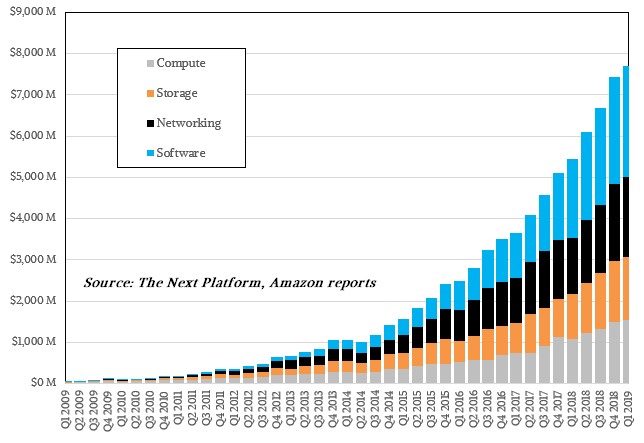

Considering all of the hundreds of different moving parts, as gauged by different types of features and services, that Amazon Web Services delivers on its public cloud, and the ever-increasing complexity of the AWS platform, it is pretty amazing that the cloud juggernaut can delivery pretty consistently growing revenue growth. Sure, there is a hiccup here and there, but if Amazon had executed as well in its online retailing business as it has in the public cloud, half the strip malls in America would be dead.

With an annualized run rate of over $30 billion, AWS has become one of the dominant platform peddlers not only here in the 21st century, but since the advent of data processing on electronic devices in datacenters five or six decades ago, depending on where you want to draw the lines.No single Unix platform was ever as big as Amazon, and even IBM’s system business, viewed in the totality of its System z mainframes and Power Systems server lines and the systems software and support and financial services that are wrapped up with them, is now smaller than the AWS cloud.

In fact, there are very few companies left that provide complete platforms, and even fewer that have the kind of scale that AWS brings to bear and keeps expanding. The “real” Intel datacenter business, which is comprised of server chjps, chipsets, motherboards, whole servers, various network adapters and switches, flash and 3D XPoint memory, FPGAs, some IoT wares, and some systems software and compilers, is also smaller than AWS and, importantly, is not a complete systems business in that Intel doesn’t really control a software platform such as Linux or Windows Server and their virtualization and container extensions so much as provide the chippery that others use to build hardware that in turn runs this systems software.

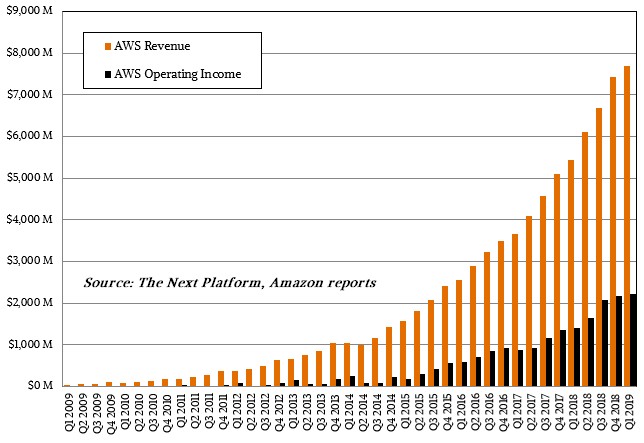

The explosive, triple digit growth that AWS enjoyed in the early days is long gone, way back in 2011, and the company is settling into a pattern of quarterly growth rates of between 40 percent and 45 percent. This is the same growth rates that the ODMs that supply the hyperscalers and cloud builders have settled into, and that is no coincidence.

This is well above an order of magnitude better growth than the IT industry as a whole is experiencing, and that means AWS is eating market share and upsetting established markets left and right. But this pace is still hay taking over a garden or birch trees entering a field, not a hurricane even though it sometimes feels otherwise. The IT sector accounts for $3 trillion in spending every year, and it is helpful to remember just how small $30 billion is against that figure.

It is also helpful to remember that very few IT vendors today have a systems hardware business that drives more than $4 billion or $5 billion in sales, and very few of them can deliver a complete stack as AWS can. You can use Amazon’s Linux on virtual compute instances and never bother with other Linuxes or Windows Server, and we have no idea how prevalent the AWS Linux AMIs are out there in its EC2 installed base. Even in its heyday, back in the late 1980s and early 1990s, the IBM mainframe line probably only drove somewhere around $35 billion to $40 billion in revenues for Big Blue, and it won’t be long before AWS crosses that threshold. Now, if you inflation adjust that over 30 years, then IBM’s platform was generating somewhere between $68 billion and $78 billion in sales, so to be fair, it will probably take a few years before AWS can claim the worldwide systems title for all time. Sometime around late 2020 and early 2021 should do the trick at current growth rates, which we believe AWS can hold.

It is still early days in the public cloud, and there is nothing quite like early mover advantage and a relentless pursuit of innovation to keep AWS ahead of its competition, which is Google, Microsoft, IBM, Alibaba, and Tencent for the most part as well as on premises datacenters that are trying to keep up.

In the first quarter of 2019, sales at AWS rose by 41.4 percent to just a smidgen under $7.7 billion, and operating income for the cloud business rose at a considerably faster rate as it has been doing since early 2018, when AWS started worrying as much about squeezing more efficiencies out of its iron and the datacenters that wrap around them as it did trying to build more raw capacity in new datacenters and regions. Operating income rose, in fact, by 58.8 percent to $2.22 billion, and comprises 28.9 percent of revenues. It is hard to say for sure how AWS looks from a net income perspective because we don’t know how to allocate costs, but it is not hard to imagine that AWS is perhaps as profitable and maybe even twice as profitable as the rest of the Amazon business, which is focused largely on electronic retailing and related devices and services. Amazon overall had $59.7 billion in sales, up 17 percent, and operating income more than doubled to $4.42 billion in the first quarter. But if you back out AWS from Amazon, the remaining Amazon businesses had $52 billion in sales and generated $2.2 billion in operating income. In other words, AWS is as profitable, at the middle line, as the rest of the Amazon businesses added up, which are 6.8X as large. That is another way of saying that AWS is 6.8X as profitable as those non-AWS businesses at Amazon.

At what point will Wall Street start clamoring for “unlocking the value of AWS” and spinning it out? This would be a patently stupid thing to do, because all it would do is deflate the rest of the Amazon businesses. But stupider things have happened. And activist investors are in it for themselves and for the short term, not for companies or markets.

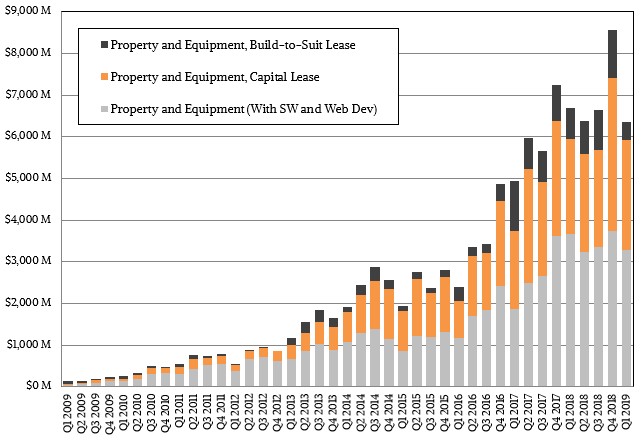

The capital investment spike in the fourth quarter of 2018 is very obvious in the chart above, and so is the drop back down to lower levels. It is not possible to separate investments in the warehousing operations from the retail business from the investments in AWS hardware, software, and datacenters, so this data is only presented as a kind of proxy for capital spending by AWS. But Brian Olsavsky, Amazon’s chief financial officer, did offer some insight into how AWS thinks about its capital investments.

“It is more than leading through excess capacity,” Olsavsky explained. “We have some really impressive gains and efficiencies in both the warehouses and also the datacenters. We talk efficiency. And every percentage utilization in our datacenters is worth tens and more millions of dollars. So again, that is a big part of our model. It is not only investing, but also working on efficiencies, and adding new products and features for customers. And as we lower costs, we pass those along to customers, either through new rates or new deals that we have. So I would say that I would look back on the performance in 2018 and say that that was great work with a lot of efficiency as we also banked a lot of capacity that had been built previously. Moving forward, that’s why I say it will be increasing as we move through the year. And that will be a constant battle between growth, geographic expansion in AWS, and also efficiencies to limit how much we actually need. I think we are also getting much better at adding capacity faster, so there is less need to build it six to twelve 12 months in advance.”

If Amazon is working to get better at all of these things, you can bet the that remaining Super 8 hyperscalers and cloud builders are doing just the same – as they have been doing for the past decade. It would be enlightening to see how far they have been able to push it, and to calculate just how much inefficient use of on premises IT infrastructure revenues have been lost with the rise of the public cloud.

wall street can go screw itself, that’s one way to be activist.