Amazon Web Services may be the 800-pound silverback alpha-ape in the rapidly expanding cloud industry, seeing as how its infrastructure revenue is greater than its four closest competitors combined, but that hasn’t stopped its fast-growing challenger, Microsoft Azure, from beating its own chest and showing off its strengths.

At Microsoft’s Build 2015 developer’s conference in San Francisco this week, Scott Guthrie, Redmond’s executive vice president for cloud and enterprise, enthusiastically peppered his Azure keynote presentation with phrases such as “unmatched productivity,” “unparalleled developer productivity,” “super-fast development cycles,” and “applications that can change the world.”

Guthrie can, of course, be forgiven for indulging in a bit of marketing puffery — after all, his boss, Microsoft CEO Satya Nadella was listening in the wings — but he also backed up his description of Azure as a “hyperscale cloud platform” with some solid numbers and took a few swipes at rival AWS, as well.

The Numbers Game

Guthrie said that there are now 19 unique Azure regions up and running worldwide. “That’s more locations in more countries than both AWS and Google Cloud combined,” he bragged. And although AWS may have the lion’s share of the cloud infrastructure biz, Microsoft’s revenues are growing much faster, with Synergy Research Group reporting a 96 percent jump from 2013 to 2014 — twice that of AWS.

Part of that growth is due to Microsoft throwing money at the problem in an effort to catch up with the more-mature AWS. “We continue to invest billions of dollars each year building out new infrastructure,” Guthrie said, “and our cloud platform now manages over one million servers.”

But it’s not just in iron that Redmond is investing; it’s also software and services. In the 12 months since Build 2014, Guthrie said that the Azure team has delivered over 500 new Azure services and features, “and greatly expanded the footprint and capabilities of what Azure delivers.”

From the numbers he reeled off, that effort appears to be bearing fruit:

- Over 90 thousand new Azure customer subscriptions per month

- 1.4 million SQL databases being used by applications hosted inside Azure

- About 160 thousand SQL databases created or dropped each day in Azure

- Over 50 trillion objects stored in Azure Storage

- 425 million users in the Azure Active Directory system

- 3 million developers registered with Visual Studio Online services

Interestingly, Azure’s growth is not just among enterprise and business users. “More than 40 percent of our revenue and usage now comes actually from startups and from ISVs,” Guthrie said.

Of course, the rapidly rising cloudy tide is raising all boats, not just Microsoft’s. And if Guthrie can be believed, that rising sea level is outpacing even that brought on by climate change: more than 90 percent of all technology companies are now delivering or building online SaaS services, he said.

About That 800-Pound Gorilla

When reeling off a list of some Azure-using enterprises, Guthrie couldn’t help getting in a bit of a dig at AWS. In addition to 3M, Salesforce, DocuSign, GE Healthcare, ESRI, Ford Motor Company, Rockwell Animation, and the NFL, he mentioned the global weather-forecasting service AccuWeather, which he said processes more than 6 billion data requests each day. “They were originally actually an AWS customer and then switched to Azure to power their weather service,” he said.

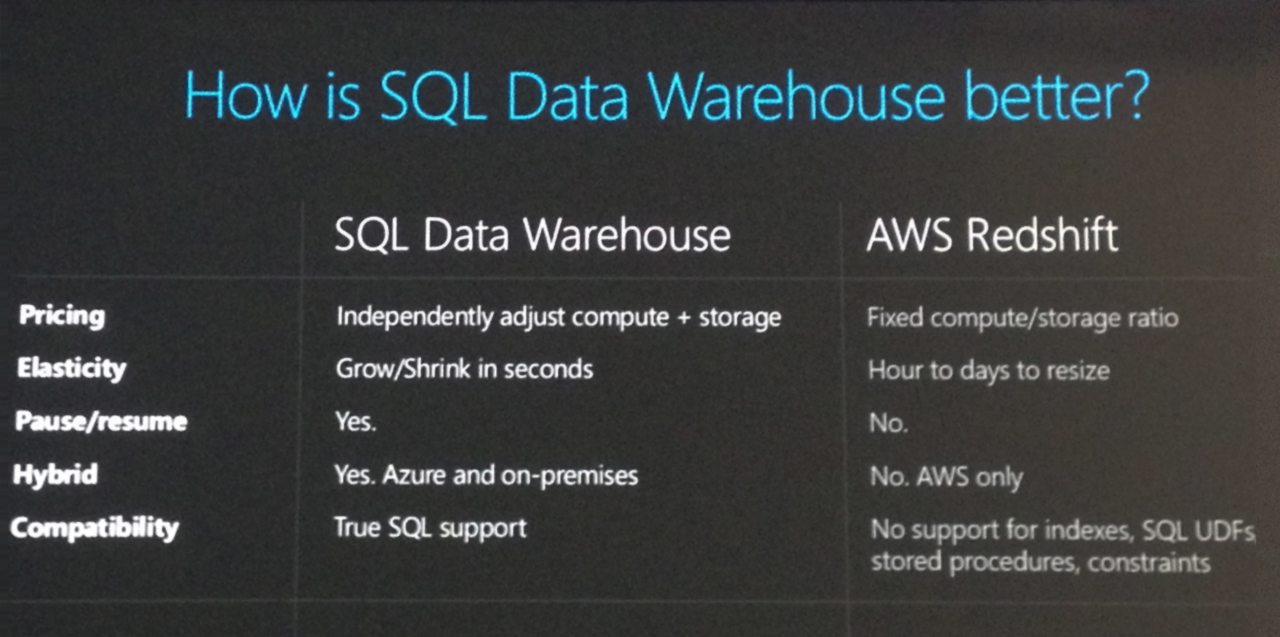

But when Guthrie introduced the Azure SQL Data Warehouse data-analytics enabling service, which The Next Platform told you about yesterday, he got more specific in his comparisons between Azure and AWS.

Guthrie first gave a nod to AWS’s Redshift data-warehousing service, which AWS describes as “a fast, fully managed, petabyte-scale data warehouse solution that makes it simple and cost-effective to efficiently analyze all your data using your existing business intelligence tools,” and which was announced in November 2012, brought out of preview in February 2013, and has enjoyed a series of upgrades since. “AWS has seen a good uplift with its Redshift offering,” Guthrie said — but, as might come as no surprise, he prefers Azure. What did come as somewhat of a surprise is that he then enumerated specific differences between the two, a departure from his team’s previous aversion to direct and specific comparisons.

“I thought I’d just spend a little bit of time talking about how now Azure is even better [than Redshift],” he said, first focusing on the fact that a user can independently adjust the amount of compute and storage that you use with SQL Data Warehouse, as opposed to the fixed ratio required by Redshift. “This allows you to reduce costs and pay only for what you actually need,” he noted.

SQL Data Warehouse, he said, will allow you to automatically scale up your data warehouse “in seconds.” Not so with Redshift, Guthrie claimed, dissing AWS’s service because “typically it takes hours or even days to rescale your data warehouse, and your data warehouse goes into a read-only mode with [performance] degradation.”

He also said that Redshift doesn’t allow you to pause a cluster. “Unlike SQL Data Warehouse, where you can pause when you no longer need your data warehouse and pay only for storage,” he said. He also praised Azure’s data-warehousing service for being able to also run on-premises, unlike AWS’s offering, and its ability to provide “a full SQL experience” that “allows you to build super-powerful applications with ease.” In the data-warehouse arena, he said, Amazon can’t match Microsoft’s breadth of SQL support.

As we noted, it’s rare to see Microsoft so aggressively and specifically comparing itself in public to its competition (and there were also a few swipes at Apple during the consumer-focused parts of the keynote). The Next Platform welcomes any such warfare, as long as the combatants come armed with legitimate facts and use cases.

After all, when such comparisons are done only by sales teams in customers’ conference rooms, who knows what exaggerations are made and insinuations are implied? Shut out from back-room bargaining, it is hard for the competition to argue against distortions or half-truths. When claims are out in the open, however, we all know what’s being asserted, we can all do our own research, and we can all come to our own conclusions. And besides, who doesn’t enjoy a good, clean fight?

Be the first to comment