At some point, every company that has equity, venture, or public investors, has to start being profitable. Nutanix, the pioneer in the hyperconverged storage arena was founded in 2009, dropped out of stealth in the summer of 2011 with its first product, and went public in September 2016, is growing fast but it is getting further away from profitability, not closer.

It helps to have lots of money in the bank to remain calm under such circumstances, and Nutanix certainly does, having closed out its fourth quarter of fiscal 2018 in July with $934.3 million in cash and investments, with $230 million of that coming from its initial public offering; there is another $631.2 million in deferred revenue on the books. The equity investors who pumped in $393.7 million into Nutanix between 2011 and 2016 have presumably gotten their bait back and then some, with Nutanix having a valuation of around $2 billion before it went public and $9.55 billion today as we go to press. Dheeraj Pandey, one of the company’s co-founders and its chief executive officer and chairman, is more concerned with building a large company with a long and profitable life than in short-term return on investment, but Wall Street is rarely that patient.

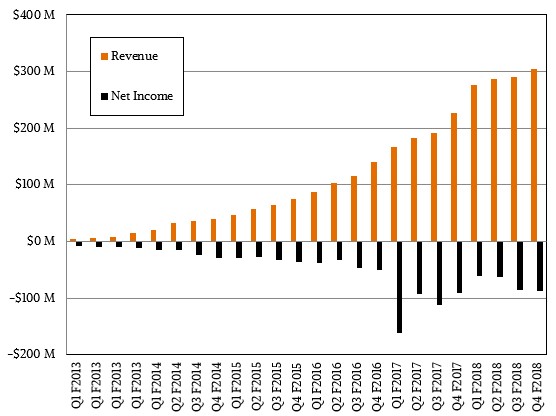

Nutanix has done a remarkable job in orchestrating its rise in the enterprise, creating a compute and storage platform that is not really as inspired by Google and other hyperscalers as many like to believe but is more like what VMware had to become to stay relevant to the enterprise. And the fourth quarter, where Nutanix grew revenues by 20.3 percent to $304.8 million, represented some pretty big milestones. The company had sales of $1.16 billion, including some hardware passthrough sales of $169 million, to break through the $1 billion barrier, and it also has accumulated 10,610 cumulative customers to date, rivalling the size of the vSAN virtual storage installed base from VMware but nowhere close to the 500,000 customers that VMware has overall for its server virtualization stack.

Nutanix more often than not is competing against VMware in the enterprise, but what the company is measuring itself against is Red Hat, the largest commercial Linux distributor and the largest and most profitable provider of support services for a cornucopia of infrastructure software.

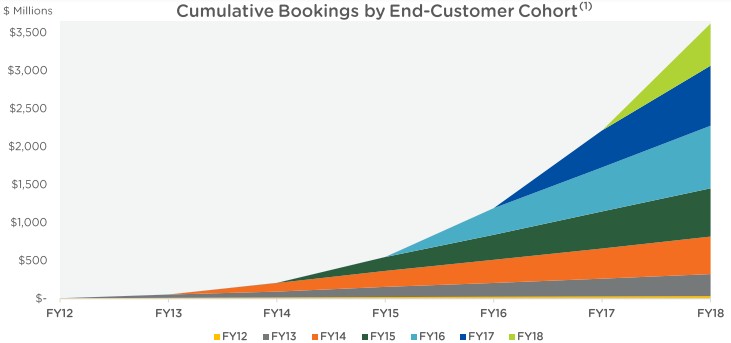

“While both Red Hat and Nutanix leverage open source, at our current pace, we expect to achieve Red Hat-like sales by fiscal 2021,” explained Pandey on a recent call with Wall Street analysts; to be precise, Nutanix is telling Wall Street that it will have at least $3 billion in billings during 2021, three years from now. “That’s in about half the time it took them because of our emphasis on last-mile problems of enterprise-grade reliability, consumer-grade design, and our innovation in data and orchestration services.” Pandey added that Nutanix Files, a network file services layer for the Enterprise Cloud Platform formerly known as Acropolis File Services, took one-tenth as many engineers and one-tenth the time to build as NetApp’s ground-breaking filer software, and that Acropolis Hypervisor (AHV for short, and a variant of the KVM hypervisor tuned for its virtual SAN stack) takes one-tenth the number of engineers as VMware’s ESXi hypervisor and took only a few years to build as opposed to the two decades it took for VMware to get a full-on virtualization layer with today’s capabilities.

These comparisons are apt, even if they are not precisely fair. VMware is doing its own work, and was a pioneer in many areas while Nutanix is basing the extensions of its core virtual server-SAN hybrid mashup (which most definitely is not open source) on open source technologies. It is an interesting business model, and perhaps one that can be profitable in time. But the losses continue at Nutanix, and that is a caution. In the fourth quarter, Nutanix booked a loss of $87.4 million against its $224.65 million in product sales and $79.1 million in support and services sales. For the year, Nutanix has booked losses of $379.6 million against that $1.16 billion in revenues. Cumulatively over the past six years (fiscal 2013 through fiscal 2018, inclusive) the company has brought in $2.77 billion in sales but $1.17 billion in losses. The initial venture and stock IPO certainly helped cover a lot of those losses – about half – and the money in the bank more than covers what is left.

The penetration that Nutanix is getting among large enterprises is, at first glance, a good sign. But the large enterprises that Nutanix is chasing – as are VMware and Red Hat with similar infrastructure software stacks – might be as much the problem as they are the solution. The hyperscalers and large public cloud builders write their own infrastructure software and command the lowest prices in the industry for physical servers and storage, and large enterprises tend to get much better deals that small and medium businesses that do not buy in high volume and therefore cannot get the deep discounts. The company has 710 customers in the Global 2000, which is a very respectable 35.5 percent penetration, more than double what it had two years ago and if all things go on the same trajectory, it will have whatever piece of the Global 2000 it can get within the next two or three years or so.

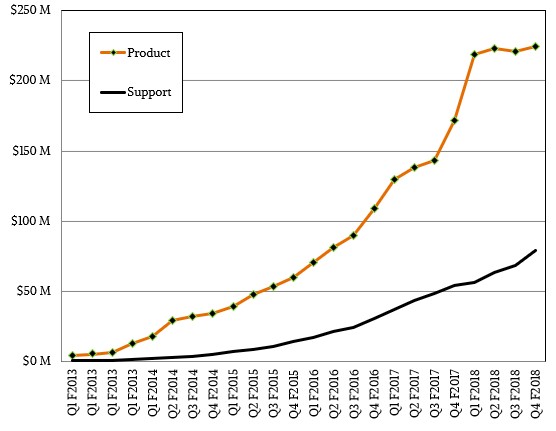

Still, at the current rate, Nutanix will never reach the 500,000-strong customer base that VMware enjoys, much less the millions of customers that Red Hat has. Nutanix is a complete platform play, which makes it hard to dislodge the hodge podge of best of breed stuff installed at large enterprises. Nutanix may reach the revenue levels of Red Hat and then VMware at some point, but it is not clear that the company will be as profitable as either. A lot depends on how much enterprise customers spend and how they return. It also depends on how Nutanix gets product sales growing again. As you can see from the chart below, product sales at Nutanix have gone flat at around $225 million per quarter:

The growth was tapering off in fiscal 2017 and then accelerated to a new level in a few quarters, and perhaps it can do it again. There are something on the order of 50,000 large enterprises in the world – this is where The Next Platform focuses – and tens of millions of small and medium businesses that would be well served by something akin to Enterprise Cloud Platform. Many of them will be using a public cloud of some sort and won’t have on premises iron, which is why Nutanix is building its own public cloud, called Xi, that is initially starting out providing disaster recovery services.

In the meantime, getting more of the Global 2000 and then the Global 10000 is what Nutanix is going to concentrate on, driving revenues and repeat sales. In the fourth fiscal quarter, Nutanix had 23 deals worth more than $1 million, who had a collective lifetime spend with Nutanix of more than $5 million each. Nutanix has 240 customers that have spent more than $1 million. The numbers can get quite large. One of its largest customers, in the healthcare industry, used Nutanix for remote and branch offices initially and then decided to refit the entire datacenter with Enterprise Cloud Platform; this healthcare firm has invested more than $10 million with Nutanix. The largest deal it has done to date, with one department in the US Department of Defense, was for $20 million. Such investments are on par with large academic and government supercomputing centers, just to give it perspective. One French multinational company has invested more than $20 million in Nutanix gear so far, and has more than 20,000 virtual machines under management.

This list goes on and on.

In the short-term, Nutanix has been shifting from selling appliances to selling software and eliminating the hardware passthrough from its books. In the past, Nutanix offered software licenses for its software stack on its appliances that were not perpetual – living on forever and portable across devices – but rather tied to specific devices and their economic and technical life in the field. Going forward, Nutanix will sell subscriptions to its software stack based on subscriptions of one, three, or five years that are not tied to any particular device. So some of that flatlining of sales we see in the chart above is really the company pulling out hardware sales.

But the shift is more than that, as Pandey explained. VMware crams a lot of its functionality into the ESXi hypervisor – in the kernel, to be specific – and it is software that it develops on its own; they also sell perpetual licenses, not subscriptions, so VMware has to continually resell to a portion of its base to keep the money coming in. Nutanix, by contrast, does a lot of its code above the KVM hypervisor in the Linux user space, and it is shifting to a subscription model where everyone will pay monthly or annually for one, three, or five years. (Probably three years, akin to the typical Enterprise Cloud Platform support contract these days.) And importantly, Nutanix gets to position itself as the Switzerland of servers, a role that VMware played for many years to its great benefit and which is harder for it to do, to a certain degree, now that it has been owned by Dell for nearly three years.

“We can’t lean too much to one side in this multi cloud world,” Pandey explained. “Customers are looking for a cloud, not the cloud. There is a reason why VMware didn’t want to be part of Dell. They had to be the Switzerland of servers. But what about looking at cloud as the new server? Doesn’t someone need to play the Switzerland of clouds and make money like VMware did a decade ago? That’s our strategy, and that’s how we’re differentiated against VMware.”

VMware will be pretty tough to dislodge from datacenters, but then again, so were the Unix businesses of Sun Microsystems, Hewlett Packard Enterprise, and IBM, which have been relegated to legacy status and largely replaced by Linux or Windows Server platforms that cost a lot less. For many enterprises, the consistency and simplicity of what Nutanix is building will appeal more than the broad flexibility that VMware has with its stack – there are so many different ways to skin any cat. Sometimes, having too many choices hurts more than it helps.

The competition between Nutanix, Red Hat, and VMware will only get more intense, and that will only put pressure on profits if these players run into each other in a lot of deals. Enterprise datacenter managers would do well to bring all three parties in on any deal, and cause the prices to go down as the competition goes up. This will, of course, make it all that much harder for all three companies to bring some black ink to the bottom line. But that is their problem.

Be the first to comment