Tailoring systems for specific jobs is one of the foundational themes of The Next Platform, so we like to keep an eye on the segments of the systems market that have a particular platform bend to them. This includes engineered systems, as Oracle likes to call machines with integrated hardware and software stacks, as well as modular systems, or often converged systems or integrated infrastructure systems. In 2014, the market for the former hit a bit of an air pocket, while sales of the latter are growing linearly and steadily.

The good news for the several makers of both types of systems is that they are, at least on an annual basis, outgrowing the overall server market in terms of revenue growth, and more importantly, integrated systems, as the box counters at IDC refer to these two distinct types of machines, deliver a higher profit margin to their makers as well as operational benefits and capital cost reductions compared to systems that are put together by hand.

To be more precise in the IDC nomenclature, integrated platforms are hardware stacks that include servers, storage, and switches plus systems software that has been tuned to support a particular workload. Oracle’s Exadata, Exalogic, and Exalytics machines, IBM’s Pure Systems, and Hewlett-Packard’s CloudSystems are all examples of such machines. Integrated infrastructure systems generally converge servers and switching and either some storage or at least access to external storage, but do not include anything beyond infrastructure management for all the software and are not tuned for specific application workloads. The Cisco Systems’ Unified Computing Systems, Dell’s Active Systems, HP’s BladeSystem, and the IBM (now Lenovo) Flex System are examples of the bare bones modular systems.

A little more than a year ago, after IDC’s server analyst saw the markets for these two classes of machines firming up, they started tracking them independently of the quarterly server reports, which dice and slice server revenues and shipments by vendor, shipments, processor architecture, and other parameters. To help you get a better sense of how these products are being received by the market, we gathered up the stats for the past two years from IDC on the integrated systems. This is how the last two years of the markets for both kinds of systems maps out:

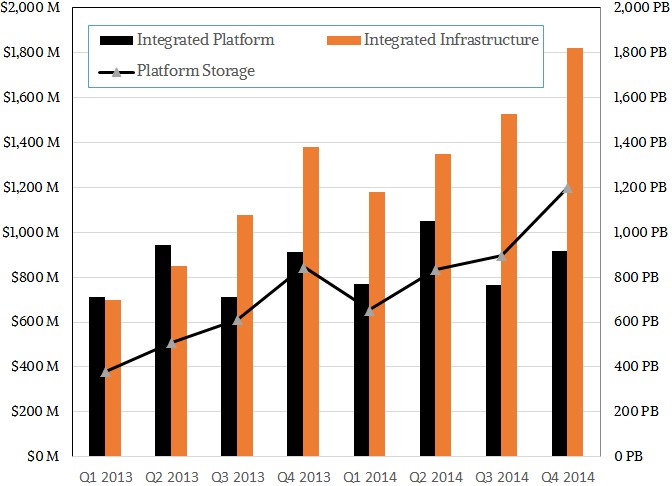

There are a few interesting things to note here. First, IDC gives out the amount of storage associated with the integrated platforms each quarter, which topped 1.2 EB (that’s exabytes and we are still not quite used to that abbreviation) in the fourth quarter. This is about three times the capacity that was shipped with integrated platforms two years ago. Here’s the funny bit, and a lesson in the limits of correlation. While the amount of storage roughly tracks the revenue for integrated platforms, the capacity increases this quarter have a very tight correlation to the revenue from the absolutely unrelated integrated infrastructure (or modular as we call them) systems. The storage capacity grows each quarter sequentially and then takes a slight dip in the first quarter and resumes growth throughout the rest of the year. This curve is a function of some customer holding off on their spending until the third and fourth quarters of the year, when Intel generally ships its processors and, frankly, when the IT industry has traditionally done a big portion of its buying and selling of systems.

Another thing to notice is just how linear the growth is for the modular systems. It looks like it is being drawn with a ruler, and you would guess from this chart that sales should hit $2.3 billion or so in the fourth quarter of this year.

The integrated platforms are on a different cycle, and this has mostly to do with Oracle’s engineered systems, which account for roughly half of revenues in this category in any given quarter. Oracle’s fiscal year comes to an end on May 31 and that fiscal quarter tends to be its biggest finish and hence the revenue bumps up for integrated platforms during the second calendar quarter.

Here is one other interesting observation about this market data. Back in the first quarter of 2013, when data first became available about these integrated systems, the size of the engineered systems and modular systems markets were almost identical, hovering around $700 million. Over those eight quarters, sales of engineered systems have grown by about a third, averaging a little under $1 billion in recent quarters, but sales of integrated infrastructure systems have more about double and are set to push through $2 billion in a quarter or two if history is any guide.

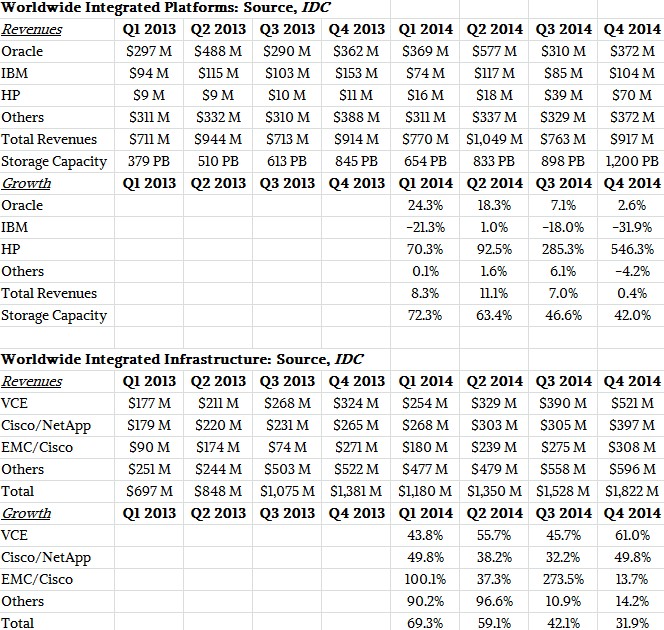

Here is what the quarterly breakdown is by vendors and integrated system type:

Growth in Oracle’s sales of its engineered systems, in the aggregate across all types, has slowed throughout 2014, as you can see, and IBM’s has outright declined in three of the four quarters of last year, no doubt due to the uncertainty surrounding its server business as it was selling off the Flex System line to Lenovo Group. IBM is still committed to its Pure Systems platforms and is reselling machines now controlled by Lenovo, but it is not clear how aggressively Big Blue is pursuing such deals as it tries to position its own Power Systems against X86 systems. It took Hewlett-Packard a long time to get traction in the integrated platform area, but it is finding its feet, having more than quintupled its business for such machines in the fourth quarter. That said, other vendors in this space collectively have a lot more revenues than either IBM or HP; Dell could pop out as a top four supplier soon.

The integrated infrastructure market that was created by Cisco with its UCS line six years ago is still dominated by those modular UCS systems, and thanks in part to the VCE partnership that was set up between Cisco, EMC, and VMware. Cisco’s machines are driving close to two-thirds of the revenues in this integrated infrastructure category, and for 2014, that accounted for $3.7 billion in sales. This is the kind of market penetration that Cisco has enjoyed in the router and switch businesses and has been able to attain at least in this portion of the systems business. Small wonder, then, that Cisco last fall expanded its server platform with a UCS variant tailored to the needs of hyperscaler and service providers, where it still sells a lot of switches despite the nascent open switch movement.

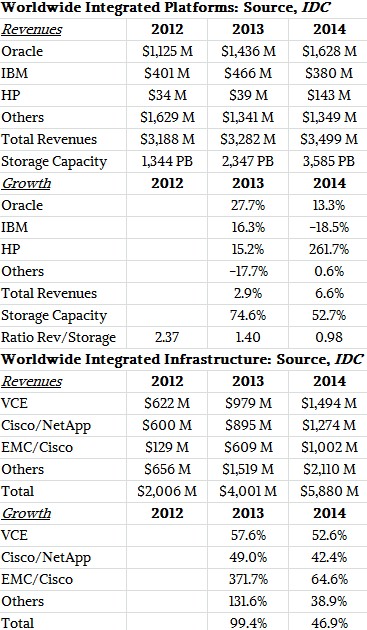

As is the case with most high-end systems markets, it is perhaps sensible to evaluate it on an annual, rather than a quarterly basis, since these are generally big deals at large corporations and by their very nature there are a limited number of such deals. That means any given quarter can be lumpy and bumpy. To the right is a table with the same data but summed on an annual basis, including sales for 2012 added alongside that of 2013 and 2014.

Despite much of the skepticism surrounding these two types of integrated systems since they debuted several years ago – particularly the engineered or platform varieties – they now account for something close to $10 billion in sales, almost double from three years ago and thanks in large part to the tripling of sales of these modular machines (like the UCS) in that time.

Just for fun, we looked at the correlation between the aggregate storage capacity sold on integrated platforms and the revenue generated from them. While storage capacity growth has slowed across all vendors pushing engineered systems, revenue growth is inching upwards ever so slightly. That said, there is so much flash and disk storage associated with these machines that the storage is a large portion of the revenues from these machines. In many cases, such as that of Oracle with its Exa line of machines, it often builds in processor and storage upgrades in the system and holds the price the same. This is a good strategy for not only expanding the customer base, but also expanding the use of such machines among existing customers.

The IDC #’s appear flawed. You seem to point it out how you can estimate the qtr numbers with a ruler! I wouldn’t be surprised if that’s what IDC is doing, considering EMC doesn’t report out VCE #’s and neither does Cisco, so it’s a big guessing game. Oracle on other hand specifically points out # of systems and rough guideline on revenues on quarterly basis. HP seems to have relabeled all their blade systems as “Converged” systems and hence the 500%+ increase all of a sudden-wow-that’s growth-especially when HP continues to report revenue declines.

Heres another flaw. Take a look at the unit volumes of each vendor and the revenue they’ve generated from those units and just do a simple calculation of Revenue/Units and you’ll see that the average selling price per system for VCE is significantly higher then almost every one else. VCE isn’t selling at a premium as far as I can tell. Also, why is the “Others” category such a large % of total? Who is in the “Other” category and why doesn’t IDC break it out further to atleast top 10? This quarterly analysis seems to be quite flawed and why I think needs clarification from IDC on their “methodology”.