In recent years, when the economy became unstable, enterprises tended to look to the cloud as a safe haven. It happed during the COVID-19 pandemic, with the dramatic shift to remote work as organizations looked to slow the spread of the highly contagious virus by sending employees home. They accelerated their move to cloud services as a way to continue operating even as their offices essentially sat empty for a year or more.

Now the global economy is being rocked by inflation that started to gain momentum at the beginning of the year and fears of a potential recession. However, standing strong again amidst the uncertain financial picture is a cloud industry that continues to see enterprises ramping their spending on infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS) capacity despite recessionary worries.

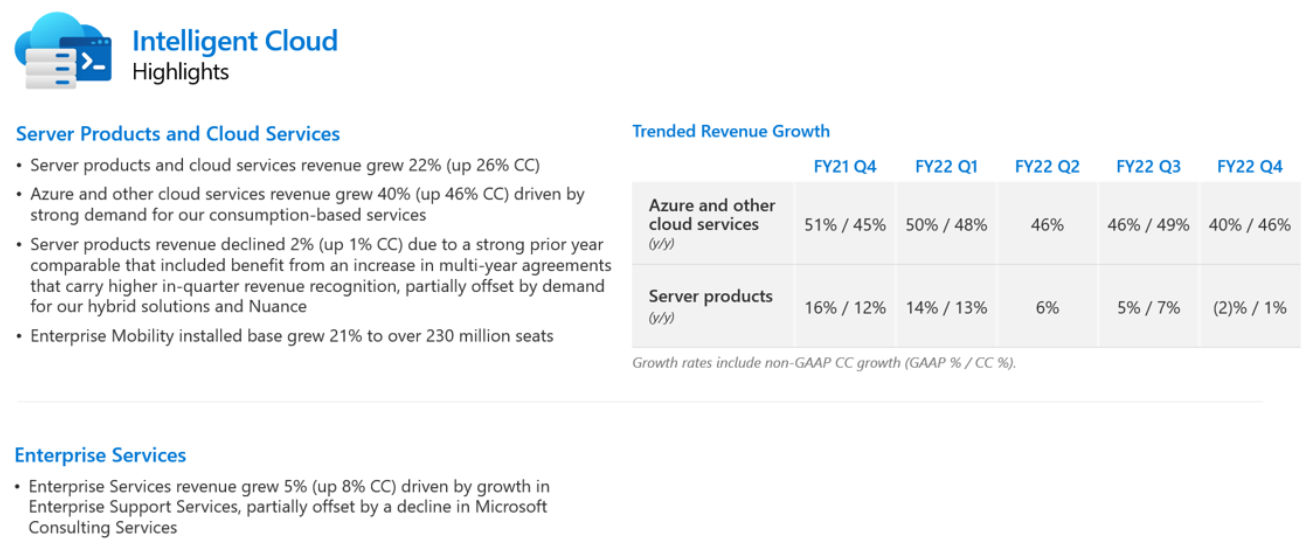

Microsoft’s cloud business, anchored by its Azure public cloud operations, was no exception. In the second quarter, revenue reached $25 billion, up 33 percent year-over-year. As the macroeconomic situation plays out, enterprises are looking to the cloud as a way to continue functioning with contracting budgets, according to Microsoft chairman and chief executive officer Satya Nadella.

“Moving to the cloud is the best way to shape your spend with demand uncertainty, because in fact, if anything, one of the things that we’re seeing is an increased shift towards the cloud, and then, of course, optimizing your bill,” Nadella said during a July 26 call with financial analysts about the company’s Q2 results. “We are incenting even our own field to ensure that the bills for our customers come down. And that … even shows up in some of the volatility in our Azure numbers, because that’s one of the big benefits of the public cloud. And that’s why I think, coming out of this macroeconomic crisis, the public cloud will be even a bigger winner, because it does act as that deflationary force.”

The cloud industry already seems to be winning big. Analysts with Synergy Research Group said in a report in late July that in the second quarter, global spending on cloud infrastructure services approached $55 billion that – despite economic turbulence and a strengthened US dollar – was a 29 percent growth over the same time in 2021. (Had exchange rates remained constant over the past year, that number may have gone as high as 35 percent, they wrote.)

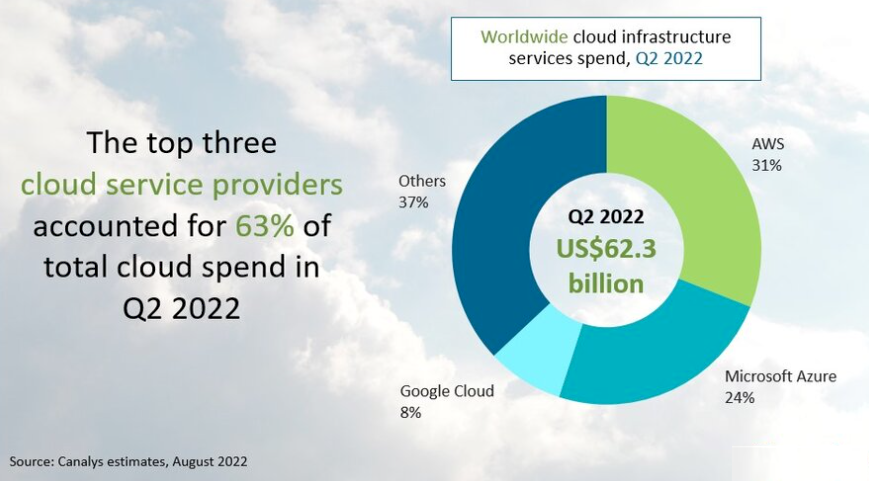

Days later, their counterparts at Canalys said that public cloud services spending jumped 33 percent year-over-year in the second quarter, to $62.3 billion, thanks in part by the expanding demand for data analytics and machine learning capabilities, datacenter consolidation, application migration and cloud-native development.

“As the cloud market continues to surge, the biggest story in Q2 was all about macroeconomics rather than actual cloud usage,” said John Dinsdale, a chief analyst at Synergy Research, noting the volatility of the numbers brought about by the movements in foreign exchange rates. “As evidenced by [Q2] earnings calls, global cloud providers are certainly not immune from the impact of ongoing shifts in exchange rates. However, the fact remains that the underlying growth in cloud usage continues to grow at truly impressive rates. This has caused a clear acceleration in both the launch of new hyperscale datacenters and the level of spending on datacenter hardware and software.”

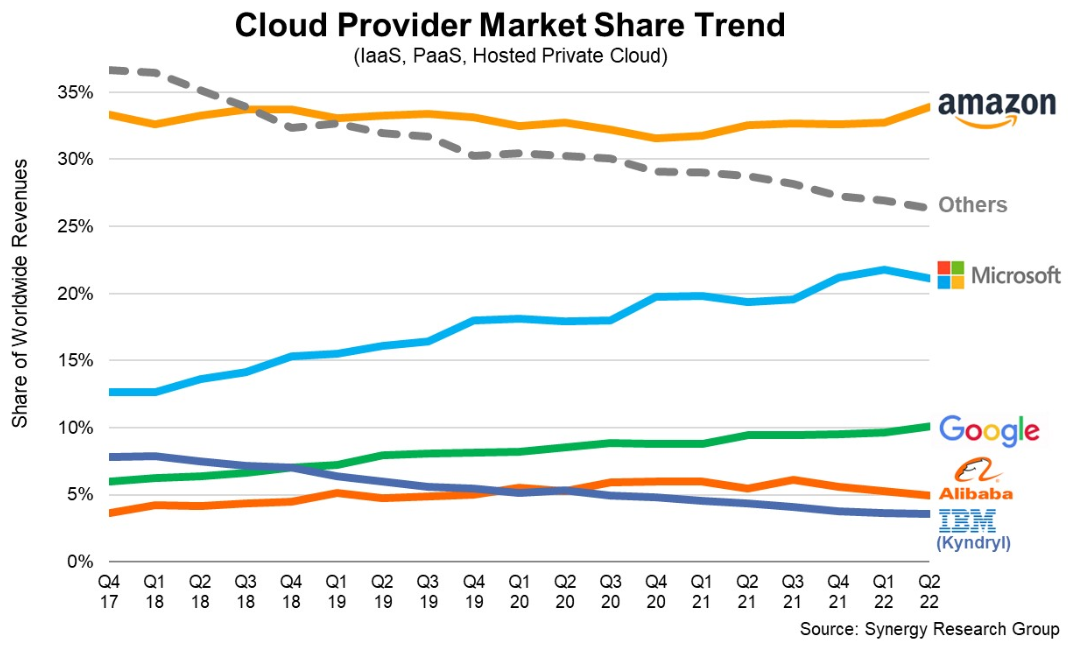

While volatility in the global economy may have spilled over into the public cloud market, there were constants beyond the continued growth in worldwide revenue. The primary one was that Amazon Web Services continued to hold onto the largest share of the market, Microsoft Azure continued to chip away at that lead and Google Cloud remained in third, followed by the dozens of cloud providers bunched into the “others category.” Synergy said AWS held 34 percent of the market, with Azure over 20 percent and Google Cloud creeping above 10 percent.

Canalys had the breakdown AWS at 34 percent, Microsoft Azure at 24 percent, and Google Cloud at 8 percent. Both firms had all three combining for almost two-thirds of the market, with Synergy having that figure at 65 percent and Canalys at 63 percent.

Unsurprisingly, all three cloud builders say they will continue to invest in their infrastructure. Microsoft said it inked a record number of multiyear deals in the $100 million-plus and $1 billion-plus range and Canalys analysts said Microsoft has been able to keep the pressure on AWS with a diverse go-to-market ecosystem, a broad portfolio, and a growing number of software partnerships. Azure has more than 60 datacenter regions and is planning to add another 10 over the next year.

Last month, the company launched Microsoft Cloud for Sovereignty to help government and public sector organizations more securely move sensitive data and workloads in the cloud while meeting high security and compliance standards.

Microsoft also is extending the life of its cloud servers and networking equipment from four to six years, which will boost operating income for the company, according to Canalys Vice President Alex Smith, adding that the move “suggests that Microsoft will sweat its assets more, which helps investment cycles as the scale of its infrastructure continues to soar. The question will be whether customers feel any negative impact in terms of user experience in the future, as some services will inevitably run on legacy equipment.”

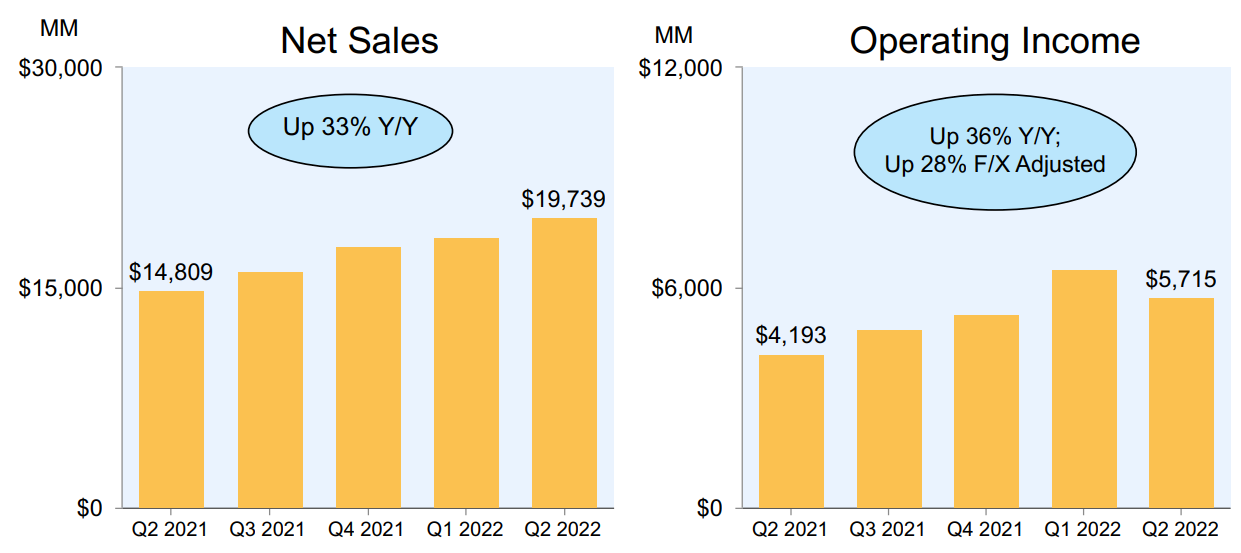

AWS, which saw sales in the quarter jump 33 percent year-over-year to more than $19.7 billion, said it will build launch 24 availability zones across eight regions this year.

We did a full analysis of the financials of AWS here.

While increase capacity is important, the cloud providers will have to continue to focus on software and partnerships to address expanding enterprise demand for more specialized services across verticals, Canalys said, noting Microsoft’s announcement last month that it added services to make it easier to migrate Oracle workloads to Azure and connect them back to databases in Oracle Cloud.

Google Cloud revenue jumped to $6.3 billion for the quarter, up 36 percent over the same period in 2021. Like Microsoft, it also launched a cloud segment aimed at the private sector and signed on such high-profile names like Target and H&M Group. The company also expanded its cybersecurity capabilities in the cloud, seeing that as a differentiator for enterprises was looking at cloud providers. A part of that included its $5.4 billion bid to buy Mandiant.

All that said, the cloud providers are not immune to the economic challenges that is hitting the tech industry particularly hard, as workers at Oracle and other companies can attest. Both Microsoft and Google are tapping the brakes on hiring. In speaking with financial analysts about the second quarter, Sundar Pichai, chief executive officer of Google and parent company Alphabet, said that the focus will be on hiring engineers and technical professionals.

The cloud continues to be a substantial market opportunity for Google that is still in its early stages, Pichai said. He added that there is a “varying mix of some customers impacted [by macroeconomic trends] in terms of their ability to spend. Some customers just slightly [are] taking longer times. And maybe in some cases … thinking about the term for which they’re booking and so on. But I don’t necessarily view it as a longer-term trend as much as working through the macro uncertainty everyone is dealing with.”

Be the first to comment