The good news about having a diverse product line, as chip maker AMD increasingly does, is that the company operates like a multi-cylinder engine and that not all of the lines need to be firing full bore for the business to accelerate down its roadmap. The downside – and this is just life – is that some lines are declining as others are rising.

It is a rare moment when all cylinders are firing; when it happens cherish it, but it is not normal.

So it is with AMD during its second quarter. But no one will care much about how the custom processor business for Sony and Microsoft game consoles is a bit soft because all eyes are on the second generation “Rome” Epyc processors for servers, which are looming large. The Rome announcement is set for August 7, as AMD chief executive officer Lisa Su revealed during a conference call going over the numbers with Wall Street. This is what matters more than anything AMD has done in the past decade and a half.

During the Great Recession a decade ago, AMD basically ceded the datacenter CPU business to Intel and left the datacenter GPU business wide open for Nvidia to create and benefit handsomely from. But this time around, under the steady hand of Su, AMD has gotten its CPU and GPU acts together and is now generating approximately 15 percent of its revenues from products aimed specifically at the datacenter. Su says that in the second quarter, this datacenter business was more heavily weighted towards CPUs as it pushed first generation “Naples” Epyc processors into the Amazon and Microsoft public clouds and as it did initial customer shipments of Rome processors to unnamed hyperscalers and cloud builders. In the second quarter, even with datacenter GPU sales rising, server CPU sales rose faster and the CPU share of the AMD datacenter pie grew. Su said that in the second half of 2019, CPUs will get an even larger slice of the pie as Rome ramps further and ships in volume.

The ramp is not an explosion, but a ramp, and so Su tried to temper Wall Street’s expectations a little, and reminded everyone that AMD has seen the same tepid spending among the hyperscalers and cloud builders that has been affecting Intel in recent quarters. Intel was shipping new “Cascade Lake” Xeon SP processors, launched in April, so the slowdown is somewhat perplexing, but with AMD a slowdown is no surprise because everyone knew that Rome Epycs were coming in the third quarter of this year.

“Our plan was always very heavily second-half weighted,” Su explained on the call. “And from our standpoint, we have seen significant customer engagement and pull for the Rome product and we see a number of new installations that will come online over the next couple of quarters. So I believe that there is some cloud digestion that is happening out there. I also believe that given where we are from the product cycle standpoint, we are well positioned to grow.”

We previewed the Rome chip architecture last November, and talked about AMD’s renewed push into the HPC sector with Naples and Rome in April ahead of the Cascade Lake Xeon SP launch from Intel. AMD has had some significant wins with the Epyc chips and its Radeon Instinct GPU accelerators, notably the custom CPUs and GPUs that will be going into the 1.5 exaflops “Frontier” supercomputer at Oak Ridge National Laboratory – displacing both IBM’s Power10 processor and Nvidia’s future Tesla GPU accelerator – in 2021. The Rome chip will have eight chiplets, each with eight Zen 2 cores, all etched in the 7 nanometer processes from Taiwan Semiconductor Manufacturing Corp, wrapped around a central I/O and memory controller chip that is etched in the established 14 nanometer processes from GlobalFoundries. The combination creates a package with a maximum of 64 cores, eight memory controllers, and 128 lanes of PCI-Express 4.0 peripheral bandwidth – a very potent compute, memory, and I/O complex indeed and something that Intel cannot really touch at this point. (We shall see what the future “Ice Lake” chip holds when The Empire Strikes Back, as it always does.)

“Rome is on time and exceeding expectations, delivering leadership performance and TCO across a significantly expanded number of cloud and enterprise workloads,” said Su. “Customer excitement continues to grow. Compared to our first-generation Epyc processors, we have more than twice the number of platforms in development with a larger set of partners. We also have four times more enterprise and cloud customers actively engaged on deployments prior to launch. As a result, Rome is on track to ramp significantly faster than our first-generation Epyc processor. We are seeing particular strength in HPC where we offer leadership compute density and I/O.”

The shorthand is Rome has twice the integer oomph and four times the floating point oomph, clock for clock, as Naples, and it looks like it is driving twice as many platforms and four times as many customer engagements. (Funny synchronicity on those sets of numbers, but it is not causal.) On the cusp of the Rome launch, the datacenter products at AMD are probably driving around $230 million or so, and there are probably lots of consumer Radeon GPUs and some consumer Ryzen CPUs that make their way into the datacenter even if they are not formally part of the datacenter lineup from AMD. But we are discounting that at the moment. If Naples has been driving 60 percent of the formal datacenter business so far in 2019, then that works out to $114 million in Epyc processor sales in Q1 of this year (up by a factor of 6X year on year in our estimates) and $138 million in Epyc CPU sales in Q2 (up by 3.6X compared to the year ago period). This is before Rome has really kicked in and against increasingly tough compares as AMD has eaten a few points of server market share in 2018.

The point is, it is absolutely conceivable that AMD could soon be driving a $1 billion annualized run rate for server processors alone and hitting a $2 billion annual run rate is not out of the question. It is much harder to reckon how Radeon Instinct GPU accelerators will do, since the ROCm software environment is not nearly as mature and not exactly portable from Nvidia’s CUDA environment for its Tesla GPU accelerators. The software stack is something that AMD, Cray, and Oak Ridge will be working on with the Frontier system, and they are experts in CUDA and OpenACC programming so it will be interesting to see what Oak Ridge helps cook up that the rest of the IT community can benefit from. (This is how it is supposed to work.)

The initial shipments of Rome chips to the hyperscalers and cloud builders – we expect that Google was at the front of the line, since it was an enthusiastic buyer of AMD”s Opteron processors more than a decade ago – helped push CPU sales upwards sequentially from the first quarter. But this was not enough to offset the declines in custom processor sales for game consoles.

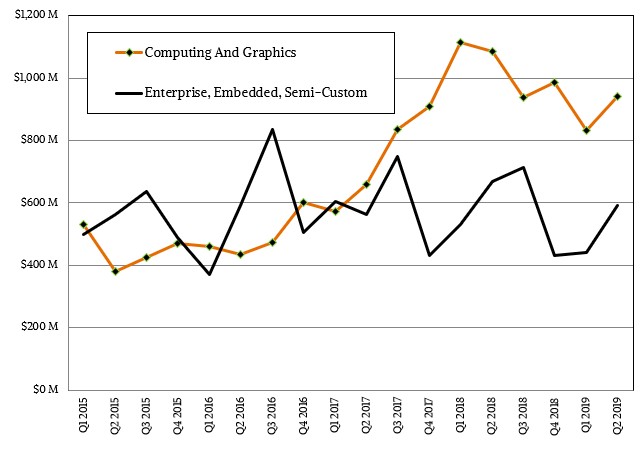

And thus, sales for the Enterprise, Embedded, and Semi-Custom group at AMD fell by 11.8 percent to $591 million in the quarter. As we said above, we estimate that datacenter products – Epyc CPUs and Radeon Instinct GPUs – accounted for around $230 million of this, up by a factor of 3.6X. This is now a presentative part of the AMD business, and it might behoove AMD to break this datacenter business out separately from the embedded and semi-custom businesses that it is lumped with currently in its financial reporting. The Enterprise, Embedded, and Semi-Custom group had a 29 percent jump in operating income in the second quarter, to $89 million, thanks to the combination, we think, of Epyc and Radeon Instinct compute.

Sales in the Computing and Graphics group, which includes Ryzen CPUs and Radeon GPUs aimed at PCs, fell by 13.4 percent to $940 million in the second quarter, mostly because of the buildup on GPU inventories in the channel that Nvidia has also experienced. Operating income for the Computing and Graphics group fell by 81.2 percent to $22 million.

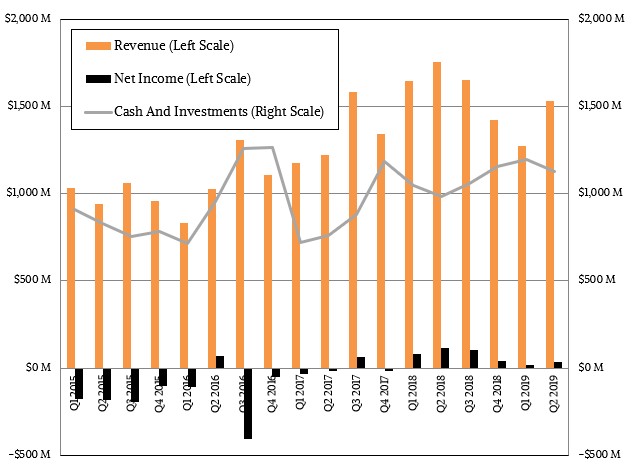

Add it all up and AMD had $1.53 billion in sales for the quarter, down 12.8 percent, and net income was $35 million, falling by 69.8 percent.

FYI All GPU sales, even ones going into data center, are classified in their COmputing and Graphics segment. Hence Radeons sold into the data center are not classified in their Enterprise,Semi-custom, Embedded segment as you wrote on n your piece.