The server cycle has some long waves that are not always in phase with each other, and that is generally a good thing. But every now and then, the waves synchronize, and it is either really exciting as the market rises or something of a bummer as it falls. In the first quarter of this year, there was a bit of a dip but still an order of magnitude less dramatic than the collapse in shipments and sales during the Great Recession.

It is important to keep perspective, and it is actually quite remarkable that the server market is as stable as it clearly is. This, perhaps more than anything, shows just how much systems are at the backbone of the modern economy.

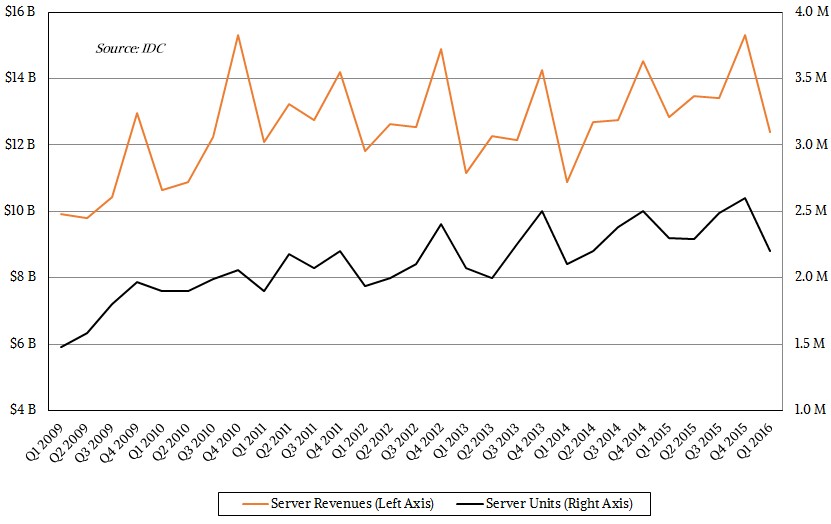

In the quarter ended in March, the researchers at IDC reckon that server makers, including both OEMs and ODMs, shipped 2.2 million servers, down 3 percent compared to the year-ago period, and overall revenues across all server types and processor architectures amounted to $12.38 billion, down 3.6 percent. The general trendline is still pretty healthy, as you can see from the chart below, but it is a little disconcerting to some that there was any decline at all.

A confluence of events came together that softened the systems market in the first quarter. For one thing, everyone knew that Intel was getting ready to launch its “Broadwell” Xeon E5 v4 processors for two-socket machines, which occurred at the end of March, and its Xeon E7 v4 chips for machines with four or more sockets, which happened today, so it is not much of a surprise that both enterprise and hyperscaler customers pulled back a bit on the spending. Some HPC centers and many hyperscalers have been able to get their hands on Broadwell Xeon E5 processors since last fall, but it could be that Intel has a bit of a supply constraint there as it is ramping up the 14 nanometer processes that the Broadwell chips employ. The 14 nanometer ramp has been problematic for Intel, and the Xeon chips are considerably more complex than the PC chips that Intel uses to do the initial ramp for any process. (No one else has had an easy time with their 16 nanometer or 14 nanometer manufacturing, either, by the way.) So the slowdown in hyperscaler spending might have as much to do with the number of Broadwell chips Intel could crank out as the capacity planning at the big seven hyperscalers (Google, Microsoft, Amazon, Facebook, Baidu, Alibaba, and Tencent) and their close cousins the telcos and service providers who are also building out their cloudy infrastructure.

Kuba Stolarski, research director of computing platforms at IDC, also said that the first quarter marked the end of a long refresh cycle among enterprise customers. That this enterprise slowdown is happening as Broadwell Xeons ramp is not necessarily causality, but given the substantial architectural changes that are coming with the “Skylake” Xeon v5 processors next year and the ramping of faster, fatter, and cheaper flash and the incorporation of 3D XPoint memory into systems, we think that the Broadwell generation of Xeons could be a bit more subdued as enterprises examine whether they should hold off until next year for major system upgrades.

Most companies than need new iron for new projects, that want to consolidate machines to save operational and software license costs, or that have capacity needs that must be met now cannot wait, and that is why the server revenues and shipments only wiggle up and down a few percentage points each quarter. In aggregate, the tens of millions of companies that buy iron in the world act like a flywheel for the systems business, and as competitive and aggressive as it clearly is, as a whole it is very tough to perturb from its course.

Another mitigating factor for system revenues in the first quarter of 2016 is a big drop in mainframe sales at IBM. Sales of high-end systems, which cost more than $250,000, fell by 33.4 percent in Q1 to $1.4 billion, which is an indicator of how the end of the System z13 mainframe cycle hurt both Big Blue and the market overall. The Power8 processor at the heart of IBM’s Power Systems line is also at the end of its cycle, and helped pull down IBM’s overall systems revenues. IBM has not sold X86-based systems for more than a year now, and with Power Systems and System z combined, IBM posted $1.14 billion in sales in Q1 2016, down 32.9 percent. (IBM accounts for about two thirds of high-end system sales, and it also sells some smaller scale-out machines that fit into the volume and midrange categories at IDC, so it is not a perfect proxy for the high end.)

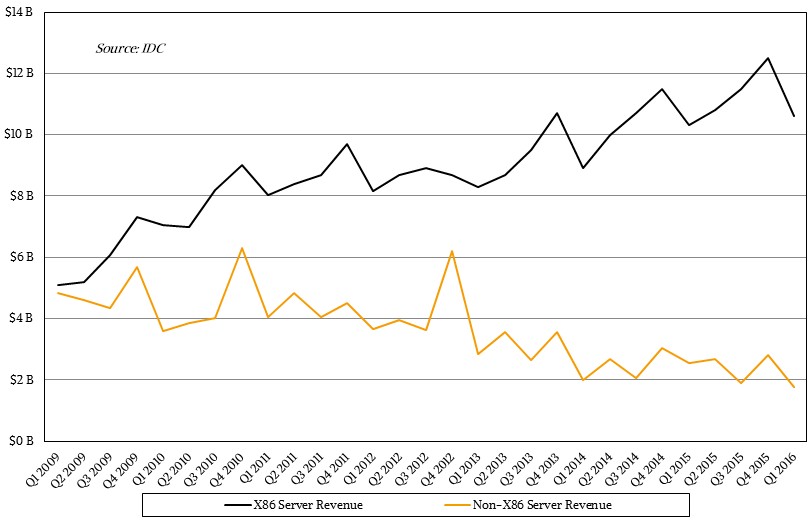

If you look at the volume segment, where systems cost less than $25,000 as they are configured at the factory before they ship to customers, then the news was actually not too bad on the revenue front. IDC believes that volume server sales rose by 1.8 percent to $9.8 billion. Nearly all of these machines were based on the X86 architecture, and to be more precise, almost all of them were based on Intel’s Xeon family of processors. In the midrange systems segment, where machines cost between $25,000 and $250,000, aggregate revenues across all vendors and architectures came to $1.1 billion and rose by 8.3 percent, in part because Intel’s Xeon E7s are getting traction as in-memory processing of various types is taking hold in a niche part of the datacenter. RISC machines running a variant of Unix or a proprietary operating system have been in decline for years, and presumably this slide continued in the first quarter. (IDC did not say in its public data.)

The rise in the volume segment mirrors that of the rise of the X86 platform overall in the datacenter. Of the 2.2 million machines shipped in Q1, the overwhelming majority have X86 processors of one kind or another. Revenues for X86 iron rose by 2.6 percent to $10.6 billion. Hewlett-Packard Enterprise had a 29.7 percent share of X86 server revenues in Q1, according to IDC, up 5.5 percent, while Dell, the number two shipper, had a 21.5 percent revenue share and fell 1.8 percent year-on-year.

On a regional basis, China exhibited very strong growth, with revenues up 14.9 percent to $1.9 billion and bucking the market severely. A lot of that growth in China is coming through the country’s cloud buildout, and indigenous server makers such as Lenovo, Inspur, Huawei Technologies, and Sugon are all growing rapidly there; Dell apparently, did, too. Thanks to China, the Asia/Pacific region had 10.2 percent revenue growth. The United States had a 6 percent revenue contraction – driven we think by a pullback by both enterprises and cloud builders – and Western Europe actually had 1.7 percent growth (but against an easy compare). Central and Eastern Europe stomached a 41.6 percent revenue decline, and Latin America fell by 32.3 percent, which took some of the steam out of the systems market for sure.

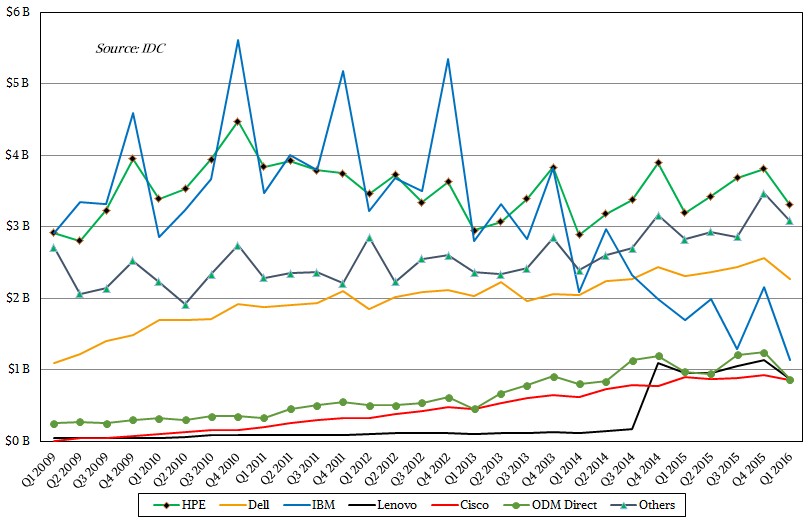

As far as IDC can tell, all of the major vendors and the ODMs as a group all had a decline in Q1, but that is not all that surprising since Q1 is always lower than Q4 of the prior year thanks to annual IT budget cycles that tend to end at the calendar year. What you look for is when Q1 of one year is lower than Q1 of the prior year, which happened to Dell, Lenovo, IBM, and to the ODMs as a group, as you can see here:

If this pattern holds, then we should expect the hyperscalers to curtail their spending in Q2 to make a trough between another camel’s hump that will start growing again in Q3, as has happened in the past two years. The cloud builders are getting more efficient at using their infrastructure, which allows them to cut back on capital spending, and we think customers are also getting smarter about how they use that infrastructure, which means the cloud builders don’t have to buy so much excess capacity as they might have had to do in years gone by.

The interesting other thing to note about Q1 2016 is that HPE grew revenues by 3.5 percent to $3.31 billion, bucking the trend of the overall market, and Dell’s revenues only shrank by 1.8 percent – half the rate of the overall market – to $2.27 billion. The ODMs had an 11 percent decline to $863.8 million, which was tough indeed, and while ODMs are a proxy for the hyperscalers, you have to remember that Dell and HPE sell iron to Microsoft and Dell does a lot of business with Baidu, Alibaba, and Tencent, so you can’t equate ODM sales to hyperscaler sales. Another fun thing to watch is that the Others category, which does not include the top five vendors – HPE, Dell, IBM, Lenovo, and Cisco – or the ODMs grew by 9 percent to $3.08 billion. There is plenty of innovation and competition going on outside of the top OEMs, clearly.

IDC believes that the slowdown in Q1 is a temporary phenomenon. “Now that the cyclical refresh has comes to an end, the market focus is shifting towards software-defined infrastructure, hybrid environment management, and next-gen IT domains such as the Internet of Things (IoT), robotics, and cognitive analytics,” says Stolarski.” In the short term, IDC expects the second half of 2016 to re-energize hyperscale cloud infrastructure expansion with existing datacenters filling out and new cloud datacenters standing up across the globe.”

Think of it as every fifth cloud server is another tower server that does not make it under a desk and into a data closet. This is part of what is going on out there.

“big eight hyperscalers (Google, Microsoft, Amazon, Facebook, Baidu, Alibaba, and Tencent)” – which one isn’t listed?

IBM – and rightfully so. I have no idea why “The Next Platform” and “The Register” always insists in counting in IBM as a valid Cloud/Hyperscale contender (see here for one of many examples: https://www.nextplatform.com/2016/03/22/systems-services-ibm-floats-cloud-concept-2016/). IBM wouldn’t know what Cloud or Hyperscale is, even if it got bit in the ass by it (which it has already been).

Maybe “The Register” has catered to Enterprise-IT just a bit too long. Time to wake up guys – Enterprise-IT isn’t top of the line anymore. Those days are over – thank God.