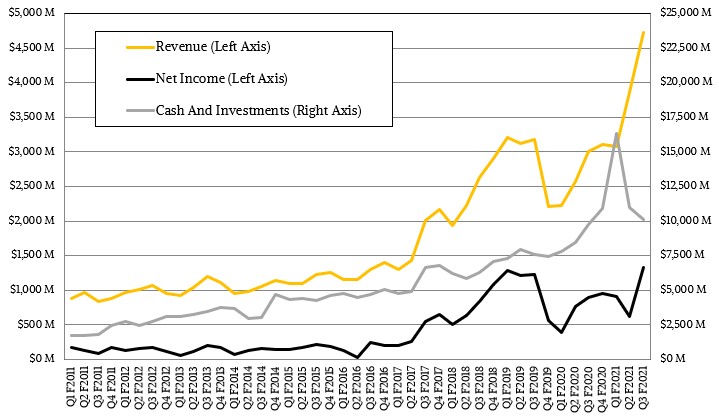

To one way of thinking about it, this is the best of times among the worst of times for Nvidia. Despite a global pandemic that has caused disruption in IT operations as well as spending among enterprises large and small and that has disrupted supply chains all over the IT sector, Nvidia has launched new products across the board and has turned in the best quarter in terms of absolute revenues and absolute profits in its history and is growing like a startup.

It is remarkable, really, that in the third quarter of fiscal 2021 ended in October that Nvidia grew revenues by 56.8 percent to $4.73 billion, and net income by 48.6 percent to $1.34 billion, comprising 28 percent of revenues. And it is a testament to great engineering and savvy marketing meeting so many different opportunities across different industries, workloads, and market segments. It shows what happens when insight creates innovation and turns that into great products and then into cash.

Drilling down into the results, Nvidia’s Compute & Networking group rose by a factor of 2.46X to $1.94 billion – we love when we shift from percents to factors in describing growth, which is rare in a company that has been around for two and a half decades – and operating income rose by a factor of 3.67X to $738 million, comprising 38.1 percent of revenues. Revenues were up 8.9 percent sequentially from the second quarter of fiscal 2021, ended in July, and operating income was up 6.8 percent sequentially. This was a record quarter for shipments of T4 GPU accelerators, which are predominantly used for virtual workstations and machine learning inference, and all of the big public clouds have bought their banks of Ampere A100 accelerators for doing AI and HPC workloads and they have only been activating them for public use for a few weeks so we are not sure yet how they will take off both for internal workloads or external ones used by cloud customers.

Nvidia’s Graphics group posted sales of $2.79 billion, up 25.2 percent, and operating income rose by 25.9 percent to $1.35 billion, representing 48.3 percent of revenues. This is roughly the same operating margin level that Intel’s Data Center Group, which sells server CPUs, motherboards, and chipsets, has attained for more than a decade. And as Nvidia’s co-founder and chief executive officer reminded everyone on a conference call with Wall Street analysts to go over the numbers, there are more than 200 million GeForce gamer customers in the world, and with Ampere offering twice the raw performance and AI-assisted rendering and ray tracing for increasingly life-like virtual worlds, this is a business that is going to just keep raking in the sales and profits. Both the Compute & Networking and Graphics groups will have their ups and downs, of course, depending on the state of global economies, product roadmaps, competition, and personal and commercial proclivities.

(Note: This is a new financial presentation format from Nvidia in the wake of its acquisition of Mellanox, and we need one more quarter of data before we will have eight quarters to chart out the new presentation, so hold tight until February for that.)

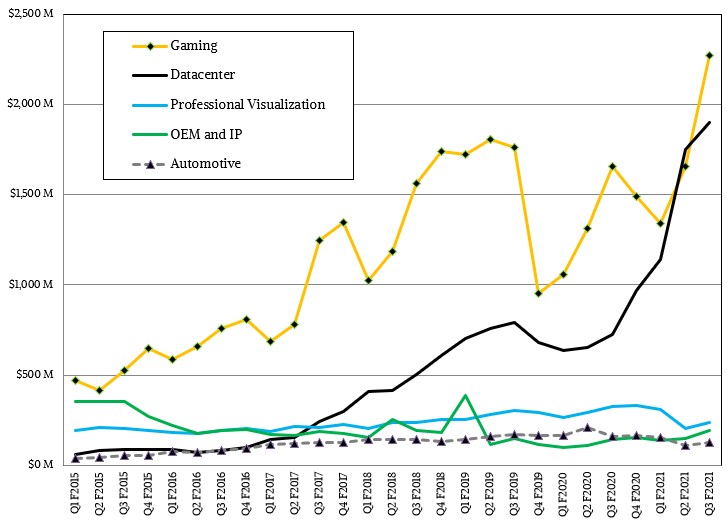

Nvidia is still using the older presentation of its business by divisions, and the Datacenter division, which includes Mellanox switches, network interface adapters, data processing units (DPUs), and network cables and transceivers now as well as GPU compute accelerators, GPU switches, HGX system boards, and DGX whole systems, posted sales of $1.9 billion, up 2.62X year on year and up 8.4 percent sequentially. Mellanox switching products comprised about 13 percent of overall Nvidia revenues, or about $614 million, bolstered significantly by a big acquisition of stuff by a Chinese OEM, widely believed to be Huawei Technology, which will not be a factor in the current fiscal Q4. (What precisely did Huawei buy? No one is saying.) The Mellanox business represented 32.3 percent of the Datacenter division’s sales at Nvidia in fiscal Q3, and if you take out the effect of Mellanox, then the Datacenter division “only” grew by 77.2 percent to $1.29 billion.

Looking ahead to the fourth fiscal quarter, Collette Kress, Nvidia’s chief financial officer, said on the call that the company expected for the Networking business formerly known as Mellanox would still grow by 30 percent year on year. Which is pretty good growth, and a reflection of the adoption of switches and adapters by the hyperscalers and cloud builders that represent roughly half of Nvidia’s Datacenter division revenues.

When pressed about the current environment, Kress said that Nvidia expected that sequentially, Datacenter division revenues in fiscal Q4 would be “down slightly,” with the compute products growing in the mid-single-digits as products like the “Ampere” A100 accelerator continue to ramp. If this is up, then Mellanox is the big thing that will go down. By how much, we cannot say, but if the Mellanox brings in around $500 million in business, at 5 percent growth for the underlying datacenter compute business leads to $1.35 billion in sales for this part of the Datacenter division and add them together and the whole shebang is $1.85 billion, down 2.5 percent sequentially. That will still be the second-best Datacenter division quarter in Nvidia’s history, and we think the real issue will be supply constraint more than underlying demand.

“Our growth, in the in the near term, is more affected by the cycle time of manufacturing and flexibility of supply,” Huang explained in reference to the prospects for the core datacenter business. “We are in a good shape, and all of our supply chain informs our guidance. But we would appreciate shorter cycle times. We would appreciate more agile supply chains. But the world is constrained at the moment. And so, we just have to make the best of it. But, even in that condition, all of that is built into our guidance, and we expect to grow.”

We think that if there had not been a global pandemic messing up supply chains and if the foundry partners that Nvidia has – mainly Taiwan Semiconductor Manufacturing Corp and Samsung Electronics – were not supply constrained themselves (separate from the pandemic), Nvidia would have turned in an even bigger quarter with more sales and profits.

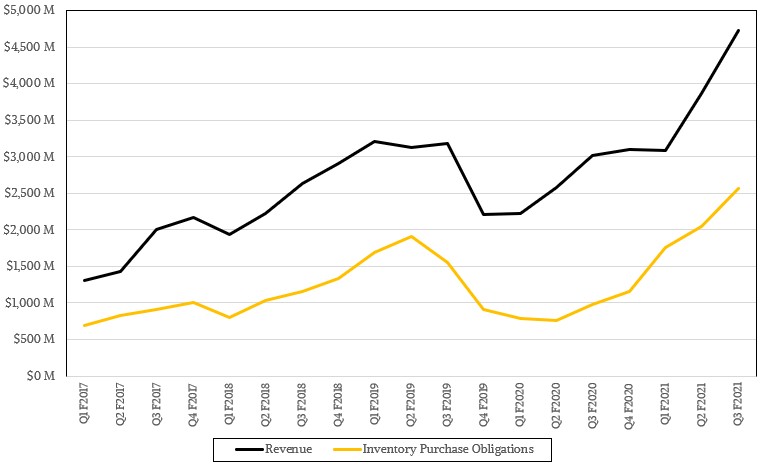

So how much supply constraint are we talking about here? It is hard to say. But we can sort of get a sense of the demand situation that Nvidia is planning for by looking at its inventory purchase obligations in its 10-Q quarterly reports and 10-K annual reports to the US Securities and Exchange Commission. This is essentially a measure of the purchase orders that Nvidia had outstanding as each quarter came to an end that are outstanding – meaning not yet paid – for materials that are used in its manufacturing of devices.

Here’s the ratio between the two as reported in the past four years:

Obviously, this inventory purchase obligations number has grown as Nvidia itself has grown, and sometimes the company buys more stuff than it can sell in the following quarters and has to burn off inventory – remember the explosion in GPU sales for cryptocurrency for both AMD and Nvidia and how quickly that dried up? Just for fun, we took this number and related it to the next quarter to see what the ratio might be and how it changes over time. Nvidia’s guidance for the fourth quarter of fiscal 2021 ending in January 2021 is for sales to be $4.8 billion, plus or minus 2 percent. Now, Nvidia has a habit of beating its guidance, so you have to take that with a grain of salt. But, if we look at the ratio between revenues in one quarter and the inventory purchasing obligations, that would imply a future revenue stream of $5.6 billion. (The ratio is 2.39, to be precise.)

Now, no one is saying that Nvidia will be able to capture all of that implied revenue. But this might be a good signal for demand. And by our math, we think if Nvidia hit the midpoint of its guidance, then Graphics group revenues will be just a tad under $3 billion and Compute & Networking group will have $1.85 billion in sales. And probably add 5 percent or so to that.

Be the first to comment