If you can’t beat the cloud, you had better steal all of its best ideas.

Three years ago at its Financial Analyst Conference, Cisco Systems outlined plans for shifting the business model for the company. Over the previous two decades, Cisco had become the dominant player in the datacenter networking market by selling switches, routers and other gear integrated with its software for such tasks as managing, monitoring, and securing the hardware.

But by 2017, Cisco – like other traditional enterprise hardware makers – understood the transformative nature of the public cloud and the need to adapt how it did business to the rapid changes that were reshaping the industry, from the cloud and proliferation of mobile devices to the Internet of Things (IoT), edge computing and the exponentially growing amounts of data being generated. And there were the ever-present demands for more speed, less complexity, more flexibility and lower costs.

Cisco at the time echoed what rivals like Dell, Hewlett Packard Enterprise, IBM and others also were saying, that they wanted to transform from hardware vendors to software and services providers, with a strong shift away from single upfront sales to recurring revenue driven by subscription, pay-as-you-go and similar plans. During a conference call in August, Chuck Robbins, Cisco’s CEO since 2015, noted some of the metrics the vendor had met since 2017: the goal of having 30 percent of its revenue come from software (it reached 29 percent in fiscal year 2020 but 31 percent in the fourth quarter), 50 percent of revenue from software and services in FY 2020 (it hit 51 percent) and 66 percent of revenue via subscription (it came in at 78 percent).

Robbins in August also spoke about a plan to make as much of its portfolio as possible available as a service, an initiative he said already was in motion.

“We’re even looking at how we deliver our traditional networking hardware as a service over time, so it is literally across the portfolio,” he said. “And we see an acceleration of some of the work that’s already been underway. Obviously, the collaboration portfolio has been transitioning to as a service for quite a while. We even launched … our hardware as a service in the collaboration portfolio as a pilot and we’ve been working hard on all the operational capabilities and the systems work that needs to be done to do that. It’s clear that many of our customers do want to consume the technology as a service … and I think we’ll have a lot of that in the marketplace by the end of the calendar year.”

Cisco’s move to an as-a-service model echoes what other top-tier hardware vendors are doing. HPE last year announced plans to offer its entire portfolio as a service by 2022, with its GreenLake platform playing a central role, and IBM for the past several years has moved away from the hardware business to focus more on hybrid clouds and AI, including selling its x86 server business to Lenovo in 2014 for $2.43 billion and, most recently, announcing this month plans to spin off its managed infrastructure services. For its part, Dell this month announced Project Apex, an initiative to make more of its offerings available as a service, starting with its new Storage-as-a-Service in the first half of 2021.

Fueling the shift toward services has been the rise of hybrid cloud environments and the need to grow beyond the datacenter and into the cloud. Most organizations see a future where some workloads and data run in multiple public clouds while others stay in traditional datacenters, and they want a seamless IT environment that stretches from on premises into the cloud. That includes creating a cloud-like environment – with all the scalability, agility and flexible consumption options – in the datacenter.

Public cloud providers are extending their reach down into the datacenter to play both sides of the hybrid cloud. That includes Amazon Web Services (AWS) with its Outposts hardware and Microsoft with Azure Arc and Google Cloud with Anthos, which both enable enterprises to run public cloud services on premises. Likewise, the as-a-service push is helping traditional datacenter IT vendors reach up into the cloud to enable single tools for managing on-premises and cloud environments and hardware and software offerings that can run in multiple clouds.

“It’s bi-directional,” Todd Brannon, senior director of datacenter marketing at Cisco, tells The Next Platform. “The key is openness. Customers want to harvest innovation from the cloud, wherever they find it. They like the machine vision on Google or database and more mainstream pieces on AWS. But effectively, you need to let their developers go harvest that innovation where they want to harvest it. The approach has to be fundamentally open. That’s our strategy. We want to be a neutral party, help customers who want to avoid cloud lock-in and harvest innovation. The common theme you see across everything that we’re doing here is integrating with all the cloud platforms in a neutral way to give customers that kind of choice.”

Prashanth Shenoy, vice president of marketing for enterprise, datacenter and cloud networking, IoT and developer platforms at Cisco, says enterprises are demanding flexibility and choice in the services they use and expect vendors like Cisco to have services they can use in any cloud.

“They are looking towards more cloud-agnostic vendors like Cisco to say, ‘Hey, provide me the right security, the right connectivity and the right services that I need and I’m going to pick the right application, things that are IaaS [infrastructure-as-a-service] or SaaS [software-as-a-service] services from a slew of choices that I have,’” Shenoy says. “That’s the hybrid cloud world that would be evolving. Organizations and vendors that provide those orchestration services, those security services and those application experience services, no matter which cloud and no matter where the workload resides – edge, closer to the user or public cloud or datacenter – are going to be the critical trusted IT partner in this evolution of hybrid strategy.”

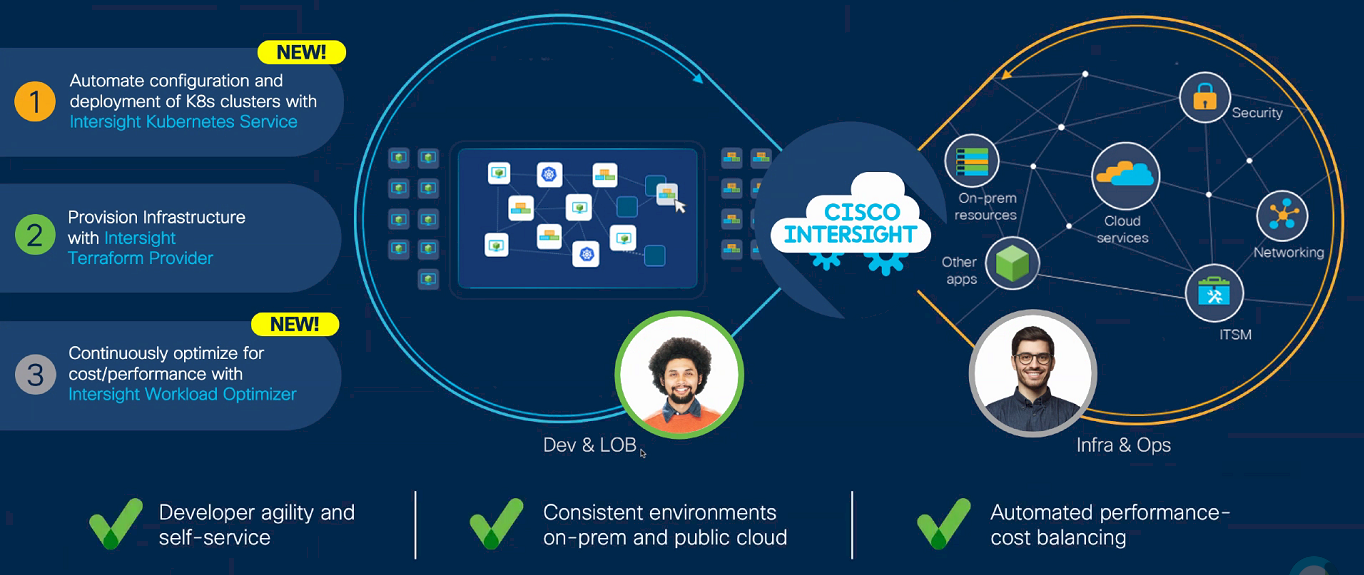

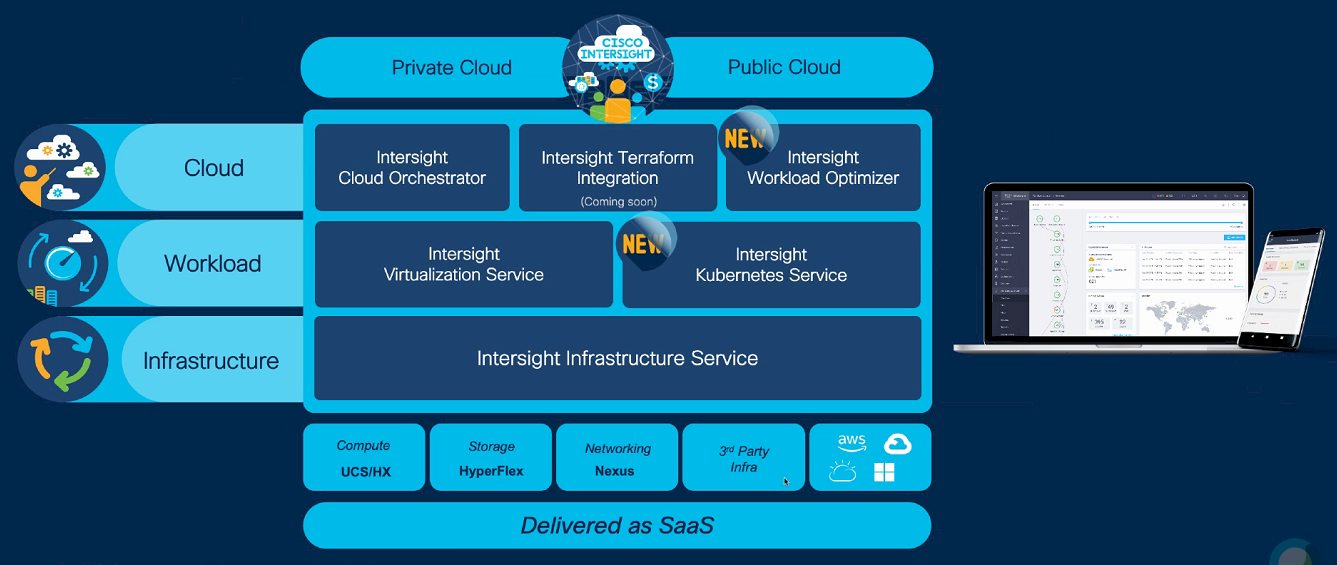

At its digital Partner Summit this week, Cisco is taking several steps in its push to strengthen its hybrid cloud play, build out the services it offers, simplify and automate operations from the datacenter into the cloud and network edge through software-delivered solutions. A key is evolving Intersight, which was launched in 2017 as a cloud-based systems management platform. The company is adding new features designed to make Intersight a hybrid cloud platform.

Those features include Intersight Kubernetes Service, which enables infrastructure teams to automate the management of Kubernetes and containerized applications, and InterSight Workload Optimizer, which enables enterprises to gain real-tie visibility and insights throughout the entire IT stack to help balance performance and costs. In addition, Cisco is integrating Intersight with its AppDynamics application performance management solution. A new functionality in AppDynamics called Cloud-Native Visibility helps monitor serverless functions and microservices in the public cloud, giving enterprises a tool for monitoring containerized and virtual machine (VM)-based workloads on premises and in the cloud.

“The first step is comprehensive visibility in the AppD team is expanded out into cloud-native functions,” Brannon says. “We have an integration there between Workload Optimizer and AppD. What we’re doing there is stepping in to keep the data together between the business tier and the applications tier and the infrastructure underneath and we create this common data lake between the products that basically gives you a single source of truth.”

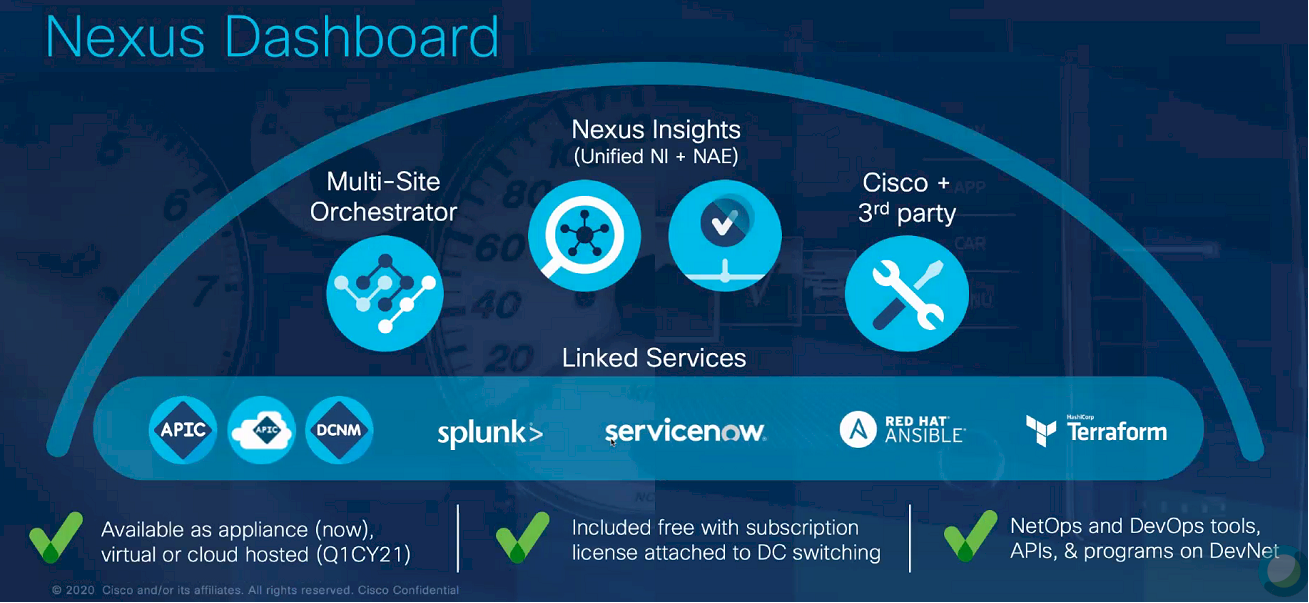

Cisco is also introducing the Nexus Dashboard, a single place for operating and managing in on-premises, multicloud and edge environments. Enterprises can use it for all infrastructure lifecycle tasks, from zero-day initial configuration and capacity planning to troubleshooting the entire IT infrastructure. It also can work with such applications as Nexus Insights (for automating. Monitoring and analyzing the network), Multi-Site Orchestrator (provisioning and health monitoring) and third-party IT tools. “The whole idea of this tool is to make the world of infrastructure and application and DevOps come a lot closer together,” Shenoy says.

In addition, Cisco is making infrastructure more quickly and automatically available to cloud-native applications, what Shenoy calls infrastructure-as-code.

“What that means is the moment an application is available, they should be able to go through a single API in a simple manner: Here’s the infrastructure requirements for this application,” he says. “Thanks to Ansible Playbooks and Terraform Providers, these are plausible. What we’ve done is made it very simple to call for those infrastructure resources either directly to the Nexus Dashboard or through the Terraform Providers. Make the silos between DevOps and the infrastructure ops broken so now it’s easy to provision applications or provision an infrastructure for these applications … whether it’s through Red Hat Ansible or Terraform.”

The Nexus Dashboard is available now as an appliance and will be available by the first quarter next year as a virtual instance and as a cloud-hosted platform that can be managed by any service provider, channel partner, or Cisco itself.

Be the first to comment