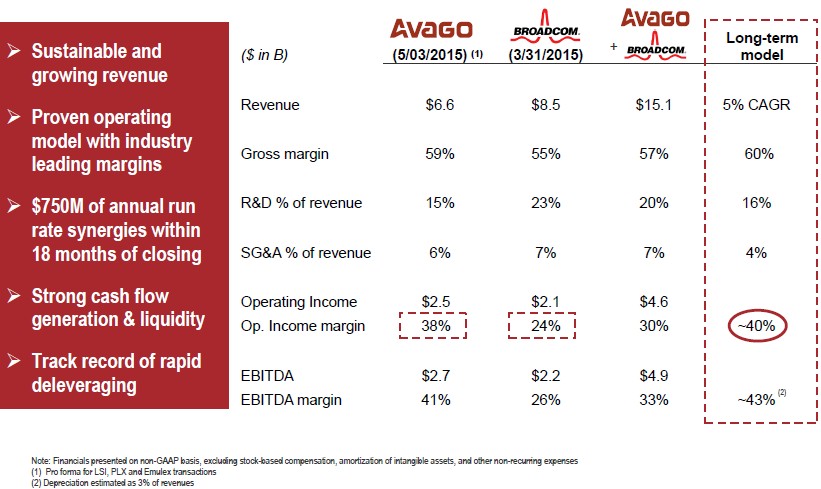

Here are how the raw financials stack up for the combination of Avago and Broadcom:

Broadcom is the bigger company, and it spends more on research and development. Over the long haul, thanks to various synergies between the companies and more focused R&D and less of it, the combined company expects to boost gross margins into the nirvana of 60 percent and deliver operating margins of around 40 percent of revenues. Intel’s Data Center Group, by contrast, has delivered $14.98 billion in revenues and $7.66 billion in operating margins in the past four quarters, which is 51.2 percent of revenues. And Intel’s CEO Brian Krzanich has projected that Intel can grow its datacenter business on the order of 14 percent to 16 percent per year. So the target just keeps getting juicier.

That growth model probably has some competition built into it from the ARM collective. The question now is how Intel will compete with upstarts like Cavium and the new Broadcom while preserving its margins. The ARM server and networking upstarts can’t cut too deeply or else they will disappoint their own shareholders and affect the compensation of their own executives. So it will be a delicate fight – right up to the point that someone decides to really go to war and storm the glass house with everything they’ve got. In fact, we expect all of the ARM upstarts to do just that.

Be the first to comment