According to Hyperion Research, 2018 was a banner year for the high performance computing industry. And if the first half of 2019 is any indication, we may be seeing something close to a repeat performance this year.

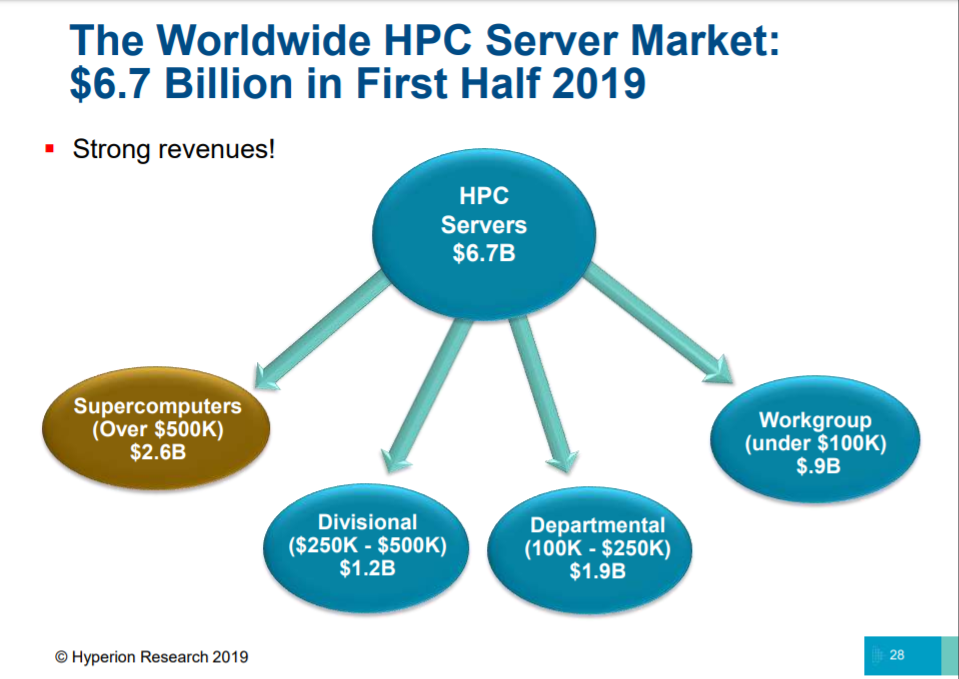

As Hyperion previously reported, $13.7 billion was spent on HPC servers in 2018, representing 15 percent year-over-year growth and a new high water mark. Server revenue in 2019 is already at $6.7 billion for the first half of year, a period that typically has less spending than the final two quarters. If that pattern holds true, the market would break $14 billion or possibly even $15 billion by the end of the year.

The first half server revenue has the biggest chunk ($2.6 billion) going to supercomputers of $500,000 or more and the smallest chunk ($0.9 billion) going to the workgroup segment. That segment, which represents systems costing less than $100,000, has remained essentially flat for the last 10 years or so. Initially Hyperion speculated that these smaller buyers were moving their applications into the cloud, but what they found was that this group is keeping their systems twice as long. And at this point, they’re not sure why that’s occurring.

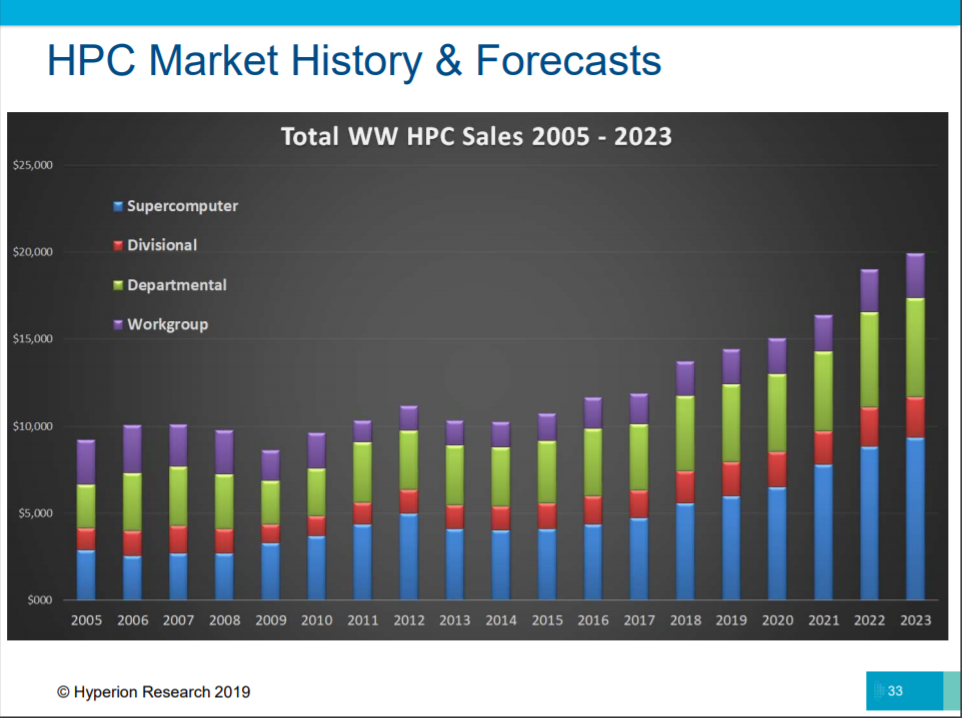

As far as the broader HPC market goes, Hyperion is sticking with its long-range forecast to 2023, the year when they believe overall HPC spending will hit $39 billion. That includes servers ($19.9 billion), storage ($7.7 billion), middleware ($2.2 billion), applications ($6.4 billion), and services ($2.8 billion).

One area of intense interest right now for Hyperion is the supercomputer category, not only because it consistently generates the largest revenue of all their system categories, but also because the upcoming exascale deployments are going to pump a lot of extra cash into this segment. Even one or two systems costing $600 million or more can make a big difference to vendors. And that’s true if you’re talking about HPE, the market leader, and even more so for a smaller player like Fujitsu. As a result, they expect the supercomputer market to be “fundamentally redefined in the next three to four years.”

The impact of the exascale system can be seen in Hyperion’s historical record for the different system categories, with their five-year forecast tacked on. In particular, the big jump in supercomputer revenue is visibly apparent in the 2021 to 2023 timeframe, when a large number of exascale systems are expected to be purchased.

According to Hyperion’s Bob Sorensen, between 2020 and 2025, they expect to see 26 exascale and near-exascale systems deployed, which will inject about $9 billion into the HPC market. In 2021 alone, the four or five machines that are slated to come online in Japan, the US, and China will be worth about $2 billion.

Sorensen thinks once this initial “exascale bubble” is over, there may be a return to more modest growth at the high end, the rationale being that these kinds of systems are just too expensive keep buying in bulk. In fact, we’re seeing that today with the slower turnover rate of leading-edge systems. The price tag on these machines has been increasing for some time, primarily because node counts are getting bigger, but also because the chips themselves are getting more expensive. “I think we’re going to see a certain slowdown, mainly because these big boxes are just getting very, very expensive,” explained Sorensen.

Nonetheless, Hyperion has been tracking some promising trends in the HPC marketplace, all of which are expected to drive stronger revenue growth in the long-term. One thing they are seeing is a profusion of new buyers from the enterprise space moving into HPC. And these buyers tend to be in fast-growing areas like business intelligence, personalized medicine, smart cities, fraud detection, affinity marketing, and IoT.

“What’s driving this is AI and big data,” explained Joseph. “And what they realize is that they really can’t effectively do that on non-HPC hardware, software, and systems.”

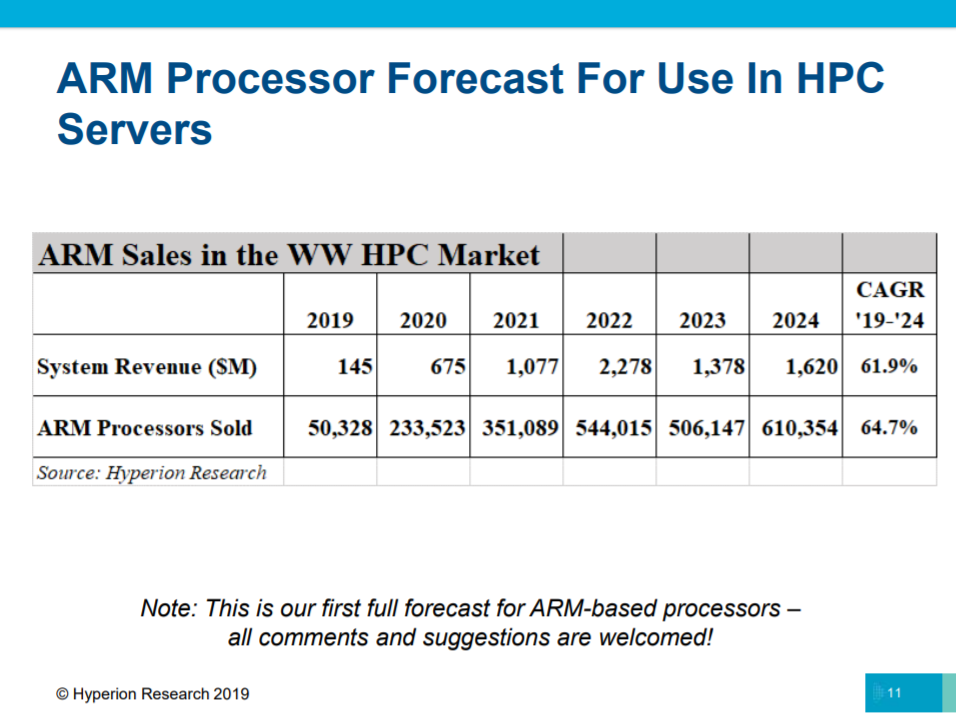

Another area they’re watching closely is the adoption of the Arm architecture. Based on surveys, they’re projecting Arm sales in HPC will grow by appreciably over the next five years, forecasting a 64.7 percent compound annual growth rate (CAGR) for these processors. Likewise, revenue for systems equipped with Arm chips is expected to grow at a 61.9 percent annual clip over this same period. That suggests we may be at a tipping point for Arm adoption in this space.

Joseph recalled the last big tipping point in HPC, when X86 processors became powerful enough to be suitable for server workloads. In a matter of a few years, from 2002 to 2005, they came to dominate the HPC market. Perhaps more importantly, the introduction of the X86 server also coincided with explosive growth in high performance computing. “The market almost tripled,” noted Joseph.

Of course, that was mainly due to the fact these commodity chips significantly reduced the cost of the servers compared to the more customized hardware that preceded it. For HPC to experience a similar phenomenon with Arm would require a similar improvement in price-performance and thus far that has not been evident.

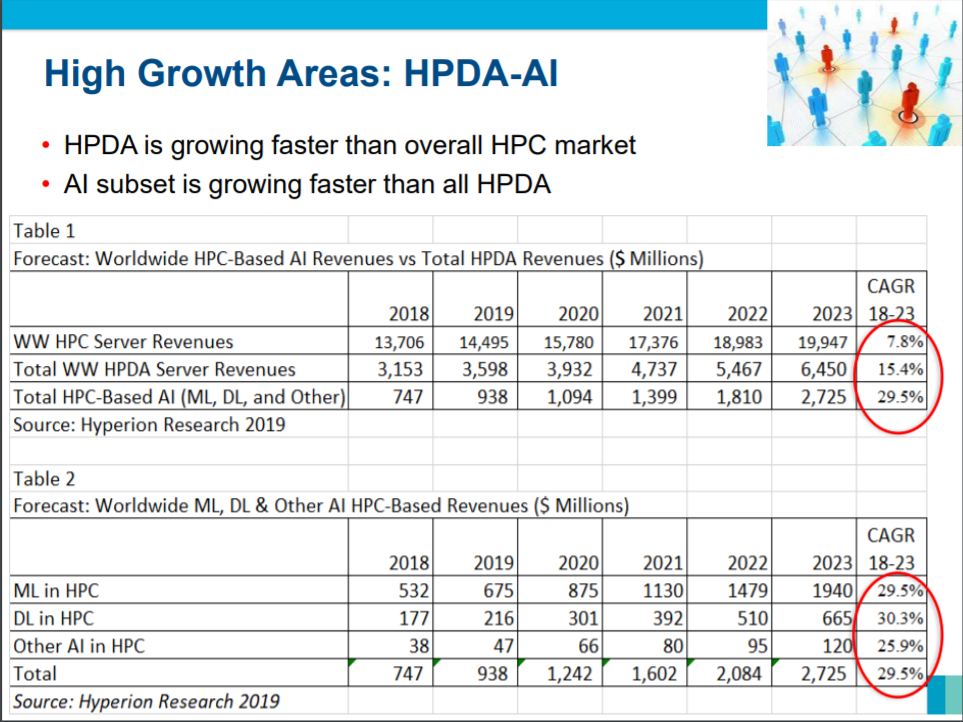

Another high growth area, and one that appear to be more clearly additive to the market, is the subset of HPC applied to artificial intelligence. From 2018 to 2023, Hyperion forecasts AI server spending will grow at a 29.5 percent CAGR – even more than the 15.4 percent CAGR that the high performance data analytics (HPDA) segment to which it belongs. Overall, HPC server spending is expected to grow at just 7.8 percent.

Nevertheless, Hyperion believes we’re still at the beginning of AI as far as capability goes. Today, most of these applications deal with bounded problems, like image or voice recognition and driving assistance. In the future, they expect to see applications addressing unbounded problems, such as discerning human behavior and performing fully automated driving.

They are also seeing that the emphasis is shifting from the training side of AI to the inference side. That is certainly borne out by the market dynamics of the space, with AI market research specialists like Tractica predicting that inference spending will be 3.5 times that of training over the next several years. Much of that inference deployment is expected to occur in edge computing environments.

From Hyperion’s perspective, most the of economically important use cases for AI will involve coupled environments in areas like automated driving and healthcare delivery. In these areas, decision-making will be performed by linking up endpoints like cars and medical devices with private clouds.

The other area that is taking off is HPC in the cloud. Hyperion is already seeing significant revenue growth in the first half of 2019 and thinks we are now at an inflection point for a major expansion. There’s a lot of ground to cover about how and why this is occurring – too much to detail here. We will be covering Hyperion’s analysis and forecast of this phenomenon in a future article.

Be the first to comment