Hewlett Packard built up its conglomerate in the 2000s in good faith, trying to be a larger and more profitable supplier of IT products and services. And it has trimmed back to the enterprise hardware core in an effort to become more focused and relevant to enterprise datacenters – the companies that don’t demand the HPC or hyperscale bloodletting – and who still have to pay a premium of sorts for infrastructure.

This is a tough business, infrastructure, and it is getting tougher all the time. It is easy to play armchair quarterback on what the company that is now called Hewlett Packard Enterprise could have and should have done. The only clear failure that we can see is that the original HP shelled out a whopping $10.7 billion to buy data analytics software maker Autonomy back in 2011, subsequently having to writeoff $8.8 billion of that investment. One could argue about the $13.9 billion that HP spent on Electronic Data Services in 2008 to try to build out a services arm like Big Blue has, and that was six years after it spent $25 billion to acquire PC and server volume leader Compaq, which had just enough of a datacenter services business to give HP a taste for it.

The datacenter is the HPE’s main place of business now – it has nothing to do with consumers – and it will do the best it can under the circumstances, just like every other supplier to the glass house. This ain’t the iPhone racket, this ain’t making money off printer ink, and IT shops have never been more savvy and more demanding even if they are less cut-throat about price/performance and cost containment than the hyperscalers and cloud builders.

In the second quarter of fiscal 2018 ended in April, HPE showed some improvement in profitability, but a lot of that had to do with passing on the costs of DRAM and flash memory to customers as the price increases that have been crushing all server makers for the past year and a half are leveling off. HPE has spun off that services business and a big chunk of its software business, and the new HPE under Antonio Neri, the company’s relatively new chief executive officer but a 23 veteran of the company, is quite a bit skinnier than the one that Carly Fiorina, the first CEO brought in from the outside of HP, assembled.

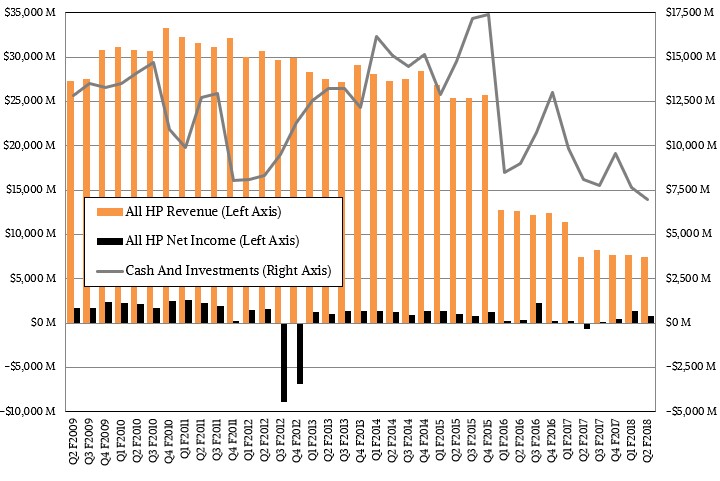

In the second quarter, after taking out discontinued business lines, HPE booked $7.47 billion in revenues, up just a tad under 10 percent, which is pretty good for any established IT gear supplier, and it flipped to a $778 million net profit compared to a $612 million net loss in the year-ago period. The chart above does not take into account he stream of discontinued businesses, and HPE has not provided a full backwards cast of its financials to help us understand how its existing businesses have done, so we have to make do. Within a quarter, we will have updated financials based on the new characterizations and ongoing business lines and we will start talking about them as a whole. While generally we think it is relevant to think about vendors since we started coming out of the Great Recession in 2009, in HPE’s case, it is probably more relevant to compare HPE starting in the first quarter of its fiscal 2017, when all of the businesses – PCs, printers, software, and IT services – were being sold off to try to get a smaller more profitable company focused on the datacenter.

The part of HPE that is most interesting to The Next Platform is the bit called Hybrid IT, a term that we are still not exactly sure HPE means and that is even more peculiar as HPE is backing away from peddling minimalist servers and storage to hyperscalers and cloud builders and doubling down on selling more traditional – and profitable – ProLiant gear to enterprises. If there was ever one thing that never made sense, logically, it is that HPE expected the hyperscalers and cloud builders to use a different set of iron. What HPE could have done is put a baseboard management controller in hyperscale and cloud boxes and fought it tooth and nail with the ODMs, but that didn’t make much economic sense. HPE has tried to partner with Foxconn to keep in the hyperscale and cloud server game, and now it is just giving up on that.

The Hybrid IT group at HPE, which includes its servers (almost entirely ProLiant gear), datacenter switches, Aruba edge networking wares, and Pointnext technical services grew by 6 percent to just over $6 billion in the second quarter. Here is what the numbers look like for the Hybrid IT group since the refactoring of the HPE books:

Within this Hybrid IT group, sales of servers rose by 5.9 percent (HPE now calls it compute, just like we tend to these days) to $3.21 billion. Neri said on the call with Wall Street analysts that if you ignore the drop in sales to Tier 1 service providers (what we call hyperscalers and cloud builders), then sales would have been up 9 percent. This implies that HPE’s custom server business dropped very fast, and Neri warned that HPE would see a similar downdraft in the coming quarters because it had some big deals late last fiscal year with the Foxconn gear. HPE had “strong growth” in HPC, composable infrastructure (Synergy) and hyperconverged infrastructure (SimpliVity).

Tim Stonesifer, HPE’s chief financial officer, gave some additional color on what was going on in the Hybrid IT group. In the Compute division, passing on DRAM memory costs help push up sales, but so did richer configurations of ProLiant Gen10 iron, no doubt helped by GPU accelerators and flash drives as well as fat memory configurations. HPC system sales were up 20 percent, and hyperconverged storage rose in the triple digits. Synergy, Stonesifer said, was “gaining increasing customer traction.”

The acquisition of Nimble Storage for all-flash arrays and 3PAR way back a few years ago basically saved the HPE storage business, and it rose by 24.3 percent to $912 million. Take out Nimble and the storage business still grew by 14 percent; Stonesifer did not say what it was if you take out 3PAR. He did say that all-flash array sales rose by 20 percent.

Datacenter networking, which comes mostly from the 3Com acquisition, is a relatively small business, and it rose by a mere 2.2 percent to $46 million. HPE’s networking business has a long way to go, obviously, to be of a size that is commensurate with its ProLiant server business. The Pointnext technical services division had 1.5 percent growth, to $1.85 billion, and when you add it all up and take out the costs, the Hybrid IT group had an operating profit of $621 million, up 35.9 percent. That is a lot of improvement, for sure.

The Aruba Intelligent Edge networking group had $710 million in sales, up 17.2 percent, and had an operating profit that was flat at $46 million. Previously, Aruba was added to the 3Com and HP homegrown switch lines to make up its Networking division, and clearly Aruba is delivering for HPE a lot better in terms of revenue growth than 3Com has done over the long haul.

The Financial Services group at HPE, which acts as a bank for buyers of HPE’s gear, had $916 million in sales, up 5 percent, and its operating profit fell by 6.5 percent to $72 million.

The 10 percent revenue jump was good, but Stonesifer was perfectly honest about how that happened, with 3.5 percent of that coming from foreign exchange benefits thanks to a strong dollar and 2 percent coming from the addition of revenues from the Nimble and SimpliVity product lines, leaving 4.5 percent of that growth coming from improved execution. He added that tough compares in the second half with Tier 1 server sales would be a 2.5 percent headwind to overall revenue growth at HPE, and that growth would not be at the 10 percent level that HPE enjoyed in the second fiscal quarter. This of course has caused Wall Street to freak out, because they are knee jerks and they don’t really invest for the future.

The good news is that HPE, in its many guides, does. Even if the future doesn’t pan out the way it expects, it keeps going at it.

This reminds us of Major General Nathanael Greene, who was second in command to George Washington during the America Revolution in leading a large portion of the Continental Army and various state militias to victory in a protracted battle that lasted for nine years. Greene didn’t win a lot of battles and he lost a few, but his actions kept the British at bay in the North and compelled them to leave the field in the South because so many hills were too dearly won with the loss of life. “We fight, get beat, rise and fight again,” Greene famously said to the Marquis de Lafayette in describing the particularly bloody battles in North Carolina and South Carolina that turned the war for the Americans.

You can admire tenacity. We do. The HPE stock price, which took a 10 percent hit, will sort itself out over the long run – or it won’t. All we know is somebody has to build servers for the enterprise, and they have to figure out how to make money doing it, which HPE is not exactly doing right now. (Toni Sacconaghi of Sanford Bernstein recons that servers, storage, and datacenter networking have operating margins on the order of 1 percent to 2 percent at HPE.) All of the margins, as we have pointed out before, are going to Intel, Microsoft, and Red Hat, and an enterprising HPE might want to have a real hard think about that.

Be the first to comment