The announced acquisition of enterprise storage giant EMC by server and PC maker Dell has fueled the pontifications of pundits across the tech industry, leaving almost no area unanalyzed. The $67 billion deal covers a panoply of technologies from the outmoded to the innovative, setting up the combined mega-firm to seek synergies in what to keep and what to let go.

In fact, each company is so broad and deep across multiple workflows that in 2014 Dell and EMC held the number-one revenue shares for servers and storage, respectively, for high performance computing, positions that surprise many members of the HPC community – and even the companies themselves. Let’s take a closer look.

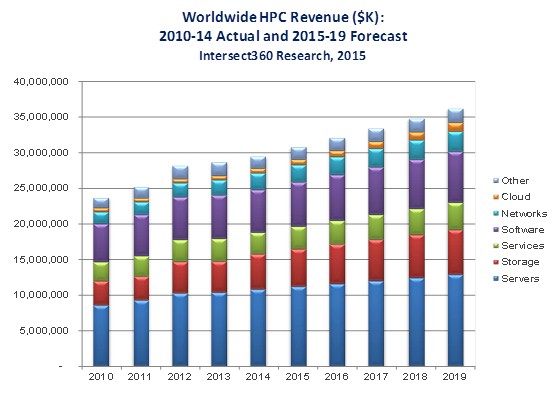

In June, Intersect360 Research released its annual Worldwide HPC Market Model and Forecast, stating that the HPC industry had grown to $29.4 billion in 2014. This is inclusive of both high performance technical computing (HPTC) applications in academia, government, and scientific or engineering applications in industries like manufacturing, pharmaceuticals, and oil exploration, and high performance business computing (HPBC) applications in non-science business areas like financial services, media and entertainment, and online game hosting. (The hyperscale market – for supercomputing infrastructures found at places like Google and Amazon – once part of the HPBC segment, is now tracked separately by Intersect360 Research and is not considered part of the HPC revenue figure.)

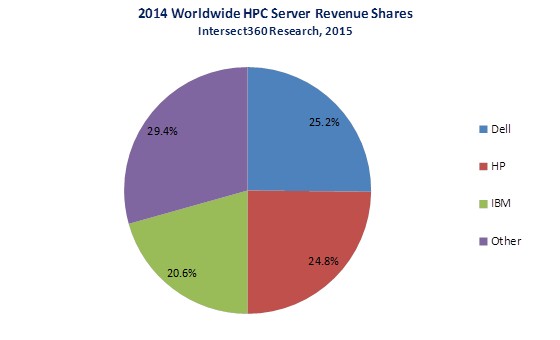

The largest revenue component of the HPC market is servers (including complete systems, such as clusters and supercomputers), at $11.3 billion in 2014. In its report, Intersect360 Research stated that in the wake of IBM’s sale of its X86-based server business to Lenovo, Dell had overtaken IBM as the number-one server vendor by revenue, very narrowly ahead of rival Hewlett-Packard. (The difference between Dell and HP is insignificant, really, except perhaps for Dell PR purposes.)

If Dell’s HPC leadership position takes you by surprise, you can take solace from the fact that it also surprised some people inside Dell. But the fact remains that Dell has maintained a strong HPC position for several years. The annual HPC User Site Census report on system vendors showed Dell with the highest number of systems installed in the survey, with particular strength in public sector markets. HP has been gaining as well, particularly in the commercial vertical markets that have fueled recent market growth, and the two companies will likely remain close for the market share lead.

Their relative market strengths are reflective of the respective HPC outlooks within Dell and HP. Dell has often considered HPC to be a research market, and the company historically has relegated industrial workloads to be part of its enterprise focus. HP, by contrast, has long viewed enterprise server sales to manufacturers, banks, and the like to be part of its HPC presence, and therefore, HP perceived a bigger HPC market overall than Dell. But when forced into a common methodological definition, we find the true shares of Dell and HP to be quite close.

HPC server market positions are certain to continue to shift in 2015. For starters, IBM’s 2014 totals still included three business quarters of X86 server revenue, prior to its deal closing with Lenovo, so IBM’s share will be considerably lower in 2015, with Lenovo as the incumbent number three. (Cray and the X86-free IBM will likely compete for the fourth-place slot.) Meanwhile, HP is going through an organizational change of its own, which could be a distraction in some sales conversations. Lenovo’s nascent HPC business is still becoming established. Overall there are considerable opportunities for the next tier of HPC system vendors – such as Cray, Bull (now part of Atos), Fujitsu, SGI, and Penguin Computing – to make gains.

For EMC, HPC revenue is even more obscured. The company has achieved a number-one revenue share position without a focused, corporate HPC strategy, especially when viewed in contrast to performance-oriented storage companies like DDN, Panasas, or Xyratex (now part of Seagate). In fact, DDN leads all vendors in the HPC Site Census for storage vendors, slightly ahead of IBM, but in this case further analysis is necessary in determining true revenue share.

- The $4.7 billion storage market for HPC is highly disaggregated. It consists of spinning disks, flash/SSDs, and tape libraries, spanning a wide range of vendors, none of which has a commanding revenue share.

- EMC’s revenue for HPC includes not only enterprise storage offerings such as VMAX with ScaleIO, but also contributions from its flash-based XtremIO and hybrid VNX/VNXe offerings, as well as Isilon, which EMC acquired in 2010. Any of these products can appear in infrastructures used by HPC applications, and in total they add up to a number one market share for EMC in HPC storage.

- EMC’s HPC position significantly improved in 2014, bolstered by meteoric growth in XtremIO, which EMC recently announced had achieved over $1 billion in bookings in its first six quarters of sales, often in support of HPC applications. EMC and others also gained share from NetApp, which had been the number-one HPC storage vendor in 2013, as NetApp lost money at a corporate level and also strategically shied away from its high-performance E-Series product line.

EMC’s Site Census survey position is compromised somewhat by “self-selection bias,” meaning an EMC user is less likely to identify with an HPC-oriented survey than a DDN user, even if each user meets an objective definition of what HPC is. Outside of Isilon, EMC doesn’t have a broad HPC strategy, though it does target big data and offers point HPC solutions for ScaleIO, XtremIO, and VNX. Many commercial EMC customers have HPC applications.

All in all, we are faced with this: The number one HPC server vendor by revenue (Dell) is acquiring the number one HPC storage vendor by revenue (EMC). If the combined management teams appreciate this position, there is a significant opportunity to drive this combination to significant competitive advantage. Scalable data management solutions have been a relative weak point in Dell’s HPC strategy, and the EMC portfolio gives them the pieces they need to bolster it, to the point where it could become a positive differentiator versus HP and Lenovo.

But the benefits will not be automatic. Beyond the general pain of any massive organizational change, the company will need to maintain a vision of HPC as an important segment. If Dell/EMC takes a narrow view of HPC as a low-growth research market, it could lead to a lack of continued investment in performance and scalability. And at a technical level, the company will need to define its portfolio in an integrated way, especially in regards to storage software. For example, EMC Isilon relies on the OneFS file system, whereas the VNX series runs MPFS, and the ScaleIO solution allows for integration with Lustre. (Consolidation on Lustre would be a stroke for Intel, a critical Dell partner.)

What’s clear is that the effects of Dell’s acquisition of EMC are far-reaching, touching almost every corner of enterprise IT. In all the discussion, HPC can seem a forgotten market. After all, it is a niche worth only $15 billion in servers and storage, in which Dell and EMC each lead their product segments, whether they realize it or not. How the merged company treats this opportunity will determine whether it can coordinate its offerings to extend its lead, or move onto another opportunity and leave its leadership position up for grabs.

Addison Snell is the CEO of Intersect360 Research and a veteran of the high performance computing industry. He launched the company in 2007 as Tabor Research, a division of Tabor Communications, and served as that company’s VP/GM until he and his partner, Christopher Willard, Ph.D., acquired Tabor Research in 2009. Snell was previously an HPC industry analyst for IDC and prior to that was marketing leader and spokesperson for SGI’s supercomputing products and strategy. Snell holds a master’s degree from the Kellogg School of Management at Northwestern University and a bachelor’s degree from the University of Pennsylvania.

Be the first to comment