Every startup has to be both flexible and focused, and it is tough to balance the two. There is always more than one way to attack any given market, and sometimes the obvious way to land and expand a given technology in its market when a company is founded turns out to not be the best way after some experimentation.

This turns out to be the case with Arrcus, which provides an independent, third party switching and routing network operating system for datacenter and edge equipment. Given the dominance of Broadcom’s various ASICs in the merchant silicon market and their ubiquity in datacenter switching with the “Trident” and “Tomahawk” and increasingly in routing as well with the “Jericho” ASICs, Arrcus initially focused on selling its ArcOS platform on datacenter switches and routers based on these devices and went after the hyperscalers and cloud builders who were trying to get better performance as well as something that could, in time, span multiple ASICs.

ArcOS is not open source, so it is not analogous to Linux on servers, but more like Microsoft’s Windows Server, which is popular and closed source. Arrcus co-founder and former chief executive officer Devesh Garg, who uncloaked Arrcus from stealth mode in July 2018, was never shy about the fact that he did not think it mattered that ArcOS was closed source. What matters more, Garg stressed, was having the experts who helped define and create the Border Gateway Protocol (BGP) for routing and now extended down to switching by the hyperscalers and Arrcus, on the Arrcus team. The ArcOS stack was written from the ground up to take advantage of multithreading in CPUs and all of the features in modern networking ASICs and to provide performance and optionality for those who really need both.

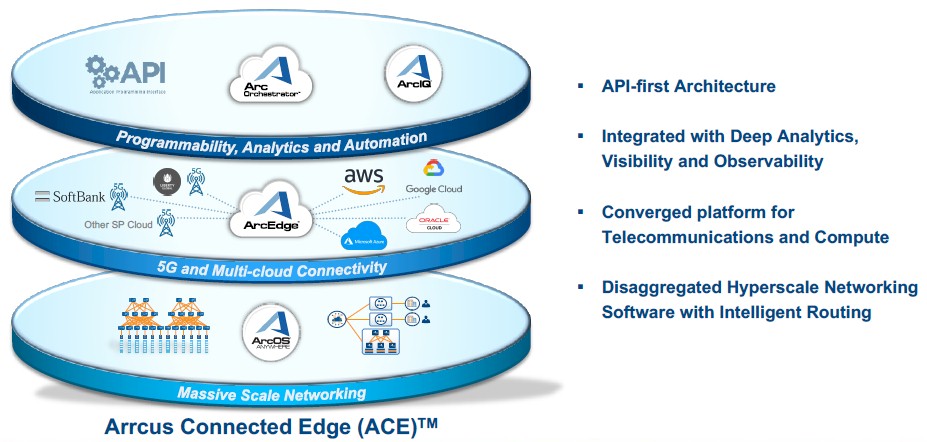

As it turns out, breaking into an established market with strong incumbents is more difficult than solving a new problem that is more of a greenfield opportunity, and that is why Arrcus was increasingly focused on the “connected edge” and why, as the company recently took down another $30 million in financing, it brought in Shekar Ayyar, who used to run VMware’s $1 billion service provider business and who also spearheaded VMware’s merger and acquisition team and did its acquisitions of Nicira, Velocloud Networks, and AirWatch, among others, to be the new chief executive officer of Arrcus.

Ayyar tells The Next Platform that after leaving VMware in early 2021, he set up a special purpose acquisition company, or SPAC, and also became a venture partner and was looking for investments; Ayyar was not aware that Arrcus was on the hunt for a new CEO to take the company up to the next level, but he was looking at Arrcus as a “diamond in the rough” and with its next round of investment, with the right kind of direction, could create a disruption in networking. “That disruption,” says Ayyar, “is the transition to the edge.”

As we have been saying for quite some time, the edge is just another form of distributed, disaggregated system, and one that will need a distributed and disaggregated network fabric to stitch it all together and to link it back into corporate datacenters or independent clouds. That edge fabric is wide open, and chasing the opportunity is what Arrcus is going to focus on for now while at the same time keeping the pressure on datacenter switching and routing. To our way of thinking about it, Arrcus will be able to prove itself at the edge and then have a shot at switching and routing in the datacenter, particularly among those service providers who do not have the resources to build their own network operating systems like Google, Amazon, Facebook, and Microsoft do.

The ArcOS stack has a hardware abstraction layer, called DPAL, that allows Arrcus to adapt the network operating system fairly easily to different hardware platforms, whether they are proprietary or merchant switch or routing ASICs or merchant silicon from Broadcom, Cisco Systems, Intel (Barefoot Networks), Marvell (Innovium), or Nvidia (Mellanox). It can port to a new chip in a matter of weeks, not the months to a year that a big incumbent network operating system maker like Cisco or Juniper or Arista takes.

But being a startup, Arrcus has to be customer driven, and thus far its customers and proofs of concept have all been on Broadcom chippery. Both Garg and now Ayyar say that Arrcus can port ArcOS to any chip, or offload networking functions to X86 or Arm processors, as needed and will do so when customers make a good use case and a commitment to using ArcOS, thus justifying the engineering cost. At the moment, Arrcus seems to be really focusing on the Broadcom Jericho family of ASICs, which run a little slower but have the deep buffers that make them better suited to routing that regular switch ASICs like the Trident and Tomahawk chips.

Arrcus now has around 90 employees, and significantly, Keyur Patel and Derel Yeung, the company’s co-founders and the BGP experts, are still on board as chief technology officer and chief architect, respectively. The other employees are mostly engineers, which is a good thing, and are split between offices in San Jose and Bangalore. (Garg is still a shareholder in Arrcus and is working as an advisor to the company.)

With the recent Series C funding of $28 million, which including funds from Liberty Global, SoftBank Corp and Samsung Next as well as earlier funding partners Clear Ventures, General Catalyst Partners, and Lightspeed Venture Partners, Arrcus has raised a total of $77 million to date. The company has bagged a handful of big Fortune 100 customers in the financial services, telecom, media, and service provider sectors and has dozens of proofs of concept in the field as well. In the long term, Ayyar will be building a channel strategy so Arrcus does not have to do all of its sales directly, much as Microsoft, VMware, and Red Hat have done to build their software empires.

For now, the edge focus seems to be resonating with customers, and Arrcus saw 75 percent growth in bookings from Q2 2021 to Q3 2021. One quarter does not a year make, of course, but that’s the kind of traction a startup expects. We were not given any comparative data for prior quarters or years, which is no surprise given that Arrcus is a privately held startup. But Sreekanth Kannan, the new vice president of product management and marketing at the network software supplier, did give us a bit of insight.

“Our 75 percent growth during the last quarter is a direct result of rapidly increasing demand from service providers and enterprises as they adjust their long-term IT budget with strategic importance of edge computing,” Kannan tells The Next Platform. “There’s also been a tremendous response of interest since our recent introduction of the Arrcus Connected Edge platform. This is a result of maturing and expanding digital transformation that are being aided by new opportunities created by advancements in 5G, distributed applications, and automation as well as changing requirements since the start of the pandemic to better serve customers and employees. Our pipeline is strong and healthy with lots of evaluations taking place with compelling differentiation to result in continued revenue growth in 2022.”

The ACE platform is sold under a subscription model and is available now.

Be the first to comment