What is a legacy data management and data analytics platform with 1,800 large enterprise customers worth? That’s a tough question to answer, obviously, but private equity firms KKR and Clayton, Dubilier & Rice have an answer when it comes to commercial Hadoop pioneer Cloudera: $5.3 billion.

This week, KKR and CD&R announced that they would together be shelling out $5.3 billion in cash to take control of Cloudera, which was founded in 2008 and became the largest of the commercial Hadoop platform providers, which went public in 2017, and which merged with rival Hortonworks a year and a half later to basically drive rival MapR Technologies out of the market and into the arms of a Hewlett Packard Enterprise that is not all that interested in being a software provider.

Private equity firms, whether they are privately held like CD&R or publicly traded like KKR, are a secretive bunch, so they did not elaborate much on why they thought Cloudera was worth taking private, removing it from the New York Stock Exchange after a decade long fight to get there and at the price that they struck to do the deal. Activist investor Carl Icahn, who has forced so many deals in his long history to either sell or breakup companies, owned 18 percent of Cloudera and compelled the board to give him two seats of representation on its board of directors two years ago and is no doubt instigating this deal. Ahead of the announcement of the deal this week, Cloudera had a market capitalization of $3.8 billion and $769.7 million in cash in the bank, so that $5.3 billion figure represents a pretty hefty premium at the enterprise value for the company when you do all the math. It’s on the order of a 75 percent premium, not the 24 percent everyone is quoting from the KKR and CD&R press release, which just looks at the stock price before and after the deal was announced.

Here are the interesting twists. Jeff Hawn, who has run a number of software companies – Attachmate (sold to Micro Focus), Quest Software (sold to Dell), and BMC Software (which was public and taken private by KKR) – was running Epicor Software, a provider of ERP systems for manufacturers and distributors that is itself a massive conglomerate, last year when KKR sold it to CD&R for $4.7 billion. Hawn became a partner at CD&R and will be chairman of Cloudera when the transaction is done, asserting the will of the private equity owners. Both KKR and CD&R are experts at snapping up legacy software and hardware businesses and milking them for profits; sometimes they turn around and sell them, sometimes they keep them and live on the fat.

Given the financial woes that Cloudera, Hortonworks, and MapR have had over the years in trying to first make a living off the open source Hadoop MapReduce platform created by a bunch of techies from Yahoo, Google, and Facebook and then extending this to become a data platform with more sophisticated analytics and machine learning capabilities, this seems an odd choice on first blush. But Cloudera is breaking through a $1 billion run rate and with a more aggressive cost cutting program, there is a chance that it could even go profitable. This would be the bet that Icahn and also KKR and CD&R are making. What seems clear is that Cloudera has been unwilling or unable to make such calls and has been spending a fortune on research, development, sales, and marketing to try to expand the reach of the Cloudera Data Platform.

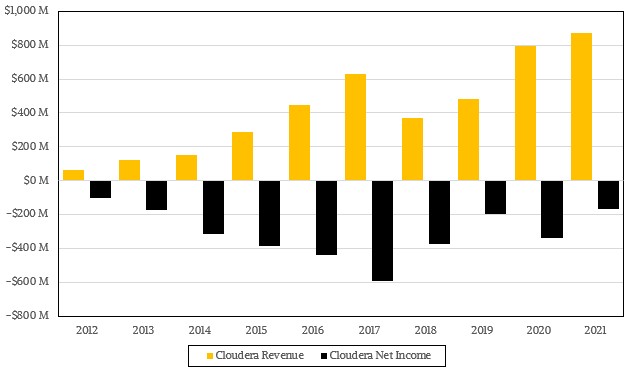

We drilled down into the financials, installed base, and total addressable market of Cloudera and Hortonworks when the two companies merged three years ago, and called it correctly that Hadoop needed to be a business, not just a platform. We are updating it here:

This data combines Cloudera and Hortonworks financials all the way back in time, as all financial reporting does not do and certainly should. No cheap and easy compares here, folks.

In many ways, the financial situation has not improved as much as it needs to at Cloudera and the customer base is smaller, too. So that is odd. When Cloudera and Hortonworks merged, the company had a fully diluted equity value of $5.2 billion, it had $500 million in the bank, no debt, and 2,500 customers. When Cloudera announced its financials this week for the first quarter of fiscal 2022 (which ends next January), it said it had 1,800 customers and had posted sales of $224.3 million and a net loss of only $40.4 million, and $468.2 million in debt. The value of the company is presumably fair at the $5.3 billion that KKR and CD&R are offering.

The loss of those 700 customers, which probably took years to cultivate, has not really hurt Cloudera’s top line or its bottom line. Which is peculiar, but it does show the resilience, of a sort, of the Cloudera revenue stream. And what we know about Hawn as well as KKR and CD&R when it comes to technology investments is that they collectively know how to take legacy businesses and pare them down to more profitability while maintaining or even extending their customer base. At that $5.3 billion price tag, this is an extension play and this is all about leveraging those 1,800 die-hard Cloudera customers and helping them create a modern machine learning platform. Because if we all know one thing, it is this: Most enterprises are not going to go grab open source code and weave it together themselves, any more than they did when Hadoop was all the rage and was all that you could use to try to tackle big data like a hyperscaler.

The funny bit is when and if Cloudera does turn around, we won’t be able to see it because it will be a private company. And considering that between fiscal 2012 and 2021, the combined Hortonworks and Cloudera businesses brought in $4.22 billion in revenues but posted cumulative losses of $3.06 billion, we really want to see how this turns around, and why, when it does.

We know one other thing, too. Having 1,800 enterprise customers is worth billions and billions of dollars on the face of it, and KKR and CD&R can do all kinds of things to build an AI conglomerate, much as Epicor was created from a hodge-podge of companies to create a conglomerate with dozens and dozens of products. Cloudera started off this week building itself out, snapping up Datacoral, which has a data management and integration SaaS service, and Cazena, which creates data lakes that span the public clouds, for undisclosed sums.

When a company stops focusing on research, development and market share, everyone but the few bankers monetising the existing assets lose. In this case the loss will likely be in the low billions. If necessary, companies directly affected can likely switch to a non-elephant themed map-reduce solution with better data analytics easily enough.