The IT sector was bracing for a slowdown in system spending a few weeks ago, but it doesn’t look much like a slowdown has materialized, despite warnings from server adapter card maker QLogic that its business had slowed because the ramp for Intel’s “Haswell” Xeon E5 v3 processors and their “Grantley” server platform was not as fast as QLogic hoped. With Dell going private and IBM selling off its System x server business last year, that leaves Hewlett-Packard’s system and services business as perhaps the best bellwether (that is publicly traded) for the overall IT market and for systems in particular.

HP has not seen much of a slowdown, and certainly not anything that was as alarming as what QLogic was talking about. Judcging by HP’s most recent financial results, business is brisk in the datacenter and considerably better than many had been expecting given the economic challenges in Europe and China and the finger pointing by QLogic about a slowdown. It is perhaps not a coincidence that long-time Intel and EMC executive Prasad Rampalli, who has been CEO at QLogic since February 2014, resigned the day after Hewlett-Packard reported that its X86 server business was up sharply in its third quarter of fiscal 2015 ended in July.

Whatever is going on in the market, it doesn’t appear to be having much of an effect on HP Enterprise, the datacenter business that HP is in the process of spinning out separately from its PC and printer business. At least not yet.

In a few days, we will have a better sense of what happened in the systems market in the second quarter of 2015 when Gartner and IDC release their shipment and revenue figures. We won’t know what is happening in the third quarter until pretty late in the calendar year. What we can tell you is that Intel is more or less on track to grow its datacenter business by 15 percent this year, even with a slowdown in enterprise spending, thanks to aggressive server rollouts by cloud builders, hyperscalers, and HPC shops. And we can tell you what HP and its peers that public report are doing. (Supermicro is growing faster than the market, too, for instance.)

Here at The Next Platform, we concern ourselves mostly with what is going on in the datacenters at large enterprises, HPC centers, hyperscalers, and cloud builders, and thus the HP split doesn’t do anything for us but mirror the world as we already see it. The only effects of the self-fissioning of HP that we can see affecting HP Enterprise are extra costs for back office and management functions, some writeoffs, and a loss of some leverage with processing partner Intel, with one side of HP buying server, storage, and network chips and subsystems and the other side buying client chips. This latter bit could be the big concern over the long run.

Ultimately, this split between PCs and enterprise gear was one factor in IBM never quite being able to get its systems down to price parity with HP and Dell. Big Blue was never a low-cost manufacturer, and thus Lenovo bought the IBM PC business in 2005. A decade later, IBM threw in the towel with servers, and now Lenovo has both the IBM PC business, which it has combined with its own and made quite competitive, and the System x business, which the Chinese company intends to take into battle in the datacenter against HP, Dell, and a bunch of rivals in China including Sugon and Inspur. Dell has kept both its server and PC businesses and will presumably do so into the foreseeable future, and will be trying to eat market share from both sides of HP just like Lenovo is going to try to do.

This systems business just keeps getting tougher, but no one wants to walk away from a $50 billion market, even if it is tough to wring out some profits. We all have to do something to earn our keep, and there is always hope to make it up in volume.

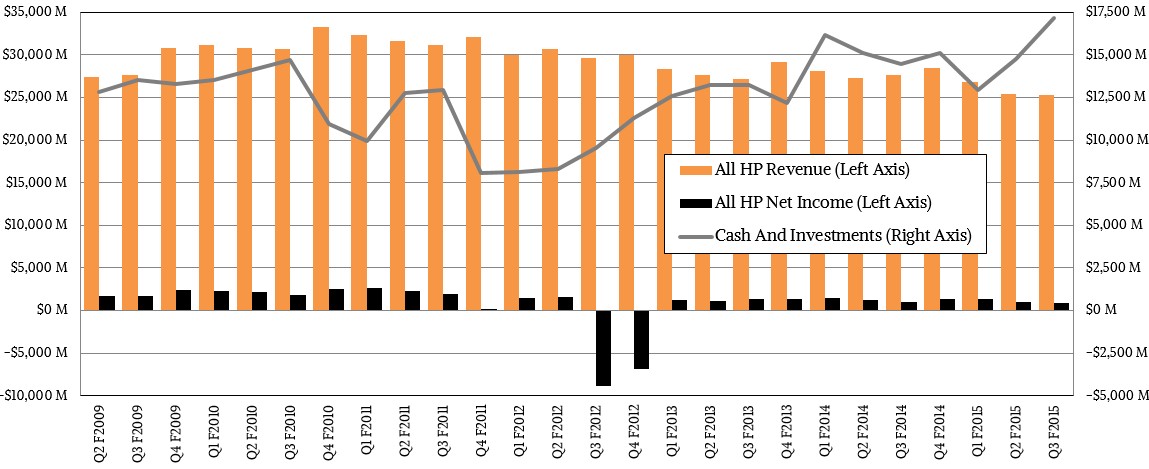

In the July quarter, HP’s overall revenues dropped by 8.1 percent to $25.35 billion, and net income was adversely impacted by restructuring charges, separation costs, benefit plan changes, and datacenter asset writeoffs totaling $723 million. These charges pushed net income for the combined HP down by 13.3 percent to $854 million. Taking into account all of these charges plus a substantial currency exchange rate headwind that all IT suppliers based in the United States are facing as the US dollar rises against the euro, renmimbi and yen, the quarter could have been a lot worse for big HP. The company ended the quarter with $17.1 billion in cash and equivalents, which gives its two halves maneuvering room after this dough is divvied up. But parent HP also has just over $11 billion in notes and short term debts and another $14.5 billion in long term debt. Some of this debt is related to its HP Financial unit, which provides financing to customers acquiring HP wares as well as to resellers who in turn sell HP wares to customers.

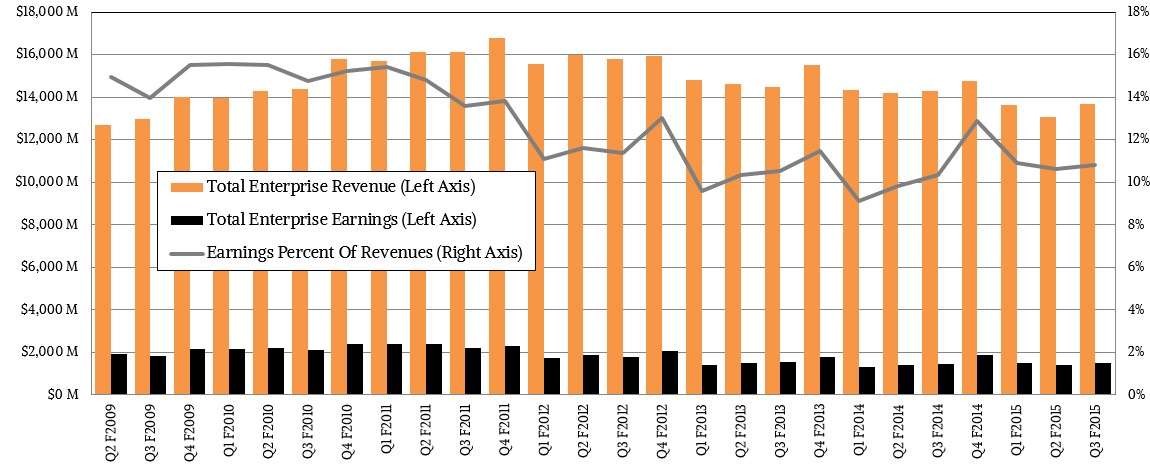

What we have been keeping track of since the launch of The Next Platform early this year is how the parts of the business that will become HP Enterprise are faring. This includes sales of servers, storage, switches, software, and services in the datacenter as well as financing. This is a big business for HP, even if it does struggle sometimes to get profits from it. (As does all of its rivals with diversified IT portfolios.) If you look at that core datacenter business – meaning servers, storage, and switching – then this part of HP Enterprise brought in $5.13 billion in sales, up 6.8 percent despite currency effects.

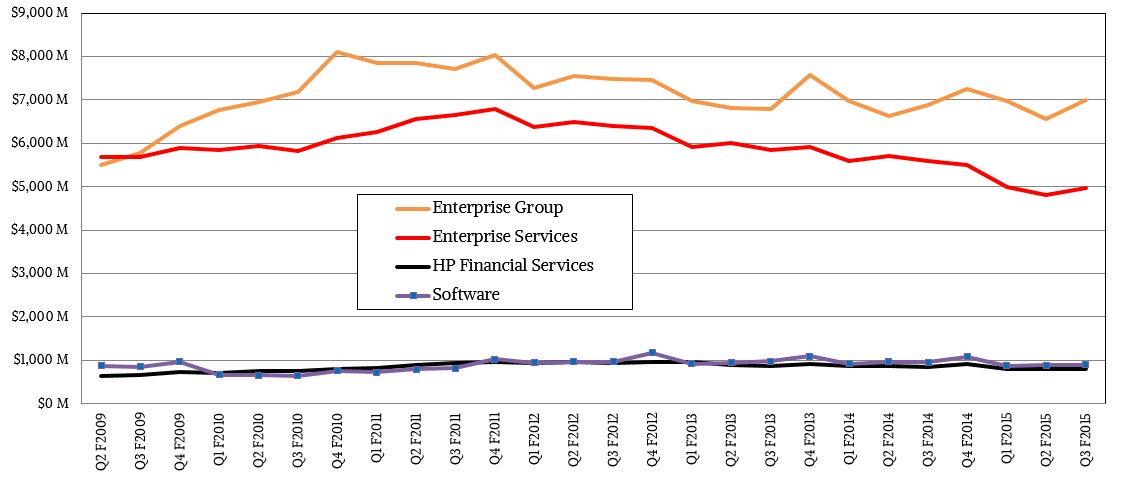

Enterprise Group, which is this business plus the technical support services related to this hardware, posted just over $7 billion in sales, up 2 percent as reported; operating profits were $912 million, down 5.6 percent from the year-ago period. The Enterprise Services part of HP, which combines the Electronic Data Services and Compaq professional services businesses from days gone by, had an 11 percent decline as reported but because of restructuring (which is still not finished) this group saw operating profits increase by 30 percent to $297 million. HP wants to be able to get more profits from its services unit, and is undergoing what CFO Cathie Lesjak, who retain that job for HP Inc (the PC and printer company), called its “last restructuring” on a conference call with Wall Street analysts going over the numbers.

HP Software, which has not grown as HP had hoped so many years ago when it had IBM envy, posted $900 million in revenues (down 6.2 percent) and an operating profit of $185 million (down 8.9 percent). HP Financial Services had $806 million in revenues, off 5.7 points, and an operating income of $87 million, rising 10.1 percent.

Add it all up and this proxy for the soon-to-be-independent HP Enterprise had $13.8 billion in revenues, off 4.3 percent, and operating income of $1.48 billion, up a fraction of a point from a year ago.

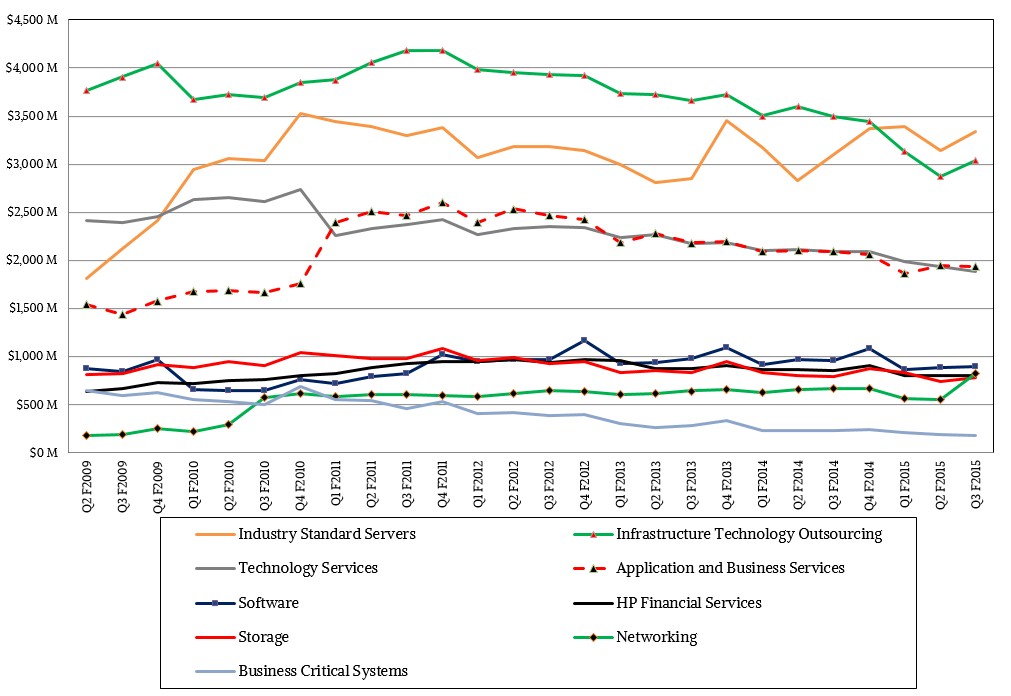

Unlike many of its rivals, HP has always provided a fairly detailed revenue breakdown of its broader hardware and services businesses, but it does not give out profit figures for these divisions. The most important unit at HP by far, in terms of its identity as well as its top line, is its Industry Standard Servers division, which is comprised of its traditional ProLiant as well as its new Moonshot and Apollo machines as well as the hyperscale boxes it is making in conjunction with Foxconn. In the quarter, HP’s sales for these machines came to $3.34 billion, up 8 percent as reported and up 15 percent in constant currency. (This latter bit means using the prevailing exchange rates during the third fiscal quarter of last year to convert into dollars, thereby removing the effects of currency exchange fluctuations and therefore, CEOs and CFOs the world over argue, giving a better account of the health of the underlying business).

Lesjak said on the call that margins in the Industry Standard Servers division “were somewhat pressured” because of currency effects and the popularity of density-optimized machines, which is shorthand for the kinds of minimalist machines that hyperscalers and some HPC shops insist upon.

The Business Critical Systems division, which sells Itanium-based machines as well as the new Xeon E7-based Superdome X and NonStop X platforms, had a 21 percent decline as reported, to $184 million; it was only down 15 percent at constant currency, however.

HP’s storage business, thanks to the uptake in modern storage arrays and particularly flash-based 3PAR arrays, did fairly well compared to recent quarters, with revenues up 7 percent at constant currency and only falling 2 percent as reported, to $784 million. HP’s so-called “converged storage” portfolio, meaning 3PAR and LeftHand Networks gear plus come hyperconverged products like the EVO:RAIL and StoreVirtual, grew 18 percent at constant currency in the third fiscal quarter according to Lesjak, and these products together now account for more than half of HP’s storage revenues. That growth is not quite enough to keep the overall storage business from falling, not when currency is shaving off double-digit percentages on sales outside of the US in some markets. High-end storage, by which HP means adding 3PAR plus its existing EVA and XP product lines, had 13 percent growth at constant currency. (Shave about 9 points off these figures to get the as-reported growth rates.) All flash storage sales for HP rose by 400 percent in the quarter, attesting to the burgeoning popularity of NAND flash in the datacenter, but the revenues are still relatively small.

HP Networking has been bolstered significantly from the acquisition of Aruba Networks in March for $2.7 billion. Meg Whitman, CEO at HP and who will have that same position at HP Enterprise after the breakup on November 1, said on the call that at constant currency and including the Aruba bump, the networking business had a 28 percent revenue bump in the third fiscal quarter, with “strong performance in all regions except China.” HP’s new partnership with Tsinghua University in China is helping push sequential growth at least, Whitman said, adding that even without Aruba, the HP networking business grew by “mid-single digits” at constant currency. But as reported in US dollars, this business declined. Including Aruba, the networking division had sales of $823 million, up 22 percent.

The race is now on to see if storage or networking will reach $1 billion in actual sales in a quarter – and sustain it – for HP Enterprise. If HP’s networking and storage businesses reflected the markets at large, then relative to the size of its system business, both networking and storage should be well above $1.5 billion. That will be a tall order in a world that is switching to storage servers and sever SANs instead of storage appliances as we are accustomed to. But that is, in fact, what customers and Wall Street expect HP to do – get its share.

Be the first to comment