On the one hand, it might seem, from the outside at least, that supercomputing systems at both the national lab and Fortune 500 level would require a great number of specialized pieces to fit with the high performance applications and system profiles. On the other, it is perfectly reasonable to think that general enterprise storage vendors would have the technical chops to meet high performance computing demands with existing offers.

Either way, it comes down to a matter of market focus. And for those who do not tailor their storage offerings toward this growing set of users, it “starts feeling like this is the $4.6 billion growth market no one wants,” at least to Addison Snell, CEO of Intersect360 Research, whose analyst firm focuses on the HPC segment.

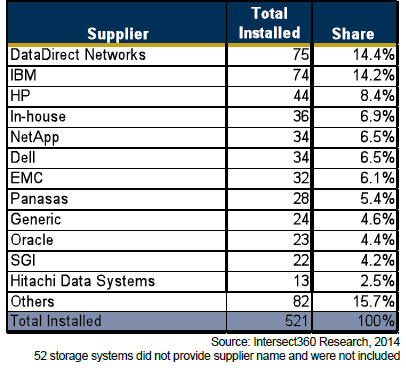

Storage has always been a fragmented market in high performance computing without a dominant vendor and if one actually breaks the numbers down to revenue market shares, it’s been the enterprise storage vendors (NetApp, EMC, HDS, etc) on the top, although no one company has ever had more than 15% of the revenue pie, according to Snell. Based on his team’ssurvey-based analysis over the last eight years, he says those leaders are now falling back into the pack, so it’s more disaggregated and competitive as the more performance-oriented vendors gain share.

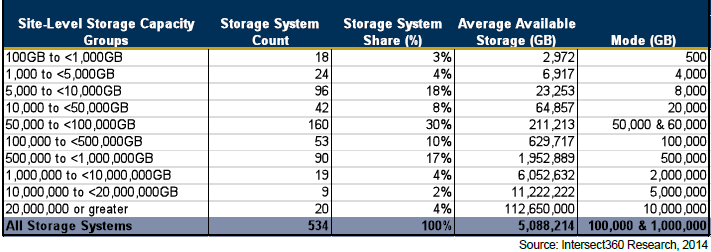

Just to put all of this in perspective, consider the growth of high performance storage overall. Among the 400 sites in Intersect360’s surveys, total storage capacity has tripled since 2012. And while it might sound skewed given that many of these are supercomputing sites (both academic and commercial) multi-petabyte-scale installations were under 10% of the collective three exabytes as of 2015. Thirty percent of the installations were between 50-100 terabytes, if that is any indication.

Among the storage vendors who fall into that high performance computing focus sphere is Data Direct Networks (DDN) whom Snell says maintains an advantage over enterprise storage vendors who look at HPC as just another market without making a concerted effort to extend their reach more fully to the supercomputing and enterprise HPC set. The most recent results indicate that DDN has a 14.4% share of the sites surveyed with IBM closely trailing at 14.2%. Remember that this does not equate to market share—but it is a fair approximation of what sites are choosing to deploy among those interviewed.

In pointing to how these vendors have made key acquisitions to bolster their HPC reach, but did not have robust follow-through in capitalizing on those gainsm Snell notes that while there are competitive offerings along the same lines from EMC, NetApp, HDS and others, there is a breakdown in how those larger enterprise vendors are connecting with the HPC market. “If you look at how the LSI Engenio line folded into NetApp, the HDS acquisition of BlueArc, EMC buying Isilon—when you look at the growth areas in high performance business computing applications, they all took a vertically minded approach where they looked at these as commercial markets and assumed that they didn’t care as much about performance. It’s entirely backwards in terms of why they made these acquisitions to begin with. It’s a swing and a miss against the opportunity, so it creates a real growth area for those who are sensitive to high performance workloads, which is reflected by DDN’s share.”

Intersect360 Research found that others, including IBM and HP had a strong showing, with Seagate gathering steam. “IBM has couched its high performance strategy in their data-centric architectures and they’re leading with the data management aspects of their solutions. IBM has not had a good year from a server sales perspective, in part because of the Lenovo deal, but we’re seeing IBM showing up with relative strength on the data management side compared to some of the short term suffering they’ve gone through on the compute side.” Snell suggests that this is something HP has to take a good look at, and it’s a question of their new HPC and big data business unit under Bill Mannell—the question is how they are going to coordinate the storage components with the compute components to make it look like a synthesized solution.”

According to Intersect360 Research, EMC has continued to hold a solid position in the market based on the breadth of its product line and strong position as an enterprise brand. “EMC targets certain HPC segments with its Isilon-branded storage, and also holds enough general-purpose storage business to see spillover into HPC workloads, either in shared resource environments or through sales made by resellers. This effect also helps other suppliers, such as IBM and HP. However, EMC’s share has declined since last year’s report, and the majority of systems reported were acquired in 2011 or earlier, suggesting that their share could continue to decline without increased focus on the HPC market.”

In addition to monitoring HPC storage vendor trends, Intersect360 has noted a sizable uptick in SSD deployments over the last year in particular, driven in large part by falling costs of SSDs and an increase in more robust I/O throughput capabilities. “As a result, we’re seeing a resurgence of local disk on a node. Prior to SSDs, that had been declining where fewer users would have a system disk on the node to be used for scratch space or OS, and people were heading toward diskless nodes. We’re now seeing that more than 20% of new systems have SSDs on the node.”

Snell and team expect to round out their future reports with more specific information around specific topics in storage (as well as other elements of the stack). We’ll check in again to track some of the file system and interconnect stories that hook into the storage trends they’ve observed across supercomputing sites in academia and industry.

Be the first to comment