More than anything else, over its long history in the computing business, IBM has been a platform company and say what you will about the woes it has had through several phases of its history, what seems obvious is that when Big Blue forgets this it runs into trouble.

If you stare at its quarterly financial results long enough, you can still see that platform company looking back at you, even through the artificially dissected product groups the company has used for the past decade and the new ones that IBM is using starting in 2016.

It is important to remember that even after all the divestures of its System x server business to Lenovo and its Microelectronics chip business to Globalfoundries last year, IBM’s systems business is still a much larger platform company than Amazon Web Services and is many times larger than Google Compute Platform and Microsoft Azure (at least the part that is selling raw capacity and services to end users). In 2014, when IBM still sold servers based on Intel Xeon processors, that systems business generated around $33.3 billion, including servers, storage, operating systems, transaction processing software, integration middleware, technical support, and financing of this gear, and in 2015, after divesting itself of that Xeon server business and the associated revenue streams, the overall systems business fell by 14.5 percent to $28.5 billion.

This is still 3.6X as large as AWS, although the two are arguably very different animals indeed, and AWS is growing at 80 percent a year and if IBM’s systems business continues to shrink, they will be roughly the same size at $25 billion a year in 2018.

That will be a remarkable day, should it come to pass.

Not at all ironically, IBM is trying to become more like AWS, with its acquisition of SoftLayer being just part of that, as well as a supplier of on-demand, cloud-based software for marketing, advertising, and analytics. But these nascent businesses are utterly dwarfed by the tradition System z and Power Systems platforms that the company still sells and the DB2 database and WebSphere middleware that dominates on these systems and is often sold on machines made by others to do transaction processing.

The important thing for Big Blue is that these legacy platform businesses continue to generate revenues and profits as the rest of the company undergoes another wrenching transformation. It would be easy to pick on IBM, but its peers among the largest IT suppliers (including Sun Microsystems, Hewlett Packard Enterprise, Dell, and Microsoft) have arguably had no more easy a time of it in the past two decades.

What is concerning is that during the first quarter ended in March, the mainframe and Power Systems cycles seemed to run out of steam and it looks like there will be quite a wait until the next round of System z14 and Power9 machines are out the door – we don’t know when the next mainframe cycle begins, but IBM did not launch Power8+ systems this year as its roadmaps had suggested it would and is just adding NVLink interconnects for GPU accelerators to the existing Power8 chips that have been around since 2014. It is not clear that IBM’s customers need a new chip right now, or its partners in the OpenPower collective, for that matter, but what is important is that an updated Power chip implies a boost in price/performance, which would have gone a long way toward helping Power-based machines compete better against the new “Broadwell” Xeon E5 v4 processors that Intel just launched. In any event, a 24-core Power9 chip aimed at two-socket systems is coming next year, timed roughly to coincide with Intel’s “Skylake” Xeon E5 v5 processors, so this is where the real battle will take place. This should also be when companies like Google and Rackspace Hosting deploy Power-based systems in their infrastructure in reasonable volumes, and perhaps we will see some big design wins for ARM-based servers, too.

We think 2018 is going to be a very interesting year for systems, and we think that IBM is gearing up the Power platform with its partners to get a bigger slice of the pie while at the same time doing everything it can to shore up its mainframe business to help fuel the transformation of its platform business.

Drilling Into IBM’s Numbers

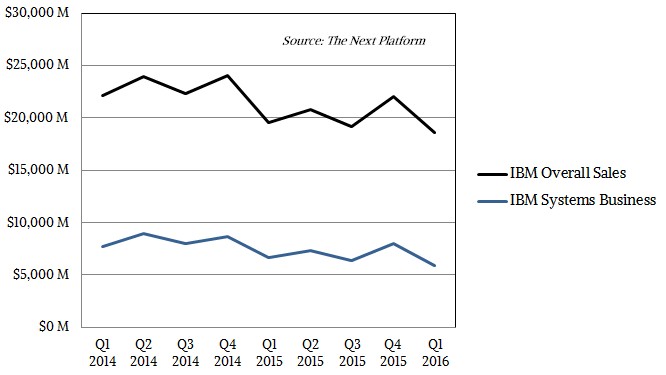

In the first quarter ended in March, IBM’s overall revenues continued to trend down as did its core systems business, which depending on the quarter accounts for about a third of its overall revenues. IBM still sells a lot of services, from systems integration to application hosting, that we are not counting in this core systems business, and we are also not adding in its SoftLayer cloud because we don’t actually know how large it is but it is probably around an order of magnitude lower than the sale of systems to large enterprises, governments, and service providers that constitutes most of the IBM systems business.

During the period, revenues fell by 3.7 percent to $18.64 billion, and net income fell by 13.5 percent to just over $2 billion. IBM had a big tax benefit that helped bolster its earnings – it could have been far worse, but then again, IBM is a master at engineering its numbers so the timing on these things works out. The company exited the quarter with $14.35 billion in cash, which is a respectable amount for an IT company of its size, but it also carries $40.5 billion in debt, most of which is related to its financing portfolio.

Starting in 2016, IBM is carving its business into five main groups. Its Global Business Services and Global Financing units are essentially unchanged from their prior characterization in financial reports.

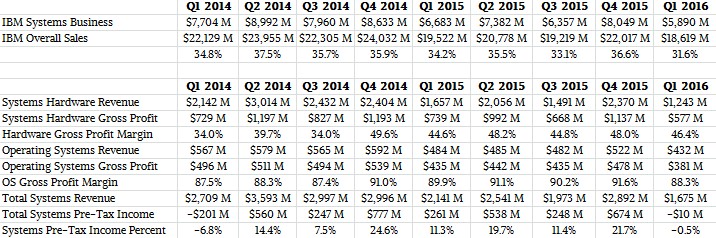

The Systems group that IBM has created, which we detail in the table above, brings together the server and storage hardware it sells with the operating systems that were put into the former Software Group, which has been disbanded. IBM sold $1.68 billion in servers in the first quarter to customers, and another $212 million to other units that use its hardware as the basis for appliances. Within the external customers, $1.24 billion of that was for servers and storage, down 25 percent, and $432 million was for operating systems, down 10.7 percent.

IBM’s operating system sales are dominated by its System z mainframes, which are paid for on a monthly basis and are therefore very stable and almost like an annuity. Sales of its own AIX and IBM i operating systems are perpetual licenses with monthly maintenance fees, and the company also resells Red Hat, SUSE Linux, and Canonical Linux distributions on its System z and Power Systems iron. IBM said that its System z revenues were off 43 percent in the quarter, which is a bigger drop than the tail end of a mainframe cycle typically gets, and added that after four quarters of growth in 2015, the Power Systems business posted a 14 percent decline in Q1 2016. IBM’s tape, disk, and flash storage business had a 7 percent drop, and IBM did not elaborate further.

This System group posted a gross profit of $958 million in the first quarter, with the operating system portion being very profitable, with 88.3 percent gross margins. Hardware has lower gross margins, at 46.4 percent, but this is to be expected. The overall Systems group did have a pre-tax loss of $10 million once corporate overhead costs were allocated to it, which is not good news.

The other new group is called Cognitive Solutions, and this includes a slew of transaction processing software, including databases and transaction monitors, that had been previously part of Software Group as well as data analytics tools such as the Cognos and SPSS statistical modeling tools and the BigInsights Hadoop distribution. In the first quarter, this part of IBM drove just under $4 billion in sales externally and another $668 million to other groups at the company. IBM sold $1.28 billion in transaction processing software externally in the quarter, and $2.7 billion in cognitive software, which includes databases and analytics tools as well as its nascent Watson analytics platform. While this business posted a pre-tax income of over $1 billion, it is down by 33.7 percent compared to the year ago period.

The final part of the “new” IBM is called Technical Services and Cloud Platform group, which has all kinds of infrastructure and technical support services and, for some reason, its WebSphere and other integration software is also put into this category. This is now the largest part of IBM, with $8.4 billion in sales in the first quarter and fell by 1.5 percent. Because of restructuring, this group had a big drop in pre-tax income, off 77.2 percent to $258 million in the quarter.

The SoftLayer public cloud, which is not broken out separately, is part of this final group, and all IBM said about it was that SoftLayer had “double digit” revenue growth in the period. Within the Technology Services and Cloud Platform group, IBM said that it had $1.2 billion in cloud-related revenues, up 50 percent year-on-year, and that the run rate on its “as a Service” products running on its own infrastructure hit $3.7 billion from within the TS&CP group.

Across all of its groups, cloud products drove $2.6 billion in sales (up 36 percent) and those cloud services (infrastructure, platform, and software as a service) had an annualized run rate of $5.4 billion, up 46 percent. IBM is focusing on the growth here, obviously, and we think it is probably being very generous with the definition of “cloud” when it comes to mainframe and Power Systems sales, too. Again across all of its groups, analytics products and services drove $4.2 billion in sales, up 9 percent. These two areas are the main drives for the company’s “strategic imperatives,” which also includes mobile and social application development tools and security software.

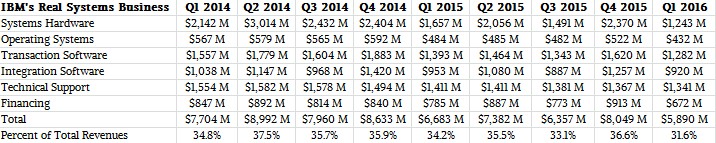

As we have pointed out before, IBM’s “real” systems business is considerably larger than its systems hardware and operating system sales suggest. To get a sense of the size of that “real” business, we added up systems hardware, operating systems, transaction processing and database software, plus 90 percent of its integration software sales and 75 percent of its tech support and financing revenues. Add it all up, and as we pointed out already, and this is about a third of the company’s overall revenues in any given quarter.

Here is the raw data from the past two years for this “real” platform business at Big Blue:

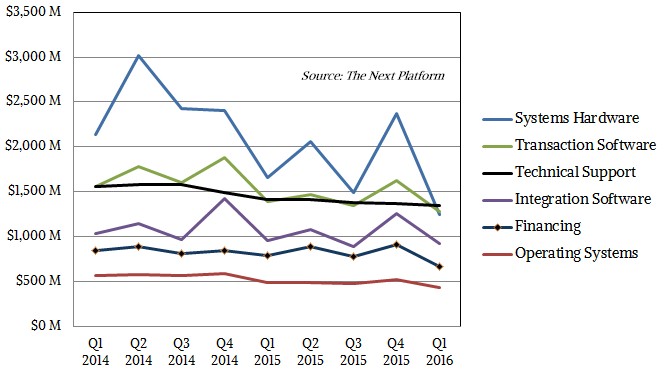

And here is the chart that gives you a better sense of how the revenues for each component are trending:

The numbers are all down over the past two years and one quarter. This is not a good thing, obviously.

What we want to know is what the future IBM platform will look like and how it will grow. IBM’s future is not the mainframe business, even though it is lucrative. We think that IBM needs to put a stake in the ground and build a Power-based variant of SoftLayer that makes its case for that platform. It cannot wait until Google comes around. Perhaps this is the plan, and perhaps this is how it will sell a lot of its Power Systems capacity in the future.

Be the first to comment