While chip designer and maker Intel has a new strategy and a new executive team to implement it, it is going to take a long time for changes made last year and this year to be felt and for product and process roadmap changes to put the company into a better competitive situation.

And even when it does, competitive pressures in the datacenter, in the client, and at the edge are all going to make it very difficult – we are intentionally hesitating to say impossible – for the company to make the 50 percent or so operating margins that it enjoyed when AMD was not selling server CPUs and Arm server chips were still a dream, not an increasing reality among the hyperscalers and cloud builders who dominate server spending in the 2020s.

Intel has a new financial organization for itself in the wake of Pat Gelsinger rejoining the company as chief executive officer a little more than a year ago, which makes it easier to see some things about its datacenter business and harder in other ways. And it will be a while before we have four quarters of data and four quarters of the backwards compare to create a new model of Intel’s “real” datacenter business, which did not change just because Intel rejiggered the categories and labels for its businesses that it uses when talking to Wall Street. So for now, we will focus on what the company has said about its first quarter 2022 and get used to the new language.

In the quarter ending in March, Intel’s revenues were down 6.7 percent to $18.36 billion. Despite $1.21 billion in restructuring charges and rising research and development expenses (up 20.4 percent to $4.36 billion in the period) and thanks to $4.32 billion gain on equity investments, Intel was able to report a net income of $8.11 billion, 2.4X higher than the year ago quarter. Intel is out of the security software business and out of the flash storage business, which were distractions largely engendered by its dominance of server CPU compute between 2009 and 2017, and now it is looking to take its Mobileye self-driving vehicle compute business public to “unlock value” inherent in it, and we will once again point out, as we did with VMware being acquired by EMC and then going public, that Intel shareholders already own Mobileye and it is therefore already public.

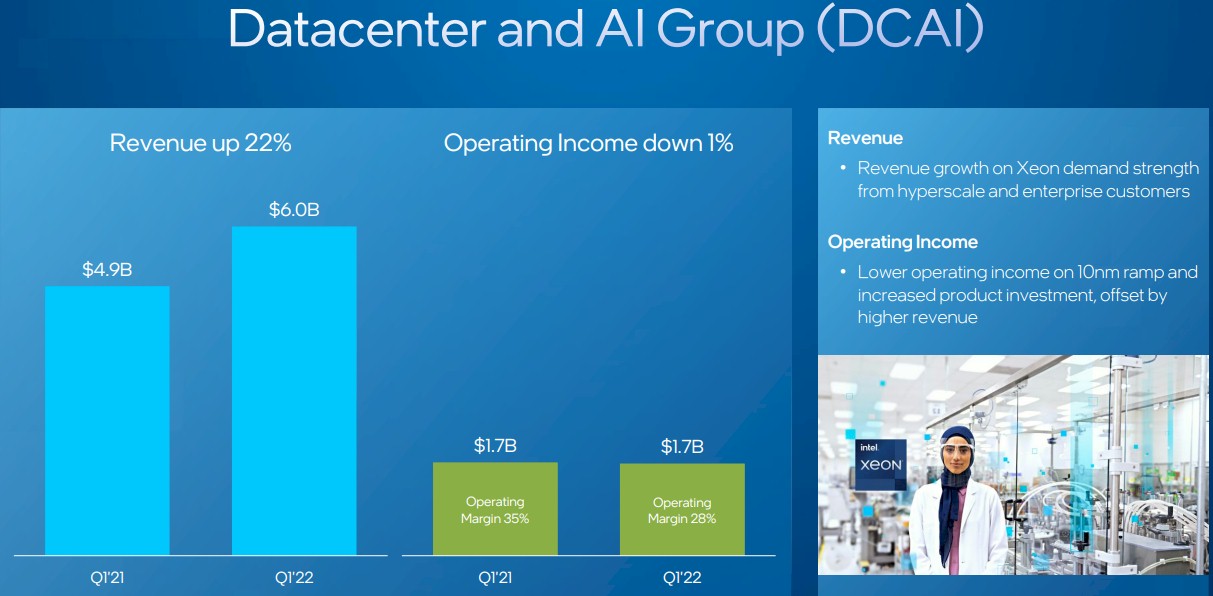

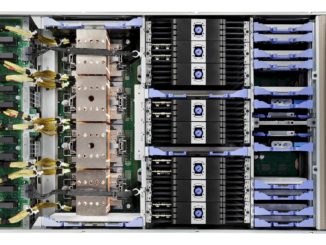

In any event, there is a new Datacenter and AI group, which has Xeon SP CPUs, chipsets, and motherboards, with the Altera FPGA business, the Habana matrix math engines, and other ASICs tossed in there, too. (Where they belong.) Revenues for the Datacenter and AI group rose by 22.2 percent to $6.03 billion, but operating income was down 1.2 percent to $1.69 billion due to the ramping of Intel 7 processes (10 nanometer SuperFIN) and Intel 3 manufacturing processes and the increasing R&D costs relating to the Xeon SP server roadmap. We also think that the bundling practices that Intel has relied on to keep Xeon SP prices higher than they might otherwise be are less effective since Intel is suffering shortages of its Ethernet controllers just like other NIC makers, which is having a ripple effect on server sales. In the conference call with Wall Street analysts, Gelsinger said that the company expected “headwinds” with Ethernet NIC sales (and therefore the consequent pressure on Xeon SP CPU sales) for the remainder of 2022.

Here is the important math. In Q1 2021, operating profits were 34.5 percent of revenues, which is a long way down from that 50 percent level Intel’s Data Center Group had in the heyday between 2010 and 2018, with a few bad quarters in the mix. In Q1 2022, operating profits fell further to 27.9 percent of revenues.

It is very hard to for Intel to throw off the cash it needs to build foundries just at the time it needs a lot of cash to build foundries. If Intel had used its cash to build foundries over the past decade and did more investing in research and development and did not rest on its 22 nanometer and 14 nanometer laurels, it might not be in this bind. All of those share buybacks and expensive acquisitions that did not lead to revenues and profits now come home to roost.

With Gelsinger at the helm, it seems there will be a lot more focus on the core businesses, but as we said above, it seems unlikely that competitive pressures and the ever-higher costs of manufacturing compute, networking, and storage engines will allow Intel to return to anything like the profitability it once enjoyed in the glass house.

Intel is no longer giving out growth rates for shipments of datacenter products to hyperscalers and cloud builders, telcos and other suppliers, and enterprises and governments as it used to, which is a shame. But as you can see in the chart above, the company said that hyperscalers and enterprises were buying products even though they know that the “Sapphire Rapids” Xeon SPs, the third generation in this server CPU line, is due in the second half of this year. Sapphire Rapids CPUs have begun initial shipping to selected customers, and the Habana 2 matrix math engine is also sampling, according to Gelsinger.

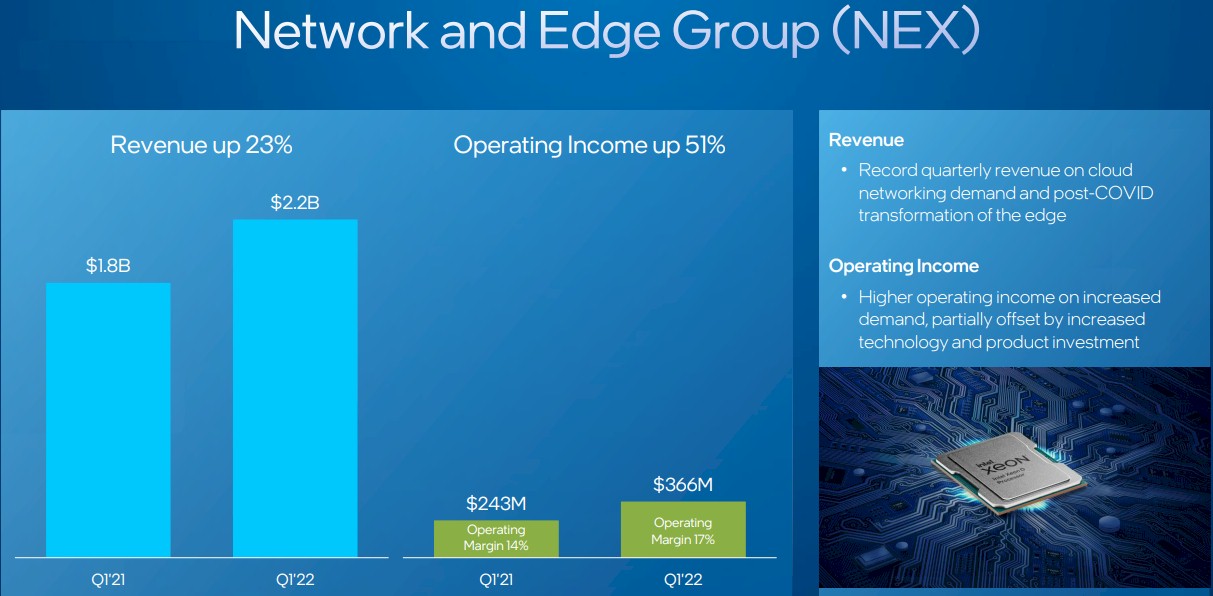

The Network and Edge group, which is called NEX for short for some strange reason, had sales of $2.21 billion in the quarter, up 23 percent year on year, with operating profits of $366 million, up 50.6 percent. The NEX group includes the Barefoot Networks switching business, silicon photonics such as used with Ethernet transceivers, and the Xeon D compute engines – things that are generally sold to network equipment makers or network operators directly. Operating profits rose from 13.6 percent of revenues a year ago to 16.5 percent of revenues this quarter, but that is still not the kind of middle line that Intel and its shareholders are used to, and it is arguable, given the products and customers here that it will be anywhere close to as profitable as Data Center Group once was.

The Accelerated Computing Systems and Graphics group, shortened to AXG for some strange reason, is bleeding money at the moment, and quite heavily as Intel tries to build a discrete graphics business from scratch and incurs the development costs of bringing compute engines specifically for HPC and AI customers, such as the Sapphire Rapids Xeon SPs with HBM memory or the “Ponte Vecchio” Xe HPC GPU complex to be used in the “Aurora” supercomputer at Argonne National Labs, to market. Ponte Vecchio is sampling and presumably so is the HBM memory variant of the Sapphire Rapids CPU, which is also being used in the Aurora system. Intel reminds everyone that it has a generic datacenter GPU, called “Arctic Sound,” aimed at media processing and inference, coming out in the second half the year.

Gelsinger said that Intel was on track to hit $1 billion in revenues for AXG this year, but we wonder at what cost. In the year ago quarter, AXG had $181 million in sales but posted a $176 million loss. And while Intel was able to grow AXG sales by 21 percent to $219 million in Q1 2022, the losses grew by a factor of 2.2X to $390 million. We wonder what affect Aurora will have on the AXG group’s revenues and profits when it gets booked. It looks like, based on Intel’s statements, that building up an inventory of Sapphire Rapids HBM and Ponte Vecchio parts for Aurora has taken a toll on operating profits, and so has production ramp for these parts and investments in the specialized CPUs and discrete GPUs that Intel is creating under the guise of AXG.

David Zisner, Intel’s newly appointed chief financial officer, said on the call that the Datacenter and AI group “expects to see a stronger second half of the year as hyperscale customer demand remains robust, component supply improves, and the ramp of Ice Lake, and Sapphire Rapid’s increased competitiveness.” And speaking of Ice Lake, Intel has now sold nearly 4 million units of this Xeon SP and Gelsinger said that Intel would be ramping Ice Lake “more aggressively with higher volumes” as Intel moves into the second half of the year. Gelsinger added that there were some DDR5 memory interface issues with Sapphire Rapids – apparently with the memory vendors, not Intel – and now multiple vendors are qualified to have their memory inside of Sapphire Rapids platforms. And, Gelsinger said that Sapphire Rapids would ramp faster than Ice Lake, but this is a given considering how much better at 10 nanometers Intel is compared to where it was even a year ago.

Intel is trying to transform it’s company to focus on their technology and scale of manufacturing. It will get back to it’s glorious days of margin sooner than you think. Intel’s margin is lower now mainly due to large investment in new plants and research, that is nothing wrong with it. The competition is keen, that is no doubt about it, Intel and USA must win, there is no other choice. A 2 to 3 years investment, and lower profit is worthy of it, you seemed to criticizing every steps, it appears that you are the problem, not Intel’s. Intel’s large investment now is the result of pass neglect, now it is playing catch up, is there something wrong with it? Is there any other alternatives or just to let it slide?

No, I am not criticizing it. Intel is doing what it has to do, and the best it can under the circumstances, and I think it will get better at process and processors. But that it not the same thing as believing that it will be able to get back to a place where there was no competition. It won’t, and that same level of profitability can never return. Any more than the profits of the Unix market were retained when the world shifted to Linux-X86, just to give an example. That easy game is over, and now it is the hard game for everyone because there is competition.

That is the point, Intel was used to have basically zero or close to zero competition. Market fragmentation and a high level of competition in addition to much more general options on the market for customers, adds price pressure for everyone. Just look at the memory foundry business, where it was once and where its these days. The bigger the competition the smaller your piece of the cake with following lower the margins. People should lower their expectations on Intel, and seperate “turn around” from “old” margins. A turn-around is in general possible as in getting back to the market, but not to a state which most people were used to. And I believe the disappointment will be big. Not to mention that everyone in the foundry business is currently building up potential overcapacities (in 1-2years to come up), which might slowly end up in a boom bust cycle some day, not as dramatic as the last one, but this will cause a margin bleed. The logic foundry business will end up in the same spot where the memory business was and is(with exceptions for top notch nodes).

“It won’t, and that same level of profitability can never return. ”

Intel has spent over $15B in R&D over the last 12 months, and over $12B/yr for the last 6 yrs. It isn’t hard to imagine some of that research having large returns. Their FPGAs are now on Intel-7 process. Their Mobileye business is testing robotaxis. Their silicon photonics business is selling 800Gb pluggable optics. Their Optane PMEM products are creating a buzz in HPC and cloud storage. Their NFV products are taking off.

“Intel is suffering shortages of its Ethernet controllers just like other NIC makers, which is having a ripple effect on server sales.”

This shortage seems an edge for AMD, as fewer servers do the same job?

AMD itself is also suffering from shortages due to limited capacities. In the end lead times are up to 40 weeks and more for most top server products. AMD is at a point where they simply cant bake more cakes than they have room in the oven. They are also already in a position of price domination due to superior products, so the benefits of intels particular shortages are rather thin. Only more capacitiy would matter to AMD.

Absolutely. And I would say AMD sized an oven with TSMC when it should have had one maybe 2X to 3X as big, but it could not have known how badly Intel would trip with both 10 nanometer and 7 nanometer processes.

“They are also already in a position of price domination due to superior products…”

The Mercury research numbers still show Intel with about 90% of server market share for 2021. AMD excels in a confined segment of the market, and will expand that with the zen4 chips, but Intel’s SPR-HBM also appears to be raising the bar.

Intel is apparently bidding vs AMD for the limited N5 and N3 capacity at TSM, unlike in years past, and AMD now is reportedly in line there behind both Intel and Apple.

So you actually addressed the question of AMD’s superior products, only to gaslight everyone with a non-sequitur and speculating about Intel powerpoint roadmaps and TSMC allocation rumors.

Standard JayN nonsense.

Short summary is a combination of extreme hubris, numerous horrible business decisions / acquisitions, inept execution, and a culture grounded in “Intel First” has led to well over a lost decade of growth, declining margins, lost customers, multiple technology delays and failures, numerous technologically and business-wise superior competitors, and now a growing list of customers doing their own processors, accelerators, NICs, etc. Intel is paying Pat G. $100s of millions to turn this around, but the price tag is astoundingly large and relies on getting billions of subsidies from the US and EU governments (TSMC and Global Foundries have ponied up to the trough as well, but not because they screwed the pooch like Intel). In investment terms, Intel remains “dead money”, i.e., its stock has barely appreciated over the past 20 years, and in real dollars it has actually depreciated due to inflation. As for Intel’s foundry ambitions, they’ll need to overcome significant tool chain deficiencies (TSMC is superior as noted by multiple Intel design teams who have privately remarked as such) and change their culture from “Intel First” to “Customer First”. It will be a very long road to turn it around, and I truly hope they do especially as de-globalization accelerates. Fortunately, the other three major foundries are stepping up to create more resilient supply chains and infrastructures.

Intel just opened the new D1X fab expansion in Oregon. They have expansions scheduled to open in Ireland next year and in Israel in the following year.

The new projects in AZ, NM and Ohio are just beginning, but the other expansions will contribute to Intel’s earnings in the near term, as will the increased use of TSM for the new discrete GPU program.

It will be difficult for them not to increase revenues, with all that capacity expansion.