Given the rollout of the “ZZ” and “Boston” variants of its Power9 systems, which are aimed at customers who are building clusters and at midrange enterprises that use a Power System server as their main back-end system, you might be expecting for the Power Systems line at IBM to have had a big bump in the second quarter of this year. Particularly against a relatively easy compare and especially with close to 10,000 nodes of the Power AC922 system being booked once the “Summit” and “Sierra” supercomputers built by IBM were accepted by the US Department of Energy.

But that apparently did not happen.

Still, as measured at constant currency exchange rates – meaning use the same exchange rates to the US dollar from today and apply them to revenues from around the world from the year ago period as well as to the current period, thus removing the effects of currency exchange rate changes – the Power Systems server business had a 4 percent revenue bump in the second quarter, according to Big Blue’s latest financial report.

IBM is obviously quite product of the fact that it delivered two pre-exascale systems based on the Power9 processor to the DoE, albeit we would point out that they were stood up about six to nine months later than the initial plan. This happens in HPC, and that is the very nature of HPC, so we don’t get bent out of shape about it. This is what it means to be on the bleeding edge and to take risks as IBM is certainly doing with its Power9 machines. But it sure would have been good for the Power9 ramp if IBM had been able to ship Summit and Sierra and book the revenue last fall instead of in the early summer. IBM has never said why it took so long to ship the Power9 iron, but we suspect that there were similar delays with volume shipments of Nvidia’s “Volta” Tesla V100 accelerators – we stress the word volume, since these two machines had 44,928 of these GPU units installed – that caused the delay. The important thing is that IBM and its partners, Nvidia and Mellanox Technologies, got the machines done in May 2018 rather than in October 2017 as expected. Intel was supposed to ship the original “Aurora” pre-exascale system based on its “Knights Hill” manycore processor and based on the Cray “Cascade” architecture with Omni-Path 200 interconnects to Argonne National Laboratory, and this machine was scrapped for reasons that Intel, Cray, and Argonne have yet to explain.

IBM turned in its test a little late, and Intel asked for more time to study and to take a harder exascale test in the future. The US needs a second exascale supplier so badly to mitigate risk that it agreed. The Aurora failure has hurt both Cray and Intel, but we are confident that Cray will rebound with a broader set of architectural choices that do not tie it so closely to Intel. It remains to be seen what Intel will do, and if it will prevail as a vendor of supercomputers.

In any event, the rise in Power Systems sales coincides with improving financials for Big Blue on many fronts, and that is a pretty good indicator that the core 3,000 or so large enterprises, which The Next Platform cares about because they drive IT innovation, too, that IBM serves are feeling pretty good about the company and the economies at large. This is as good as it is going to get as chairman and CEO Ginni Rometty is no doubt preparing to name a successor as she reaches the traditional retirement age of IBM’s top executive this year. We think that Tom Rosamilia, who comes out of IBM’s mainframe heritage but who spearheaded its wildly successful WebSphere middleware family, who did a massive reorganization of IBM under Rometty, and who has run its systems and software business units for years, is the obvious choice as the next chief executive of the company.

In the second quarter ended in June, IBM’s overall revenues were up by 3.7 percent to just a tiny bit more than $20 billion, and net income rose mostly in parallel by 3 percent to $2.4 billion. IBM ended the quarter with $10.74 billion in cash, which is pretty good, but it has $7.65 billion in short-term debt and another $37.85 billion in long-term debt, the latter being mostly associated with its vast Global Financing business, which helps grease the skids when IBM peddles its hardware, software, and services to large enterprises. (Very few large organizations want to own large systems or clusters these days, not when the cost of borrowing is so low and not when a lease or financing converts what would be a capital expense into an operating one.)

IBM does not break out revenues for its Power Systems and its System z mainframe servers individually, so we don’t know how much each line brings in, but we do know that Power Systems was up 4 percent and System z was up 112 percent, thanks to the pent up demand ahead of the z14 processor upgrade cycle, which is now being fulfilled. For whatever reason, the Power9 business is not seeing the same revenue bump, and a lot of that has to do with competitive pressure from X86 platforms. The 5,000 or so companies that are using System z mainframes are doing a lot more stuff with them – particularly with Linux partitions for new kinds of workloads. IBM has tried to push Power clusters for in-memory, machine learning, HPC, and other advanced workloads, but has not seen this kind of growth. (Imagine what the quarter would look like without Summit and Sierra in the June numbers.)

IBM’s overall systems sales to external customers – which includes the servers, the networking, and the operating systems that go with the iron – rose by 24.6 percent to $2.18 billion in the second quarter, and the company sold another $242 million in systems to other IBM groups for their own products and services, up 36.7 percent. Overall system sales were therefore $2.42 billion, with pretax income of $346 million, up 4.7X from the year ago period and a hell of a lot better than the $204 million pretax loss that IBM Systems had in the first quarter even with the System z14 upgrade cycle humming along nicely.

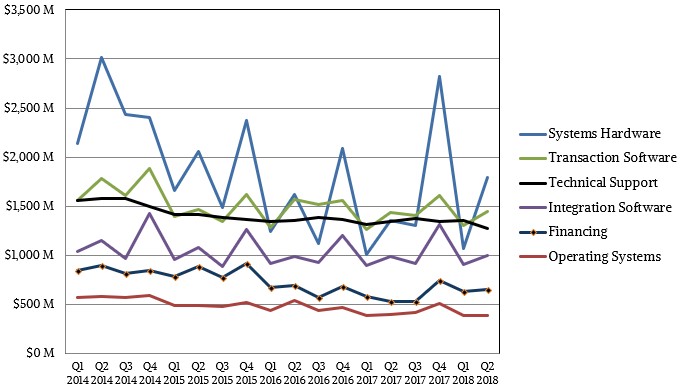

IBM sells a lot of software and services, of course, and here is what the breakdown by product type looks like over the past several years, including the latest quarter:

The mainframe generational changes drive some pretty large spikes in sales, as you can see. It is unclear what the curve looks like for Power Systems, but it probably has a similar shape, sometimes out of phase with the mainframe, sometimes in phase with it as it is now.

It is important to not gauge IBM’s commitment to its server hardware business by that business alone, since Big Blue derives so much of its profits from ancillary storage, tech support, software, and financing businesses that are in turn largely dependent on its systems installed base. Without the ongoing investments in hardware, all of this adjacent business would stall and eventually collapse, as has happened with most other proprietary and RISC/Unix platforms. The fact that IBM has these adjacent businesses is why it can continue to be in the systems business, making its own processors and building most of its own iron. IBM sometimes gets some help, as with the latest Boston Power9 machines that are actually rebranded Supermicro designs, but builds the “Newell” Power AC922 system that is at the heart of Summit and Sierra, launched last December, as well as the mainstream “ZZ” Power Systems S, L, and H class servers, which debuted in February of this year.

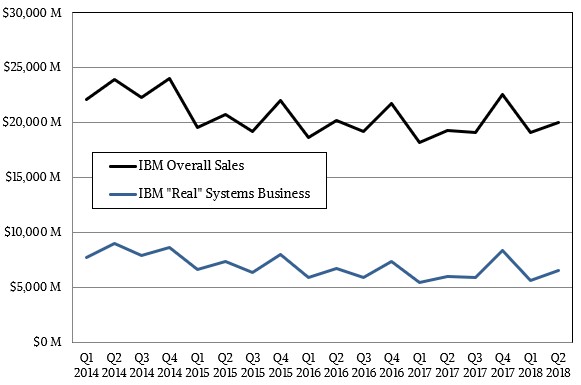

Only IBM knows for sure how much business it drives with its indigenous systems business, but we take a stab each quarter in trying to figure it out. This “real” systems business does not include relational database and middleware software, or applications, but just the core system hardware, add-on storage, operating system, transaction processing software, technical support, and financing. If you make some guesses about how much of the adjacencies is driven by Power Systems and System z iron – we think all of the systems hardware, operating systems, and transaction software goes in here, plus 90 percent of the integration software, plus 75 percent of the tech support and financing – then IBM’s “real” systems business had $6.54 billion in sales in the second quarter, up 8.4 percent year on year and representing 32.7 percent of revenues. The database software – what IBM now lumps into Cognitive Systems – is not included here, but if you did, it would probably push indigenous systems well above $10 billion. Heaven only knows how much additional integration and outsourcing services IBM sells on top of this for its own systems.

Anyway, ignoring databases, other higher level software, and services, we think that $6.54 billion drove around $3.6 billion in gross profits, which is 55.1 percent of that revenue segment and 39.2 percent of its gross profits.

This is a big and important business for Big Blue, and many large enterprises and quite a few HPC centers depend on this to continue to be true for the foreseeable future. This real systems business at IBM has been shrinking for more than two decades, but as the chart above shows, IBM has been able to stabilize it. Now, the question is whether it can get the Power Systems business to take a bigger bite out of the datacenter and exhibit the kind of explosive growth it engineered against Hewlett Packard Enterprise, Sun Microsystems, and others back in the 2000s. IBM has done a good job getting the price/performance of Power machines in line with X86 alternatives, it has created a Linux ecosystem while preserving its IBM i and AIX bases, but it is not riding the explosion in server spending to the same degree that other vendors are.

Be the first to comment