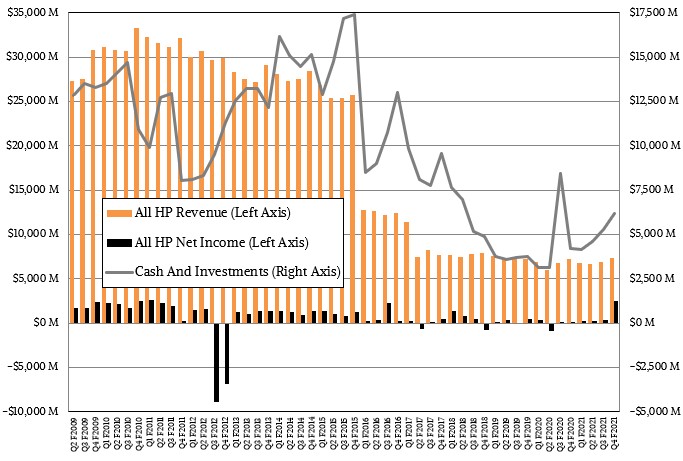

It may have taken the better part of a decade, but the Itanium platform has yielded the kinds of profits that Hewlett Packard Enterprise long sought and rarely attained. Thanks to a final ruling in a long-running lawsuit with software giant Oracle over its pulling of support for its software in HPE’s Itanium platforms back in June 2011, HPE won a $3 billion settlement from Oracle at the end of September, which hit the HPE books as a $2.35 billion litigation judgment for the final quarter of fiscal 2021 ended in October.

This has obviously made HPE wildly profitable in that thirteen week period, but HPE was doing pretty well – by its own historical standards, at least – without the Oracle settlement.

In the quarter, HPE’s overall revenues were up 2 percent to $7.53 billion, which is about what you would expect given the OEM markets where HPE plays, the uncertainty in enterprise IT spending, and the state of the global supply chain for semiconductors and manufactured gear. HPE trimmed its cost of sales, boosted research and development spending a tiny bit, spent a little bit more on back office and administration costs and more than doubled earnings from operations to $350 million, after adding in earnings from investments, the litigation judgment and taking out taxes, net earnings came out $2.55 billion, but would have been in the ballpark of $220 million we reckon, which would have been up 40 percent from the $157 million in net income HPE booked in the year ago quarter. What would have been a very solid quarter for an OEM supplier with razor-thin margins turned into a winning lottery ticket thanks to the Oracle lawsuit settlement.

If you think that Oracle regrets anything, you don’t know co-founder and chairman Larry Ellison very well.

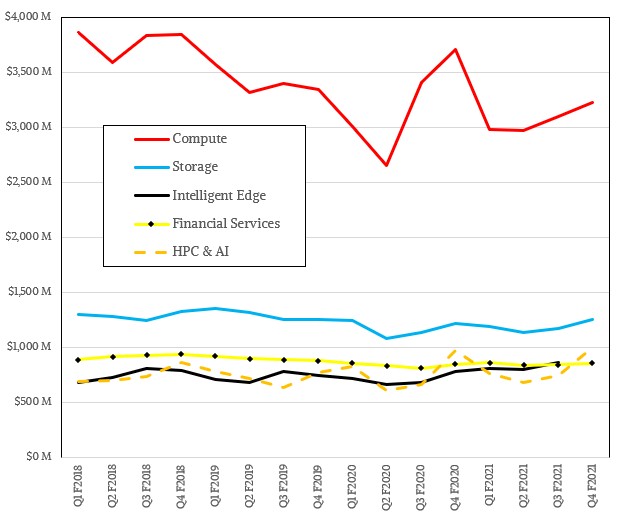

Setting aside the legal windfall, HPE managed through some challenges in the quarter. The company’s Compute division, which is mainly the ProLiant X86 server line, had a 13.2 percent decline in sales, to $3.23 billion, but its operating earnings rose by 55.7 percent to $302 million. Clearly, HPE has been able to target profitable deals in the enterprise and focus on these while not getting bogged down on money-losing deals with smaller hyperscalers, clouds, and telcos. Sales in the Compute division were up 3.9 percent sequentially.

And recall: in the year ago period, HPE had a huge backlog of ProLiant server sales from earlier in 2020 that it was able to fulfil once the coronavirus pandemic settled down a little bit, which makes for a pretty tough compare this quarter.

The HPC & AI division – which used to be called High Performance Computing and Mission Critical Systems, meaning scale out supercomputing clusters as well as scale up NUMA big iron – booked an even $1 billion in sales in fiscal Q4, up 2.6 percent year on year but up 35 percent sequentially. Operating earnings rose by 20.2 percent to $143 million, which is again the numbers moving in the right direction. We still maintain that it is very difficult to make money in the core HPC market, but it is looking like AI is a bit easier.

HPE is no doubt pleased by the success rate it has had peddling the “Shasta” Cray EX supercomputer lineup, often with the Slingshot interconnect created by Cray, but it remains to be seen if these deals will be highly profitable for HPE. A lot depends on the price that AMD is charging for CPUs and GPUs as HPE stuffs these machines full of these compute engines. That said, plenty of the Shasta deals that HPE is taking down also have Intel CPUs and Nvidia GPUs, so pricing here will matter, too, and it is possible that HPE does smaller deals with Intel and Nvidia motors and makes a higher profit margin on them. We are also fairly certain that the bulk of the profits inherent in a Shasta supercomputer, no matter who is making the compute engines, goes to the compute engine makers – although HPE gets to keep a lot of the networking money with so many Slingshot attach rates with Shasta deals.

Incidentally, HPE reiterated its expectation that the HPC & AI business could have an 8 percent to 12 percent compound annual growth rate between fiscal 2020 and fiscal 2022, inclusive. Given the big exascale deals, you might be thinking it should be higher than that. There is $1.2 billion alone in bookings for HPE in the three labs of the US Department of Energy that are getting exascale systems built on HPE/Cray technology. That would be, in expected installation order, the 1.5 exaflops “Frontier” supercomputer at Oak Ridge National Laboratory, the 2 exaflops “Aurora” supercomputer at Argonne National Laboratory, and the 2.2 exaflops “El Capitan” supercomputer at Lawrence Livermore National Laboratory. In any event, Antonio Neri, HPE’s chief executive officer, said on a call with Wall Street analysts going over the numbers that the HPC & AI division has an order book of contracts valued at $2.7 billion, and that doesn’t count the utility-priced GreenLake supercomputer that HPE is building for the US National Security Agency for $2 billion.

Tarek Robbiati, HPE’s chief financial officer, said on the call that HPE did have “some customer acceptances of some large contracts get pushed out into fiscal 2022,” and we think that means, possibly among other things, the Frontier machine at Oak Ridge, which was not unveiled at the SC21 supercomputer conference last month as an exascale-class machine as had been expected.

New architectures take a lot of tuning, so we are not surprised by this push out, even if we were clearly disappointed. We think that AMD has a pretty good handle on the custom “Rome” Epyc processors used in Frontier and similarly it has a good handle on the “Aldebran” Instinct MI200 GPU accelerators that provide the bulk of the compute. If we had to guess – and we have to – we would expect that the coherency between the CPUs and GPUs needs some tuning to drive performance and that the Slingshot interconnect, which has never been operated at scale before, also needs some tuning. The clock is now ticking for the June 2022 Top500 supercomputer rankings, and HPE is well aware of that. Now it is a race to see if Aurora or Frontier will be the first running exascale supercomputer in the United States.

Speaking of GreenLake, Neri said that HPE added 300 new GreenLake customers in fiscal 2021, bringing the total customer count to 1,250, and that the cumulative contract value of GreenLake deals had risen by $1.5 billion in the fiscal year, boosting the total contract value of GreenLake to $5.7 billion. It will not be long before GreenLake is a financially significant part of the HPE revenue stream, and we hope that the company eventually provides some insight into how this revenue stream behaves as opposed to dumping it all into the same bucket as other “as-a-service” offerings.

The Storage division plugged along better than Compute did, with sales up 3.3 percent to $1.26 billion, but operating earnings fell by 14.3 percent to $174 million. All flash array sales rose by 7 percent and hyperconverged infrastructure was up “in the double digits” during the quarter.

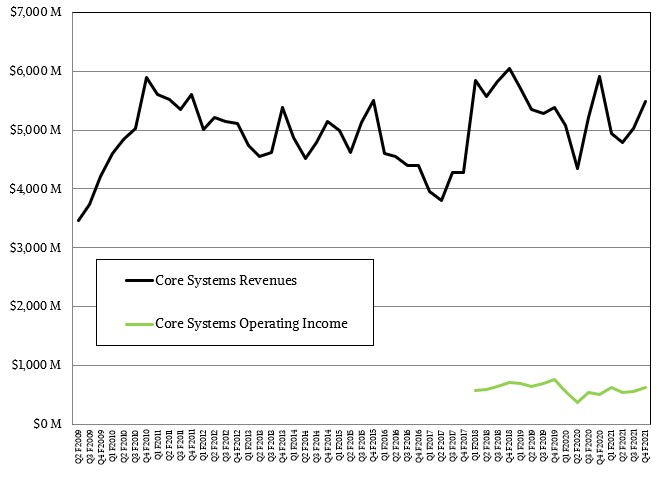

If you plot out the core systems business at HPE over time – including servers, storage, and switching hardware – this business fell by 7.2 percent to $5.48 billion, but operating earnings rose by 20 percent to $619 million.

HPE exited the quarter with $6.21 billion in cash and investments. For the full year. HPE booked $27.78 billion in sales, up 3 percent, and net income was $3.43 billion, which compares quite nicely with a $322 million loss in fiscal 2020.

Be the first to comment