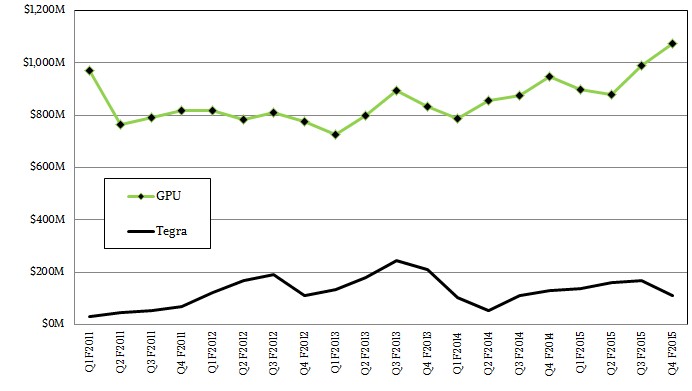

The graphics processor business was humming along as Nvidia ended its fiscal 2015 year in late January. This part of the company broke through $1 billion in sales in a quarter for the first time, thanks in part to the growing adoption of Tesla GPU coprocessors for a variety of computing tasks.

In the fourth quarter of fiscal 2015, which ended on January 25, GPU revenue rose by 13 percent year-on-year to $1.073 billion. In her commentary, CFO Colette Kress said that the Tesla GPU business “increased strongly,” driven in particular by big deals Nvidia and its partners had won at large cloud service providers. Interestingly, sales of GeForce GPUs aimed at desktop gaming and notebooks rose sharply, increasing 38 percent from Q4 fiscal 2014 and up in part thanks to the adoption of GPUs in various devices based on Nvidia’s “Maxwell” family of GPUs. Sales of Quadro GPUs, which are predominantly used in workstations, “remained healthy” in the final period of the fiscal year.

As far as enterprises, supercomputing centers, and hyperscale datacenter operators are concerned, the core GPU business for various kinds of client devices is the foundation for the accelerated computing platform that Nvidia has built with its CUDA programming environment and spanning X86, Power, and ARM CPUs working in conjunction with Tesla coprocessors. The fact that this business is healthy is what has made it a firm foundation for all kinds of sophisticated computing, starting with various modeling and simulation workloads when the “Fermi” line of coprocessors took off back in 2008, in much the same way Intel’s dominance of desktops allowed it to extend into the datacenter over the past 22 years. Over time, Tesla GPU coprocessors have been adopted in large hybrid supercomputers as the programming models for such machines have matured and Nvidia has more recently worked with researchers and partners to apply the CUDA environment and GPU coprocessing to various analytics and machine learning workloads. (The latter will be one of the areas of focus for the upcoming GPU Technology Conference that Nvidia is hosting in its hometown of San Jose in the middle of March.)

Elaborating on the Tesla business unit on a conference call with Wall Street analysts, Kress said that revenue growth for the fiscal year “exceeded 50 percent,” driven by the combination of HPC customers and cloud service providers (what we at The Next Platform sometimes call the hyperscale datacenter operators, or hyperscalers for short) adopting hybrid CPU-GPU machinery. Kress reminded everyone that the Tesla dual-GPU K80 coprocessor launched during the quarter, and that a single machine using a Tesla K80 had the same level of floating point processing as eight servers using the Fermi-class of GPUs from days gone by, and said that margins from gaming (GeForce) and accelerated computing (Tesla) helped pump up margins in both the fourth quarter and for the full year.

For now, Nvidia has not broken out revenues for the Tesla line separately from its other GPU products, but company co-founder and CEO Jen-Hsun Huang confirmed on the call that the Tesla line was driving “several hundred million dollars” of revenue per year. If the growth rates continue, it will not be long before Tesla is a material part of the business. It would not be surprising to see Nvidia eventually break out all server-side GPU products separately from GPUs sold for various client devices.

Incidentally, this Tesla revenue stream does not include any sales of GRID virtualized graphics units, which are also growing at a fast clip. And when and if Nvidia ever does break out client and server GPU businesses separately in its financial reports, it will almost certainly put together the Tesla and GRID products.

Nvidia did not hint at the revenue stream from its GRID line when reporting its results, but Huang did say that a year ago the company had around 400 trials underway with its GRID and as it ended fiscal 2015, it had well over 1,000 trials underway. He added that a year ago, there were about 50 different platforms that had been optimized for the GRID variants of its GPUs, and that as this year ended, there were close to a hundred different machines that can be equipped with them. The fact that VMware now supports virtual GPUs with its latest ESXi hypervisor and Horizon View desktop virtualization broker will no doubt help Nvidia grow this GRID business.

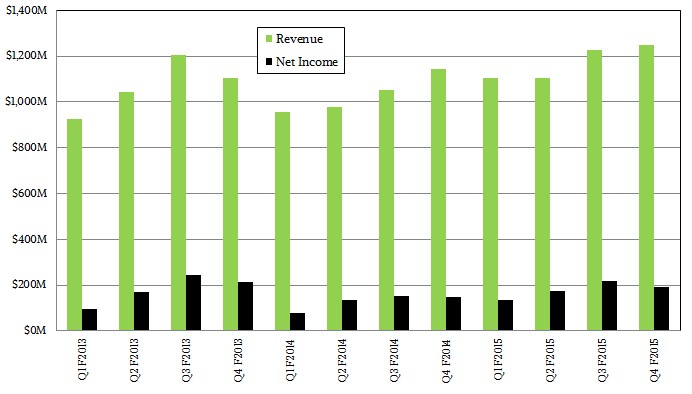

Add up the GPU sales with Tegra processor sales and the $66 million in patent licensing that Nvidia gets every quarter from Intel, and the company hit $1.25 billion in sales for the fourth fiscal quarter, an increase of 9 percent compared to the year-ago quarter. Nvidia spent $348.3 million on research and development in the period, up 3.5 percent year-on-year and representing a very healthy 27.8 percent of revenues. Nvidia is an engineering company and invests heavily in R&D, which it must do to remain competitive, Nvidia kept sales and administrative costs more or less flat. Thanks to operating expense controls, Nvidia was able to bring $193.1 million to the bottom line, an increase of 31.5 percent versus the same quarter last fiscal year.

For the full year, Nvidia posted $4.68 billion in sales, up 13.4 percent, and net income of $630.6 million, up 43.3 percent. It is worth noting that in the fiscal year, Nvidia bought 44.4 million of its shares off the market and paid another $186 million in dividends to shareholders and only shrank its cash hoard by a tiny bit to $4.62 billion and had only $1.38 billion in debts outstanding, a smidgen higher than it was a year ago. Nvidia spent $1 billion on dividends and share repurchases in fiscal 2015, and expects to drop that to $600 million in fiscal 2016.

Looking ahead, Nvidia expects for revenues to be around $1.16 billion, plus or minus 2 percent, in the first quarter of fiscal 2016 ending in April. This represents a 5.2 percent increase in revenues year-on-year at the midpoint of that range.

The ecosystem for Tesla coprocessors and accelerated computing in general is growing, and exactly how fast is something that no one is really sure about as best as we can tell. Nvidia has its bases covered with support for its CUDA programming environment on X86, Power, and ARM processors. It is difficult to get a handle on how large this business is right now, however. Jon Peddie Research, which tracks the workstation and graphics markets, reckons that somewhere on the order of 200,000 servers were sold in the fourth quarter of 2014 that had an embedded GPU in their processor or that had an add-in board like a an Nvidia Tesla or AMD FirePro S series GPU accelerator installed. Peddie tells The Next Platform that he estimates sales of the GPU-based add-in coprocessors to be on the order of about 100,000 units per year with a compound annual growth rate of 10 percent to maybe 15 percent for shipments going forward. Peddie adds that it is hard to track this part of the GPU market because of the nature of the large-scale supercomputers that the devices often end up in, and we would add that it is doubly difficult now because of the hyperscale datacenter operators that are putting GPU coprocessors to use for data analytics and machine learning applications are very secretive about what components they are using.

What we do know is that the use of GPU accelerators is on the rise, and we will get a better sense of the growth of this ecosystem at the GPU Technology Conference.

Be the first to comment