As everybody in the world now knows, there are downsides to just-in-time manufacturing during a global pandemic. Demand can spike dramatically or fall off a cliff, depending on the nature of the product, and if you are lucky enough to see a spike in business, manufacturing to meet that demand becomes a challenge because factories aren’t fully staffed and getting raw materials for your products gets harder and takes more time for the same reasons.

The whole thing really becomes a mess. And during a global pandemic that had everyone stuck at home for a long time, semiconductors are a lot like toilet paper, and sooner or later the supply was not going to keep pace with demand and we see that lead times across the board for components and finished devices are now double what they were before the coronavirus pandemic. It’s crazy. And it is utterly amazing that companies like Arista Networks have been able to keep growing during the pandemic, considering how bad the supply pain is out there.

“In my career of several decades, I have never seen it be dispersed,” Jayshree Ullal, chief executive officer at Arista Networks, explained in a call with Wall Street analysts going over the numbers for the second quarter of 2021. “Never. This is the worst I have seen it, and there have been some pretty big ups and downs. And more than the worst I have ever seen it, I think it’s also going to be prolonged. I guess we’re all hopeful that we will all recover from the COVID pandemic, but everything from copper shortages to wafer starts to assembly to manpower, people, logistics, freight. Just about every aspect of it is challenged, too.”

Anshul Sadana, chief product officer at the company, said that it wasn’t just the shortages, but the panic buying that makes it even worse. The semiconductor and device manufacturers that companies like Arista Networks depend on never expected such a large mismatch between demand and supply, which causes the first crunch, and then the second crunch comes as the pandemic continues and then companies try to buy ahead to try to not be the one that can’t buy gear even further down the road for future projects. Just because hyperscaler and cloud builder capacity feels infinite to its users, the Super 8 have to plan for excess capacity, and their services were slammed during the pandemic and they needed more of just about everything – servers, storage, switching, routing, and copper cables. Copper is a bottleneck in the 21st century? Who’d a-thunk it?

The upside to this, explained Ullal and Sadana, is that with lead times on components and finished products ranging from 40 weeks to 60 weeks – double the norm – Arista Networks has twice as much visibility into what customers want to do. So demand forecasting, ironically enough, has gotten easier. These “cloud titans,” as Arista Networks calls them, comprise the biggest part of the company’s switching business, but they normally only tell the switch maker what they will need maybe one or two quarters in advance. Now, they have to reveal their plans further out if they hope to have the gear they want because there is no slack at all in the supply chain. Components are running short, factories are going full tilt boogie, and it is still not enough to meet demand. So they have to order earlier than they otherwise would, and then wait like the rest of us do for all kinds of things.

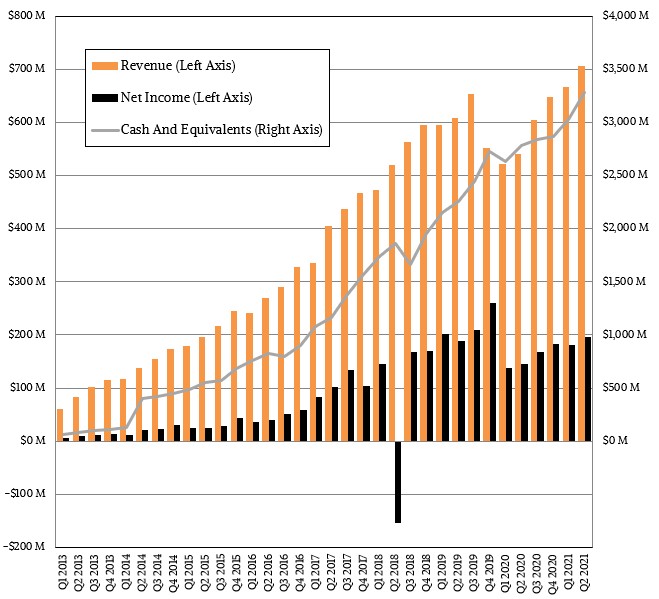

As you can see, Arista Networks was hit pretty hard by a revenue decline starting at the end of 2019, which was before the coronavirus pandemic hit the global economy. (Although there is increasing consensus that the virus outbreak actually started around September to October 2019; this is correlation, not causation with regard to Arista Networks.) No, what hit Arista Networks were the hyperscalers and cloud builders skipping the 200 Gb/sec wave until they had no choice but to gut their networks, or at least consider using more advanced networking in their newer datacenters, after the pandemic caused a huge spike in capacity demands across their own users. The cost of 200 Gb/sec and 400 Gb/sec switching was too high – particularly for the optical transceivers – and the industry had to come up for the workarounds to make these higher speeds more economically palatable. There is no way a cloud titan is going to pay more per bit moved with new gear compared to old gear. (We think that day is coming as Moore’s Law slows and process shrinks get more difficult and more costly. So they better get used to that idea.)

But that transition is starting, and not a moment too soon for all of those companies peddling high speed Ethernet switching. (There is a reason Marvell just shelled out $1.1 billion to acquire switch chip upstart and recent unicorn Innovium.)

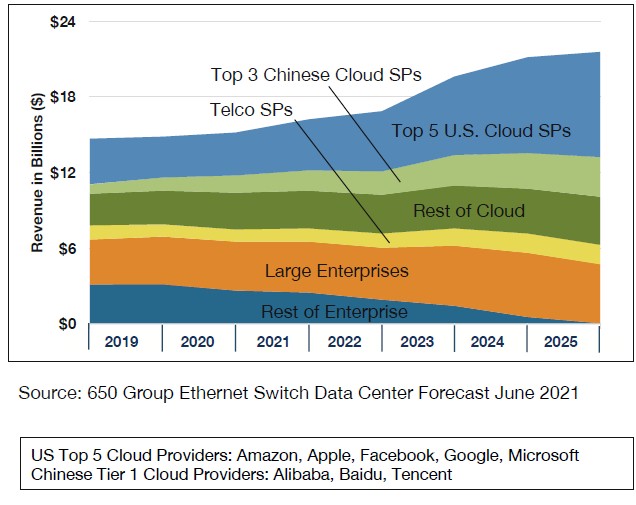

These two charts, which Arista Networks provided in its Q2 2021 financial report, sum up the state of the datacenter switching market and how it is changing. First, a chart that shows datacenter Ethernet switch revenues by company type:

The Super 8 are predicted by The 650 Group to account for more than half of the switch revenues before the end of 2025, where the forecast period ends. That’s more than $10 billion in sales across eight companies. The rest of the cloud providers and the telcos and service providers are about another quarter and every other company – small, medium, or large – will only account for about a quarter of all switching revenue.

Chew on that for a bit.

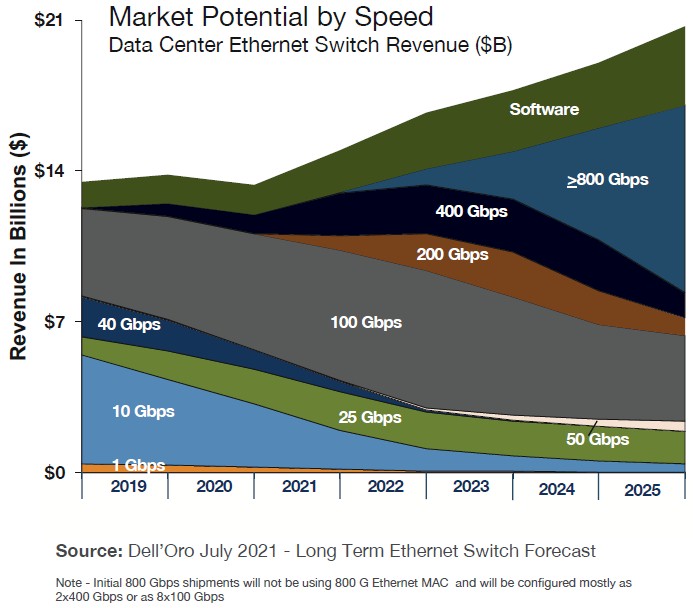

Now look at this forecast from Dell’Oro Group that shows revenues by port speeds on the switches:

While the adoption of 100 Gb/sec Ethernet switches has been rising, it was not enough in 2020 to offset declines in 10 Gb/sec and 40 Gb/sec gear and 200 Gb/sec gear, which should have helped, were non-existent and frankly are only starting to pick up steam. Last year, for instance, Arista Networks had 75 customers who were buying switching gear at 100 Gb/sec, 200 Gb/sec, or 400 Gb/sec speeds – and as far as we know, two of them (Microsoft and Facebook) were in the Super 8 and accounted 30.5 percent of the company’s $2.32 billion in annual sales. The word on the street is that Google is bow buying gear from Arista Networks and that Facebook is picking up the pace again after a pause to jump over 200 Gb/sec straight to 400 Gb/sec from 100 Gb/sec, and now Arista Networks is projecting it will triple or quadruple the size of its customer base in 2021 for customers running at 100 Gb/sec or higher speeds.

During the 100 Gb/sec cycle, Arista Networks has had roughly 30 percent of the ports in recent years compared to roughly 22 percent for switching and routing industry juggernaut Cisco Systems, which is a remarkable feat. And another remarkable feat, which Ullal noted on the call, is that Arista Networks has now shipped a cumulative 50 million Ethernet ports into the datacenter since it dropped out of stealth mode in 2008 and started shipping products in earnest in 2009. The next 50 million could take a half to a third of the time, depending on how the bandwidth ramp goes in the coming years.

Our point is that the 200 Gb/sec and 400 Gb/sec dead zone for Arista Networks makes for an easier set of compares in 2021. All companies win the Compare Lottery every now and again, and they also lose it every now and again, as it Arista Networks certainly did in 2020.

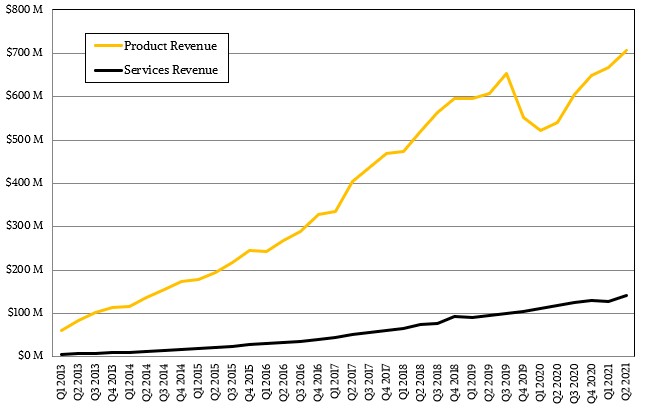

In the quarter ended in June, Arista Networks had $566.5 million in product revenues, up 31.2 percent year on year, and $141 million in services revenues, up 14.5 percent. Software and services sold on a subscription basis came in at 22.3 percent of overall revenues, or $158.1 million, up 10.4 percent sequentially from Q1 2021. (This is a new metric the company is giving out, so we don’t have the annual comparison.) Net income rose by 30.3 percent to $197.9 million, which presented a very healthy 27.8 percent of revenues (now bad for a mostly hardware company). The company exited the quarter with $3.28 billion in the bank and didn’t blow any of the cash on share buybacks. (Back in 2019, the company’s board approved a $1 billion buyback over three years, and the company has spent $763 million on that so far. All companies need stock they can distribute to employees, and of course this helps the earnings per share comparisons that we have learned to completely ignore because it compels companies – yes, we are talking to you, IBM – to steer themselves on the wrong lines on the road to the future.

Arista Networks has never been big on forecasting in too much detail and never that far out in the future, but told Wall Street it would book revenues of between $725 million and $745 million in the third quarter, which obviously will set a new record – and one that will very likely have to be broken again in the fourth quarter. We will have a better sense of if this can happens in thirteen weeks, when Q3 numbers are in and if we are all back in lockdown again because of the Delta, Delta-Plus, and Lambda variants of the coronavirus. Who knows what 2022 will bring? The top brass at Arista Networks will give some sense of it before the year is out, but certainly not now. There are too many variables and unknowns.

mb

thank you, mb

So the difference in Arista and Cisco revenue r who?